I’ve wanted to write about the New Pension Scheme (NPS) a lot sooner, but never got around to it. Reader Gaurav sent me some great material on it, and got me started.

The stuff that he sent me was an entire post in itself, but I thought I’d add to it, and create a comprehensive post on the New Pension Scheme.

First off, you can call it New Pension Scheme, National Pension System, New Pension System or NPS, anything you like. They’re all the same; I’ve seen different articles call them different names, so that might get a bit confusing, but you’ll soon get used to it.

Next up, some of the things this post will address, are:

- What is the New Pension Scheme?

- What are Tier I and Tier II accounts in the NPS?

- What are the three categories in the NPS?

- Fees and Expenses related to the NPS?

- What is the minimum amount needed to invest in the NPS?

- What are the tax implications of NPS?

- How can I open a NPS account?

- Why hasn’t this become popular?

What is the New Pension Scheme?

The NPS was introduced by the government last year to give people a way to get a pension during their old age. Employees of the government sector already get a pension, so this scheme was introduced as a social security measure that enables people from the unorganized sector to draw a pension as well.

The working mechanism is quite simple – you contribute a certain sum every month during your working years, which is then invested according to your preference. You can then withdraw the money when you retire, which is currently set at 60 years old.

When I say you invest according to your preference, I mean that there are a couple of different options that you need to select from. These options pertain to your preference on withdrawal, and asset allocation.

What are Tier I and Tier II accounts in the NPS?

The NPS is meant to be a pension scheme, so it is geared towards giving you a steady stream of income on your retirement.

That means that NPS makes it difficult to withdraw your money during your working years or till the age of 60 in this case.

Tier I and Tier II are two options under the scheme where you can invest your money, the primary difference between them is how they differ in allowing you to withdraw your money before retirement.

NPS Tier I

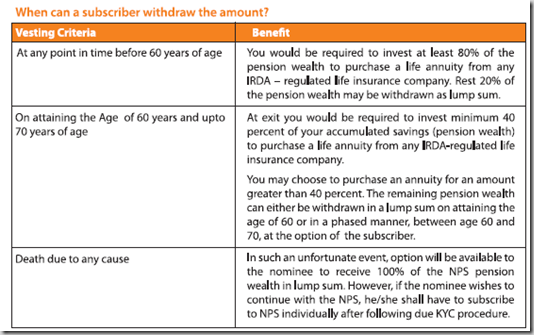

There is severe restriction on withdrawing your money before the age of 60, because it is necessary to invest 80% of your money in an annuity with Insurance Regulatory Development Authority (IRDA) if you withdraw before 60. You can keep the remaining 20% with you.

When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA; the remaining can be withdrawn in lump-sum or in a phased manner.

Here are the details of how your money can be withdrawn in a NPS Tier I account.

Death is another way of getting the money, but that might come in the way of other plans you have.

NPS Tier II Account

The first thing about the NPS Tier II account is that you need to have a Tier I account in order to open a Tier II account.

The Tier II account makes it easy for you to withdraw your money before retirement because there is no limit on the withdrawals you can make from the Tier II account.

You need to maintain a minimum balance of Rs. 2,000, and you can transfer money from the Tier II account to Tier I account, but not the other way around.

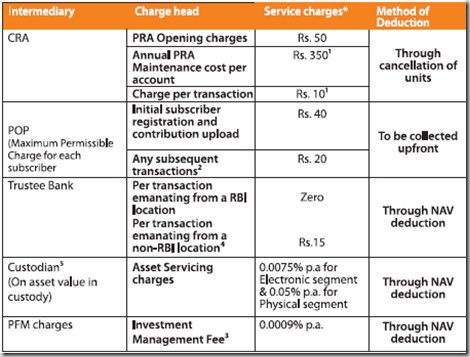

There is a Rs. 350 CRA (Credit Record Keeping Agency) charge which is not present in the Tier II account, but the rest of the fees remain the same.

Asset Allocation and Categories in the NPS

There is an Active Choice option, and an Auto Choice option. If you select Auto Choice then your money is invested in a certain percentage in the various classes based on your age.

Here are the three investment classes:

| Class | Risk Profile | Description |

| G | Ultra Safe | Will only invest in Central and State government bonds. |

| C | Safe | Fixed income securities of entities other than the government |

| E | Medium | Investment in equity related products like index funds that replicate the Sensex. However, equity investment will be restricted to 50% of the portfolio. |

In the Active Choice you can select how much of your money will be invested in the different classes with a cap of 50% in Class E.

Now, there are pension funds that will manage your money, and in either of these options you have to select the fund manager who will manage your fund. So even if you select the Auto Choice, you still have to tell them which fund manager you want to manage your money.

