Couple of days ago I wrote a post answering some questions about monetary policy, and in this post I’m going to write about the difference between fiscal policy and monetary policy as these are two terms which are used together quite often.

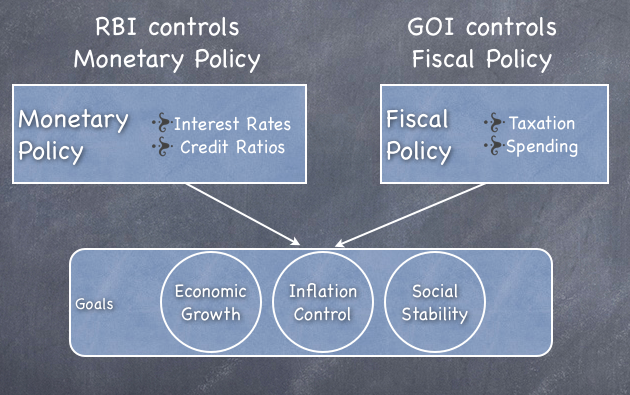

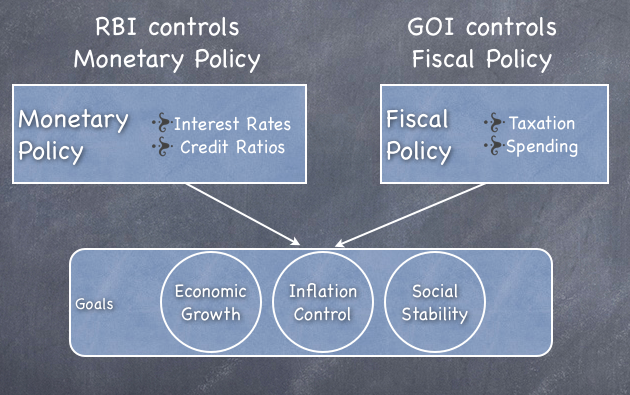

Both of these are used to influence the economy of a country, but while the monetary policy is decided by the central bank or RBI in India’s case, the fiscal policy is decided by the government.

Monetary Policy

Monetary policy is carried out by RBI and manifests itself by setting interest rates like the Repo and Reverse Repo as well as determining levels of CRR and SLR which influence money supply and credit flow in the economy.

The main aim of RBI’s monetary policy is to keep a check on inflation and maintain an optimum level of GDP growth at the same time. If they raise the interest rates too high then that might help in checking inflation but at the same time deter economic activity and slow down GDP growth, and if they keep the rates too low then that will promote economic activity but it will also spur inflation.

They have to keep a balance between both so one is not sacrificed for the sake of the other.

The RBI is independent from the government and you can see this in the fact that RBI has been very slow to lower rates even when a lot of government officials have publicly said that rates should come down in the past couple of years or so.

Fiscal Policy

Fiscal policy is the policy that determines how the government spends money, and taxes people to pay for those expenses. Taxes are the main form of earnings for the government although there are other forms as well like 3G auctions or PSU disinvestments. When the government is not able to come up with enough earnings to pay for their expenses they incur a fiscal deficit (Read: What is the meaning of fiscal deficit?), and this deficit is financed by borrowings.

The purpose of the fiscal policy is to promote economic growth as well, and during times of recession when government increases its spending or cuts taxes – that’s termed as a fiscal stimulus package because you are using the instruments of fiscal policy to boost the economy. India has had three fiscal stimulus packages following the last recession which involved tax cuts and boosts in spending, and were similar to stimulus measures used by countries around the world.

Conclusion

The goals of the monetary policy and fiscal policy are the same which is to promote stable and growing economic conditions in an economy, but the instruments used to carry these out and the bodies that carry these out are different.

They should be in synch to work well and such that actions of one don’t scuttle the actions of another and they succeed in their goals of maintaining a reasonable level of inflation and steady economic growth.

Very simple to undersand monetary policy and fiscal policy via this article.

Thank u Mr. Writer

hie,

is there any changes of reducing the current situation of CAD in India, or are their any measures taken by both the bodies????

Can you explain why fiscal deficit is referred in terms of GDP

The number on its own may not mean much as because of the size of different economies, for example the US has a deficit of $1.1 trillion which is about the size of the Indian economy so just saying that it is so large doesn’t give a perspective on how big it really is or what it means to that economy. Referring it against GDP gives a measure of how big it is with respect to that country and every country declares it this way so you can compare two countries to see which one has the bigger deficit.

Simple and good article. Very easy to understand.

