This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

I have already posted three articles for Sukanya Samriddhi Yojana and the queries regarding this scheme are not showing any signs of tiredness. People have been asking all kind of queries regarding various features of this scheme and sharing all kind of experiences here on these posts. The biggest problem they are facing is to find out which bank branches are opening this account and accepting deposits from the general public. Banks are showing their inability to open these accounts as they do not have any clue about the account opening process.

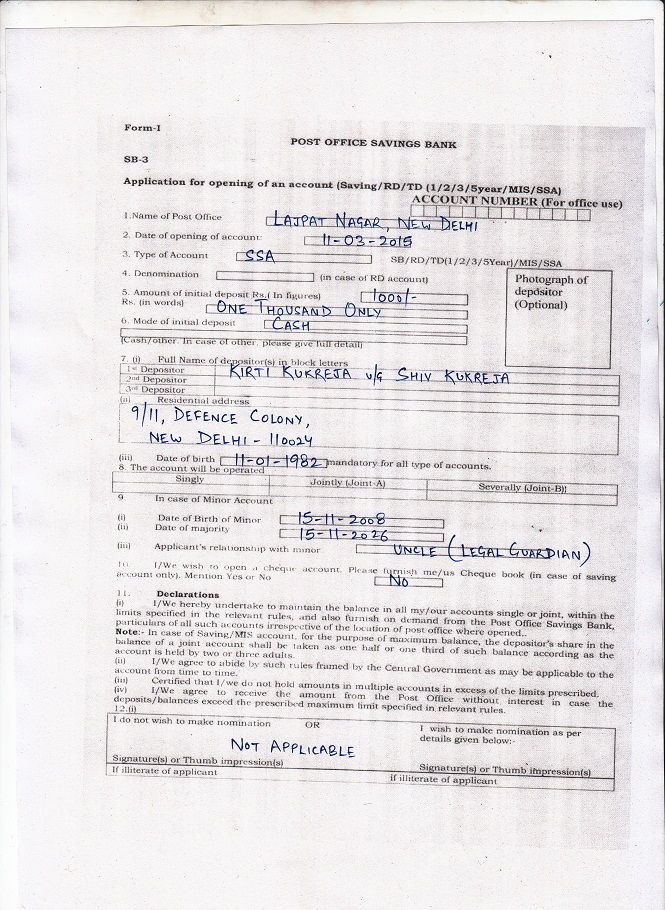

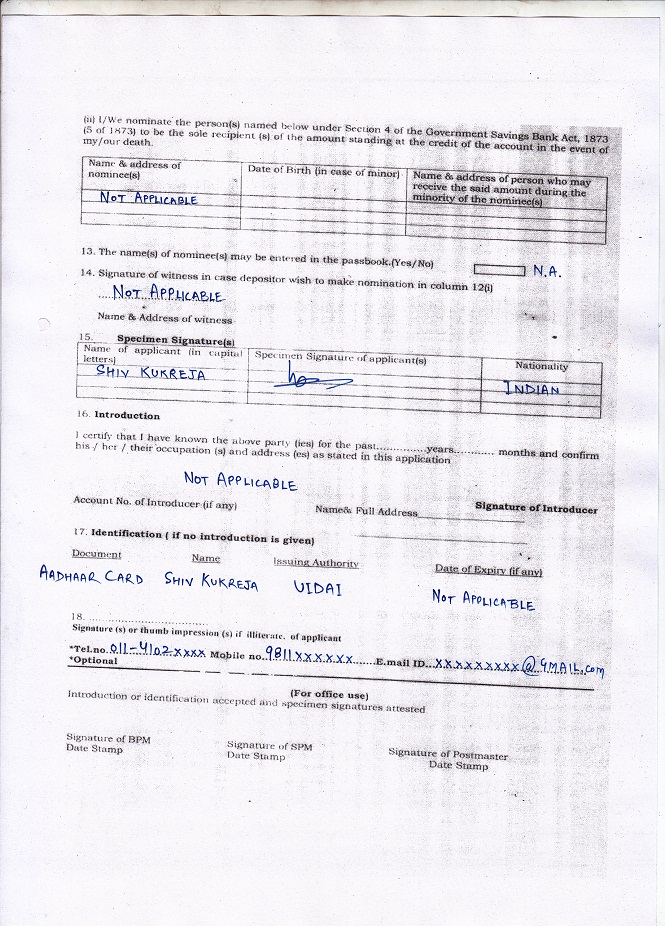

I also got a few comments in which people wanted me to post a duly filled application form so that they can also easily fill the application form for themselves. So, here you have the sample of a duly filled application form:

The application form is fairly simple and you can fill it in less than two minutes. Also, I have filled this application form to the best of my knowledge. So, if any of you find any discrepancy in it, please point it out to me and I’ll rectify it as soon as possible.

Please don’t forget to carry the necessary documents to open this account, which are as under:

* Birth Certificate of the Girl Child

* Identity Proof or Aadhaar Card of the Parent/Legal Guardian

* Residence Proof or Aadhaar Card of the Parent/Legal Guardian

* 2 Photographs of the Depositor/Parent/Legal Guardian

Much has already been mentioned about this scheme in my earlier posts, so I’ll wrap it up here. If you have any query regarding this scheme or any of its features, please let me know.

Application Form for Sukanya Samriddhi Yojana

List of authorised commercial banks where you can get this account opened

Calculating Maturity Value of SSA

Sir my question is ……suppose deposit Rs130000 in the sukanya a/c in first financial year and in the next financial year say i deposit Rs. 25000 and again in next financial year say Rs. 50000 and in the next financial year just 10000. So basically i want to know is the amout to be deposited each financial year flexible and can i deposit as per my convenience

Yes Kumar, you can deposit any amount between Rs. 1,000 and Rs. 1.50 lakh in a financial year.