Fees and Costs related to the NPS

I talk about expenses a lot here, and the expenses on the NPS are really low. The annual fund management charge is 0.0009%, which is probably the lowest in the world.

There are some other expenses associated with the NPS, but as you will see all of them are quite low as well. Here is a list of the other expenses.

What is the minimum amount needed to invest in the NPS?

For a Tier I NPS account you need to contribute a minimum of Rs. 6,000 per year, and make at least 4 contributions in a year. The minimum amount per contribution can be Rs. 500.

Minimum amount for opening Tier II account is Rs. 1,000, minimum balance at the end of a year is Rs. 2,000, and you need to make at least 4 contributions in a year.

What are the tax implications of NPS?

The revised Direct Tax Code proposes to make the NPS tax exempt at the time of withdrawal. Initially NPS was going to be taxed at the time of withdrawal, and that had put it at a disadvantage to other products like ULIPs and Mutual Funds. But the revised code proposes it to be exempt from tax, and that really adds to its lure.

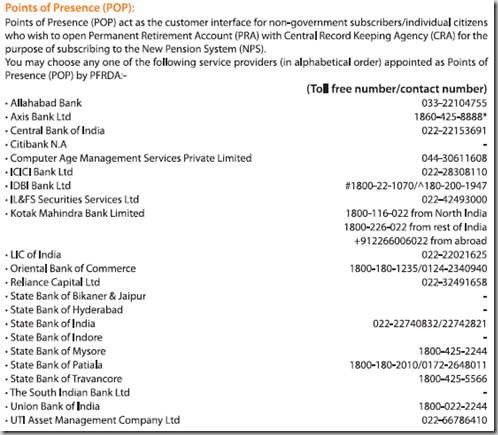

How can I open a NPS account?

You can open a NPS account by going to the bank branches of the banks that are authorized to sell this.

Conclusion

This is quite a good option for people who wish to invest for their retirement, and the government has done good to come up with such an option. It is still early days for the scheme so there are going to be some teething troubles, and I am sure you have come across several articles that write the NPS off completely, or suggest major changes.

While it has not gained in popularity the way you would’ve expected with the low cost structure, a primary reason of that is there is no real incentive for anyone to push this to consumers, so it has not gained any real traction.

That being said, the scheme is a good initiative, and given enough time, the chinks should be ironed out in its favor.

As a final word – a big thank you to Gaurav who sent me all the material, and pushed me to write about the NPS. Thanks Gaurav!

Hi Guys,

The most important aspect of any saving is final withdrawal after a long term accumulation.

This point of how the final fund can be withdrawn is very unclear here. The NPS says that you can withdraw certain portion in cash and buy annuity from the rest !!

Can any one explain what is annuity, how to buy it, what is the cost or expenses, where to buy and other terms of annuity.

Thanks …

Tejas

Annuity means a continuing payment with a fixed annual/monthly amount. You need to purchase immidiate annuity product from PFRDA empannled Life insureres. Cost and expenses depends on that particulr product. Currently, the Indian life insurers who act as Annuity Service Providers provide the following type of annuities in India:

-Pension (Annuity) payable for life at a uniform rate to the annuitant only

-Pension (Annuity) payable for 5, 10, 15 or 20 years certain and thereafter as long as you are alive.

-Pension (Annuity) for life with return of purchase price on death of the annuitant

(Policyholder).

-Pension (Annuity) payable for life increasing at a simple rate of 3% p.a.

-Pension (Annuity) for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

-Pension (Annuity) for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

Hi, It is not clear to me whether the contributions to NPS is tax free or after tax? Also can you contribute every month or every pay period? What is the maximum you can contribute free of tax? is it 10% of salary? I heard if the employer deposited this amount on your behalf it becomes an expense for employer and a free of tax saving for you?

Contribution to NPS is not tax free, but it will help you in saving tax u/s 80C . Also if your employer contributes to NPS on your behalf then this would be taken as additional tax saving, as this contribution does not get added in your total income as per section 80ccd(2)

You can contribute the way you like, one txn per year is compulsory.

maximum contribution to claim tax benefit is 10% of salary in case of employees and 10% of Gross total Income in case of self employed.

Dear Sir,

I am a central govt. employee having Tire-I account. I want to open the Tire-II also. But i have not much knowledge about Tire-II. Pl let me know what is the minimum cotribution required ?, is it monthly basis ? The contributions are as like Tire-I Through monthly deduction from salary ? or there is other way to make the cotribuion?

I am awaiting for your kind reply.

Thanks.

