This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

I have already posted three articles for Sukanya Samriddhi Yojana and the queries regarding this scheme are not showing any signs of tiredness. People have been asking all kind of queries regarding various features of this scheme and sharing all kind of experiences here on these posts. The biggest problem they are facing is to find out which bank branches are opening this account and accepting deposits from the general public. Banks are showing their inability to open these accounts as they do not have any clue about the account opening process.

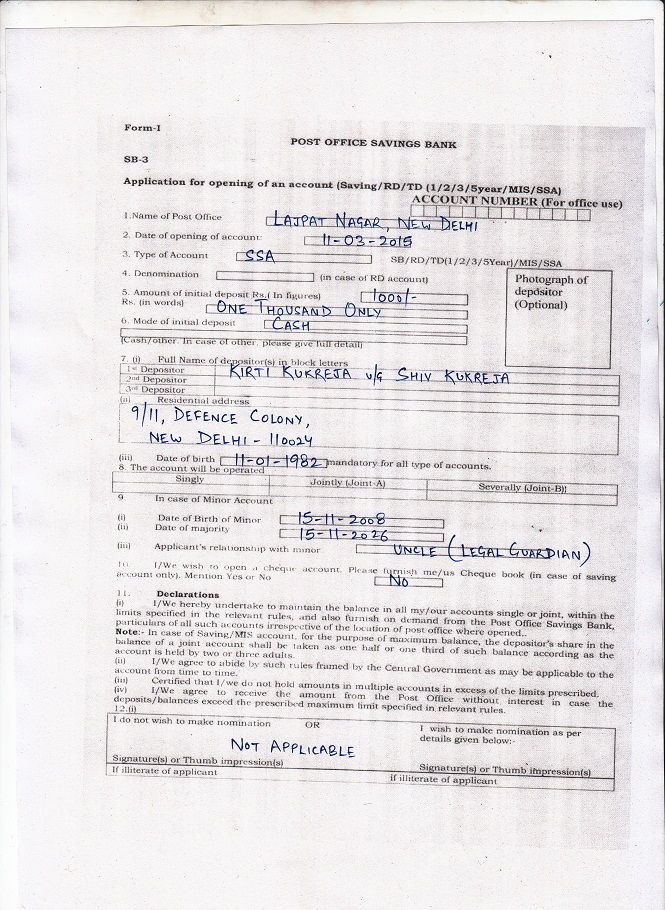

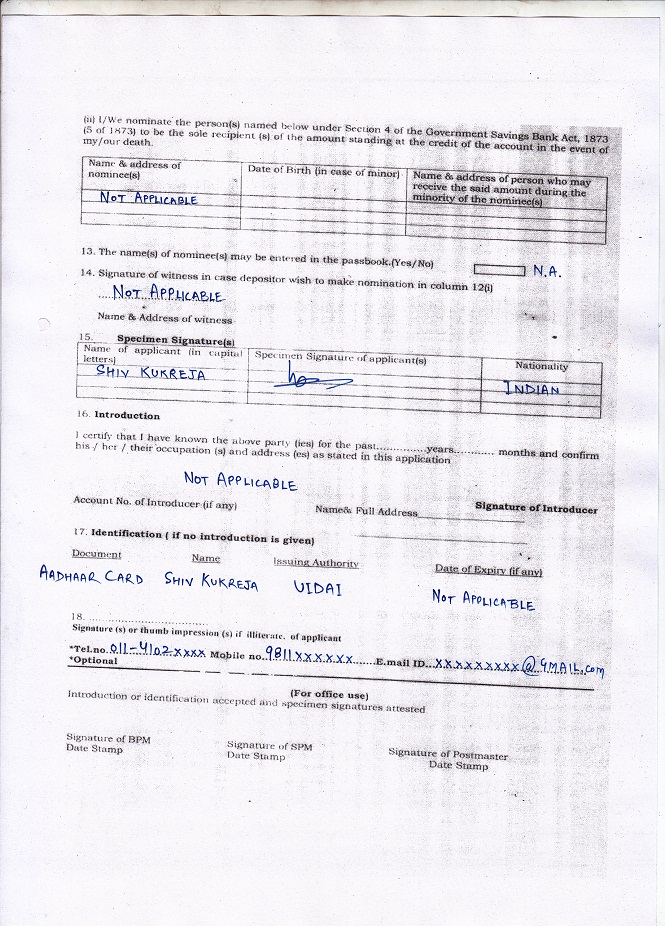

I also got a few comments in which people wanted me to post a duly filled application form so that they can also easily fill the application form for themselves. So, here you have the sample of a duly filled application form:

The application form is fairly simple and you can fill it in less than two minutes. Also, I have filled this application form to the best of my knowledge. So, if any of you find any discrepancy in it, please point it out to me and I’ll rectify it as soon as possible.

Please don’t forget to carry the necessary documents to open this account, which are as under:

* Birth Certificate of the Girl Child

* Identity Proof or Aadhaar Card of the Parent/Legal Guardian

* Residence Proof or Aadhaar Card of the Parent/Legal Guardian

* 2 Photographs of the Depositor/Parent/Legal Guardian

Much has already been mentioned about this scheme in my earlier posts, so I’ll wrap it up here. If you have any query regarding this scheme or any of its features, please let me know.

Application Form for Sukanya Samriddhi Yojana

List of authorised commercial banks where you can get this account opened

Calculating Maturity Value of SSA

Hi sir , my daughter birthday is 12-09-2006 ….If I opened account with monthly 1000 in year.Then upto which year I have to deposit the same and which is the maturity year..???

Hi Manoj,

You’ll have to deposit money in this account for 14 years i.e. till 2029. Maturity year would be 2036 or when your daughter gets married, whichever is earlier.

Dear

Shiv Kukreja

Is this scheme applicable for NRIs?

thanks with regards

Hi Shivani,

It is still not clear whether NRIs are eligible for this scheme or not. You’ll have to wait some more time for further clarity on this matter.

Shiv Sir,

Thanks so much for taking efforts to educate needy people with details of this scheme. Unfortunately gov didn’t do thier job correctly to publish info clearly.

Your comments on (March 27, 2015 at 11:08 am) are contradicting to rest of the posts.

Child dob 22.07.2012 but, date of maturity..?

Date of Maturity would be 21.07.2033 or when the girl child gets married, whichever is earlier.

Could you please confirm once again?

1. After opening account parent/gardian needs to deposite every year minimum 1000 for 14 years from opening the account. (Not 14 years of girl’s age)

2. Account will mature and money will be availalble after 21 years from opening the account. (Not 21 years of girl’s age) OR after girls marriage if it happens before.

Is my understanding correct?

Thanks Nilesh for your kind words!

1. Yes, that’s correct. Girl’s age of 14 years is irrelevant.

2. Yes, that’s also correct. Girl’s age of 21 years is also irrelevant.

Sir agr koe karn vas paisa 6year ya 7year deposit huaa. to 18year ke bad paisa mile gaya ya nhi

Agar aap har saal kam se kam Rs. 1,000 jama nahin karenge to account inactive ho jaayega. Paisa aapko beti ki shaadi pe ya 21 saal baad milega, 18 saal baad nahin. Paisa nikaalte time account active hona chahiye.

Wat if goverment changes will the scheme rule change or will remain the same.

Hi Prachi, nobody can predict the future developments with regards to this scheme and the government moves. So, I don’t have an answer for this query.

Plz sir guideline upload in PDF file

Sir my daughter DOB14/6/10 ,

I HAVE Birth certificate which provided by hospital, can I open the account about my child

Yes Jayavardhan, you can get this account opened for your daughter.

Sir sukanya yojna ki 11-4-15 last date hai kya?

Nahin Vijayji, it is an ongoing scheme, isliye is scheme ki koi last date nahin hai.

Hello sir my daughter b’date is 10 april 2004, she is applicable or not for this policy…

Hi Rekha,

Your daughter is eligible for this scheme.

Regards

Neeraj

Respected sir,

Firstly thanks to you to remove out the many confusion of many peoples.But I also want to know that if my daughter is 8 year old now so opening date is april 2015 and maturity date is april 2036.I want to marry my daughter approx. in 2030.Then can I withdraw my money, if yes then can I get the same maturity amount which I will got in april 2036 or less.

