Sourabh left a comment with a question about Ex – Dividend, Record Date, and Declaration Dates with respect to dividends, so I thought I’d do a post on it with an example because there are quite a few dates involved, and it can sometimes get overwhelming.

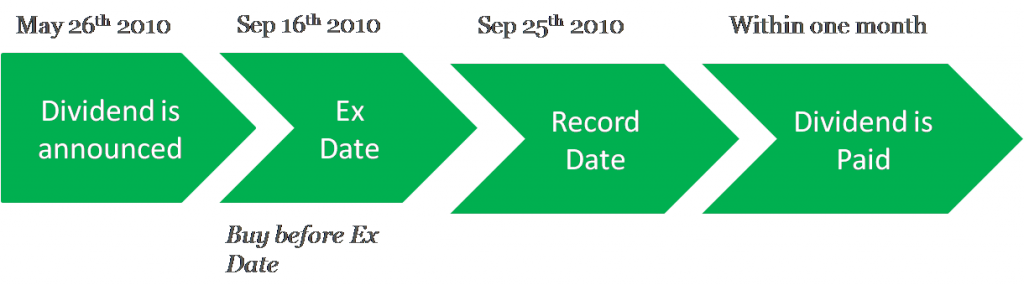

Let’s take an example of Oil India Limited’s Final Dividend to see how this works. The first date is of course the date on which the dividend is announced.

Normally, this is when the Board of Directors recommend a dividend, and it is still subject to shareholder’s approval.

In our example – Oil India’s Dividend was recommended on May 26 2010, when their directors said that the company will pay a dividend of Rs. 16 per share, if it’s approved by the shareholders in their AGM (Annual General Meeting).

The AGM was held on 25th September and the dividend was approved by the shareholders.

But, the question is who gets the dividend?

Since shares are traded throughout the year, and dividends declared just a few times in a year – it becomes necessary to fix a date, and say that whoever owns the shares on this particular date will be entitled to the dividend.

This is called the “Record Dateâ€, and in our example this is 25th September 2010, so whoever has their name in the company’s books on 25th September 2010 will get the 16 rupee dividend.

However, there is another more important date, which is called the “Ex-Dateâ€. There is a time gap between when you buy a share, and when your name gets on to the company records, so if you buy Oil India shares on 25th September – your name will not be in the books of the company on 25th itself, and you won’t get the dividend.

You need to buy the share before the Ex Date because that ensures that there is enough time for your name to get into the company’s registers, and get you the dividend.

In this case the Ex – Date was 16 September 2010. This was much earlier than the 25th September 2010 Record Date because the company closed its books from 18th September to 25th September, and in other cases (especially of interim dividend) the Ex Date can be just one or two days earlier than the Record Date.

So, if you want to buy a share for its dividend, then make sure you purchase it before the Ex Date.

Do keep in mind however, that the share will lose in value on the Ex – Date because the person who buys the share on that date will not get the dividend.

How can you find out the Ex Date?

The easiest way to find the Ex Date is to lookup the info from the NSE Website. You can input the ticker on the search box on the home page, and when the price details open up on the next page, scroll to the bottom of the page and click on “Corporate Actionsâ€, and this will open up a table that shows you Ex Date for each announcement among other things.

I don’t think it makes much sense to buy a share a few days before the Ex Date in order to get the dividend because the share will lose in value as soon as you hit the Ex Date, so I’d say knowing this concept is good for your knowledge, but don’t try to buy stocks too close to the Ex Date because the market is efficient enough to reduce the price of the share with the value of the dividend when the Ex Date is reached.

I had bought reliance capital 1400 shares on 04/05/2016..will get dividend. Pls reply

What is the “Effective date” Manshu ?? Is is the same as Ex-Dividendd date ?? Will I get the dividend if I purchase the share on the effective date ??

Hi,

What would be the effective date for the dividend ?