A little while ago I had written about the lack of a silver ETF in India, and that was prompted by a question from reader Prasanna. He stumbled upon this scheme called the Milestone Bullion Series – 1, which lets you get into a structured investment and gain exposure to gold and silver, and was kind enough to send their brochure along my way.

This is a structured product, and the minimum investment needed to get into this product is Rs. 5 lakhs, so this is clearly not for everyone.

The way it works is that they take the money and invest in a portfolio with the following assets:

- Silver: Up to 40%

- Gold forwards / Gold deposit schemes: up to 40%

- Gold linked structure: up to 30%

The fee charged is as follows:

- One time set up fee of 2% or 2.5% in case of investment less than 10 lacs.

- Annual Management fee of 1.5% of the committed amount.

The brochure states that there is a 10% profit sharing as well, but I think that kicks in only after a certain hurdle rate has been met.

Now, the first and second components of Silver and Gold forwards / Gold deposit schemes are pretty self explanatory, so I won’t go there, but where it gets interesting is the third component of a gold linked structure.

Simply put, this is a debenture with the interest rate linked to the price of gold. So that means your principal is protected (to the tune of 30%) and the interest rate is linked to the price of gold. Since this is a debenture, this exposes you to counter party risk, however low you may perceive that to be (remember Lehman?).

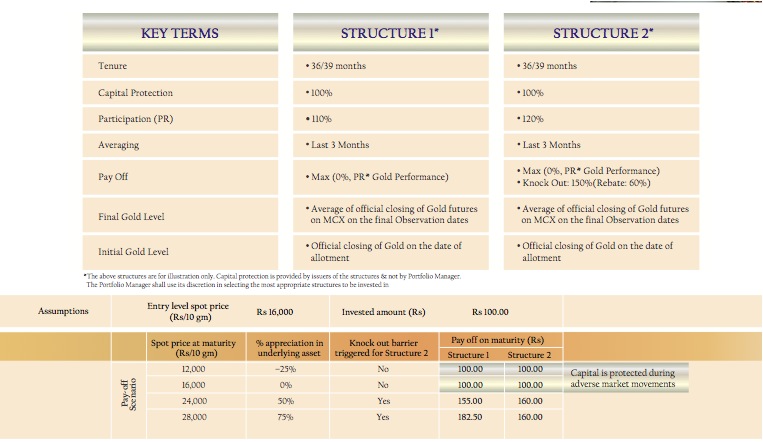

The brochure included a couple of scenarios which I am pasting below:

So by investing in Milestone Bullion Series I – you are getting a bit of gold, silver, and this structured product which is like an ETN (Exchange Traded Note), and if this kind of thing interests you then you can get further details from Milestone Capital.

Personally, I am staying away from gold and silver, and I will list my thoughts in a future post, but thanks to Prasanna for making us aware of this option.