This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

I have already posted three articles for Sukanya Samriddhi Yojana and the queries regarding this scheme are not showing any signs of tiredness. People have been asking all kind of queries regarding various features of this scheme and sharing all kind of experiences here on these posts. The biggest problem they are facing is to find out which bank branches are opening this account and accepting deposits from the general public. Banks are showing their inability to open these accounts as they do not have any clue about the account opening process.

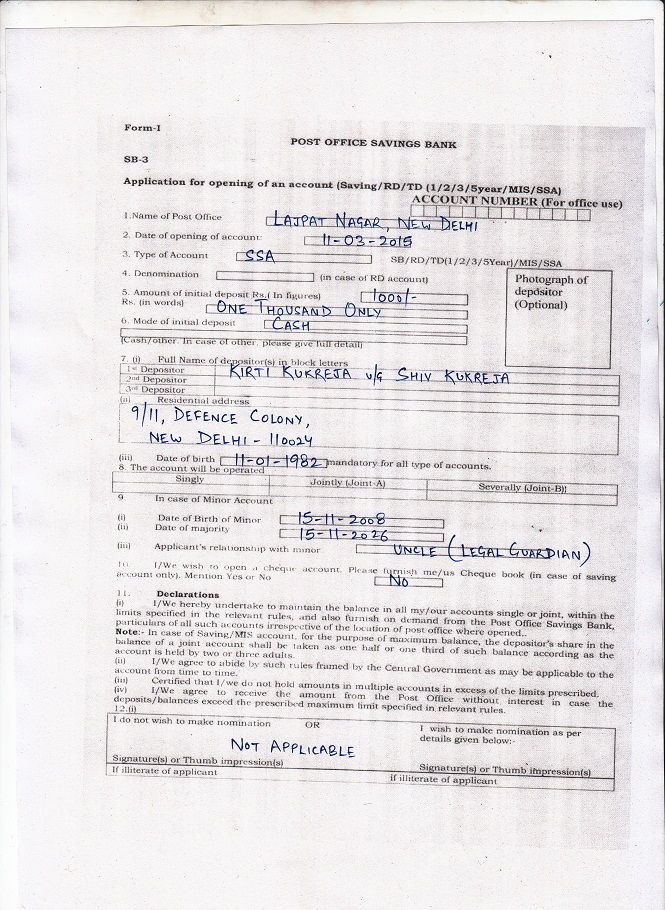

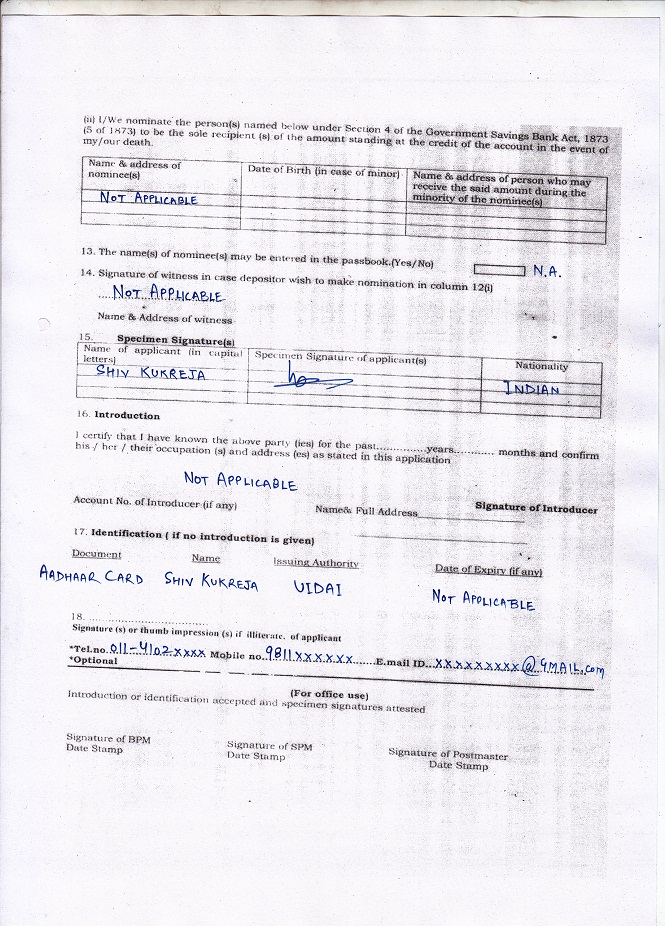

I also got a few comments in which people wanted me to post a duly filled application form so that they can also easily fill the application form for themselves. So, here you have the sample of a duly filled application form:

The application form is fairly simple and you can fill it in less than two minutes. Also, I have filled this application form to the best of my knowledge. So, if any of you find any discrepancy in it, please point it out to me and I’ll rectify it as soon as possible.

Please don’t forget to carry the necessary documents to open this account, which are as under:

* Birth Certificate of the Girl Child

* Identity Proof or Aadhaar Card of the Parent/Legal Guardian

* Residence Proof or Aadhaar Card of the Parent/Legal Guardian

* 2 Photographs of the Depositor/Parent/Legal Guardian

Much has already been mentioned about this scheme in my earlier posts, so I’ll wrap it up here. If you have any query regarding this scheme or any of its features, please let me know.