In TIER 2 a/c minimum amount per contribution should be Rs 250/- and minimum contributio should be 1 per annum. along with this you need to maintain a balance of Rs 2000/- at the end of each financial year

i m employee of upgov. i join job as KI in sitapur at 10th feb 2006.how can i know my contribution status in nps? i m contributing in NPS since joinig job.

NPS is a good scheme which will ensure stability at age of benefit.

i have a pran account since last one year but transaction is nil..

can i close my pran account?

I am not sure, but you may close your PRAN account but will not be able to withdraw money out of it. Now as your deposit is NIL, so it hardly matters i guess. Better to write a closure request to POS.

can i close my pran account please tell me?

What if the employer is changed. Is there any provision for fund transfer?

There’s no need of fund transfer. Same account will remain operative.

sir maine education dept me 2005 me join kiya.june 2007 se cpf cut raha hai.mera cpf no 8348 hai.2010 me pran bhara tha par abhi tak pran no nahi aaya nahi information .mera mobail no 9411525443.mujhe apne cpf fund ki kuch jaokari nhi hai ki kitna hai aur kahan invest hai.par ab dept se suchna aai hai ki phir se prdn form bharen.aakhir kab tak koi bada ghotala to nahi sir paresan hun pls suggest kijiye.

i can’t open my a/c and could’t see my cra record statement .i also inform to that no record statement is at my home address till

I want to know that i am a govt. employee and had C.P.F. can i join this scheme please tell me. I am 34 years old now.

good informations,thnku sir

hai

i am 40 years i start the nps if iwant to rs 20000/- pensons how much expend /invest per month suggest mepls

Main Abhi 31 years ka hoon.Main Govt. Job mein Hoon aur Old Pension Scheme mein covered hoon jahan par mujhe retirement ke baad meri us samay ki basi ka half plus DA as a pension milega. But abhi mujhe ek doosri Govt job mil rahi hai senior post ke liye. Main wo join karna chahta hoon but problem ye hai ki main wahan par NPS mein cover hoonga. Shouls i join ? Kynki mujhe doubt hai ki yahan par mujhe kya pension milegi. Pls help me to take decision.

Alok your query needs a details retirement planning calculation, which include the calculations related to pension if you continue with the current job, changes in income profile and accumulation which you can make in your other job and other goals for which you may require money in your lifetime.

On the face of it , i feel defined benefit pension as you are currently eligible for as compared to defined contribution one as in NPS accumulation is much better.

I am 46 yrs old. I want a pension of rs 30,000 per month at the age of 60. How much amount per annum i will have to invest in tier i pension scheme?

Uday, here you have to be very clear on your goal. You want Rs 30,000/- as in current monetary terms or its the future value you are asking for? If i assume this as the future value and assume NPS return to be 10% ( 50% E @12% and 50% C/G @8%) , and pension rate to be 6% then for “with return of purchase price pension†you need to save around Rs 16500/- p.m. Please note i have not taken taxation aspect in the calculation.

I am 34 yrs old. I want a pension of rs 10,000 per month at the age of 60. How much amount per annum i will have to invest in tier i pension scheme?

Damini, here you have to be very clear on your goal. You want Rs 10,000/- as in current monetary terms or its the future value you are asking for? If i assume this as the future value and assume NPS return to be 10% ( 50% E @12% and 50% C/G @8%) , and pension rate to be 6% then for “with return of purchase price pension” you need to save around Rs 1600/- p.m. Please note i have not taken taxation aspect in the calculation.

m central gov job m hu , m is job se dusari job m jana chahta hu bo bhi central gov job h ,lekin maine vaha proper chenal se apply nahi kya h , m is job ko dusari job m show ni karna chahta plz.. muje is ka kya tarika h batae .mujhe pran no ki vajah se koi muskil to nahi ayegi plz.. mera marg darsan kare

I also have the same problem. I could not apply through proper channel at the time of applying for the new job. Can I apply for the new PRAN number in the new job? if i use the existing one, will the DDO come to know abt the previous transactions?

i m also facing the same problem,please inform me if you got to know anything about this matter

Hi

There is no answer for the question of tax contraints on withrawal from Tier2 account

Can someone please clarify

If i invest Rs2000 in Tier 2 account today and want to withdraw it next year say it has grown to Rs2400 then what is the tax payable?

is entire 2400 taxed or simply the gains ie 400 ?

Thanks

vishnu

Yes, It works on the same principal like of pension plans of insurance companies i.e EET (Exempt-Exempt-Taxable) , Which means that complete withdrawal amount is taxable.

what is the process to draw money from nps

Dinesh, you’ll have compulsory start with the pension. Please chk out the article above, it has a table which shows the withdrawal process details.