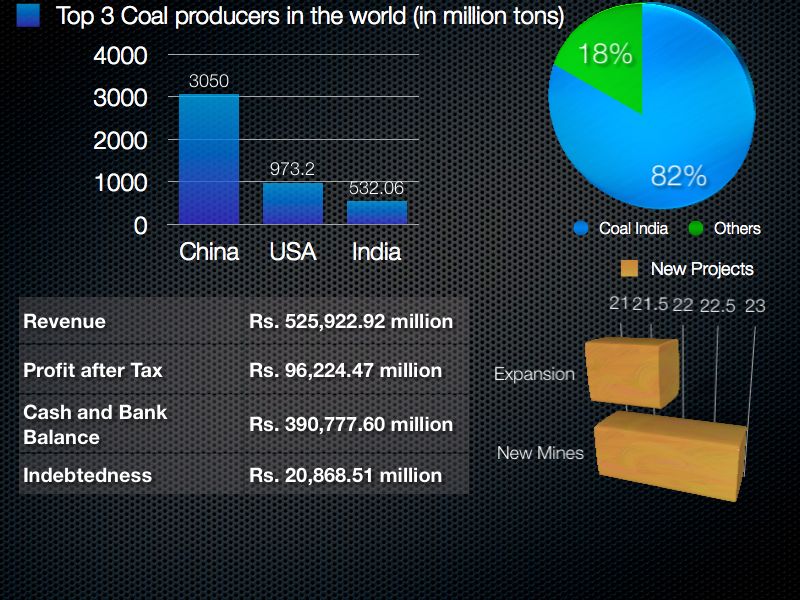

Coal India IPO is likely to be the biggest Indian IPO when it opens on the 18th of October this year. The IPO is expected to fetch the government $3 billion, by divesting about 10% of it’s stake in this Navratna. The big numbers are not surprising given that Coal India is the biggest coal producer in the world with a production of 431.26 million tons in 2010. Coal India also holds the highest coal reserves in the world, and produced 81.9% of total coal production in India. They had revenues of Rs. 525,922.92 million in 2010, with a profit after tax of Rs. 98,294.09 million in 2010. The Networth was Rs. 258,437.73 million, cash and bank balances of Rs. 390,777.60 million, and total debt of Rs. 20,868.51 million, and had 397,158 employees.

With numbers such as these, it is easy to see why CARE assigned a grade of 5 out of 5 to the Coal India IPO. Point worth repeating is that IPO grades don’t take pricing into account, and only consider the fundamental strength of the company.

Coal India operates 471 mines in 21 major coal fields across 8 states in India. They produce non coking coal, and coking coal, but the majority of raw coal production is non coking coal with 91.6%. Despite the big numbers, Coal India continues to expand with 45 projects lined up as of March 2010. Of these – 22 projects are capacity expansion projects and 23 are new mine projects.

The company sells to power generation, steel and cement companies among other industrial companies. NTPC was their biggest customer, and the top 5 customers are all public sector power utilities. The company prices it’s high grade quality coal 15% below the landed cost of comparative imported coal in India.

Financials of Coal India IPO

The company has grown its revenues consistently over the last few years, and they were Rs. 525,922.92 million for 2009 – 10, Rs. 460,640.65 million for 2008-09, and Rs. 386,166.97 million for 2007-08.

The profit after tax was Rs. 96,224.47 million for 2010, Rs. 20,786.92 million for 2008-09, and Rs. 52,432.72 million for 2007-08.

The dip in profits in between is due to an increased expense on employee remuneration. The employee remuneration charge was Rs. 166,555.22 million in 2010, Rs. 197,420.85 million in 2009, and Rs. 126, 351.59 million in 2008.

This increase was due to the provision for retroactive increase in remuneration. What this means is that they had a salary increase for executive, non executive employees, and in the amount of gratuity as well, and this amount was increased retrospectively due to which the company had to create provisions for increased remuneration in 2008, 2009 and 2010, with 2009 being the biggest number at Rs. 41,157.80 million for salaries and wages, and Rs. 39,997.01 million for increased liability towards gratuity.

The total workforce size reduced from 2007 to 2010, but the productivity as measured by output per manshift increased from 2.54 tons in 2007 to 4.47 tons in 2010.

Coal India had an EPS of Rs. 15.56 in 2010, Rs. 6.43 in 2009, and Rs. 6.78 in 2008. The Return on Net Worth (RONW) was 38.03% for 2010, 21.37% for 2009 and 24.91% for 2008.

Coal India IPO Grading Rationale

It’s not often that an IPO gets graded 5 out of 5, but it’s not very hard to see why Coal India got graded that based on their near monopolistic position, and their huge size. Here are some points from the ICRA grading report about the Coal India IPO.

- Coal India is the largest coal company in the world with access to vast reserves.

- Highly favorable demand supply situation in the domestic coal industry.

- Coal India’s near monopolistic position in this industry.

- Continuous labor productivity due to the use of technology, and high share of production from open cast mines.

- Deregulated coal pricing regime gives them the power to price their coal along with other factors like favorable demand – supply, and cost competitiveness.

Coal India IPO Price and Dates

The price for this IPO hasn’t been fixed yet, and I will update this section once it is done. The IPO will most likely open on the 18th October, and close on the 21st October.

These were some of the more interesting things I found in the prospectus that Coal India has filed for its IPO, and this is no way is a comprehensive review, but I hope you will find this useful in deciding how well Coal India fits in your portfolio. I will update this post with more information as and when I find it.

Update: The price band has been fixed between Rs. 225 and Rs. 245, and there is a 5% discount for retail investors.

Click here to read about the IDFC Infrastructure Bonds.

precise , Valuable and related information are provided. more may be added about subscription of share and their financials. your information helps to give a base to understand.