The Rupee has fallen down quite a bit in the last few days and this naturally brings to attention the topic of what the RBI can do to stop this slide.

The last time such a slide happened the RBI did a few things, the most noticeable of which was making NRE deposits tax free which made banks give high interest rates on NRE deposits and given how this was tax free money, this drew quite a bit of attention.

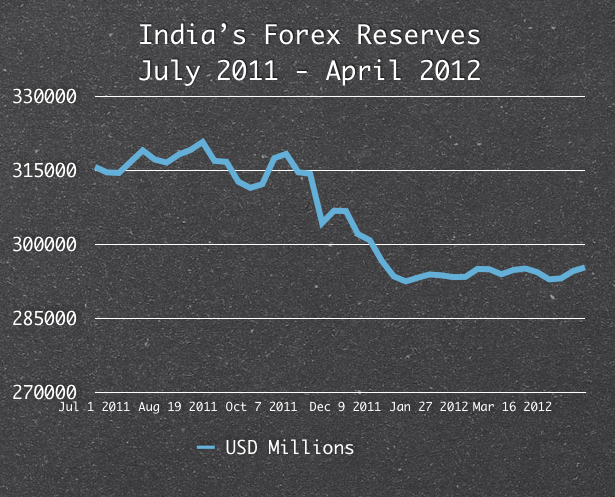

Other than this there were some talks of RBI selling USD in the forex market but looking at India’s forex reserves data from July of last year, the size of those transactions can’t be significant.

RBI publishes the reserve position every week and I took data from July 2011 till the most recent date and charted it here.

I’ve also created a Google Spreadsheet with this data so if anyone is interested in using it you can access it here.

Here is the chart.

This chart shows that after being comfortably above $300 billion for several months last year, the reserves came down below $300 billion early this year and have remained that low ever since (although you do see a slight uptick in the last number reported where the reserves rose by $758 million).

Given the current climate, it isn’t likely that the reserves are going to increase any time soon, and if the RBI does sell Dollars to stop the Rupee slide, the reserves will come down even more and not even cover the 6 months current accounts that they do now per S&P.

Much of this slide is due to government actions that RBI has had to clean up. GAAR was just the latest hit that has dried up FII volumes, and also made other foreign investors more wary of investing in India. India runs a current account deficit and depends on FII and FDI inflows to finance this deficit and if even that dries up then the Rupee is going to get hurt and go down even more.

That has a lot of implications, some known like oil prices going up (they may not get passed to the end customer but that just means that the government deficit on account of subsidy is higher) and some unknown like Jet Airways freezing hiring of foreign pilots or stopping foreign advertising to contain non rupee expenses.

Let’s just hope the slide stops, but the exchange rate and the forex reserves will be two key things to look at in the next months.

Earliesr post on what the RBI can do to manage the exchange rate