This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

88% of India’s total labour force of 47.29 crore belongs to the unorganised sector, in which the workers do not have any formal provision of getting a regular pension payment on retirement. Moreover, due to increasing labour wages and better medical facilities, these people also face a risk of increasing longevity. So, this work force would require some kind of assured income guarantee to sustain itself in the coming years.

Launching Atal Pension Yojana (APY) from June 1, 2015

To encourage workers in the unorganised sector to voluntarily save for their retirement, the government of India will be launching a new scheme, called Atal Pension Yojana (APY), from 1st June, 2015. Finance Minister Arun Jaitley announced this scheme in his budget speech on February 28th.

This scheme will replace the UPA government’s Swavalamban Yojana – NPS Lite and will be administered by the Pension Fund Regulatory and Development Authority (PFRDA). The benefits of this scheme in terms of fixed pension will be guaranteed by the government and the government will also make contribution to these accounts on behalf of its subscribers.

Under this scheme, a subscriber would receive a minimum fixed pension of Rs. 1,000 per month and in multiples of Rs. 1,000 per month thereafter, up to a maximum of Rs. 5,000 per month, depending on the subscriber’s contribution, which itself would vary on the age of joining this scheme.

The minimum age of joining this scheme is 18 years and maximum age is 40 years. Pension payment will start at the age of 60 years. Therefore, minimum period of contribution by the subscriber under APY would be 20 years or more.

The Central Government would also co-contribute 50% of the subscriber’s contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber account, for a period of 5 years, i.e., from 2015-16 to 2019-20, who join the NPS before 31st December, 2015 and who are not income tax payers. The existing subscribers of Swavalamban Scheme would be automatically migrated to APY, unless they opt out.

Who is eligible for Atal Pension Yojana?

Any Citizen of India, aged between 18 years and 40 years, who has his/her savings bank account opened and also possesses a mobile number, would be eligible to subscribe to this scheme.

Government Funding – Indian Government would provide (i) fixed pension guarantee for the subscribers; (ii) would co-contribute 50% of the subscriber contribution or Rs. 1,000 per annum, whichever is lower, to eligible subscribers; and (iii) would also reimburse the promotional and development activities including incentive to the contribution collection agencies to encourage people to join the APY.

Who is eligible for Government Co-Contribution in Atal Pension Yojana?

Subscribers of this scheme, who are not covered under any other statutory social security scheme and are not income tax payers, would be eligible for the government’s co-contribution of up to Rs. 1,000 per annum.

Social Security Schemes which are not eligible for Government Co-Contribution

- Employees’ Provident Fund (EPF) & Miscellaneous Provision Act, 1952

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948

- Assam Tea PlantationProvident Fund and Miscellaneous Provision, 1955

- Seamens’ Provident Fund Act, 1966

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act, 1961

- Any other statutory social security scheme

Minimum/Maximum Pension Payable – This scheme will pay a minimum pension of Rs. 1,000 per month and a maximum pension of Rs. 5,000 per month, depending on the subscriber’s own contribution per month.

Minimum/Maximum Period of Contribution – As the minimum age of joining APY is 18 years and maximum age is 40 years, minimum period of contribution by the subscriber under this scheme would be 20 years and maximum period of contribution would be 42 years.

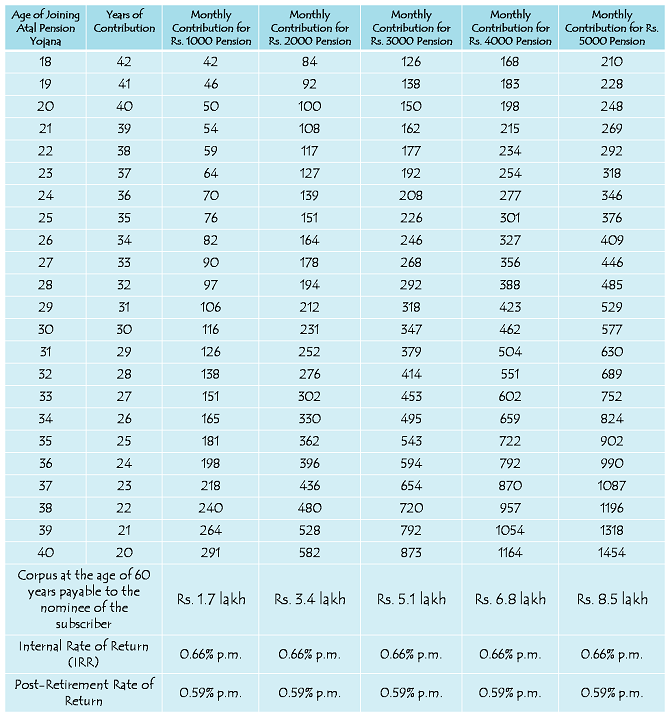

Atal Pension Yojana – Contribution Period, Contribution Levels, Fixed Monthly Pension and Return of Corpus to the Nominees of Subscribers

