The Shipping Corporation of India (SCI) has filed its draft red herring prospectus with SEBI, and this Navratna will probably come out with an FPO this November.

The company will come out with an issue of 84,690,730 equity shares – half of which are existing government shares, and half of which are fresh issue. Since this IPO contains a component of a fresh issue of shares – SCI will receive money from this issue even though this is disinvestment, and some of these funds are going to be utilized for its fleet expansion plan.

SCI is one of India’s largest shipping companies with approximately 35% of Indian flagged tonnage as on June 30th 2010. The company owned a fleet of 74 vessels of 5.11 million dead weight tonnage (DWT), and had ordered the construction of an additional 29 vessels to be delivered between 2011 and 2013.

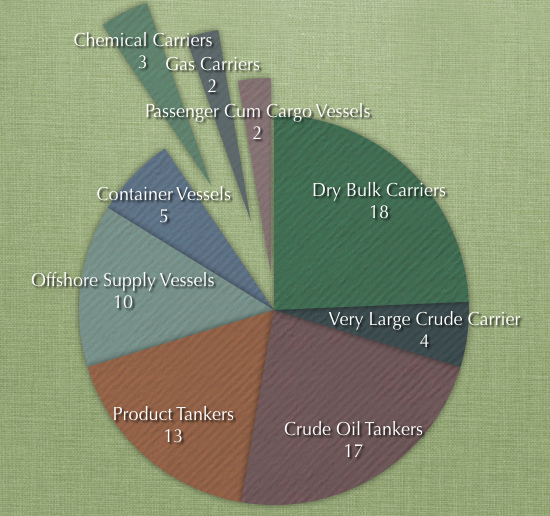

Here is a breakup of the 74 vessels.

The bulk carrier, and tanker division generates the majority of the revenue with 68.5% percent of total income coming from this segment in 2009.

SCI Financials

The fortunes of the shipping sector are closely tied with the global economic conditions, and this is clearly illustrated with the revenue movement of SCI over the years.

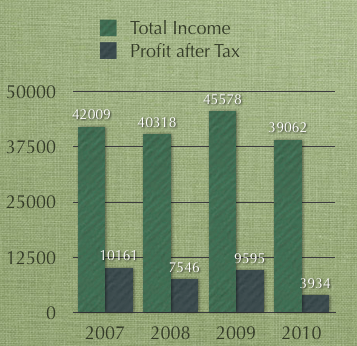

The company generated revenues of Rs. 39.06 billion for the year ended March 2010, which was lower than the revenues generated in 2009 of Rs. 45.57 billion. The profit after taxes also follow a similar trend, and the chart below shows how the numbers moved from 2007 – 2010 (in Rs. million).

SCI had Rs. 22.11 billion in cash and equivalents on June 30, 2010, and had a debt – equity ratio of 0.45. The EPS for 2010 is Rs. 9.29 which is down from Rs. 22.66 EPS in 2009, and Rs. 17.82 EPS in 2008.

The company derives the majority of its revenues from the bulk carrier and tanker division, which in turn is dependent in movement of energy related products like crude oil, gas and coal, and this segment is the cause of the drop in revenues and profit from 2009 to 2010.

These three passages from the Management Discussion are quite useful to understand how the revenues and profit of SCI are impacted by external conditions and its own cost structure.

Demand for energy products

Our bulk carrier and tanker division is the primary revenue source of our Company, accounting for 70.5%, 71.7%, 68.5% and 63% of our total income for Fiscal Years 2008, 2009 2010 and the three-month period ending June 30, 2010, respectively. The demand for our bulk carriers and tankers, to a large extent, depends on the demand for energy related products, including crude oil, gas and coal. Due to imbalance in supply and demand of tonnage and its consequential effect on the freight market, our total income and adjusted profits for Fiscal Year 2010 dropped by 14.3% and 59%, respectively, compared to Fiscal Year 2009. We expect that our results of operations will continue to be dependent upon demand for shipping of energy related products in the future.Fluctuations in charter rates

Our total income and operating margins are affected by the charter rates that we charge for our shipping services, which are largely dependent on supply and demand. Charter rates have declined during the global economic slowdown in Fiscal Years 2009 and 2010 due to the reduced demand for shipping services. During that same period, our total income and profits for Fiscal Year 2010 dropped by 14.3% and 59%, respectively.

Our operational and fixed expenses

Our profitability is significantly impacted by our operational expenses. For Fiscal Years 2008, 2009, 2010 and the three-month period ended June 30, 2010, our operational expenses were Rs. 25,939 million, Rs. 28,103 million, Rs. 27,646 million and Rs. 6,275 million, respectively, or 64.3%, 61.7%, 70.8%, and 63.1%, respectively, of our total income. Some of our expenses, such as those for rent on our properties and interest on our indebtedness, are fixed or subject to limited adjustment by us, and will not fluctuate in proportion to changes in operating revenues. The fixed expenses allow us to control our expenditure. However, if our income from operations decreases due to our inability to employ our vessels at profitable rates or low productivity, we are still required to pay such fixed expenses which will reduce our profitability and operating margin. In addition, any increase in expenses related to bunker (of fuel), maintenance, repairs, spare parts, salaries, consumables and compliance with new rules and regulations will also have a material adverse impact on the results of our operations, if we cannot pass such increased costs to our customers.

To summarize – recessionary conditions lower the demand for oil and fuel products, which drives the majority of the revenues of SCI, and charter rates for the ships are lowered due to the decreased demand. Combine this with a high fixed and operating cost, and the company really feels the squeeze of the slower economic condition, and has its fortune tied to the economy quite closely.

The pricing, or exact dates for the SCI FPO have not been declared yet, and I’ll update this post when the dates and pricing are available.

One thought on “Shipping Corporation of India FPO”