Also read about the REC Infrastructure bonds here or the IDFC Infrastructure Bonds Tranche 2 here.

Update: There has been a change in terms, and you can now invest in these bonds in physical form also. Here is the link to relevant IFCI page.

The issue has been extended till January 12 2011

The IFCI Infrastructure bonds are the latest infrastructure bonds to be issued with the 80CCF benefits, and are the second tranche from IFCI, which issued them earlier this year as well.

The IFCI bonds are issued with section 80CCF benefits which means that they will get you a tax benefit of reducing your taxable income over and above the Rs. 100,000 under Section 80C with a cap of Rs.20,000.

The issue has been rated “BWR AA†by “BRICKWORK RATINGS INDIA PVT LIMITED†which means that they are rated as instruments with high credit quality.

Here are some other details about them.

IFCI Infra Bond Options

There are 4 series that you can choose from with a combination of getting interest paid annually, cumulatively, and having a buyback or not.

Here are the details of the 4 series.

| Options | I

Buyback & Non – Cumulative |

II

Buyback & Cumulative |

III

Non Buyback & Non – Cumulative |

IV

Non – Buyback & Cumulative |

| Face Value | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 | Rs. 5,000 |

| Buy Back Option | Yes | Yes | No | No |

| Coupon | 8.00% per annum | 8.00% compounded annually | 8.25% | 8.25% to be compounded annually |

| Redemption Amount | Rs. 5.000 | Rs. 10,795 | Rs. 5,000 | Rs. 11,047 |

| Buyback allowed after | 5 years | 5 years | NA | NA |

As you probably noticed IFCI didn’t show yields in the same manner as L&T and IDFC, where they took the tax benefits based on various slabs and showed yields at different tax slabs and interest payments. This is probably a good idea given the various limitations of the way those yields were calculated.

How does the IFCI infrastructure bond buyback option work?

At the time of selecting a series you have to select either series 1 or series 2, which allow the buyback after 5 years lock in period. To exercise the buyback you have to write to IFCI to request it, and this has to be done in the month of November for the year when you want to exercise the buyback.

Open and Close Date of the IFCI Infra Bond

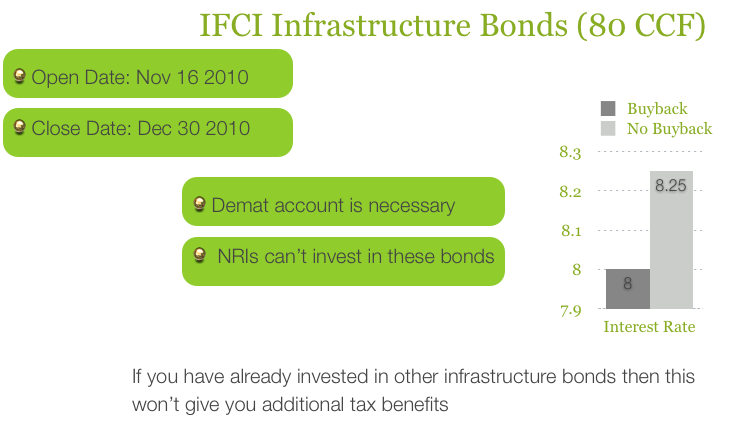

Opening date of the issue: November 16th, 2010 and Closing date of the Issue: December 31st ,2010. They can close earlier as well if their entire demand is met.

Is a Demat account necessary to apply for the IFCI Infra Bond?

Yes, right now it is necessary to have a demat account to apply for these bonds as they won’t be issued in physical format. Even the IDFC bonds started out as Demat only, and were later on changed to allow physical forms also. The target sum to be raised by IFCI bonds are much lesser than the IDFC ones, so they might not feel the need to change and include the physical format as well.

Will tax be deducted at source from the interest payment?

These IFCI 80CCF bonds will not attract TDS, however the interest itself is taxable at your hands. So, the bonds don’t attract TDS, but it doesn’t mean they are tax free.

Will the bonds list in a stock exchange?

Yes, IFCI plans to list these bonds on the Bombay Stock Exchange (BSE), but from reading the information memorandum it seems to me that you can only sell these bonds after the lock in period of 5 years.

Can NRIs invest in the IFCI Infrastructure bonds?

NRI customers are not eligible to apply for the issue.

What if you have already bought another infrastructure bond?

If you have already bought another infrastructure bond, and exhausted the limit of Rs. 20,000 then you won’t get any further tax benefit by buying this bond. There are also several banks that offer 8% interest for terms less than 5 years, so you won’t get much value out of locking your money in this instrument for 5 years.

How can you buy the IFCI infrastructure bonds?

You can buy these bonds through your broker like ICICI Direct, or can submit an application form in one of the bank branches that are accepting them. The information memorandum lists down a large number of HDFC bank branches so you can go to one near your house, and they might be selling the bonds or can at least tell you where you will get them.

Should you wait for another issue?

This issue is 50 basis points, or half a percentage higher than similar L&T bonds issued earlier, and reader Amit Khandelia actually left a comment about LIC coming up with a future issue, and possibly even offering term insurance free with their offer.

