This is another post from the Suggest a Topic page, and while the original comment had a lot of questions about the overall functioning of an economy, I thought I’d take one question from it, and try and answer that in a post.

Why can’t a country print money and become rich?

A lot of people have this misconception that a country’s currency is backed by the gold it holds. But, this is simply not true – any country can print as much money as they want, and they don’t need to have any gold to back their currency.

In fact, in recessionary times – countries do resort to printing money, or what is known as Quantitative Easing, – a term that became popular just after the recession.

But, that measure is only for extreme situations, and is also considered dangerous because printing money causes inflation in an economy, and if you print too much money you can get hyper – inflation also.

So, how does printing money cause inflation?

Demand and Price

Let’s take a simplified example to understand this. First, think of how demand of a product is related to its price.

That’s fairly easy to do right? A lot more iPads will sell at Rs. 5,000 than they will at 25,000.

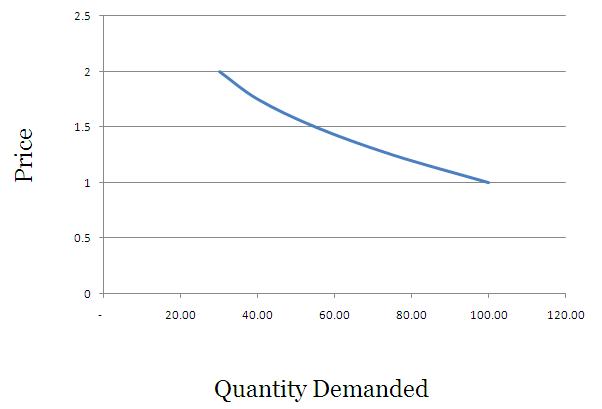

If you were to draw a graph that shows the relationship between demand and price of a product it would generally look like this.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

In this example – at 1 rupee you demand 100 units of a commodity, but at Rs. 2 you demand just 30.

You can get fancy and call this a downward sloping demand curve.

Supply and Price

On the other hand a lot more suppliers will be willing to get into a business if the end product sells at a higher rate. I remember quite a few years ago, a lot of households started planting vanilla in Kerala because vanilla rates had shot up.

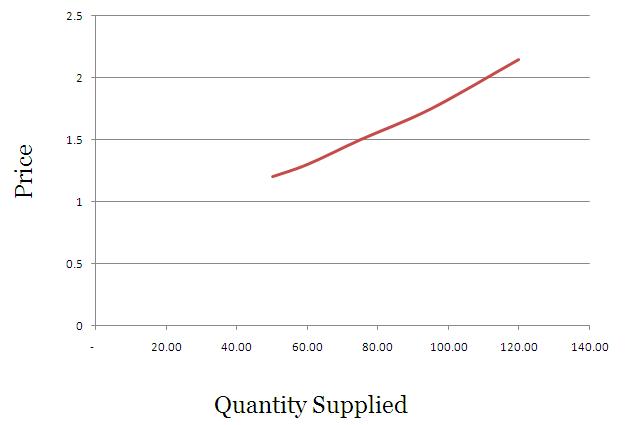

So, supply will be high at higher prices, and that curve would look something like this.

In this example – you want to supply just 50 units at Rs. 1.20, but when the price shoots up to Rs. 2.15 – you are willing to supply as much as 120 units.

Feel free to tell your friends that supply curves are upwards sloping.

How is the price finally fixed?

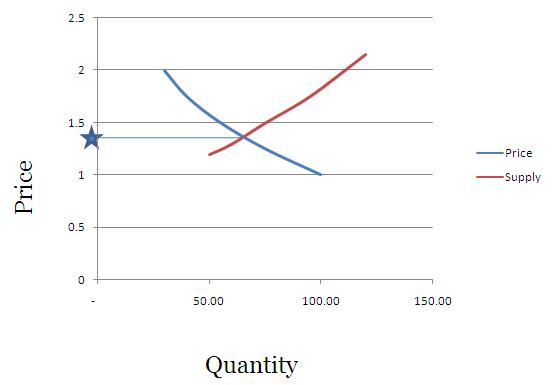

The price of any product is largely determined by its demand and supply, and when you super impose the price curve and demand curve – the intersection is called the equilibrium price, and it is generally believed that prices will move towards this point and stabilize here.

In our example this will look something like this.

What will happen if the government prints money and hands it out to its citizens?

What happens when your income rises? – Your consumption or demand of certain things also rises with your income.

I see a great example of this with cell phone usage, as I have cousins of varying ages. The one who goes to school just uses SMS and gives missed calls, the one in college doesn’t mind calling you, but you have to call her back if you want to have a long conversation, and Mr. Mittal can dedicate at least one cell phone tower to the one who has started earning.

The eldest one has gone through the stage of SMS and short calls, and as her income rose, so did her consumption. Your consumption / demand will generally increase with your income levels.

