This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

I have already posted three articles for Sukanya Samriddhi Yojana and the queries regarding this scheme are not showing any signs of tiredness. People have been asking all kind of queries regarding various features of this scheme and sharing all kind of experiences here on these posts. The biggest problem they are facing is to find out which bank branches are opening this account and accepting deposits from the general public. Banks are showing their inability to open these accounts as they do not have any clue about the account opening process.

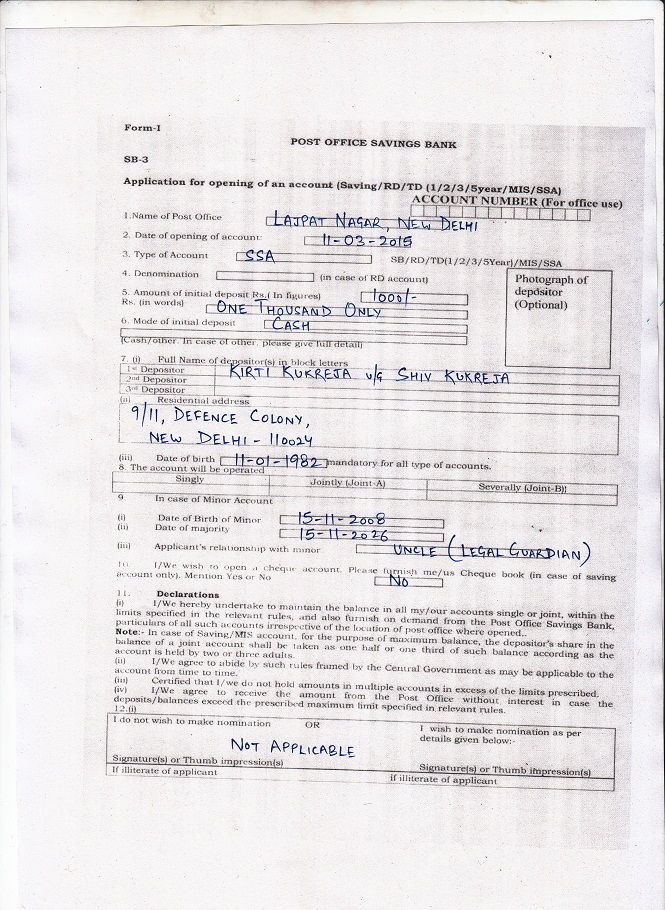

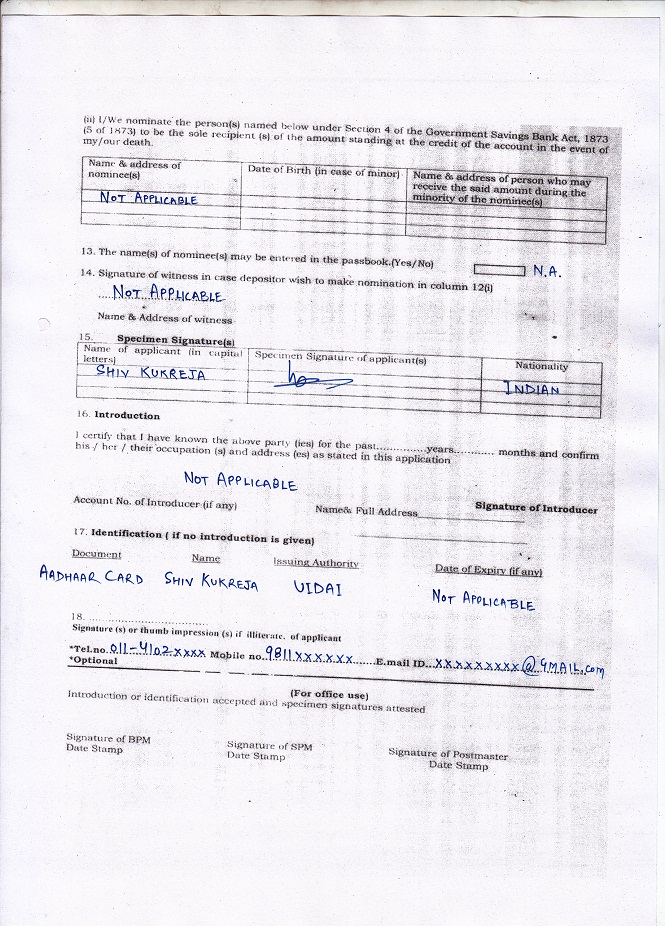

I also got a few comments in which people wanted me to post a duly filled application form so that they can also easily fill the application form for themselves. So, here you have the sample of a duly filled application form:

