This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

I have already posted three articles for Sukanya Samriddhi Yojana and the queries regarding this scheme are not showing any signs of tiredness. People have been asking all kind of queries regarding various features of this scheme and sharing all kind of experiences here on these posts. The biggest problem they are facing is to find out which bank branches are opening this account and accepting deposits from the general public. Banks are showing their inability to open these accounts as they do not have any clue about the account opening process.

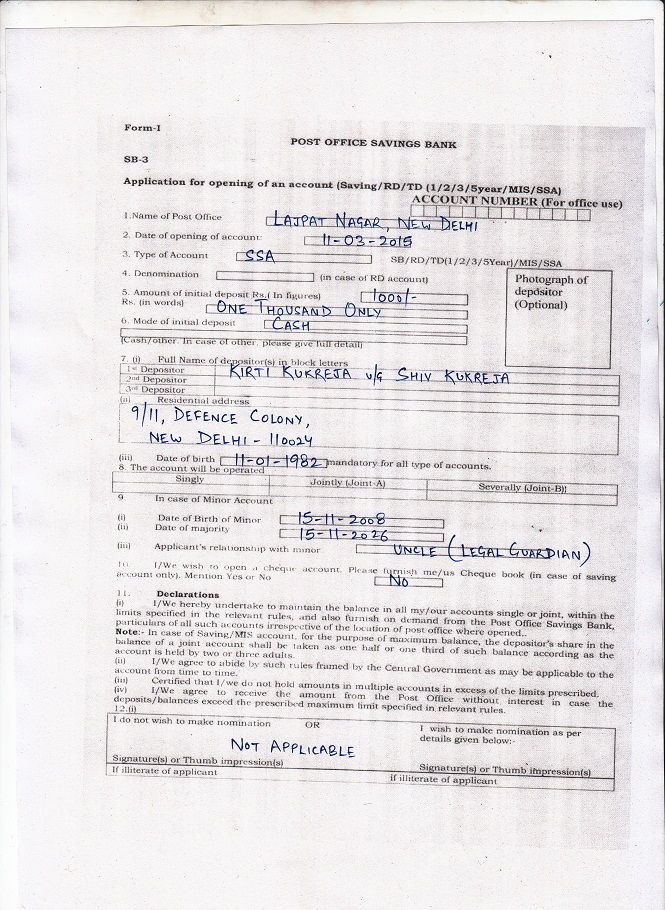

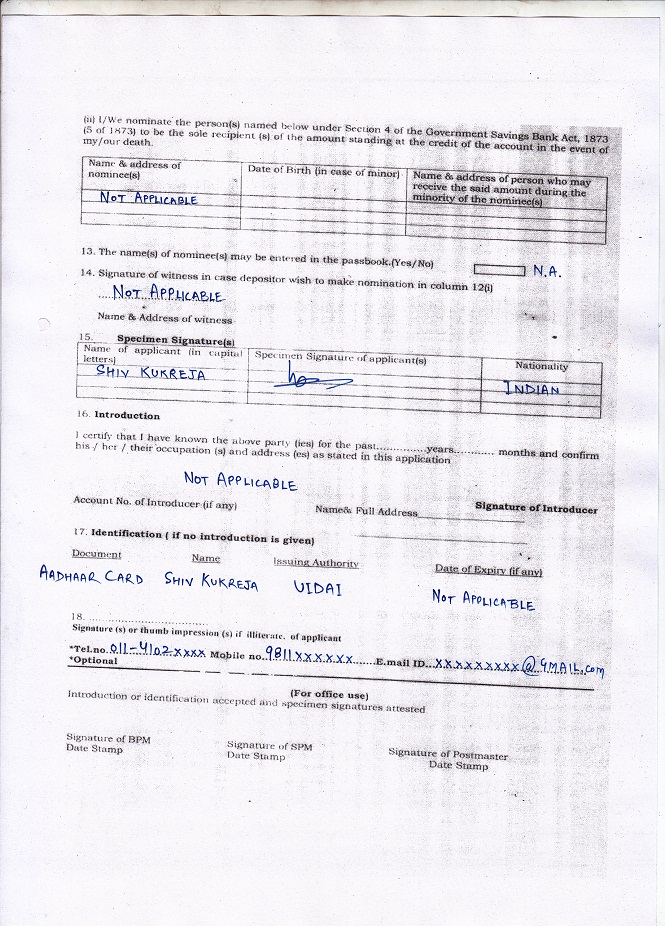

I also got a few comments in which people wanted me to post a duly filled application form so that they can also easily fill the application form for themselves. So, here you have the sample of a duly filled application form:

The application form is fairly simple and you can fill it in less than two minutes. Also, I have filled this application form to the best of my knowledge. So, if any of you find any discrepancy in it, please point it out to me and I’ll rectify it as soon as possible.

