This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

88% of India’s total labour force of 47.29 crore belongs to the unorganised sector, in which the workers do not have any formal provision of getting a regular pension payment on retirement. Moreover, due to increasing labour wages and better medical facilities, these people also face a risk of increasing longevity. So, this work force would require some kind of assured income guarantee to sustain itself in the coming years.

Launching Atal Pension Yojana (APY) from June 1, 2015

To encourage workers in the unorganised sector to voluntarily save for their retirement, the government of India will be launching a new scheme, called Atal Pension Yojana (APY), from 1st June, 2015. Finance Minister Arun Jaitley announced this scheme in his budget speech on February 28th.

This scheme will replace the UPA government’s Swavalamban Yojana – NPS Lite and will be administered by the Pension Fund Regulatory and Development Authority (PFRDA). The benefits of this scheme in terms of fixed pension will be guaranteed by the government and the government will also make contribution to these accounts on behalf of its subscribers.

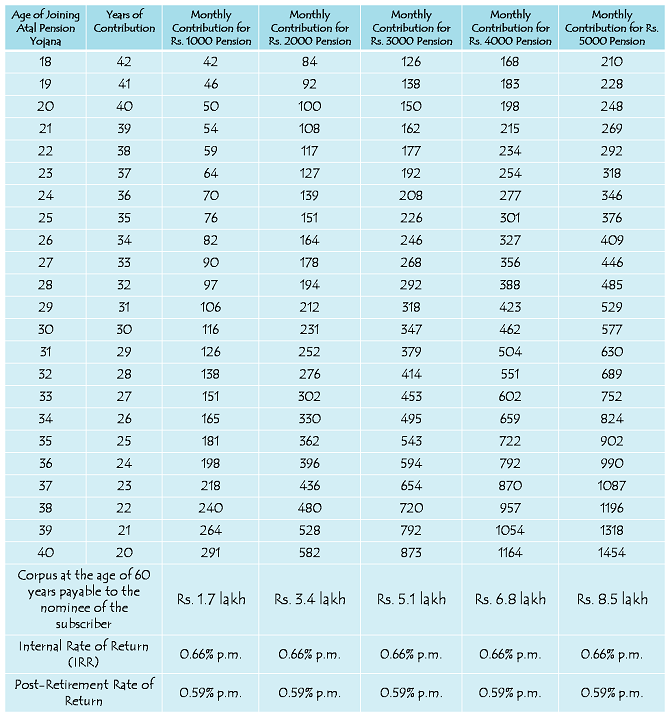

Under this scheme, a subscriber would receive a minimum fixed pension of Rs. 1,000 per month and in multiples of Rs. 1,000 per month thereafter, up to a maximum of Rs. 5,000 per month, depending on the subscriber’s contribution, which itself would vary on the age of joining this scheme.

The minimum age of joining this scheme is 18 years and maximum age is 40 years. Pension payment will start at the age of 60 years. Therefore, minimum period of contribution by the subscriber under APY would be 20 years or more.

The Central Government would also co-contribute 50% of the subscriber’s contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber account, for a period of 5 years, i.e., from 2015-16 to 2019-20, who join the NPS before 31st December, 2015 and who are not income tax payers. The existing subscribers of Swavalamban Scheme would be automatically migrated to APY, unless they opt out.

Who is eligible for Atal Pension Yojana?

Any Citizen of India, aged between 18 years and 40 years, who has his/her savings bank account opened and also possesses a mobile number, would be eligible to subscribe to this scheme.

Government Funding – Indian Government would provide (i) fixed pension guarantee for the subscribers; (ii) would co-contribute 50% of the subscriber contribution or Rs. 1,000 per annum, whichever is lower, to eligible subscribers; and (iii) would also reimburse the promotional and development activities including incentive to the contribution collection agencies to encourage people to join the APY.

Who is eligible for Government Co-Contribution in Atal Pension Yojana?

Subscribers of this scheme, who are not covered under any other statutory social security scheme and are not income tax payers, would be eligible for the government’s co-contribution of up to Rs. 1,000 per annum.

Social Security Schemes which are not eligible for Government Co-Contribution

- Employees’ Provident Fund (EPF) & Miscellaneous Provision Act, 1952

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948

- Assam Tea PlantationProvident Fund and Miscellaneous Provision, 1955

- Seamens’ Provident Fund Act, 1966

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act, 1961

- Any other statutory social security scheme

Minimum/Maximum Pension Payable – This scheme will pay a minimum pension of Rs. 1,000 per month and a maximum pension of Rs. 5,000 per month, depending on the subscriber’s own contribution per month.