Internal Rate of Return (IRR) – Thanks to the government funding of Rs. 1,000 per annum per subscriber account for 5 years, your account would generate an IRR of approximately 0.66% per month or 8% per annum. This pension amount per month is fixed and the government has made it clear that if the actual returns on the pension contributions are higher than the assumed returns, such excess return will be credited to the subscribers’ accounts, resulting in enhanced pension payment to the subscribers.

Minimum Contribution – A subscriber aged 18 years will have to contribute a minimum of Rs. 42 per month in order to get Rs. 1,000 pension per month starting 60 years of age. For a 40 years old subscriber, his/her minimum contribution would be Rs. 291 per month. The contribution levels would vary and would be low if subscriber joins early and increase if he joins late.

Maximum Contribution – A subscriber aged 40 years will have to contribute Rs. 1,454 per month in order to get Rs. 5,000 pension per month starting 60 years of age. For a 18 years old subscriber, his/her contribution for Rs. 5,000 monthly pension would be Rs. 210 per month.

Can I increase or decrease my monthly contribution for higher or lower pension amount?

The subscribers can opt to decrease or increase pension amount during the course of accumulation phase, as per the available monthly pension amounts. However, the switching option shall be provided only once in a year during the month of April.

What will happen if sufficient amount is not maintained in the savings bank account for contribution on the due date?

Non-maintenance of required balance in the savings bank account for contribution on the specified date will be considered as default. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Re. 1 to Rs. 10 per month as shown below:

(i) Re. 1 per month for contribution upto Rs. 100 per month

(ii) Rs. 2 per month for contribution upto Rs. 101 to 500 per month

(iii) Rs. 5 per month for contribution between Rs. 501 to 1,000 per month

(iv) Rs. 10 per month for contribution beyond Rs. 1,001 per month.

Discontinuation of payments of contribution amount shall lead to following:

After 6 months account will be frozen.

After 12 months account will be deactivated.

After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Post-Retirement Rate of Return – Considering a retirement corpus of Rs. 1.7 lakh and monthly pension of Rs. 1,000, this scheme is going to generate a return of 0.59% per month or 7.1% per annum for its subscribers. I think this return is also on a lower side.

Nomination Facility – This scheme will also provide the nomination facility to its subscribers. In case of the subscriber’s death after attaining 60 years of age, the whole corpus generating the pension income to the subscriber would be returned back to the nominee of the subscriber. In case of untimely death of the subscriber before 60 years of age, the balance would be returned back to the nominee of the subscriber.

Where to open APY Accounts – You need to approach points of presence (PoPs) and aggregators under existing Swavalamban Scheme. These agencies would enrol you through architecture of National Pension System (NPS).

Points of Presence & Aggregators

Application Form – Here you have the links to the application form for subscribing to Atal Pension Yojana – Application Form in English – Application Form in Hindi

I think a subscriber should opt for a minimum monthly contribution of around Rs. 167 or so, which would make it approximately Rs. 2,000 annual contribution. 50% of Rs. 2,000 i.e. Rs. 1,000 would be contributed by the government as well. So, the subscriber will get the maximum benefit of government funding.

As mentioned above, the scheme would start from June 1, 2015. So, interested people will have to wait till then to open an account. If you have any other query regarding this scheme, please share it here.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Sir,

Now I join Atal Pension Yojana, after 5 years i have a service and EPFO deduct my salary. Can the yajana continue or close?

Hi Sanjeeb,

You can continue your account even after you join some service.

Can I change the nominee name in Atal Pension Yojana? If yes, when and how many times?

Yes Goutam, you can change the nominee as & when you want.