Please don’t forget to carry the necessary documents to open this account, which are as under:

* Birth Certificate of the Girl Child

* Identity Proof or Aadhaar Card of the Parent/Legal Guardian

* Residence Proof or Aadhaar Card of the Parent/Legal Guardian

* 2 Photographs of the Depositor/Parent/Legal Guardian

Much has already been mentioned about this scheme in my earlier posts, so I’ll wrap it up here. If you have any query regarding this scheme or any of its features, please let me know.

Application Form for Sukanya Samriddhi Yojana

List of authorised commercial banks where you can get this account opened

Calculating Maturity Value of SSA

Emi will be cash only or we can can use other options

Cash/cheque/DD would be accepted.

Hi, please advice whom I can suggest as nomini in this application form , minor father or mother

Hi Pushpendra,

You need not mention nominee in this form, as the depositor would receive the balance amount if something happens to the girl child.

Nowhere on the form above mentions about sukanya samriddhi scheme name. it looks like a simple savings account in post office. how would it be differentiated. ??

Hi Roopan,

It is mentioned in the form above as SSA.

Documents kya kya lagana h sir isme

Beti ka birth certificate aur aapka id proof, address proof & 2 photographs.

Kya SSA account dusre city/state ke bank ya post office se open kara sakta hun , yadi mai kisi dusre state ka nivasi hun?

Yes Dhanraj, you can get it opened in some other state as well.

Sir investment in ssa is worth???????

I think it is a good investment Reshma.

shall i fill up the form online ?

Online account opening facility is not there with any of the post offices or banks. You will have to personally visit a post office or a bank branch.

shall we fill up the form online ?

respected Sir, can u answer for pension yojana newly launch

Hi Reshma,

Please check this link for Atal Pension Yojana – http://www.onemint.com/2015/03/13/atal-pension-yojana-government-guaranteed-pension-scheme-for-the-unorganised-sector/

Hi – Could you please let me know is a combine one photograph of parents along with girl child is require or stand alone photographs of Parents & child will suffice the requirement

Hi Mohit,

Photograph of only the father/mother or legal guardian is required, not of the girl child.

Thanks a lot sir for guideline

You are welcome Monika!

Sir, date of birth is 08.01.2004. Is it ok for eligibility?plz reply.

Yes Lokpriya, the girl child with DoB 08/01/2004 is eligible for this scheme.

Dear Sir,

(1) KYA MAI ONE MONTH 500 Rs. AUR NEXT MONTH 1000Rs. AUR FIR NEXT MONTH 500 Rs. JMA KAR SAKATA HU.

(2) KYA MAI AISA YEAR ME 7-8 MONTH JAMA KAR SAKATA HU

SIR PLEASE TELL ME

Dear Sir,

(1) KYA MAI ONE MONTH 500 Rs. AUR NEXT MONTH 1000Rs. AUR FIR NEXT MONTH 500 Rs. JMA KAR SAKATA HU.

(2) KYA MAI AISA YEAR ME 7-8 MONTH JAMA KAR SAKATA HU

SIR PLEASE TELL ME

1. Yes Rahul, aap aisa kar sakte hain.

2. Yes, aap jitne bhi baar chahen, utne baar paise deposit kar sakte hain.

Sir ye yojana punjab me bhi available hai

Yes, ye yojana Punjab samet poore Hindustan mein available hai.

Dear Sir,

I have taken kotak life policy kotak capital multiplier plan.This july i have to pay my third annual primium of 20000.But i want to transfer this plan to sukanya scheme.i have twin daughter.

Please guide me on this.

my no – 9860009178

8007385111

Dear Sir,

Can we invest one time primium in sukanya yojana.

help us.

In this scheme, you need to deposit money at least once in a year.

Hi Nanasaheb,

Sorry, I cannot comment on your policy without its analysis. But, this scheme is very good for conservative investors.

sir agar birth certificate me jo naam he wo na rakhke jo humne beti ka dusra naam rakha he us naam se account khul sakta he ?

Jo naam birth certificate mein mentioned hai, usi naam se account kholna hoga.

sir plz reply

me aaj hi post se form layi hu.waha se kuch guideline nahi de un logone.permonth invest karna he

Sir,kya humko har mahine post me jakar rs.1000 bharne padenge.

Hi Monika,

Is scheme mein har mahine invest karna zaroori nahin hai, saal mein ek baar deposit karne se bhi chalega. But, agar aap har mahine paisa deposit karna chahte ho, to aapko har mahine post office jaana padega, kyunki post office mein online money transfer ki option nahin hai.

Dear Sir,

I had approach my PNB for open the account, they do not have form to open the account. From which bank I can get the form to open the above account.

Regards

Hi Suresh,

PNB has started opening these accounts. You should talk to the bank manager of your branch and ask him why they are not opening your account. If your branch is not opening these accounts, then you should contact PNB at this number – 011-25744370 and ask which branch nearest to your place is opening it.