Minimum/Maximum Period of Contribution – As the minimum age of joining APY is 18 years and maximum age is 40 years, minimum period of contribution by the subscriber under this scheme would be 20 years and maximum period of contribution would be 42 years.

Atal Pension Yojana – Contribution Period, Contribution Levels, Fixed Monthly Pension and Return of Corpus to the Nominees of Subscribers

Internal Rate of Return (IRR) – Thanks to the government funding of Rs. 1,000 per annum per subscriber account for 5 years, your account would generate an IRR of approximately 0.66% per month or 8% per annum. This pension amount per month is fixed and the government has made it clear that if the actual returns on the pension contributions are higher than the assumed returns, such excess return will be credited to the subscribers’ accounts, resulting in enhanced pension payment to the subscribers.

Minimum Contribution – A subscriber aged 18 years will have to contribute a minimum of Rs. 42 per month in order to get Rs. 1,000 pension per month starting 60 years of age. For a 40 years old subscriber, his/her minimum contribution would be Rs. 291 per month. The contribution levels would vary and would be low if subscriber joins early and increase if he joins late.

Maximum Contribution – A subscriber aged 40 years will have to contribute Rs. 1,454 per month in order to get Rs. 5,000 pension per month starting 60 years of age. For a 18 years old subscriber, his/her contribution for Rs. 5,000 monthly pension would be Rs. 210 per month.

Can I increase or decrease my monthly contribution for higher or lower pension amount?

The subscribers can opt to decrease or increase pension amount during the course of accumulation phase, as per the available monthly pension amounts. However, the switching option shall be provided only once in a year during the month of April.

What will happen if sufficient amount is not maintained in the savings bank account for contribution on the due date?

Non-maintenance of required balance in the savings bank account for contribution on the specified date will be considered as default. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Re. 1 to Rs. 10 per month as shown below:

(i) Re. 1 per month for contribution upto Rs. 100 per month

(ii) Rs. 2 per month for contribution upto Rs. 101 to 500 per month

(iii) Rs. 5 per month for contribution between Rs. 501 to 1,000 per month

(iv) Rs. 10 per month for contribution beyond Rs. 1,001 per month.

Discontinuation of payments of contribution amount shall lead to following:

After 6 months account will be frozen.

After 12 months account will be deactivated.

After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Post-Retirement Rate of Return – Considering a retirement corpus of Rs. 1.7 lakh and monthly pension of Rs. 1,000, this scheme is going to generate a return of 0.59% per month or 7.1% per annum for its subscribers. I think this return is also on a lower side.

Nomination Facility – This scheme will also provide the nomination facility to its subscribers. In case of the subscriber’s death after attaining 60 years of age, the whole corpus generating the pension income to the subscriber would be returned back to the nominee of the subscriber. In case of untimely death of the subscriber before 60 years of age, the balance would be returned back to the nominee of the subscriber.

Where to open APY Accounts – You need to approach points of presence (PoPs) and aggregators under existing Swavalamban Scheme. These agencies would enrol you through architecture of National Pension System (NPS).

Points of Presence & Aggregators

Application Form – Here you have the links to the application form for subscribing to Atal Pension Yojana – Application Form in English – Application Form in Hindi

I think a subscriber should opt for a minimum monthly contribution of around Rs. 167 or so, which would make it approximately Rs. 2,000 annual contribution. 50% of Rs. 2,000 i.e. Rs. 1,000 would be contributed by the government as well. So, the subscriber will get the maximum benefit of government funding.

As mentioned above, the scheme would start from June 1, 2015. So, interested people will have to wait till then to open an account. If you have any other query regarding this scheme, please share it here.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

IF SOMEONE AGE IS 40 YRS. HE PAY 291/- PM FOR 20 YRS. AND GET 1.70 LAKH CORPUS FUND FROM APY SCHEME (I.E RATE OF INTEREST IS 7.93% APPROX)

IF THE SAME PERSON MADE A RECURRING DEPOSIT A/C OF RS. 291/- FOR 20 YRS. HOW MANY CORPUS FUND IS GENERATD? IF HE INVEST THE CORPUS AMOUNT IN MIS (BANK OR PO) SCHEME AFTER 20 YRS, WHICH IS BETTER FOR HIM APY OR NORMAL RECURRING DEPOSITE? WHAT IS THE RATE OF INTEREST OF APY SCHEME ?