Hello.sir..mai ye janana chahta hu ki Agatha kuch karan vas mai paise nahi bhar saka jo jama rakam muze milegi kya…or meri beti abhi 1 sal ki hui hai to nai ise yojna ka labh le sakta hu kya please reply me sir..

Yes Mahendra, aap apni beti ke liye ye account khulwa sakte hain. Agar aap kisi saal paise jama nahin karwa paate, to aapka account inactive ho jaayega aur penalty pay karke active karwana hoga.

Plz tell how am transfer my ssa ac from Maharashtra to chattishgarh.plz adivce what is processor…

Hi Sujit,

You need to check the procedure with the post office/bank branch where you have got your account opened.

Sir SSY me BPL and APL dono benifit le skte hai kya ?

Yes Heera, both can get benefits from this scheme.

Mr. Kukreja

Pls advice , that the depositing ammount monthly could varry, based on the availability or it should be fixed.

Thanks.

Hi Priya,

You can deposit any amount between Rs. 1,000 and Rs. 1.50 lakh in a financial year.

Hi sir ,

I need your help to fill up no. 7 & 15.my name is Pushpendra my daughter name jivika (11 month) & my father name Devaki Nandan. So please suggest what should I write In no 7 & 15.

Thanks & regards

7. Jivika U/G Pushpendra

15. Pushpendra, your signature & Indian

I already open account I post office couple of month back but now I want to transfer this to any bank because I am not getting any update on this through any direct access to account like through online, only post master update passbook manually, where I am seeing a risk, manually any one can update passbook.

Please sugget

Hi Santosh,

You can transfer your account from post office to any of the banks. But, I am not sure which bank has started providing such transfer facility.

What I field down in post office saving bank IGMSY form in line 7, 8, 9, 12 and all

Hi Wasim,

Aapka question clear nahin hai.

I want to field up post office saving bank form with name of towsin khalifa .

hi sir

meri 2 betiya h ak 11sal ki ak 7 sal ki kya mai ye bima karava sakata hu

Hi Mr. Lalit,

Agar aapki badi beti December 2, 2003 ya uske baad ki hai, to wo is eligible ke liye eligible hai. Aapki chhoti beti is scheme ke liye eligible hai.

Hi shiv

1.if we want to withdraw money on time of marriage of girl after age of 18 years.then what document or proof is required and how many time taken by the post office or bank to withdraw the money.

2 and same also if want to withdraw money after 21 years of agethan what document is required and how much time taken for withdraw.

3.the withdraw money we can received in terms of cash or amount will be come in account

Hi Neeraj,

1. The girl child will have to submit an affidavit of age proof and/or marriage to withdraw money after attaining 18 years of age. I have no idea how much time the post office will take to provide you with your money.

2. 21 years of age has nothing to do with the maturity of this scheme. 21 years will be calculated from the account opening date.

3. Post office/bank will issue a cheque or transfer the amount to your bank account.

Hi Shiv Sir

Please tell me which option I should choose bank or post office. Is there any difference of return or interest.

Hi Mukesh,

I think one should open this account in a bank with online transfer facility so that you need not visit bank/post office for each of your transaction. Rate of interest will remain the same in banks as well as post offices.

Why are banks in Mumbai not aware of procedure of opening the account. And they just direct you to the post office to open the same , while the RBI has also asked banks to open the account.

I think not all the banks would be directing you to post offices, select branches of these banks are opening these accounts.

Hi shiv,

I have a question please..

If any one start paying now onwards and pay for 14 years and some how the girl is no more or any miss happening may occur in future so who would be eligible to get that amount withdraw??

Please elaborate..

Hi Ajay,

In that case, the depositor will get the balance amount with interest.

Agar me aaj se yeh scheme start karu in june-2015 or dushre sal Dec-16 ko bhar sakta hu kya or form me kis jagha ladki ka name bharna hai ulekh kaha karna hai apke form ma depositor as U/G ulekh hai jara bateige .form me 2nd depositor or 3 rd depositor hai kya me apni wife ka name likh sakta hu or photo kiska lagana hai as depositor father ya daughter ka

Yes Ashwin, aap December 2016 mein apni dusri instalment deposit kar sakte hain. Form fill karne ke liye upar pasted form check keejiye aur help ke liye post office/bank visit keejiye.

Kya me ek saath 1000×12 =12000

One years ka bhar sakata hu.

Hi Tarun,

Is scheme mein monthly paise deposit karna zaroori nahin hai. Saal mein sirf ek baar deposit karna zaroori hai.

I enquired about SSA in SBI at my home town… They dont know anything about SSA… Any idea whether banks are opening this account or not

Hi Ramachandra,

Banks, including SBI, are opening these accounts.

12000/year ke rate se 11 years ke baad kitna milega

Sorry Amremdra, we do not entertain such individual calculations.

Difference between depositor and applicant. Like deposit refers to parents and applicant means my daughter ?

Hi Venkatesha,

That’s correct. Parent/legal guardian would be the depositor/operator of this account and the girl child would be the account holder/applicant.

Sir humlog rent pe rahte h isliye hamara address proof owner ke naam pe h .agar hum ye address proof use karenge n suppose baad me humne Ghar change kr diya to koi problems to nhi ayegi. Waise conditions me kya krna hoga?

Hi Jyoti,

Ghar change karne pe koi problem nahin aayegi.