Hope you understand what I want to know, waiting for your reply

Thanks Neeraj for your kind words!

If you withdraw your money in 2030, then you’ll not get the amount which you are supposed to get in 2036.

dear shiv , thanks for your all information , nicely explained and cleared.

but no one asked about nominee of this account . and in example form u also not mention any name ..

why this policy also not maintaining any insurance of girl..?

Thanks Sandeep for your kind words!

There is no provision for nomination in this scheme. I think nomination provision is not there as already two parties are involved in this scheme, first, the girl child and second, the parents/legal guardian. If something unfortunate happens with any of these two parties, the other party can claim the balance.

meri ek hi beti hai mehak chhetri 13.11 .2008 db hai hame kitane year tak paisa jama krna hai aur kitana ..jama karna hai aur kon kon sey bank me bhi acctt khul sakta hai …ham goan me rahate toa gramphrdhan ka likha birth cratifict chal jayega pls ..meri samjh me nahi aa raha kya karu pls help me..

Rakeshji, aapko 14 saal tak paisa jama karna hai. Kam se kam Rs. 1,000 har saal. Post Office, SBI, PNB, Bank of Baroda, ICICI etc. mein ye account khol sakte hain. Gram Pradhan ka birth certificate chal jaana chahiye, but post office ya bank se confirm karna padega.

???? ???????

Sir,

Aapne bhut sara guidence diya hai

magar hamari taraf se kuch sawal hai

pls aap unka bhi reply de do

hamari laado ka born hai 17/07/2005

Aapne kaha ki 21 saal pure hone ke baad hi pese milenge

magar 21 saal se pahele agar unki shaadi hoti hai to kya pese us waqt mil nahi shakte ???

ek saal me 1000 se jayada pese rakh shakte hai

is me aisa jaruri hai ki har mahine pese rakhane chahaiye ???

Is mahine 1000 rakhe to agale mahine 10000 bhi rakh shakte hai ya fir 1000 se kam 500 rakh shakte hai kya ????

Abhi to bacche chhote hai magar kahi kisi accident me gurdiance ki death ho jati hai to kya hamari laado ka account close ho jàyega ???

Ek dam se parents ki death ho jaaye to uske baad kya hoga ???

Ek saal me kitna pesa account me daale to hamari laadoo ko 21 saal ke baad 6 lack milenge ????

Ek saal me jayada se jayada kitna pesa deposit karva shakte hai ???

Aur minimum kitna pesa deposit karvana hota hai ???

1. 21 saal se pehle shaadi hone pe saara balance withdraw kar sakte hain.

2. Ek saal mein Rs. 1.5 lakh tak paisa jama kar sakte hain.

3. Nahin, har mahine paise deposit karna zaroori nahin hai.

4. Different amounts deposit kar sakte hain.

5. Koi unfortunate event hone pe aapki beti paisa withdraw kar sakti hai ya agar chahe to is account ko fund karke continue bhi kar sakti hai.

6. Maturity values ke ye ye post check keejiye – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

7. Maximum amount – 1.5 lakh

8. Minimum amount – Rs. 1,000

dear sir

kya ye scheem bank me bi hai

Yes

dear sir.

saal ka 1000/- deposit karna hai ki monthly ka isme kaafi confusion hai…

agar saal ke 1000/- kare to muturty value kitni milegi.

Sureshji,

Saal ka Rs. 1,000 deposit karna zaroori hai. Saal mein Rs. 1,000 deposit karne pe maturity value Rs. 52,944 milegi.

from deposit karne ki last date kab tak hai

Shorajji, is scheme ki koi last date nahin hai.

sir deposit karne ki last date kab tak hai

My baby born on 02-03-2007, if i am open the account today, what is maturity date. And if I submitted 2000 monthly, how much i will get after maturity , can i deposit monthly , quarterly, half yearly, annually ,.please i need calculation how much i will get at the end of scheme .

Maturity date would be 21 years from today or whenever your daughter gets married, whichever is earlier. You can deposit money in your daughter’s account any no. of times you want. For maturity values, please check this post – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/