This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

IPO season is back again. With the stock markets making new lifetime highs every other day and still showing no signs of tiredness, it seems to be the best of the times in the last few years for companies to raise fresh money by issuing new shares or for existing stakeholders to cut their stakes.

After a bumper response to Snowman Logistics IPO, Sharda Cropchem has decided to get itself listed on the bourses. The IPO, which opened the day before yesterday i.e. 5th of September, will run for two more days to close on September 9.

Objectives of the Issue – The company is not issuing any fresh shares in this IPO, rather the existing shareholders are either making an exit or cutting down their stakes. The company is presently owned by the Bubna family with 84.13% shareholding and the rest 15.87% shares are owned by HEP Mauritius Limited. Post successful completion of this issue, HEP Mauritius would be able to completely exit the company and the promoter shareholding would fall to 75%, thus making this IPO a 25% stake sale.

The offer will carry 2,25,55,124 (approximately 2.26 crore) shares during this period in the price band of Rs. 145 to Rs. 156 per share.At Rs. 156 per share, the existing shareholders will be able to realise Rs. 351.86 crore from the new investors, thus valuing the company to be worth Rs. 1,407.44 crore. 35% of the issue size, i.e. approximately 79 lakh shares, have been reserved for the retail individual investors.

Sharda Cropchem’s Business

Sharda Cropchem is a crop protection chemical company primarily engaged in the marketing and distribution of a wide range of formulations and generic active ingredients globally. It does not produce any of these products though. The company is also involved in order based procurement and supply of belts, general chemicals, dyes and dye intermediates.

The company claims that identifying generic molecules, preparing dossiers, seeking registrations, marketing and distributing formulations or generic active ingredients in fungicide, herbicide and insecticide segments are its core strengths. As of August 5, 2014, the company has over 180 Good Laboratory Practices (GLPs) certified dossiers and as of July 15, 2014, it owns over 1,040 registrations for formulations and over 155 registrations for generic active ingredients across Europe, NAFTA, Latin America and rest of the world.

The company has a presence in over 60 countries with over 100 people working in its own sales force and over 440 people working as the third party distributors.

No IPO Grading – As the issue is an offer for sale by the existing shareholders, it has not been graded by any of the rating agencies.

Risks

* As the company does not produce any of the formulations or generic active ingredients on its own and is highly dependent on the third party manufacturers for the continuity of its operating activities, it seems such a high dependence in a competitive world poses a big risk for the company.

* A substantial portion of the company’s sales gets undertaken against future payments on an ‘unsecured’ basis. So, any major default by any of its customers could result in a substantial loss for the company and its shareholders. The company states that its credit period ranges between 30 days to 180 days. But, looking at its debtor-turnover ratio of 187 days during FY 2013-14, 178 days during FY 2012-13 and 194 days in FY 2011-12, it gets fairly clear that the credit period has always remained stretched and carries a high risk for the company & its shareholders.

* The company has stated that as far as its overseas investments are concerned, there have been instances in the past of delays and failure in making the necessary filings with the RBI.

Also, non-appointment of a whole-time secretary from March 2007 to January 2009 as mandated by the company law board, not conducting internal audit for four consecutive years from FY 2009-10 to FY 2012-13 and significant delays in payment of service tax are some of the instances which reflect the unprofessional attitude of the management in all these matters.

Though the central bank, the company law board or any other regulatory authority has not imposed any kind of penalty in any of these matters, such instances in future could result in penalties or operating inefficiencies for the company.

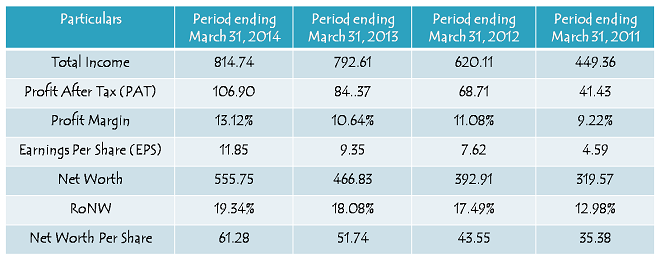

Financials of the Company

(Figures are in Rs. Crore, except per share data & percentage figures)

(Figures are in Rs. Crore, except per share data & percentage figures)

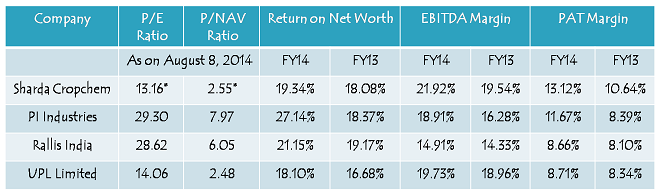

Peer Comparison

Valuations

Total income of the company has jumped from Rs. 449.36 crore in FY11 to Rs. 814.74 crore in FY14, posting a growth of 38% in FY12, 27.82% in FY13 and 2.79% in FY14. Net profit of the company grew even healthier at 65.85% in FY12, 22.79% in FY13 and 26.70% in FY14. Looking at its strong growth and based on its valuations purely, the company is fairly valued, rather cheaply valued relative to its peers. So, if the sentiment remains buoyant, there is a reasonable scope of listing gains.

But, as a large chunk of the company’s revenues come from its trading activities or from marketing and distribution of formulations and ingredients produced by some third party manufacturers, I would say it is very important for the investors to ensure that the management of the company is highly efficient, their intent is absolutely clear to grow the shareholders’ wealth and the company has a long enough history of sustainable profits. As I am not sure about any of these factors, I would like to wait for at least a few more quarters before I finally decide to make an investment in the company.

Shares of Sharda Cropchem got listed for trading on the exchanges today. It listed at Rs. 260 a share, touched a high of Rs. 274, a low of Rs. 225 and closed at Rs. 230.95. Its trading symbol on the NSE is SHARDACROP and the trading code on the BSE is 538666.

Any update here? When is the listing? I didn’t receive any allotment/refund advice yet. But my ASBA account blocked amount against the application seems to be unblocked and credited back.

It should get listed sometime next week, on or around 24th or 25th September.

Thanks Shiv!

You are welcome!

Why delete a previous comment ?

Hi Madhan,

Your comment was never got deleted, it was just awaiting moderation.

Apologies !!!!

Day 3 (September 9) subscription figures:

Category I – Qualified Institutional Buyers (QIBs) – 32.06 times

Category II – Non Institutional Investors (NIIs) – 251.35 times

Category III – Retail Individual Investors (RIIs) – 5.85 times

Total Subscription – 59.97 times

Since this is a debt-free company and has been showing consistent growth in the last 3-4 years.. could this be a long term bet or apply for listing gains ? Your advice.

Hi Madhan,

Sorry for this late reply. I think Sharda Cropchem should give some listing gains to its investors. Long term returns should depend on its operating performance going forward.

Day 2 (September 8) subscription figures:

Category I – Qualified Institutional Buyers (QIBs) – 1.72 times

Category II – Non Institutional Investors (NIIs) – 1.27 times

Category III – Retail Individual Investors (RIIs) – 1.79 times

Total Subscription – 1.67 times

Day 1 (September 5) subscription figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.04 times

Category II – Non Institutional Investors (NIIs) – 0.01 times

Category III – Retail Individual Investors (RIIs) – 0.22 times

Total Subscription – 0.11 times