This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

I covered Wonderla Holidays initial public offer (IPO) last year in April. Wonderla raised approximately Rs. 181 crore by issuing 1.45 crore shares at Rs. 125 a share. Its share price is trading close to Rs. 271 on the stock exchanges right now, a jump of 117% in less than a year.

Now, Adlabs Entertainment has launched its IPO to raise money for retiring its debt and expanding its footprint in the amusement park business. The issue opens today and will get closed on Thursday, March 12th. Wonderla Holidays is the only listed company with which we can compare Adlabs to take our investment decision. But, as Adlabs has a very short operating history, it is very difficult to compare these two companies as well.

What’s on Offer?

Adlabs has fixed its price band to be between Rs. 221-230 per share and is offering Rs. 12 per share discount to the retail investors. The issue is a mix of fresh issue of 1.83 crore shares and offer for sale of 20 lakh shares by the existing investors. The company will not receive any proceeds from the offer for sale.

The company will be issuing a total of approximately 2.03 crore shares to the investors as the offer gets fully subscribed. 10% of the issue size is reserved for the retail individual investors. At Rs. 230 per share, the company plans to raise approximately Rs. 465 crore in the IPO.

Bid Lot Size – Investors need to bid for a minimum of 65 shares and in multiples of 65 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 13,585 at the lower end of the price band and Rs. 14,170 at the upper end of the price band.

Objective of the Issue – The company plans to use the IPO proceeds to make partial repayment of its existing loan and for other general corporate purposes. However, the break-up of the issue proceeds for the repayment of loan and general corporate purposes will be disclosed after the issue gets closed.

IPO Grading – The company has opted not to get its IPO graded by any credit rating agency. SEBI had made IPO grading voluntary in December 2013.

Listing – The shares of the company will get listed on both the exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Adlabs Entertainment Limited (AEL) is a company promoted by Manmohan Shetty and Thrill Park Ltd. Adlabs currently owns and operates two amusement parks – Imagica and Aquamagica, which is a part of Imagica itself with a separate entrance. It is situated near the city of Khopoli on Mumbai-Pune expressway in Maharashtra.

Adlabs Imagica – The Theme Park, is one of the fastest growing theme parks in India. The park was opened on 18th April, 2013 on a land of 132 acres. Imagica is a one-of-a-kind offering in India and currently has 25 rides and other attractions of international standards, food and beverages (“F&B”) outlets and retail and merchandise shops spread over six theme-based zones.

It also offers entertainment through live performances by acrobats, magicians, dancers, musicians and other artists throughout the day in various parts of its theme park. It can accommodate as many as 20,000 visitors.

Aquamagica is a water park, which became fully operational on October 1, 2014. Aquamagica offers 14 kinds of water slides and wave pools and has a separate admission ticket and a separate entrance from the theme park.

Adlabs has an additional land of 170 acres around Imagica which it plans to develop in future. Adlabs is also exploring the hospitality business with its Novotel brand of hotels, which is under construction and the first phase of which is expected to get completed by March 2015.

Risks

* Limited Operating History – Adlabs Imagica became partially operational on April 18, 2013 and fully operational only on November 1, 2013, while Aquamagica became operational on October 1, 2014. So, the company has a limited operating history which might adversely affect its ability to implement its growth strategies.

* Huge Investment – Amusement parks business is capital intensive, as these companies require huge investments in land, equipments etc. Regularly adding rides to keep visitors’ interest and replacement of existing equipments also require huge funding.

High Debt – As on December 31, 2014, the company currently has debt of approximately Rs. 1,278 crore, which is likely to increase in the next few years due to company’s expansion plans in Hyderabad etc.

* Limited Diversification – The company derives all of its revenues from Imagica and Aquamagica. Its operating results might get adversely affected if the company is not able to operate these two parks successfully.

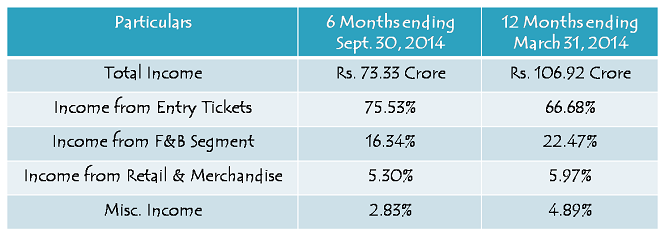

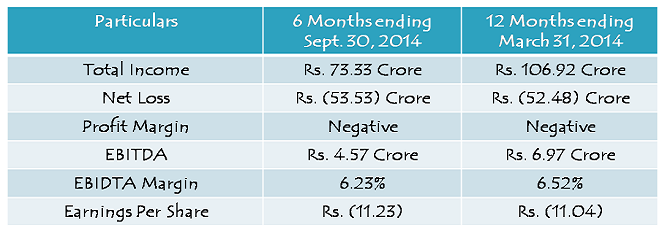

Financials of the Company

For the financial year ended March 31, 2014, total income of the company was Rs. 106.92 crore and loss was Rs. 52.48 crore. For the six months ended September 30, 2014, its total income was Rs. 73.32 crore and loss stood at Rs. 53.53 crore.

As the company has limited operational history, high interest cost due to its high level of debt, limited sources of revenue generation as of now, high capex requirements due to its expansion plans, I think it will take the company at least 3-5 years to turn profitable. As there is a high degree of uncertainty with its revenues, growth, profitability and debt retirement plans, I think this IPO is for high risk takers only. Risk-averse investors should avoid this issue as of now and closely monitor its operating performance before taking a plunge.

Girl drowns at Imagica Adlabs in Khopoli -http://timesofindia.indiatimes.com/city/navi-mumbai/Girl-drowns-at-Imagica-Adlabs-in-Khopoli/articleshow/47446931.cms

Just Posted – UFO Moviez IPO Review – http://www.onemint.com/2015/04/28/ufo-moviez-ipo-review-subscribe-or-not/

Adlabs Entertainment has got listed on the stock exchanges today. Currently trading at Rs. 171.30.

Just Posted – “Inox Wind Limited IPO Review – Subscribe or Not?”

http://www.onemint.com/2015/03/19/inox-wind-limited-ipo-review-subscribe-or-not/

In My view…Although this Ipo has higher risk and high return in short term.

bt if you are a long term investor and want capital appreciation then its good to invest in it as this is the new industry which will surely grow in next 2-3 yr And Further more its Ipo has been subscribed till.

Good luck Investors.

I want to know the detail about Inox Ipo and further upcoming Ipo’s.

Thank you

In My view…Although this Ipo has higher risk and high return in short term.

bt if you are a long term investor and want capital appreciation then its good to invest in it as this is the new industry which will surely grow in next 2-3 yr And Further more its Ipo has been subscribed till.

I want to know the detail about Inox Ipo and further upcoming Ipo’s.

Thank you