This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

88% of India’s total labour force of 47.29 crore belongs to the unorganised sector, in which the workers do not have any formal provision of getting a regular pension payment on retirement. Moreover, due to increasing labour wages and better medical facilities, these people also face a risk of increasing longevity. So, this work force would require some kind of assured income guarantee to sustain itself in the coming years.

Launching Atal Pension Yojana (APY) from June 1, 2015

To encourage workers in the unorganised sector to voluntarily save for their retirement, the government of India will be launching a new scheme, called Atal Pension Yojana (APY), from 1st June, 2015. Finance Minister Arun Jaitley announced this scheme in his budget speech on February 28th.

This scheme will replace the UPA government’s Swavalamban Yojana – NPS Lite and will be administered by the Pension Fund Regulatory and Development Authority (PFRDA). The benefits of this scheme in terms of fixed pension will be guaranteed by the government and the government will also make contribution to these accounts on behalf of its subscribers.

Under this scheme, a subscriber would receive a minimum fixed pension of Rs. 1,000 per month and in multiples of Rs. 1,000 per month thereafter, up to a maximum of Rs. 5,000 per month, depending on the subscriber’s contribution, which itself would vary on the age of joining this scheme.

The minimum age of joining this scheme is 18 years and maximum age is 40 years. Pension payment will start at the age of 60 years. Therefore, minimum period of contribution by the subscriber under APY would be 20 years or more.

The Central Government would also co-contribute 50% of the subscriber’s contribution or Rs. 1000 per annum, whichever is lower, to each eligible subscriber account, for a period of 5 years, i.e., from 2015-16 to 2019-20, who join the NPS before 31st December, 2015 and who are not income tax payers. The existing subscribers of Swavalamban Scheme would be automatically migrated to APY, unless they opt out.

Who is eligible for Atal Pension Yojana?

Any Citizen of India, aged between 18 years and 40 years, who has his/her savings bank account opened and also possesses a mobile number, would be eligible to subscribe to this scheme.

Government Funding – Indian Government would provide (i) fixed pension guarantee for the subscribers; (ii) would co-contribute 50% of the subscriber contribution or Rs. 1,000 per annum, whichever is lower, to eligible subscribers; and (iii) would also reimburse the promotional and development activities including incentive to the contribution collection agencies to encourage people to join the APY.

Who is eligible for Government Co-Contribution in Atal Pension Yojana?

Subscribers of this scheme, who are not covered under any other statutory social security scheme and are not income tax payers, would be eligible for the government’s co-contribution of up to Rs. 1,000 per annum.

Social Security Schemes which are not eligible for Government Co-Contribution

- Employees’ Provident Fund (EPF) & Miscellaneous Provision Act, 1952

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948

- Assam Tea PlantationProvident Fund and Miscellaneous Provision, 1955

- Seamens’ Provident Fund Act, 1966

- Jammu Kashmir Employees’ Provident Fund & Miscellaneous Provision Act, 1961

- Any other statutory social security scheme

Minimum/Maximum Pension Payable – This scheme will pay a minimum pension of Rs. 1,000 per month and a maximum pension of Rs. 5,000 per month, depending on the subscriber’s own contribution per month.

Minimum/Maximum Period of Contribution – As the minimum age of joining APY is 18 years and maximum age is 40 years, minimum period of contribution by the subscriber under this scheme would be 20 years and maximum period of contribution would be 42 years.

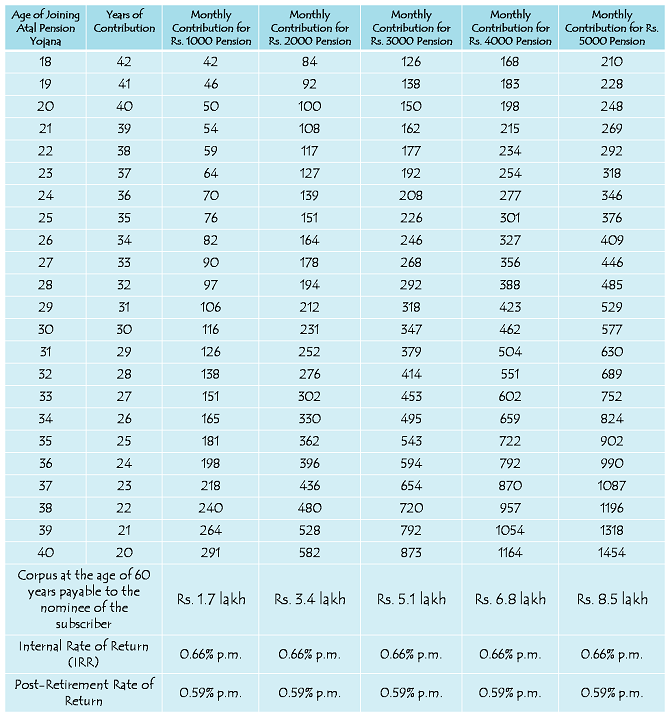

Atal Pension Yojana – Contribution Period, Contribution Levels, Fixed Monthly Pension and Return of Corpus to the Nominees of Subscribers

