Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

Update: There has been a change in terms, and you can now invest in these bonds in physical form also. Here is the link to relevant IFCI page.

The issue has been extended till January 12 2011

The IFCI Infrastructure bonds are the latest infrastructure bonds to be issued with the 80CCF benefits, and are the second tranche from IFCI, which issued them earlier this year as well.

The IFCI bonds are issued with section 80CCF benefits which means that they will get you a tax benefit of reducing your taxable income over and above the Rs. 100,000 under Section 80C with a cap of Rs.20,000.

The issue has been rated “BWR AA†by “BRICKWORK RATINGS INDIA PVT LIMITED†which means that they are rated as instruments with high credit quality.

Here are some other details about them.

IFCI Infra Bond Options

There are 4 series that you can choose from with a combination of getting interest paid annually, cumulatively, and having a buyback or not.

Here are the details of the 4 series.

| Options | I

Buyback & Non – Cumulative |

II

Buyback & Cumulative |

III

Non Buyback & Non – Cumulative |

IV

Non – Buyback & Cumulative |

| Face Value | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 |

| Buy Back Option | Yes | Yes | No | No |

| Coupon | 8.00% per annum | 8.00% compounded annually | 8.25% | 8.25% to be compounded annually |

| Redemption Amount | Rs. 5.000 | Rs. 10,795 | Rs. 5,000 | Rs. 11,047 |

| Buyback allowed after | 5 years | 5 years | NA | NA |

As you probably noticed IFCI didn’t show yields in the same manner as L&T and IDFC, where they took the tax benefits based on various slabs and showed yields at different tax slabs and interest payments. This is probably a good idea given the various limitations of the way those yields were calculated.

How does the IFCI infrastructure bond buyback option work?

At the time of selecting a series you have to select either series 1 or series 2, which allow the buyback after 5 years lock in period. To exercise the buyback you have to write to IFCI to request it, and this has to be done in the month of November for the year when you want to exercise the buyback.

Open and Close Date of the IFCI Infra Bond

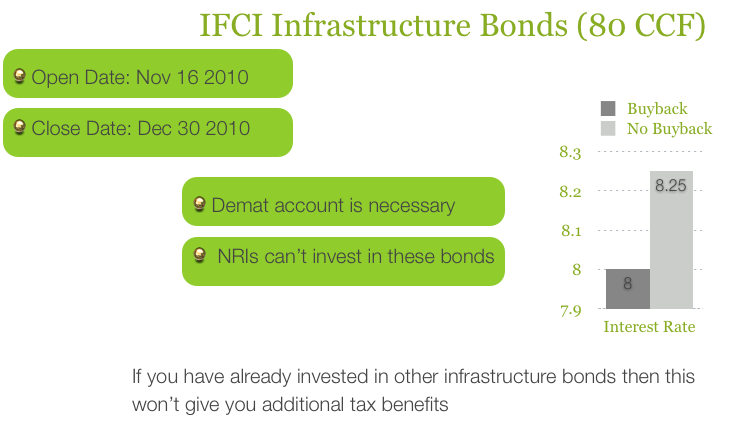

Opening date of the issue: November 16th, 2010 and Closing date of the Issue: December 31st ,2010. They can close earlier as well if their entire demand is met.

Is a Demat account necessary to apply for the IFCI Infra Bond?

Yes, right now it is necessary to have a demat account to apply for these bonds as they won’t be issued in physical format. Even the IDFC bonds started out as Demat only, and were later on changed to allow physical forms also. The target sum to be raised by IFCI bonds are much lesser than the IDFC ones, so they might not feel the need to change and include the physical format as well.

Will tax be deducted at source from the interest payment?

These IFCI 80CCF bonds will not attract TDS, however the interest itself is taxable at your hands. So, the bonds don’t attract TDS, but it doesn’t mean they are tax free.

Will the bonds list in a stock exchange?