The application form is fairly simple and you can fill it in less than two minutes. Also, I have filled this application form to the best of my knowledge. So, if any of you find any discrepancy in it, please point it out to me and I’ll rectify it as soon as possible.

Please don’t forget to carry the necessary documents to open this account, which are as under:

* Birth Certificate of the Girl Child

* Identity Proof or Aadhaar Card of the Parent/Legal Guardian

* Residence Proof or Aadhaar Card of the Parent/Legal Guardian

* 2 Photographs of the Depositor/Parent/Legal Guardian

Much has already been mentioned about this scheme in my earlier posts, so I’ll wrap it up here. If you have any query regarding this scheme or any of its features, please let me know.

Application Form for Sukanya Samriddhi Yojana

List of authorised commercial banks where you can get this account opened

Calculating Maturity Value of SSA

What is the last date of suknayana smrithi yojana through post office pls tell

It is an ongoing scheme and there is no last date as such for opening an account.

Thanks

siv kumar ji

You are welcome!

Sir,

Mai kuch jankar I cahata hun aap se plz guide me

1) Mere dughter ki date of birth 05/07/2014 to kyaa mai uska account open kar sakta hun

2) e1s b image ka jo primium hai wo monthly hai ya yearly hai

3) kya es account opening ke liye muzhe guiranter lagengi

4) es accounts minor ke deth ke baad bhi active rahega ya nahi

Hi Nilesh,

1. Yes, aap apni beti ka account open karwa sakte hain.

2. Is scheme mein saal mein ek baar paisa deposit karna zaroori hai.

3. No, guarantor is not required for this scheme.

4. Minor ki death hone pe saara balance amount aapko mil jaayega aur account close ho jaayega.

Meri ladki 2.5 years ki hai mujhe kitna jama karna aur 21 saal bad mujhe paisa milega ya ladki ko

Aapko Rs. 1,000 se Rs. 1.5 lakh ke beech mein paisa deposit karna hai. 21 saal poore hone pe beti ko maturity value milegi.

Ssa ke bare mein paise mature ke baad ladki ko na ki gaurdians ko

Hi Vikas,

Maturity ke baad paisa beti ko milega.

sir, My daughter`s age is now 8 , if i am open sukanya account now,how the account will mature at the age 21? the deposit period is 14 years, if the account will mature at the age of 22. pls correct my doubt

21 years of your daughter’s age has nothing to do with the maturity of this scheme. 21 years will be counted from the account opening date. Or, whenever your daughter gets married, this account will have to be closed down.

Dear sir,

Any Insurance covered in this scheme ,

No Prashant, insurance cover is not there.

Sir

Meri bachchi 8 sal ki hai. Mai yearly 12000rs. SSY acount me dalta hu to kb tk mujhe bank me dena hoga. Aur kb Mechyority puri hogi. Aur kitni money milegi.

Hi Santosh,

14 saal tak aapko paisa deposit karna hai. Maturity 21 saal baad ya beti ki shaadi hone pe milegi. Maturity value ke liye ye post check keejiye – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Sir

SSA me Maine AGR 1rst year rs.15000

JMA kiya to kya next year 15000 hi JMA krna hoga. Ya km ya jyada. Kya SSA 1 se jyada khola ja skta hai?

Hi Rakhi,

1. First year Rs. 15,000 deposit karne ke baad second year mein Rs. 15,000 deposit karna zaroori nahin hai. Rs. 1,000 aur Rs. 1.5 lakh ke beech mein kitna bhi deposit kar sakte hain.

