This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Sukanya Samriddhi Yojana has received a great initial response from the general public. As the scheme offers 9.1% tax-free rate of interest, investors are finding this scheme to be extremely attractive and want to invest in it as soon as possible. They also need handholding to invest in this scheme. But, due to lack of required information with the post offices and authorised bank branches, people are finding it difficult to do so.

I have posted two articles about this scheme and both have received over hundred comments from the visitors. I have been getting many queries regarding the maturity value of this scheme. People want to know the value of their investment as the scheme gets matured after 21 years.

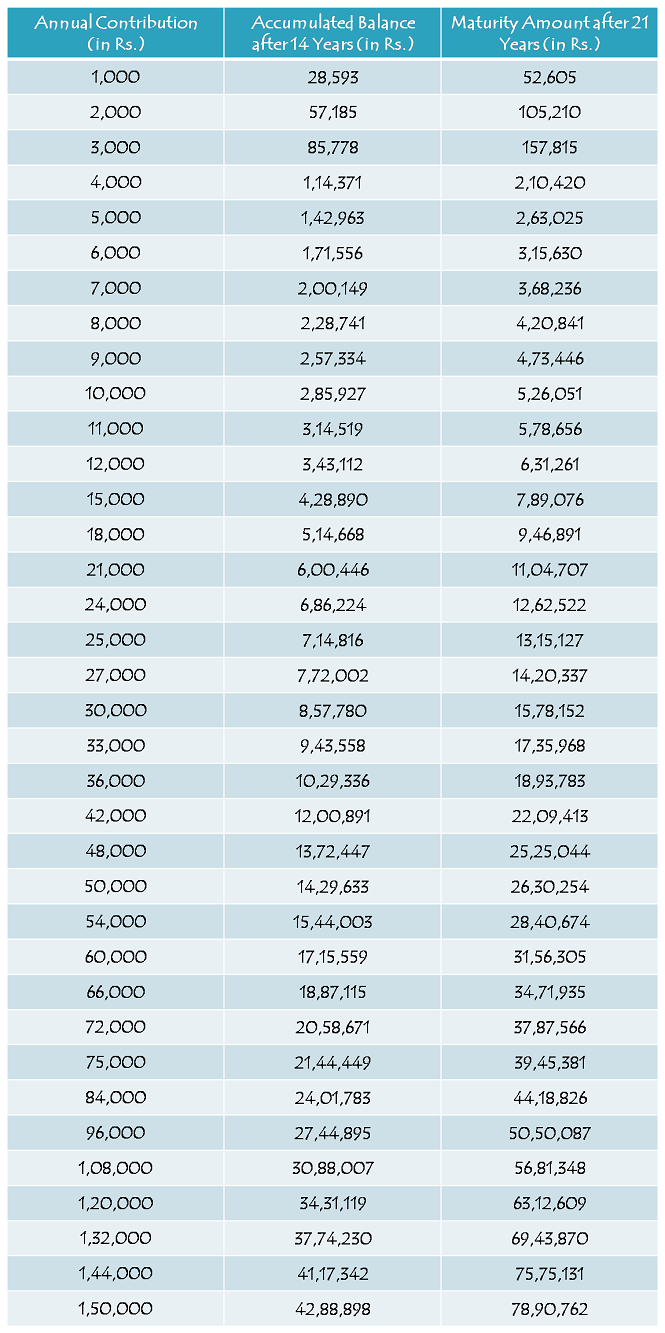

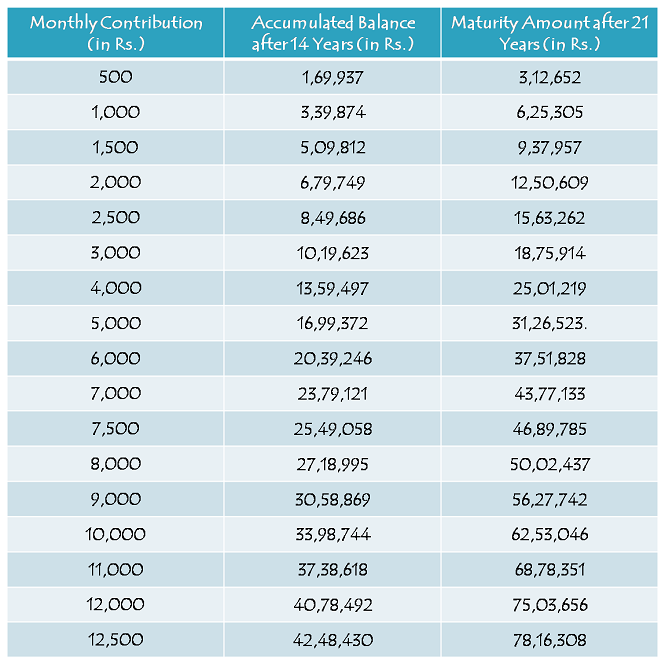

Though it is almost impossible to calculate a precise maturity value of this scheme as there are many variables on which its maturity value will depend, I have tried to make a couple of tables in which the maturity value has been calculated keeping those variables to be constant and yearly & monthly contribution to be the only variable.

