Power Finance Corporation (PFC) is the second company after IFCI to come out with their 80CCF infrastructure bonds.

These bonds help you get tax benefit over and above the Rs. 1,00,000 that you get by investing in Section 80C tax instruments.

The face value of each bond is Rs. 5,000 and PFC will come out with an issue size of Rs. 200 crores or Rs. 2 billion.

These bonds are secured, and rated AAA/Stable from CRISIL and AAA with stable outlook by ICRA.

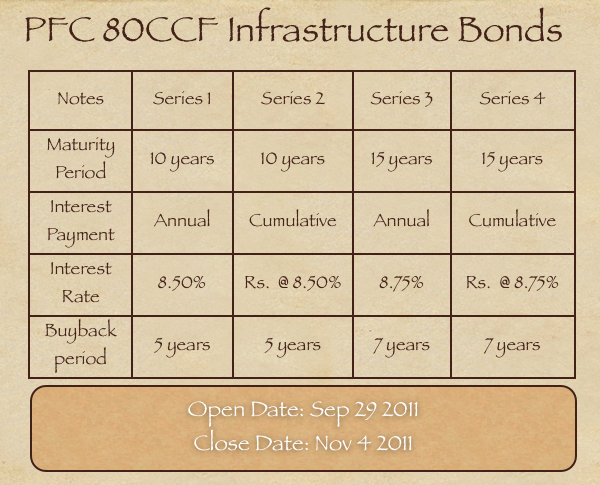

The bonds will be available in both Demat and physical form, and these are the other terms of the PFC infrastructure bonds.

Terms of the PFC 80CCF Infrastructure Bonds

It’s a good thing that PFC infrastructure bonds have opened up so much ahead of time because it gives people enough time to subscribe to them and get the tax proofs well ahead of March 31st.

PFC is a good company, and the interest rates among these 80CCF bonds aren’t going to vary much as they are capped at the 10 year government bond yields, so I think people who are looking to invest in these bonds can give PFC a serious thought.

Last year, there were some news reports that LIC was going to offer these bonds with along with free life insurance and circumvent the cap on yields, but that never materialized.

I don’t know if any other company will try to pull something similar this year or not, but with just an investment of Rs. 20,000 in these – it will not make a lot of difference in absolute terms.

Sir,

I apply for PFC Infrastructure Bond. My application No. 14876858 and deduct amount by my account. But I have no any Information, No Bond in demat account, No any certificate, No any E-mail at my E-mail I.D. about above Bond.

Please inform me necessery information as soon as possible.

Thanking You,

Sandeep Kumar

S/O Sri Bankey Lal

295, Prabhudayal, Near Lal Kuan,

Jahangirabad (Bulandshahr) U.P. – 202394

Mob. 09456029018

E-mail – [email protected]

Look you must understand that this is like a news website like Times of India. You need to contact whoever sold you the bond to get this information. Leaving comments here will not help.

Where can i check the allotment status !!! .. When it will be available ..

I had gotten the form off the net from PFC’s site and submitted it via post to a collection center.

Stamped receipt received.

Filled in demat account details, so that’s that.

Excellent! Way simpler than what I said – thanks for sharIng.

Hello,

Can you please tell me simplest way to gain Paper-baesd (without DEMAT account) Infra bonds?

Contact a bank or broker like Karvy near your house and see if they have it.

i want to by infra bonds for tax saving purpose plz tell me which bond is available

Hi Gurinder.. IFCI Infra Bonds are available as of now but the issue closes today, so if you are in a hurry, speed up your acts to apply.

Hi.. I think people who want to invest in Infrastructure Bonds should wait for a week to 10-15 days. IDFC, L&T, REC, PFS etc. are planning to come with their Infra Bonds offering in November and I’m quite confident that the Rate of Interest these cos. are going to offer would be 9%, as the 10-year Govt. bond yield has risen sharply close to 9% in October.

Hi ,

Please let me know where do I can buy the PFC Infra Bond in paper form in Mumbai

Does any bank selling physical copy of the bond? E.g., HDFC Bank

Thanks,

Suman

Hi I am deb I want to know how I able to invest in this bond & what is mean by buyback.

Deb buyback means you can redeem the bonds for less time period than the maturity, and in a way this is just like maturity.

You can buy it from one of the centers close to your home or online if your broker has this option. You can also approach a financial adviser for this.

Hi Manshu,

Pl confirm whether the redeemed amount is taxable or not?? If taxable let me know the rate and under which section the proceeds are taxable??

Hi Manshu,

Are there any paper-based Infra bonds available in Market (or coming soon).

Is there anyway one can buy the same without having Demat account?

Cheers!