2. SSA ek girl child ke naam pe sirf ek account hi khul sakta hai.

sir bachchi ka birthday 2/12/2003 hhai 1000 manthly jama karne par 21 sal me kitana banega

Approximately Rs. 634,654 – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Sir SSA me amount kaise Jma krna hoga . monthly ya yearly ya jb amaunt hua to dalna plz. Btaye

Hi Rakhi,

Saal mein ek baar deposit karna zaroori hai, jiski koi fixed date nahin hai. Aap kabhi bhi deposit kar sakte ho.

sir plyz answer

bachchi ka janm 2/12/2003 ko huwa hai to SSYA khulega ya nhi ?

Yes Netradhwj, account khul jaayega.

Sir,

What i have to fill in 12(i) 12(ii) –

Hi Lakshmi,

You need to write “Not Applicable” in 12 (i) & 12 (ii) as nomination facility is not available in this scheme.

Dear Sir,

Good after noon, please let me know the last date of this, and which is mandatory documents required for this.

Have a good day sir.

Thanks and Regards

Rakesh AP

Hi Rakesh,

It is an ongoing scheme and there is no last date as such for this scheme. Girl’s birth certificate is the only mandatory document you need for this scheme. Apart from that, you need to provide an ID proof and an address proof.

Dear Sir,

I have not my daughter birthcertificate pls guide what else can be submit as I have school I card copy, affidavit and hospital slip.Every time Post Officer tell us a new document to be submit.

Hi Reeta,

As per my understanding, girl’s birth certificate is mandatory for getting this account opened. If you have Aadhaar Card & PAN card, then you do not need anything else.

Hello Sir mere original documents adhar card,voter I’d ,pan card mere in-law. K paas h or wo log mujhe wo Dena nahi chahte h.Main apne or kon se documents laga SaktI hu

Hi Renu,

It is so unfortunate that your in-laws are not providing you your own id/address proofs. Aapko ek id proof aur ek address proof submit karna hoga. Address proof ke liye aap telephone bill, electricity bill ya ration card provide kar sakte ho. Id proof ke liye PAN card, Driving License, Voter Id card ya Passport provide kar sakte hain.

Dear Sir,

I have a few queries :

1. A little confusion on maturity date. Is it 21 years from the date of opening the account or when the girl child attains the age of 21 years?

2. The deposit period is for 14 years. Now if a girl child is 10 years old now (during opening of the a/c) and if her marriage gets settled say when she is 22 years. In that case, the deposit for only 12 years has been made. Is she eligible to get the matured amount? If no, then when can she get it at earliest?

3. After attaining 18 years, if the girl needs money for her higher studies, she is perhaps eligible to get a part of it (50% of preceding year’s balance). When she attains 20 years, her marriage gets settled but maturity date is still not reached, is she then eligible to get 50% of the remaining balance?

Thanks in advance,

Debajit

Hi Debajit,

1. 21 years is from the date of account opening.

2. She would be eligible to withdraw the amount whenever she gets married. In your case, she would get it at the age of 22 when she gets married.

3. Yes, in that case, she can withdraw the whole balance.

Hi shiv

My question is

1. Money withdrawl after 21 years then who can withdrawl this money depositor or girl .

2 what documents required at time of withdrawl money after 21 years.

3.if we want to withdrawl money at time of marrige of girl then what document or proof is required of marriage.

4. How many time required by post office or bank to withdrawl money aftet 21 years or at time of marriage.

5. Is there is any no. to check the amount with interest at any time or check the statement.

Regards

Neeraj

Hi Neeraj,

1. Girl child will have the right to the maturity amount.

2. Passbook, birth certificate copy and a declaration would be required to withdraw the balance.

3. I think just a declaration by the girl child would be enough for withdrawal on girl’s marriage.

4. I don’t think it would take more than a day or two for the post office or bank to provide you with the maturity amount.

5. Passbook will be provided to you, which you can get updated from time to time.

Sir, 1. Meaning of legal guardian ? Can I be legal guardian being grandpa ?

2. Parents and the child are out of India but Indian passport holder. Can they open account in Bank ?

Hello Mr. Thakkar,

1. Definition of a legal guardian is still not announced by the post office, so you’ll have to wait some more time for further clarity on this matter.

2. If they are NRIs, then again there is no clarity regarding NRI investments.