Yes, IFCI plans to list these bonds on the Bombay Stock Exchange (BSE), but from reading the information memorandum it seems to me that you can only sell these bonds after the lock in period of 5 years.

Can NRIs invest in the IFCI Infrastructure bonds?

NRI customers are not eligible to apply for the issue.

What if you have already bought another infrastructure bond?

If you have already bought another infrastructure bond, and exhausted the limit of Rs. 20,000 then you won’t get any further tax benefit by buying this bond. There are also several banks that offer 8% interest for terms less than 5 years, so you won’t get much value out of locking your money in this instrument for 5 years.

How can you buy the IFCI infrastructure bonds?

You can buy these bonds through your broker like ICICI Direct, or can submit an application form in one of the bank branches that are accepting them. The information memorandum lists down a large number of HDFC bank branches so you can go to one near your house, and they might be selling the bonds or can at least tell you where you will get them.

Should you wait for another issue?

This issue is 50 basis points, or half a percentage higher than similar L&T bonds issued earlier, and reader Amit Khandelia actually left a comment about LIC coming up with a future issue, and possibly even offering term insurance free with their offer.

IDFC has also indicated interest in coming up with a future issue, so they might come up with another issue too.

The advantage with waiting is that you may get a slightly higher interest rate, maybe half a percentage or one percentage more, but as I said earlier if you’re able to wait and get a bond which offers a percentage higher, and you invest the maximum Rs. 20,000 in it – that means an additional 200 bucks extra in a year; what is that worth to you? How many hours of Googling and speculating is it really worth?

The advantage of getting it now is that you can get this one thing done with, and have plenty of time to receive the certificates for tax proofs or whatever else you need.

This is a personal decision really, but something worth keeping in mind the next time you speculate on whether you should wait or go ahead with it.

Please leave a comment if you have any questions or observations.

Whether the maturity amount of these bonds will be under EET? whether full maturity amount will be taxed at the time of maturity or only interest earned will be taxed?

regards,

vivek goel

Vivek – if you take the interest option then during redemption you will get the face value (5k) back, and so there will be no additional tax on that.

Manshu,

Just browsed through your site, and came to know of the wonderful articles you have blogged here, about Tax Saving and necessary instruments to do so.

Enjoyed every bit of it, and I would be visiting more often. It’s long since I participated in any Financial discussions on net, and now I have found a good place to do so.

Keep up the good job.

Wow – thank for your kind words, and I really look forward to more comments and participation from you in the future.

Tax-Saving or Tax-Declaration season is back. No matter what, January and March are indeed the Tax Saving months and Investors, who either remain busy with their office work, business, families or other daily routines or actually get up late for these important issues in one’s life, flock to the tax saving products like there were no such products available till the start of the new calendar year. In my opinion, every person who has spare money in his/her Savings A/C. or for that matter, in fixed deposits fetching 5%-7%, must go for Tax Savings either u/s. 80C or 80CCF because one’s Bank Savings A/C. takes approx. 8.8 years to earn 30.9% i.e.; 30.9%/3.5%. With these Tax Savings you can save (or actually better to call it earn) 10.3% or 20.6% or 30.9% (depending on your tax bracket) at one go.

IFCI Infra Bonds fetch an interest rate of 8.25% without Buyback option and 8% with Buyback option. Investments can be done through demat accounts and advisable also, if you opt for higher interest rate of 8.25%, in which case you won’t be able to redeem it back to IFCI after a lock-in period of 5 years. In other words, investors going for 8.25% interest option will have to sell these bonds on the exchanges in case they want to get the liquidity for themselves. But I’m not sure who would be interested in buying these bonds after 5 years at Par value, without any tax saving benefit and who would like to sell these bonds at a value below the Par value if actually the bonds trade below it. So, in my opinion, “the most attractive option†is the cumulative scheme with a buyback after five years i.e.; option with 8% interest compounded annually. Investors who choose to exit after five years stand to benefit the most.