Hello sir,

First of all I have to join APY plan. So, first I need to fill the application form and then I have to submit to the bank which I have a bank account.

Can I join both NPS through my employer and APY in my saving bank account?

Yes Piyush, you can do so. But, you won’t get any government contribution.

Suppose today I am not a tax payer and opened the APY A/C but after few years if I become a tax payer in that case will I be eligible to continue the A/C with same benefit.

Hi Arup,

Once you become a tax payer, the government will stop making its contributions. Rest all benefits will remain.

Please confirm what is government contribution? Can we take this scheme if we have PF A/C & am a Tax Payer.

Hi Dipankar,

The government is contributing up to Rs. 1,000 per annum for 5 years to those accounts which belong to the unorganised sector. As you are covered under EPF and a tax payer, you’ll not get such contribution.

Hi shiv ,

I have started paying monthly installments for A.P.Y. according to my age but Unfortunately I have deleted the message in which I got PRAN nomber.

So ,Can I get my PRAN number from bank or any where?

Hi Tarlika,

Yes, you can get your PRAN no. from the aggregator with which you’ve opened this account. You’ll also get the physical statement for the same in which the PRAN number will be mentioned.

I am not getting u properly.Please explain the term “aggregator “.The Bank has given me a temporary receipt and in the receipt there is a explanation that “Please collect your Acknoledgement and PRAN from the branch”.This Receipt doesnot containing pran number.

I asked at my bank but they are saying that this is not as much important,account have started debiting monthly installments so you are enrolled.but I am not sure about their answer.

You should not be worried about it. Your bank is right, your account has started and sooner or later, you’ll get your PRAN number.

In your case, your bank is the aggregator and you need to ask the branch staff to provide you your PRAN number.

Thank u very much Shiv.

You are welcome Tarlika!

Tarlika,

You could find the PRAN no mentioned in the bank statement where they mention the transaction ID for the deduction of the premium. The Last 12 digit of the transaction ID is actually your PRAN No.

Thanks for help Avik.

Thanks…..

Support me this chart…

If death in mid of the policy what is the process of nominee Pension

Hi Prabha,

As per my information the nominee will get the total corpus accumulated till date.

Thanks Avik!

Hi,

I have joined APY and received PRAN no on mobile. Also the amount from my account get credited to APY account. Now I have mailed APY team and asked whether I will get any physical PRAN card or Electronic PRAN card. But their answer is negetive. So my question is if I dont have any PRAN card, any documents, how do I claim my pension after 60 yrs? After my death how my spouse and child will claim the pension and corpus amount? Please clarify my doubts…

Hi Avik,

You’ll get your physical PRAN card & physical statements as well in which all the details would be mentioned.

Thank you so much for your reply. I have mailed APY guys and they replied that “Dear Subscriber,

This has reference to your email, regarding non receipt of PRAN card for PRAN: 5**************.

In this regard, we wish to inform you that we have verified our records and it has been observed that your PRAN 5******** is registered under Atal Pension Yojana (APY). Currently, under APY, there is no provision to send PRAN card/I-PIN and T-PIN to the subscriber.”

Hi Avik,

As the scheme is new, they are not issuing it as of now. But, later on it will get issued.

Hi,

If a subscriber dies before reaching age of 60 yrs, then his nominee would receive lump sum amount. My question is how much the nominee will receive

a) only monthly contribution made by subscriber till date

Or

b) monthly contribution made by subscriber till date plus IRR of 0.66 pm ( i.e. Interest component on his monthly contribution).

Thanks

Hi Tushar,

Nominee will also get the interest amount on contributions made.

Dear Sir,

A man who is working with a private company where no pension facility is there and aged 50 +, what is the option for him towards Pension Plan ? if any suitable scheme for him. Please advise.

Regards

Hi Mr. Sambhu,

Mutual Fund SIPs are good for investments.

Sir,

I am 24year old and my income is 10,000 per month. I don’t pay task. I am unmarried. No wife no children. Do this plan useful for me? If yes now to whom I will keep nominee?