I’m intaerestet in pansin palan

Hi Prashant,

You need to approach the nearest POP – SP for the same – https://npscra.nsdl.co.in/pop-sp.php

where can we claim for the money.. when we need it back

Hi Piyush,

You need to approach the aggregator where your account is held.

I am primary teacher of state govt. West Bengal , can I apply apy. Or this is only unemployed.

Hi Santu,

You can apply for this scheme, but you’ll not get the government contribution.

Today I am not a tax payer and after few years if I become a tax payer so will I benefit from this plan as well as, will I be eligible to continue if I start coming into the category of tax payer.

Yes, you can continue with the scheme in that case, but you’ll not get the government contribution.

I am working in a pvt sector and I have epf a/c. Can I take this APY

Hi Kailash,

You are eligible for this scheme. But, you are not eligible for the government contribution.

sir

my wife is a state govt. Teacher but she is join job in 2005. can she applied in atal pension scheem..

she have not any govt. pension scheem till date..

she can applly in APY scheem for future benefit.

Umesh Kesarwani

9026066463

02.07.2015

Yes Umesh, your wife is eligible. But, if your wife is a tax payer, then she is not eligible for the government contribution.

Hello sir,

my self and my wife have 39 & 37 age respectively. both of us have a PAN card. but past 4-5 years we not written the income tax. because of income down. now we are eligible for APY or not. and i have a bank a/c. with Axis only. so i can apply this bank or nationalized bank only. if nationalized bank only means can i open any saving account in this bank is mandatory?

Hi Murugesh,

You both are eligible for this scheme. Also, you can open this account in any of the banks which are providing services for it.

If someone’s Date of Birth is 27th may 1975 (just crossed 40) will the person be eligible to join Atal Pension Yojna

Hi Partha,

Yes, a person with DoB 27th May 2015 would be eligible for this scheme.

Dear sir,

I’m 28 yrs old and I’m not a tax payer / PPF account holder as well.

But what if I open acc for this APY & in next year if i wish to open acc for PPF then will I be eligible for govt. contribution for APY thereafter?

And Is NRI eligible for this APY?

Hi Monali,

1. I think you’ll get the government contribution in case you have PPF account. But, if you are working & have EPF account, then you are not eligible for the government contribution.

2. NRIs are not eligible for this scheme.

I am a govt sevent. Ican open this scheme

Thanks sir for your answer

1.what are the changes happen with their pension if one person getting government contribution and second person who get gov job after oprning APY and gov stop contributing 1000 rs in second person acc…so will there any changes in there pension after 60 year?

2. Is bank giving some acknowledgment or any certificate after opning APY?

3. What are the documents to be attach with APY form

1. Yes Atul, there will be a nominal difference in the pension amount.

2. Yes, you will get the periodic statements for the same. You’ll also receive SMS updates.

3. Required documents are mentioned in the application form.

I joined apy in allahabad bank from jun 2015. I subscribe for 1000 per month pension.now I want to increase my subscription to 5000 per month pension. What I should do?.

Hi Mousumi,

You can increase your contribution amount only once in a year in the month of April.

1.Sir , what if I will get gov job then, is gov contribution will get me or not In future.

2.is there any option to change nominee name after some year

Hi Atul,

1. Once you get a job with PF benefits, the government will stop contributing to your account.

2. Yes, you can change your nominee in future.

Dear sir,

while opening Bank account i have given pan card and aadhar card which was stating the date of birth 12.06.1981 but my orginal date of birth as my sslc marks card was 12.06.1979 .

so for which date of birth i have to apply for this scheme.

Hi Siddeswara,

You need to check it with the aggregator.

Sir i need to know about cancle account.

If i join dis sceeme and then after i want to cancle or give up then have any option??

Hi Jayesh,

I don’t think there is a way to cancel/close this account. You need to check it with an aggregator.

Hi , My date of birth is 5th Dec 1974 , Am i eligible for the PM Atal Pension Yojana ?

Hi Vela,

You need to check it with any of the aggregators.

Sir/ Madam,

I am working in private company and also member of EPF but my wife house wife age of 30 years, can she eligible for APY

Sir/ Madam,

I am employee of private company and member of EPF but my wife is house wife age of 30 years , can she eligible for APY ?

Hi Prasant,

Every Indian citizen is eligible for this scheme. If your wife is not a tax payer and not covered under any other social security scheme, then she is eligible for the government contribution.