Is it the case in EU countries that the monetary policy is administered centrally by the ECB and the fiscal policy is administered individually by each country and that is why the views may not converge and leads to a crisis in EU? For e.g. Greece may want the interest rates to go down, but the central bank may not want it because it may lead to inflation in other countries (just an example….).

The EU is a great example Ashok where the ECB sets monetary policy and then the different member countries negotiate deficits for each one of them. They have a common long term target and then they have short term targets for countries that have higher deficits like Spain and Greece. They try to stick to these targets but if the past is any indication they aren’t always successful in doing so.

Questions,Manshu.I am sorry more you make things easier to understand more the questions to you.Hope you dont mind.

1.Are their any instances where the Debts floated by the Govt of India have not been fully subscribed?(I know LIC have saved the Govt. many times in equity subscription of Govt Companies)

2.Can a foreign institutional investor subscribe to GOI Bonds?

3.Who does the Book Keeping of GOI Debts?A lot of PR work also is necessary.Who does this?

4.Will the shortfall in subscription result in GOI printing money?

5.If 2 above can be done what is the latest rate which the GOI commands in US Bond Market?Reliance have floated Bonds in USA at rates slightly less than 6% according to recent Press reports I have seen.

6.Who decides the terms of issue of GOI debt instruments?

No sir, you’re welcome to ask any questions you have and I’ll try to answer them to the best of my ability.

1. I don’t think that’s ever been the case, not recently at least.

2. Foreigners can buy bonds in India both government and corporate but there is a cap, and right now I’m not sure what that cap is. Can someone who knows please leave a comment?

3. RBI is the banker to the government so they do all this.

4. Printing money is a misnomer to the extent that no one actually prints money, it refers to borrowing which is what this is.

5. GOI bonds are denominated in INR not USD so the yield is the same that you read about in Indian papers.

6. They auction it out and yield is decided by the market forces.

Hi Manshu… A couple of points I want to put here which would differ from your answers of query no. 1 & 6.

Query no. 6 – As you’ve mentioned above, RBI is the banker to the government, it manages all of the government fiinances. It is the RBI only which decides the terms of issue of GOI debt instruments. It is done through the auction route and the yield is fixed by the RBI before the auction.

Query no. 1 – There have been many instances in the past in which the auctions held by the RBI did not find many investors at a yield set by the central bank. In those cases RBI was not able to raise the desired money from the investors and accordingly raised the yields of G-Secs in its subsequent auctions to meet the target of government borrowings.

Answer no. 2 – The cap is $75 billion.

Source – http://www.thehindubusinessline.com/industry-and-economy/banking/rbi-raises-foreign-investment-limit-in-debt-market/article4341012.ece

Thank you Shiv for the clarification.

About my query raised at point no 5,perhaps I was not very specific.My point is Reliance Industries has not only borrowed in USA by buying US bonds it has also raised money in USA thro its own US Bonds which attracted a High(by USA Standards)of about 5.8%.

My point is if Reliance has acquired Dollars in USA thro Bonds ,GOI should also have done that and if so what are the interest rates of such bonds raised by GOI comparable to RIL Bonds?.My only issue how does US bond market view GOI vis a vis RIL.

Hi Ramamurthy… I’m not aware of any instances in which the GOI has approached the US investors directly (or indirectly through RBI) to attract them buy its securities (G-Secs). It has often taken loans from the World Bank/IMF or other such global financial authorities but I have not heard about any such securities sale in the foreign markets, like Reliance has done it or other corporates have done it so many times.

If you want to have an idea about “how does US bond market view GOI vis a vis RIL”, then you can check their ratings by a common ratings agency. You’ll get a rough idea about it.

Very Feb Article but I Have a Doubt…..

I have been baffled by the fiscal policy during recession……I Read in an article that U.S will cut public spending and raise taxes….Due to the threat of recession…??

They reduced taxes and increased public spending in the threats of recession so people have more to spend and there is more employment opportunity but the US government runs a deficit which means they don’t earn all the money they spend and that leads to a big deficit which is in the trillions now.

Since the economy has not stabilized or at least stopped worsening they are cutting down spending and allowed some tax cuts to expire so the government can get more money and help plug the deficit.

Manshu,

Very simple to understand article. This will help to clear a lot of things.

Just one question though, since RBI and GOI are independent, then how do they ensure that the measures they take are in sync. Is there any other body or regular activities that follow the policies implemented by both ?

Thanks,

Amit

No there is no special body just for that and you do see both sides telling each other what to do publicly as well as I’m sure privately and the actions differ sometimes and sometimes they match up like recently the FM saying publicly the rates should come down and the rates come down by 25 bps.