Hi Soumya,

You can make your parents as your nominee. I think this is not a great long-term scheme to invest in.

Hi Shiv,

I just have 2 questions regarding APY,

1. Can i add addition amount in my NPS account opend under APY as this year 50K is excempt from TAX if invested in NPS.

2. will i get any kind of Tax benfit if invest in NPS under APY.

Thanks

Hi Vipin,

1. APY is not NPS. NPS is a different scheme.

2. No tax benefits are there for investment in APY.

Sir,

I am NRI. Can i get morethan 5000 pension plan? or can i apply 2 pension?

our expence after 37 years will be more and more.

where you going to invest this money?. is it going share market!!!

Hi Afsu,

You cannot open two APY accounts. Rs. 5,000 is the guaranteed pension amount you’ll get. However, it could be more than that. It has not been announced where the PFRDA is going to invest this money. I don’t think they are allowed to invest this money in stocks as yet.

Sir,

What is the contribution for 5,000 pension for month… as my age is 35..

Hi Dhiraj,

Please check the table above, it is Rs. 902.

Sir

I have opened APY in my saving account. But I have not got my PRAN number and also PRAN card. How to get PRAN no. ? When asking bank manager, he told that I don’t know.

Right now I have paid Rs. 689/- per month. Can show this amount for Income Tax return ?

Hi Ranjan,

You need to contact the aggregator for your account details. Also, there is no exemption with this scheme while filing ITR.

what happens to our investments if the goverment in power changes/collapses.

How safe is our investment?

Hi Deven,

I think investment in this scheme is quite safe. Also, nobody knows what will happen to this scheme if there is a change in the government.

Sir,

I have already opened Swawalambhan Account to my Name, Age:30.

The Bank has not yet approached for switching to APY from NPS Lite.

Can I keep my NPS Lite Account continued if I do not want to Switch Over or Will I be forced to Close my NPS Lite Account.

No proper details has been provided for subscribers below 40 Years, who want to keep and continue with NPS Lite.

Hi Satish,

The existing subscribers of Swavalamban Scheme – NPS Lite would be automatically migrated to APY, unless they opt out. So, your account will also be migrated to APY.

Sir,

What is the meaning of “opt out”.

Would it mean I can continue with NPS Lite Swawalmbhan or Would I be asked to quit from this investment and withdraw the amount I have deposited.

And if I am supposed to be automatically migrated, what monthly contribution shall be selected by Default.

Sir, Do you not think that A person who turns say 30, on january can save a lot of contribtion amount by selecting this scheme somewhere around a few months before his birthday.What would be the strategy for a man who contributes the same amount for a longer time, since he has not understood the Mathematics of saving in this scheme.Because I think it would be better for any body who wants to dig in this scheme, to do so a few months before their birthday rather than opting right after their birthday

Sir,

What is the meaning of “opt out”.

Would it mean I can continue with NPS Lite Swawalmbhan or Would I be asked to quit from this investment and withdraw the amount I have deposited.

And if I am supposed to be automatically migrated, what monthly contribution shall be selected by Default.

Sir, Do you not think that A person who turns say 30, on january can save a lot of contribtion amount by selecting this scheme somewhere around a few months before his birthday.What would be the strategy for a man who contributes the same amount for a longer time, since he has not understood the Mathematics of saving in this scheme.Because I think it would be better for any body who wants to dig in this scheme, to do so a few months before their birthday rather than opting right after their birthday

Hi Satish,

“Opt Out” means that if you want, you are free not to join Atal Pension Yojana. But, you can no longer continue with NPS Lite. For contribution details, you need to contact the aggregator where your account is held. Also, if I have understood this scheme correctly, then a person, who joins early, will have a higher corpus & a higher pension amount than a late joiner. Pension amounts mentioned in the table above are guaranteed amounts.

I am 23 age person working in IT sector . I am a member of Employee provident fund.

yes , i know i am eligible for atal yojna scheme . but you are saying that you will not get government contributions. What is it mean ? i will get Pesnsion right after 60 years ?

Yes Siddharth, you’ll get pension right after 60 years. Also, the government contributes Rs. 1,000 per annum to the eligible subscribers. As you are a member of the EPF, you are not eligible for the government contribution.

Dear Sir,

Can I apply for the APY online, if yes please provide me the link for that one.

Thanks and Regards

Sonu

Hi Sonu,

Online application facility is not there.