Yeah, these bonds are both paper and demat, so you can buy even the PFC issue without a demat account.

will you please confirm who are the lead brokers in PFC Infrastructure Bonds – U/s 80CCF.

SBI Capital Markets, Karvy, PNB Investment Services and ICICI Securities.

Manshu– re your point regarding demat and bonds– this year I switched from a joint a/c to a single name a/c and with bonds there was a delay because the dp has to write to the co. for the transfer, but it got done.

Re PFC just downloaded the form from ICICIsecurities, paper submission as I have a ICICIdirect a/c but no internet banking *sheepish*.

No internet banking!?

Someone please remind me what year I am in! 🙂

can anybody help me in finding agents / selling points of this bond in KOLKATA ??

Hi Manshu,

Thank you for the information. If I buy these through ICICIDirect, Do they charge us extra ? For the matter of fact, what is the advantage that we recieve if we buy them online than physical ? Please enlighten.

Cheers, Karthik

Hi Karthik,

I’m not sure what or if ICICI Direct charges any commission at all. The benefit of investing online is that it is in a Demat form along with your other securities so you don’t have to worry about paperwork, your interest will be credited to your account, and so will the redemption amount etc.

The drawback of doing it online is that the bonds will get locked in your Demat account, and if you want to close your Demat account before the maturity of these bonds then that is a huge hassle and I don’t even know if anyone has done that successfully or not.

Hello,

If i opt for paper form then where do i need to go to redeem this?

and

If i opt for demat form then what is the process to redeem this? Is it just like selling Shares online ?

Regards,

Redemption will happen automatically – you don’t have to do anything extra for that. If you want to sell when it lists on an exchange then that will be done in the case of the Demat ones only. That will also be possible only after the lock in period is over so after about 5 years or so.

One can buy IFCI Infra Bonds online on fundsindia.com

Hdfc securities has this one online.

Haven’t seen any online broker offering it yet. IFCI is already there in their list. hope they put in PFC as well just to avoid any physical applications in case one wants to apply online.

Thanks Manshu for your analysis and suggestion. Believe I will go for this investment.

Great – get all the proofs and everything in time, and file for it – I’ve seen a lot of people scampering for the tax proofs last time, and that’s always an irritating thing.

Hi Manshu,

Thanks for you post. It is helpful.

For benefit over and above 80C tax instrument (limit abov 1,00,000), which of the following is better for those in 20% and 30% tax bracket?

Option 1: Infrastructure bonds OR,

Option 2: Voluntary Provident Fund (over and above the 1,00,000 limit of 80C) which gives 9.5% interest rate.

One major difference (there are many) while calculating the returns is, that the first option has tax benefit but is taxed on interest earned while the option 2 does not have any tax benefit (since it is outside the 1,00,000 limit) but the returns are tax free.

Which is the best way to calculate the returns (post tax) between the above 2 options?

Regards,

Sandriano

I will say upto 20K Infra bonds are better because you save a lot more tax as a result of reducing your taxable salary by 20K and saving about 20% or 30% on that so 4 – 6K.

Int difference of 1% on 20K is just 200 bucks, and tax on that at 20 or 30% is even less so infra bonds are better to the extent of 20K for sure.

After that it depends on a whole host of other factors as you say.

Can somebaody explain me what does buyback means in terms of bonds? Also, will I get same interest in buyback. Buyback can be done any time after the lock-in period?

It means that after 5 / 7 years – PFC may decide to redeem your bonds – you will get the interest and everything, and this will be exactly like redemption.

Thanks Manshu for your reply. “PFC may decide to redeem your bonds :”: May decide is like there are not 100% sure. Also, After 5/7 yrs, can I redeem on any day or is there some timeline?

Thank you for asking that question – I should have elaborated that point more.

Yes, you do have an option to buyback as well, and after the lock in period there will be a notification period where you need to tell them whether to exercise the buyback or not. If you want them to exercise the buyback then they will redeem your bonds at that date, so in that sense the maturity becomes shorter than the 10 or 15 years.

Based on what I read the form should also have space for you to indicate whether you want to use the buyback facility or not, and if you indicate there that you do want the buyback to be affected then you don’t need to do anything later on, and your bonds will be redeemed during the buyback period.

So these guys are calling it a buyback facility which it really is since you as an investor have an option to choose whether you want to redeem your bonds earlier or keep it for the longer duration.

I hope this explanation is clearer – the early one was quick and didn’t cover as much details as it should have so thanks for asking the follow up question.

Thanks for nice and clear reply.

great – i’m glad it made sense.

is there a possibility to redeem d bonds before maturity if yes den how??

Hi Mayank… you cannot redeem these bonds before the lock-in period ends.