To invest in IFCI Infrastructure Bonds/ELSS and save tax u/s. 80CCF/80C — Delhi/NCR (including Gurgaon & Noida), Call/SMS: 9811797407.

Dear Manshu ,

I do not have any demat acoount but my wife has it. She is a housewife and as per office record she is dependent family member. I live in a small city in Punjab where I could not find any agent or institution through which I can purchase Infrastructure bonds in physical form.

Kindly advise:

1) will purchase of bonds in my spouse name thro’ her DP qualify for my tax deduction?

2) In case of guys like me living in cities with less resources , how to purchase physical form of bonds as u mentioned that intercity cheques are not valid?

Request your help. Thanks

I have not seen any evidence that suggests that buying in wife’s name will get you the tax benefit. If anyone else has read something that suggests this is possible then please leave a comment here.

For purchasing the bonds in physical format you do need to submit it at a place accepting them, so I don’t have any idea on how you could tackle this situation.

Hi, The return after 5 yrs is Rs.29,300 for rs 20,000/-. If tax benefit is included for 20% tax bracket, the gain is Rs.13,300/- after 5 yars. Pl clarify,

1. Does one have to pay tax for this amount at the end of 5 yrs.

2. Investing in mutual fund will give far more yeald, in general, right?

I’m not sure how you have arrived at this number Sriram, and what option you’re looking at. As for your questions – Yes, the bond is taxable, and if you take the cumulative option then you will have to pay taxes at the end of 5 years. For the interest income you will have to pay tax every year.

Mutual funds are a different kettle of fish, and especially equity mutual funds which don’t guarantee returns. So, while people might say that equity mutual funds return a higher rate over a longer time frame, they are not debt instruments, and shouldn’t be compared with these bonds.

can i get the hard copy of recipt from icfi if i purchase bond from icici direct for showing proof to get the tax assumption

They take time to send you that, so you must be prepared to wait and have some good buffer on your last date to submit tax proofs.

can i get the hard copy of recipt from icfi if i purchase bond from icici direct for showing proof to get the tax assumption.

I have invested 20,000 in IFCI infrastructure bonds trough karvy . I have not got the hard copy or allotment advice from IFCI yet. I need to show the hard copy of allotment as proof to get tax exemption. When would i get the hard copy of allotment. Does anybody else has got the hardcopy of bond allotment till now.

Also what is meant by allotment advice

can we show bank statement paid to IFCI infrastructure to get the proof for tax benefits purpose

I too put money thru icici direct 2 days back. When will I get receipt of the same? My office wil not accept icici direct printout. they need ifci receipt only.

Is the Tax Saving Infrastructure Bond option still alive or closed. I have not invested so far and need to invest Rs 20,000/- before 10th of this month.

Pl confirm.

It’s still available as the date has been extended till 12th January.

Hi

I have invested 20,000 in IFCI infrastructure bonds. I have not got the hard copy or allotment advice from IFCI yet. I need to show the hard copy of allotment as proof to get tax exemption. When would i get the hard copy of allotment. Does anybody else has got the hardcopy of bond allotment till now.

Also what is meant by allotment advice

Dear sir

I invest Rs.20000/- in IFCI-Infrastructure bond on 31.12.10 for non buyback condition for 10years.

what is the maturity amount i will get at the end of maturity.

Regards

Sanjib Agarwalla

11,047 at the end of 10 years Sanjib.

wrong calculation ,i invest rs 20000.00 and i get only 11047 at the end of 10 years.Please correct and send

The amount I wrote down was for one bond of Rs. 5,000 which is what is shown in the post also, which you somehow failed to see.

How about doing a little due diligence before saying the calculation is wrong?

Hi, If i take the IFCI bond from icicidirect 1. Can i get Bond in physical format? 2. For income tax proof submission what i need to submit? 3. Do i get any details or receipt from online application? 4. Which is the best option out of 4 options? I don’t want to keep my bond block more than minimum time period. Thanks in advance….