Application Form for Sukanya Samriddhi Yojana

List of authorised commercial banks where you can get this account opened

Calculating Maturity Value of SSA

Hello sir,

Is this possible my ssy instalments (1000/month) deducts every month automatically from my bank accout

Hi Amit,

No bank is providing any such facility as of now.

Hi, sir I am very happy with ur answers, ur helping people with ur replies. sir every thing is good that showing table maturity amt, but I am having doubt rate of interest will change every year so how can this table amt will match.

Thanks Sandeep for your kind words!

Also, this table has been prepared with certain assumptions to help investors know the approximate maturity values. It is almost certain that the actual maturity amount will not match the maturity values given in the table. But, in order to help investors, I had to create it.

hi,

1) kya mai ek sath 5,000 x 12 month = 60,000/- ke hisab se bhar me sakta hu ?

2) ishi tarah 60,000 x 14 yrs =8,40,000/-ke hisab se mujhe 21 yrs hone par 30,35,640/- milega.

Hi,

1. Yes, aap ek saath Rs. 60,000 jama karwa sakte hain.

2. Rs. 60,000 ke hissab se 21 saal baad maturity pe aapko Rs. 32,02,585 milega – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Hi

1 )kya mai ek sath 5000 x 12 month = 60,000/- ke hisab se cash/chq de sakta hu ?.

2)Ishi tarah 60,000 x 14 yrs =8,40,000/- ka 21 yrs mujhe 30,35,640/-

milega.

Sir,

Kindly suggest me my daughter is 27 January 2004 born i.e. 11 years as on date.How many years do I need to pay the premium and when will the maturity date be, as she will be turning 18 years on 27 January 2022 and 21 years on 27 January 2025.

Hi Naveen,

You need to deposit money for 14 years from the account opening date or till the time your daughter gets married, whichever is earlier. Your daughter’s account will get matured in 21 years from the account opening date or whenever she gets married, whichever is earlier. To get maximum return, one should deposit lump sum money as early as possible in a financial year.

Dear Sir

My one question -: I had go to my nearest Corporation bank in Airoli (Navi Mumbai) they are not responed to us they told us to go POST office for this scheme.

Sukanya Samriddhi Yojana

Actual reason is post office not nearest my home now what I do.

Please avise me

Hi Mr. Vinay,

You can approach SBI, PNB, IDBI Bank or Bank of India for getting this account opened.

Sir yadi guardian ki death ho jane k condition me yojna premium automatic paid hoga kya. ?

Nahin, government is account ko fund nahin karegi. Ya to aapki beti ko is account ko fund karna hoga, ya phir account close karke balance amount with interest withdraw karna hoga.

Sir yadi ladki ki 14 or 21 yr pahle death ho jane k condition me policy Ka kya hoga. ?

Ladki ki death hone pe paisa with interest aapko mil jaayega.

Is it necessary to open saving a/c with that bank in which i want to open SSA?

No, it is not necessary to open a savings account as well.

Filled up form sample is very useful.

Thank you for posting online.

You are welcome!

yadi mai evry month 1000*14 year diposit karu to after 21year maturity kya hogi

Hi Sunil,

Please check this post – http://www.onemint.com/2015/04/03/sukanya-samriddhi-yojana-calculating-maturity-values-9-2-interest-rate-applicable-for-fy-2015-16/

Aapko approximately Rs. 634,654 milenge.

Yadi main 14 year tak Rs.1000/- matra prati year jama kavata hu to 21 sal bad SSA Yojana main maturity amount kya hogi

21 saal baad approximately Rs. 53,376 maturity value milegi.

Today i visite at post office at ghandhinagar madanganj kishangarh & i fill up suknya samardhi yojna’s form my daughter Anuradh Chaudhary pl. Advise me about resulet of SSY

Sir ji…SSA yojna me hamare alava, other relative bhi hamari beti k naam se alag SSA a/c me saving kar sakta hai

Ek girl child ke naam pe ek account hi khul sakta hai.

Mr. Kukreja ,

Can i deposit 1000 for one month and next month 2000 in SSA or is it a fixed amount that i have to deposit every month

Hi Regina,

You can change the amount to be deposited, there is no problem in that. The amount to be deposited can vary between Rs. 1,000 and Rs. 1.50 lakh in a financial year.

i believe account name is SSY instead of SSA. correct?

Hi Murali,

Account name used is “Sukanya Samriddhi Account (SSA)”.

CHANCHAL MY DAUGHTER IS BORN IN 2003 16 OCTOBER . IS SHE ELIGIBLE FOR THIS YOJANA ?

No Kritika, your daughter is not eligible for this scheme.

SHIV KUKREJA JI CHANCHAL MY DAUGHTER KRITIKA IS BORN ON 16 OCTOBER 2003 SO CAN WE APPLY FOR THIS YOJANA

SHIV KUKREJA JI MY DAUGHTER KRITIKA IS BORN ON 16 OCTOBER 2003 SO CAN WE APPLY FOR THIS YOJANA

Can we deposit money by NEFT in SSA account if we get SSA open in PNB branch…? I deposit via NEFT for my SBI PPF

As of now, you cannot do that. But, going forward, some of the banks should provide such facility.

Hmm..so the account no which we will get for SSA will not be like an ordinary bank account number ?