The tax filing season is closing in on us, and you don’t want to leave everything down to the last minute. There are still a few months left, and if you haven’t already started planning for your taxes – now is a good time to start.

I’m going to start a series on tax saving instruments here, and every week I’ll try to write at least one post on a tax saving topic.

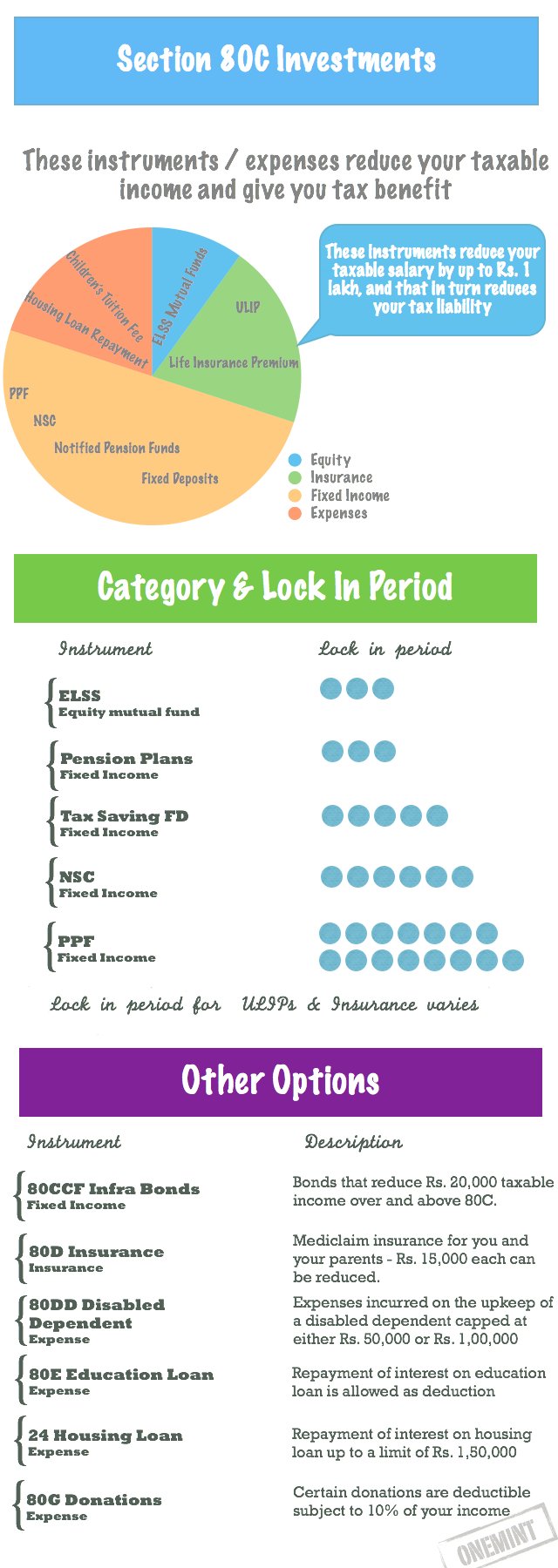

This week, I start off with an infographic I created with the hope of giving an overview on the various tax saving instruments especially 80C instruments in an easy to digest and graphical manner.

I hope this provides a good overview on the various instruments, how much they save and their lock in period.

I was a little wary of including returns because they can vary so much, and it is natural to compare one with the other but that’s not right since the risk profile of the instruments is different.

Please let me know if you see any mistakes, and also if you want to see any other information on this.

Please share it with friends and colleagues if you think this will be beneficial to them, and as usual I look forward to your comments!

Have enjoyed your site very much and benefited from the information. Thank You….

i earn handsome amount through blogging through various blog so what effect i can see after the GST

the best one

Awesome

Great content thanks for sharing it.

Great Article. comments ! I was enlightened by the information – Does anyone know if my company could possibly get ahold of a blank Bank RTGS Form form to complete ?

Check the Ways how to Save tax in india completely .. may be useful for you

http://www.examsleague.com/how-to-save-tax-legally-in-8-simple-ways/

Does NPS covers Section 80c?

M very thankful for dis great informatio.it would have veen very helpful for me if it could show how much of percentage different sections like 80c 80d pr fixed income or expemses could provide…..if possibl so plz notidy me on ma mail id

It is not a percentage but absolute amount, like 80C is a lakh. You can look at that limit in the table above.

i take a homeloan 250000 lac and i pay montly 2500 emi does Rs. 2500/ pm calculte income tax rebate

Is possession certificate mandatory to claim housing loan deductions? The below site says we need to submit it to get the benefits, please clarify.

http://www.texient.com/2011/06/india-save-income-tax-slab.html

Hi Manshu,

I recently joined one IT company with annual salary of 3 Lakhs. Actullay, I want to invest in any Life Insurance Policy to enjoy tax benefits. So please advise how would i proceed in this with minimum risks. Also suggest any plans as honestly speaking i am not aware of any scheme.

Thanks

Siddharth