Now think of a situation where you open up OneMint and read that the government is sorry for all its misdeeds, corruption, and general incompetence, and has decided to credit everyone’s savings account with Rs. 1 crores, and if you don’t have a savings account then a minister will come to your house and give you the cash personally.

After you recover from the mild heart attack this news causes you – you will think that you have become rich, and will start spending like crazy. If you used an air conditioner for just the night – you will now want to use it all the time.

Your demand for a lot of things will increase since you have this extra money now, and you are rich.

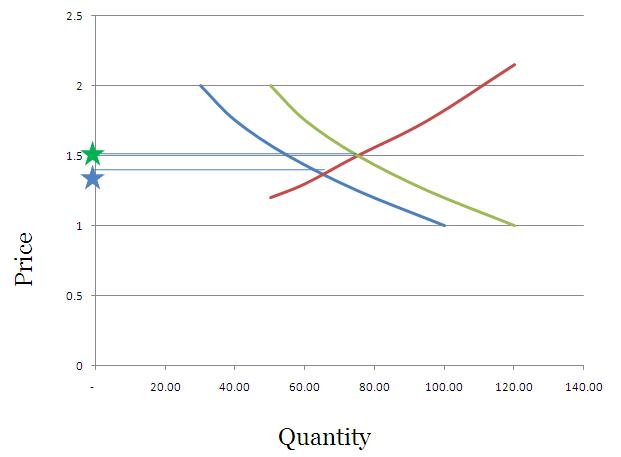

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

This will have the impact of shifting the demand curve to the right, and pushing the price of the commodity upwards.

If you were to graph this – it would look something like this.

The green star indicates the price which will be fixed due to the new realities of increased notional wealth, and people demanding more because their wealth has been increased.

Think of times when the stock market is booming – people have this “wealth effect†where they feel that they are richer and start spending more, and as a result prices rise as well. Just printing money will also do the same thing.

What I have done here is take an example that’s used with respect to increased incomes, but in this case the increased income is nothing but a handout from the government which has printed more cash. This is a theoretical way to understand the consequence of printing money, and you can see a real example of this with Zimbabwe.

At one point you could a buy a 100 billion dollar Zimbabwe bank note for 15 US Dollars at E-bay, but even that was really expensive because if you were actually in Zimbabwe you could buy just 3 eggs with it!

So, printing money is not the way to become rich – becoming competitive – producing cheaper goods, and facilitating exports are.

If your people can buy onions at 5 bucks a kg instead of 50, they are richer by the amount they save and this can be used elsewhere, but if you credit everyone’s account with more money – they will just end up driving the price of onions higher, and that won’t do them any good.

As always, feel free to weigh in on the question, and be sure to point out any mistakes that you see.

All numbers taken from here.

I totally agree with what this one mint says abot inflation,rise in cost . I would like to thank onemint fir gjving me idea about this topic.

I understood what you said. But i have a doubt. I feel that the demand may not vary with the same proportion as the money everyone gets in bank account. So ultimately if everyone gets more money then it may help.

in my view all statement r incorrect becoz india can print too much money n buy all weapons from other country like japan russia,america can lead inflamation in other country n india use necessary money that’s why my country is safe

“So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.” – This sentence needs to be corrected.

I have doubt

consider a situation in which the government prints money sufficient for an avg life style and distribute it to people who are poor

and the government has the power to determine the price of any produce , so even though the demand rises the price won’t exede so this won’t cause inflation

I agree that if more money is printed and given away to people, it will only cause inflation. But, I still feel that there are other ways the extra money can be used – E.g., Provide free education, free medicine / hospitalization, improve country’s infrastructure etc.

There could be a counter argument that we may not have enough hospitals to accommodate people if we provide free hospitalization. That may be true. But, then we can at least prioritize it to provide free treatment for life threatening diseases. Or there could be an argument that people may take their health for granted and may engage in drug abuse, smoking etc. Yes, that may be a side effect. But, the value of free treatment would be more beneficial than the negative side effects.

I am just a common man and not well versed in economics. So, just wanted to get feedback on my thoughts above. Do provide inputs on this.

If I get rs one crore from the government credited to my saving account I won’t work anymore bcoz m already having

One crore in my account why should I work? Suppose I am currently working in a mobile manufacturing company and getting rs 15000 salary pm. After being credited with one crore in my account I will surely not work for rs 15000. As a result my employer will have to offer me 2 lacs pm and this will increase cost of production of mobile immensely as I am not the only worker but there are thousands of other employees who will get or demand same kind of hike. This will increase the price of mobile from say rs 10,000 to 10,00000.moreover cost of other factors of production may also increase.

In the above article i want to say that if any country print more currency and Government of that country utilized that money on rural development or any irrigation scheme which is under taken by that government.I don’t think any type of inflation or hamper occurred to the financial condition of that country. Ultimately govt. spend our money on this social scheme.