Certain assumptions have been made for calculating these maturity values and those assumptions are:

* Rate of Interest has been assumed to be 9.1% for all these 21 years.

* Yearly contributions have been assumed to be made on April 1 every year i.e. the beginning of the financial year.

* Monthly contributions have been assumed to be made on 1st day of every month.

* Although it is not mandatory, a fixed amount of yearly/monthly contribution has been assumed.

* It is also assumed that no withdrawal is made throughout these 21 years.

Here you have the tables:

Yearly Contribution Table

Monthly Contribution Table

I hope these two tables help people in deciding how much amount they would like to contribute to this scheme in order to achieve their girl child’s marriage and/or higher education goals.

Before you go ahead and plan to get an account opened, I would like to again highlight the main features of this scheme:

Who can open this account? – Parents or a legal guardian of a girl child up to the age of 10 years, can open this account in the name of the girl child. Up to December 1, 2015, one year grace period has been provided to allow this account to get opened for a girl child who is born on or after December 2, 2003.

9.1% Tax-Free Rate of Interest – This scheme offers 9.1% rate of interest, which has also been exempted from tax in this year’s budget. But, this rate is not fixed at 9.1% for the whole tenure and is subject to a revision every financial year.

Scheme Matures in 21 years or on Girl’s Marriage, whichever is earlier – The scheme gets matured on completion of 21 years from the date of opening of the account or as the girl child gets married, whichever is earlier. Please note that the girl attaining the age of 21 years has no relevance to maturity of this scheme.

Deposit for 14 years only – You need to deposit a minimum of Rs. 1,000 and a maximum of Rs. 1,50,000 only for the first 14 years, after which you are not required to deposit any amount. Your account will keep earning the applicable interest rate for the remaining 7 years or till it gets matured on your daughter’s marriage.

Documents Required – You need birth certificate of the girl child, along with the identity proof and residence proof of the guardian, to open an account under this scheme. You can approach any post office or authorised branches of some of the commercial banks to get this account opened.

You can check the rest of the features of this scheme from this post – Sukanya Samriddhi Yojana – Tax-Free Small Savings Scheme for a Girl Child

You can also download the application form to open an account from this post – Sukanya Samriddhi Yojana – Application Form & List of Banks to Open an Account. If you still have any query or something related to discuss, please share it here.

Please tell me one time plan in SSY

Suppose I open accounts 1000/- per month at present income .Then six month after my income is now increase .so i want change calculating table it possible or not?

Sir tell me about the calculation of the SSY Scheme

How could i fill online the sukanya samriddhi yojna premium

I opened this account for my daughter in Jan 2018. im yet to start with my yearly deposit . if i deposit before march 2018 will it be counted for this financial year?

600000

S.S.Y. INTEREST RATE 9.2% SE KAM KAR DIYA HAI, KYA YAH SAHI NEWS HAI.

My sister daughter is 6 years old now, can I open this account scheme now in 2018 ,

Why because this scheme is came into existence in 2015 right even now also we can open this scheme or not

If daughter age 3 years shall I can start yearly sukanya samriddhi yojana ?

Yes u can start this scheme upto the age of 10 year.

reply me frnds

koi new schemes aayi hai kya?? releted for girl…please tell me

Myself Amrutha my sister has born on 9/4/2003 is it is possible to open account in her name? And the deposition of every year is must and should?

Hi amrutha..

You can open only till girl attains 10 years of age.

Dear Sir,

I am planning to open SSY account with SBI, Hitechcity Branch, Hyderabad, Is this account is transferable to any other Branch SBI across the India. Is it possible? Please advise?

sir,

agar maine monthly 1000 paid kiya to after 14 yers kitna total jama hota he or after 18 , 21 kitana milega.

Sir, I have started my daughter SSA in the age of 6, I want to know the maturity of the year

My daughter DOB may2014 policy will start march 2018 premium will deposit last year?Final payment year?

Sir when i opened ssy interest rate was 9.1%, now it is 8.1% my ? is at the time of maturity at what rate i get my return?

Hi, I am just wondering if the child is in overseas can this be applied? Thanks

I open a SSY at local post office. May I transfer this A/C at United Bank of India. please give me a advice. Mobile no: 7407276429

give detail about this policy

May I open the Sukanya Yojana Samridhi account through SBI local branch?

Pls advise