This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Government of India in Budget 2014 announced the revival of Varishtha Pension Bima Yojana (VPBY) with the objective of providing social security to the senior citizens of this country. It is a Government subsidised single premium pension scheme with an assured effective return of 9% to 9.38% per annum. To ensure investors’ trust and complete safety of their investments, LIC of India was given the sole privilege to operate this scheme.

Relaunched in August 2014, the government had high hopes out of this scheme and it has been encouraging LIC’s top management to promote this scheme aggressively. However, this scheme has not received the desired response from the general public as it was anticipated. So, why this scheme has not been received well by the market despite offering high guaranteed returns of 9% to 9.38%?

I think there are several reasons for that, one, the pension income is taxable, two, there is no life cover with this scheme, and three, its effective rate of return is actually below the promised rate of 9% to 9.38%. There might be other reasons also for such a muted response, but I think these three are the most important ones.

To give this scheme one more budgetary support, the Finance Minister Mr. Arun Jaitley has made Varishtha Pension Bima Yojana to be exempt from Service Tax. This scheme has been attracting a service tax of 3.09% so far and the investors have been paying this tax over and above their investment amount. Come next financial year, this scheme will not attract service tax anymore.

How is it going to benefit its investors aged 60 years or more? Which date will it be effective from? Will it be retrospective from its launch date or will it be a prospective implementation? Before we explore all that, let us first try to understand the salient features of this scheme.

Rate of Return – This scheme promises to generate a return of 9% to 9.38% for its investors on an immediate annuity basis. However, due to 3.09% service tax, the effective rate of return has been lower. As per my calculation, its effective rate of return lies between 8.73% and 9.1% so far. But, once the service tax exemption gets implemented, 9% to 9.38% would become its effective rate of return.

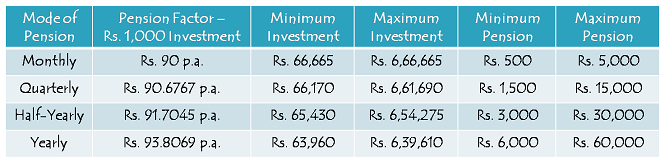

Minimum/Maximum Pension – Pension is paid on an immediate annuity basis in monthly, quarterly, half-yearly or annual mode, varying, respectively, between Rs. 500 to 5000 (monthly), Rs. 1500 to 15,000 (quarterly), Rs. 3000 to Rs. 30,000 (half-yearly) and from Rs. 6,000 to Rs. 60,000 (annually), depending on the amount subscribed and the option exercised.

Minimum Investment – You need to invest a minimum of Rs. 63,960 to get Rs. 6,000 annual pension or Rs. 65,430 to get Rs. 3,000 semi-annual pension or Rs. 66,170 to get Rs. 1,500 quarterly pension or Rs. 66,665 to get Rs. 500 monthly pension. In a way, you may also decide how much pension you need every month and then invest an amount as per your pension requirement.

Maximum Investment – You can invest a maximum of Rs. 6,66,665 in this scheme to get Rs. 5,000 monthly pension or Rs. 6,39,610 to get Rs. 60,000 annually.

Ceiling of maximum pension amounts apply to a whole family, including the pensioner, his/her spouse and dependants. So, two or more senior members of a family can invest in this scheme, but their total investment amount cannot exceed the limits specified.

Age Limit – Minimum age limit has been set as 60 years and there is no maximum age limit to invest in this scheme.

Nationality – Only Indian nationals are allowed to invest in this scheme.

Scheme Period – This scheme got launched on August 15, 2014 and will remain open for one year till August 15, 2015.

No 80C or 10(10D) tax benefits – Investment under this scheme does not qualify for any tax deduction under section 80C or 80CCD. Moreover, the pension income is taxable as per the tax slab of the pensioner.

Free Look Period – If you are not satisfied with the terms and conditions of this scheme, you may ask for a refund of your investment amount within 15 days from the date of receipt of the policy stating the reason of objections. The amount to be refunded within free look period will be the investment amount deposited by the investor less the stamp duty charges.

Premature Surrender – The policy can be surrendered after completion of 15 years. The investor will get the investment amount in full as the surrender value after 15 years. However, under exceptional circumstances, if the pensioner requires money for the treatment of any critical/terminal illness of self or spouse, then the policy can be surrendered before the completion of 15 years and the surrender value payable will be 98% of the investment amount.

Unfortunate Event – On death of the pensioner, the investment amount will be refunded in full to the nominee of the pensioner. However, as only the invested amount is refunded, there is no special insurance benefit available with this scheme.

Loan Facility – Loan facility is available after completion of 3 policy years. The maximum loan that can be granted shall be 75% of the investment amount. The rate of interest to be charged for the loan amount would be determined from time to time by LIC.

Loan interest will be recovered from pension amount payable under the policy. The interest on loan will accrue as per the frequency of pension payment under the policy and it will be due on the due date of pension. However, the loan outstanding will be recovered from the claim proceeds at the time of exit.

Service Tax Exemption on VPBY Effective April 1, 2015

So, now the question arises, whether service tax exemption be retrospective from its launch date or will it be a prospective implementation? What I understand from the info available publicly, it will be effective April 1, 2015. If it is correct, what about all those investors who have invested in this scheme till date? I think they will definitely stand disappointed and rightly so. I think they should also be provided such benefit right from their date of investment. The government should once again think about it.

As far as investment in this scheme is concerned, I think service tax exemption has made this scheme a little more attractive as compared to fixed deposits or other small saving schemes. You can consider this scheme if you want a super safe investment avenue with reasonably high returns for yourself.

Government refunded full service tax amount to the Investors.

The amount is credited in the Bank account, in which the investors opted to get the annuity payment.

Sir plz tell a how much age start this yogna my age is 32 Pls reply