Well, for one thing, there is no guarantee that the talented people stay in the country or do real work.

If the newly minted money is spent selectively on actually-needed infrastructure projects, the infrastructure stays in the country, and if it is actually needed, it will grow the economy for decades to come.

No reason why they talented people cannot become civil engineers and get paid to design bridges that can last 100 years.

I have a idea::::Why don’t government provide extra printed money free to those talented people ‘students’ etc who wants to invent something like which they can export to other countries” effects no inflation’demand of our currency’s”economic growth.. Am I correct?

In the last graph, Re. 1/- & Rs.2 is interchanged with quantity. Please see below given explanation.

So, let’s get back to our earlier example, and say that instead of demanding 30 units at Re. 1 – you will now demand 50 units at Re. 1 and instead of demanding only 1oo unit at Rs. 2 – you will now demand 120 units at Rs. 2.

I want to that is RBI printed money everyday

I totally agree with what this one mint says abot inflation,rise in cost . I would like to thank onemint fir gjving me idea about this topic.THANK U VERY MUCH.

Good article. India has 22,000 tons of Gold and imports 900 tons annually. If any agency, NGO, Company or an organisation mints Gold coins of 100 milligram weight, about 2.2 Lakh CRORE such coins may b minted and the agency would make a profit of Rs.10,000 crores assuming 5% profit.

hi,

pl clarify my doubt. when a foreign company is willing to set up a production plant in India, they exchange DOLLARS for INR. with this INR, they spend to set up facilities and factories. they produce xyz product and sell in India. Indians pay in terms of INR. my doubt is, how will he take back INR to his country.

oh bandle of thanx for eradicatng mine confusion which have been crosed for last 6 years, i ‘ve red so many book but couldn,t grasp proprly . But according to my mind is concerned the country should print money not in more quantative bt in few for rural areas instead of urban areas , there z lack of infrastructure in rural areas i,e espcially lack of roads, ,educational institution and facilities, power supply, Health centres so on problems faced who lived in rural areas, to some extent urban areas r developing than rural. For instance if we measure eco. Development on the bases of rural development eg life expectency, literacy rate, social infrastructure etc then eco. Dev.. Rate Of india may b 5%.

oh bandle of thanx for eradicatng mine confusion which have been crosed for last 6 years, i ‘ve red so many book but couldn,t grasp proprly .

need the syllabus for ri exam

Why to handover the money to citizens? Why don’t they just print the money and develop the infrastructure of the nation? Better roads, bridges? Changing cities to smart cities? Or what about setting up hydraullic peojects, in 21st Century, INDIA still suffers from power cuts.

Why do we require to print money to built infrastructure ?

if GOI itself is producing all raw material and building roads, then they dont need money .

But since this task is given to private players, you need to give them money, which inturn are either your citizens or foreign players.

Foreign players will not accept INR and will demand USD.

if its an Indian co. then again its as good as you are printing money and giving it to your citizen.

Remember , the money printed by a country is a representation of how much goods and services you produce.

If you print more money and produce less goods , then it will simply cause inflation.

Eg : say in a country there are 3 ppl, first has 10 Rs , other has 5 Bread and the third has 5 Eggs .

Now since only 10 Rs is in circulation these 3 ppl came to a conclusion by forces of market that 5 Bread cost 5 Rs and 5 Eggs cost 5 Rs .

Now suppose suddenly this country prints 90 Rs more. But this will not change the no of resources country has .

This will simply convert to 5 Bread costing 50 Rs and 5 Eggs costing 50 RS . This is Inflation.

Why do we need money to create infrastructure? 🙂

So you can buy the raw materials, pay to deliver it, and pay the engineers and laborers.

Now, you can borrow the money and pay it back with interest over 20 0r 30 years, which doubles or triples the total cost.

Or, you can print the money, which has some risk of inflation.

IF the infrastructure enables the economy to grow, all the new money is absorbed over time. There ends up being the same ratio of economy to money.

But IF the infrastructure is a boondoggle, and does nothing for economic growth, then you get direct inflation from the new money, since the money supply grows, but the economy does not.

The question is do we need money to build infrastructure projects. or do we need raw materials and labour.

If the raw materials can be bought by barter system and labourers are willing to work for food directly, we dont need money .

Best Answer !…

Awesome article and easy to grasp .

With what i understood in a layman’s language i have a question.

Why are we taking the example of printing money and GIVING IT TO THE PEOPLE. Why not we take example of printing the money and then government will USE IT FOR DEVELOPMENT which will make profit on what we have printed.By this way the demand and supply stuff will remain the same because we have not elevated the status of the people by giving them extra money.

EXACTLY!

The issue of inflation becomes whether the printed money is spent on actual viable infrastructure, which enables economic growth and turns a profit in the macro sense–which creates new demand for the printed money so as to absorb the supply–or whether the printed money is spent on bridges to nowhere, which does not.