IDFC has also indicated interest in coming up with a future issue, so they might come up with another issue too.

The advantage with waiting is that you may get a slightly higher interest rate, maybe half a percentage or one percentage more, but as I said earlier if you’re able to wait and get a bond which offers a percentage higher, and you invest the maximum Rs. 20,000 in it – that means an additional 200 bucks extra in a year; what is that worth to you? How many hours of Googling and speculating is it really worth?

The advantage of getting it now is that you can get this one thing done with, and have plenty of time to receive the certificates for tax proofs or whatever else you need.

This is a personal decision really, but something worth keeping in mind the next time you speculate on whether you should wait or go ahead with it.

Please leave a comment if you have any questions or observations.

I had applied the bonds in physical form, but I had also mentioned my demat details in the form. My Demat account does not show these yet.

Has someone received in the physical form also?

Hi

I could see the IFCI bonds under my ICICI Account under DEMAT holdings section.

However i need a hardcopy of the allotment to show as proof for tax exemption.

Will the hardcopy be sent to us.

Also if not, what we will show as proof to get tax exemption

Get a copy of ur demat account statement. and hand it over to your hr person

Hi

I could see the IFCI bonds under my ICICI Account under DEMAT holding s section.

Will the hardcopy of bond will be sent to us.

IFCI bonds are allotted today. You may check your demat account.

yet not recived ifci bond certificate of physical form of bond

I just called them on 011-29961281/2/3 , information given that it will be allocated tomorrow or day after tomorrow.

Did any one got bond allocation or any communiaction from IFCI . I am getting different feedback from their Delhi office everytime .

Has someone got allotted? It is already over Feb 9th.

I had checked with ICICI Customer care.They said once this is allocated then you can see the same in the icici bank site under ur Demat account(in demat holding) i.e The way you see the shares by loging in to icici Bank website. I am waiting for the Bond Allotment too.

I have called IFCI – Delhi office for the allocation of Bonds . They said it will get allocated on 7/2/11 . But I don’t know , how to view this in ICICI .Direct, since I will have to show this to my company for tax deduction . Please help me by informing , how to view this in ICICI . Direct .

I suggest everyone to at least scroll through the discussion forum at least once before posting a question.Physical copy for IFCI is supposed to available only after 31 Jan as per the info received from IFCI representative.

Manshu,really appreciate your tolerance for replying to the same question of “how to claim tax benefit for Infra bond” 10-15 times.

I’d like people to do that very much as it reduces overhead, but it hardly ever happens. As long as people are civil I don’t mind answering. It’s the rude ones and “do the needful” type people who tick me off, and get it from me. Thankfully those are rare, and for some reason are almost always through email.

This much information was available on this blog and I suffered lot. But finally invested on last day thru a local investment house. I have opted for dmat form and given the detail of my Dmat account, I am not sured if the same is processed properly.

What I can do now, should I keep checking my dmat account, email or IFCI website, or I will get some letter by post.

Just wait for it because calling up anyone won’t expedite. Continue checking your account.

i had applied 4 nos bonds for ifci to exempt the income tax, but no reciept or physical recieved copy or no response letter or mail will be delivered to my e-mail ID. please send me the appropriate decision to save the income tax

Hi, I purchased 4 IFCI infrastructure bonds worth Rs 20000 in December 2010. However, I’m yet to receive the bond (I dont have a demat account). My company needs me to provide a copy of the bond so as to claim the tax benefit.

Let me know when I’ll receive the same so that I can get the tax benefit out of it. My form number is: 2489147

Thanks!

No one has got them yet, so you’ll have to wait longer. I don’t know when they’ll start issuing them but someone will leave a comment here, and you can check this thread or if you get an SMS that’s even better.

Hi,

I applied for IFCI Infra Bond on 27th Dec. I still dont see it in my demat account nor received any advice that it is allotted or not. Did any of you guys received any correspondence?

Thanks,

Prabhu

How will they send physical copy of bond allotment? Is it to the present address to which they will sent by post/courier. Can we see the bond online in icici direct or ifci website?

I think the folks who got IDFC got it via registered post, and you can’t see it online yet.

I’ve Invested in IFCI Infrastructure bond, amount is deducted on 14th Jan 2011. But i haven’t received physical form of the bond. Please advice me how to proceed with this.

No one has got them yet, so I guess the only thing right now is to wait.

IFCI bond receipts for ICICIdirect users available on icici direct website.The physical copy for IFCI will be issued after 31-Jan,as per info from ifci representative

Thank you so much for sharing this info dkar – this would help a lot of folks!

already applied for IFCI and invested 20k , when do i physically receive these bonds for submission

I’ve not heard of any news on when they are going to do so Sridhar.

Wonderful discussions,keep it up. however after lot of in depth study i personally feel that option I is the best because you will keep getting your interest amount every year and you will not burden it at the end of fifth year. With so much inflation what will be the value of interest earned at the end of five years. keep saving and enjoy your money.

Thanks for your opinion Ravi – what you say makes sense to me, but as I’ve repeated countless times, what makes sense for you and me may not make sense for some one else because their situation is different, so they should evaluate these things on their own and take a final decision.