1. No.

2. They will send an allotment advice.

3. No, I haven’t heard of them giving out anything when you subscribe to it.

4. If you need to select the one with the buyback option, and see if you want to get paid interest every year or would rather have a lump – sum at the end. Keep inflation in mind which is a very real threat, and chips away on your money every year.

I have been told that it may not be prudent to invest in IFCI bond since its not rated by reputed rating agencies. Is there any risk of not getting even the guaranteed int rate of 8-8.25% since its an unsecured bond? What are the drawbacks/risks that are assoiciated with an unsecured, underrated bond. Please clarify.

Warrier – none of the other infra bonds were secured also, and I don’t think the infra bonds to be issued in the future will be secured either. In case of bankruptcy – shareholders get wiped out first, and then the unsecured debtors, so if it comes to the bankruptcy of IFCI then you can expect some problems in not only getting the interest but your principal as well. How likely that is – I have no idea.

As for the credit rating – the rating itself is good, but the agency Brickwork doesn’t have the kind of name that CRISIL has got.

IF you don’t feel comfortable investing in this then know that there will be more issues in the future that you can wait for, and buy the infra bonds from someone else.

I have invested in IFCI LT infra bonds but yet to receive any communication from IFCI regd the same.

Any idea whom should i contact to get the proof for tax benefits purpose?

This link has got some contact details towards the end of the page which you could try out.

http://www.ifciltd.com/IFCIBonds/InfrastructureBonds/CurrentIssue/tabid/218/Default.aspx

Hi,

I am planning to invest in IFCI part-2 series Infra bonds up to 20K but my demat account does not allow me to buy bonds online. I have no option but to buy in physical form.

Could you please advice if there is additional tax burden incase we buy in physical form as the correngidum states that TDS will be applicable on interest accured more than INR 2500 in a financial year.

Gaurav – there is no “additional” tax as there is a tax on the demat form as well, but that will not be TDS, just added to income which will be taxed later on. In this case it looks like it will be TDS, though I’m not very sure about this point, as there have been some changes on this point as most issues came with only demat form first, and then opened a physical option as well.

Just happened to surf up to your site. The information is cogent, well researched and useful. Really wasn’t looking for assistance on the subject but this blog is doing a great service to us whee the tax laws are complicated and understanding very poor.

Do keep up the good work

Amit

Thanks for your kind words Amit – your thoughts are much appreciated.

reading your blog …very informative for beginners like me

Just wanted to clarify . do i have to purchase such bonds evry year to claim 20k exemption .. is this startegy justified bcoz money gets locked in for such a period .

also the 4 series for the above bonds are little confusing ..which one to chose is difficult .. i think for starters and my understanding from the blog i will go for buyback non cumulative as i can sell them aftr 5 years .

i can use different startegy next year

Yes, every year, assuming that they’re allowed next year as well.

Personally, I like the option of getting some interest paid every year, and having a buyback option even if that means a slightly lower interest (because the amount itself is small) but then that is a personal preference, and you can opt for what suits you the most mrk.

hey thanks for replying ..

i will surely keep that in mind

Do we have any Infrastructure bond having only 3 year lockin period and can the same be purchased without a demat account…

No, SV, the bonds that have come in so far have had 5 year lock in as the lowest – IFCI & IDFC.

IFCI infrastructure bond is closing on december 31 2010. It is a very good opportunity to claim tax exemption on additional Rs 20,000. Infra bond is better option than SIP for 5 years.

Hmmm. very very interesting…

Can you be more elaborate Mrs.Nisha???

She was just leaving the same comment on every post, and eventually I had to ban her and mark her as spam.

Suppose I invest on IFCI Tax Saving Long Term Infrastructure Bonds– SERIES II Save Tax u/s 80CCF now, how much time will it require to get the bond to submit to my organisation for tax proof purpose. Or Is there any other way to submit.

I’ve seen that it’s taking about a month or so – the other option is to just buy it in physical form, and use the receipt for tax proof, which you will get immediately. Check with your company accountant if they are going to allow this or not first though.