The tax filing season is closing in on us, and you don’t want to leave everything down to the last minute. There are still a few months left, and if you haven’t already started planning for your taxes – now is a good time to start.

I’m going to start a series on tax saving instruments here, and every week I’ll try to write at least one post on a tax saving topic.

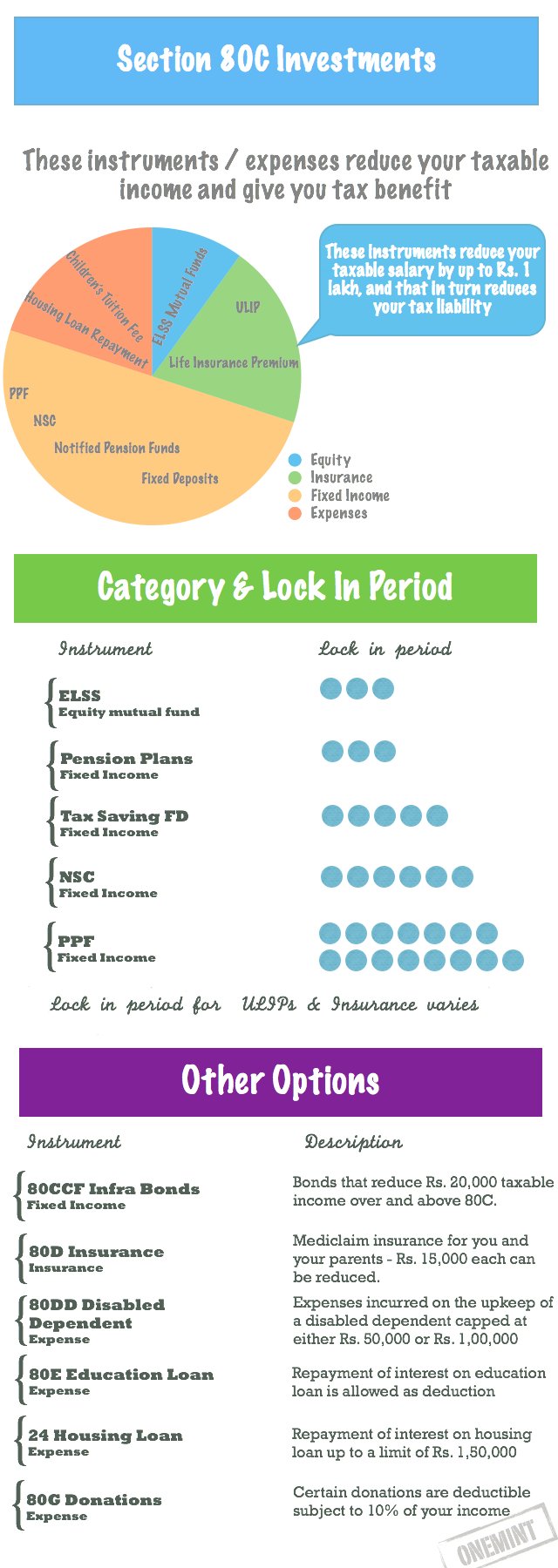

This week, I start off with an infographic I created with the hope of giving an overview on the various tax saving instruments especially 80C instruments in an easy to digest and graphical manner.

I hope this provides a good overview on the various instruments, how much they save and their lock in period.

I was a little wary of including returns because they can vary so much, and it is natural to compare one with the other but that’s not right since the risk profile of the instruments is different.

Please let me know if you see any mistakes, and also if you want to see any other information on this.

Please share it with friends and colleagues if you think this will be beneficial to them, and as usual I look forward to your comments!

Hi to all, it’s truly a nice for me to pay a visit this website, it contains priceless Information.

No need to write content, The infographic speech itself, Nice article. Thanks 🙂

1. If LIC premium paid by Wife by Cheque and policy under her name. Can Husband claim deduction u/s 80C from his ITR?

2. If LIC premium paid by Wife by CASH and policy under her name. Can Husband claim deduction u/s 80C from his ITR?

Note:- Wife is a House wife or not claim LIC deduction from her ITR.

Prior to renewal in Tax Savings Bond which is matured on 02.03.2018 for 5 years but how much amount will be claimed in the I.T return for F.Y 2017-18 and how many years can claim same renewed amount and what benefit will receive against such savings

Thanks for this post and you should check latest info about this in this artcile