Internal Rate of Return (IRR) – Thanks to the government funding of Rs. 1,000 per annum per subscriber account for 5 years, your account would generate an IRR of approximately 0.66% per month or 8% per annum. This pension amount per month is fixed and the government has made it clear that if the actual returns on the pension contributions are higher than the assumed returns, such excess return will be credited to the subscribers’ accounts, resulting in enhanced pension payment to the subscribers.

Minimum Contribution – A subscriber aged 18 years will have to contribute a minimum of Rs. 42 per month in order to get Rs. 1,000 pension per month starting 60 years of age. For a 40 years old subscriber, his/her minimum contribution would be Rs. 291 per month. The contribution levels would vary and would be low if subscriber joins early and increase if he joins late.

Maximum Contribution – A subscriber aged 40 years will have to contribute Rs. 1,454 per month in order to get Rs. 5,000 pension per month starting 60 years of age. For a 18 years old subscriber, his/her contribution for Rs. 5,000 monthly pension would be Rs. 210 per month.

Can I increase or decrease my monthly contribution for higher or lower pension amount?

The subscribers can opt to decrease or increase pension amount during the course of accumulation phase, as per the available monthly pension amounts. However, the switching option shall be provided only once in a year during the month of April.

What will happen if sufficient amount is not maintained in the savings bank account for contribution on the due date?

Non-maintenance of required balance in the savings bank account for contribution on the specified date will be considered as default. Banks are required to collect additional amount for delayed payments, such amount will vary from minimum Re. 1 to Rs. 10 per month as shown below:

(i) Re. 1 per month for contribution upto Rs. 100 per month

(ii) Rs. 2 per month for contribution upto Rs. 101 to 500 per month

(iii) Rs. 5 per month for contribution between Rs. 501 to 1,000 per month

(iv) Rs. 10 per month for contribution beyond Rs. 1,001 per month.

Discontinuation of payments of contribution amount shall lead to following:

After 6 months account will be frozen.

After 12 months account will be deactivated.

After 24 months account will be closed.

Subscriber should ensure that the Bank account to be funded enough for auto debit of contribution amount. The fixed amount of interest/penalty will remain as part of the pension corpus of the subscriber.

Post-Retirement Rate of Return – Considering a retirement corpus of Rs. 1.7 lakh and monthly pension of Rs. 1,000, this scheme is going to generate a return of 0.59% per month or 7.1% per annum for its subscribers. I think this return is also on a lower side.

Nomination Facility – This scheme will also provide the nomination facility to its subscribers. In case of the subscriber’s death after attaining 60 years of age, the whole corpus generating the pension income to the subscriber would be returned back to the nominee of the subscriber. In case of untimely death of the subscriber before 60 years of age, the balance would be returned back to the nominee of the subscriber.

Where to open APY Accounts – You need to approach points of presence (PoPs) and aggregators under existing Swavalamban Scheme. These agencies would enrol you through architecture of National Pension System (NPS).

Points of Presence & Aggregators

Application Form – Here you have the links to the application form for subscribing to Atal Pension Yojana – Application Form in English – Application Form in Hindi

I think a subscriber should opt for a minimum monthly contribution of around Rs. 167 or so, which would make it approximately Rs. 2,000 annual contribution. 50% of Rs. 2,000 i.e. Rs. 1,000 would be contributed by the government as well. So, the subscriber will get the maximum benefit of government funding.

As mentioned above, the scheme would start from June 1, 2015. So, interested people will have to wait till then to open an account. If you have any other query regarding this scheme, please share it here.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

what’s your call on power mech projects ipo should we subscribe

I’ve not analysed it yet Nitesh.

Hi sir,

Assam Govt. Service holder are eligible or not the APY.

Sir, my DOB 21-11-1977 , please suggest me about atal pension yojana for 1000 and for 4000 . Is it monthly or yearly instalment?

I am interst your pension plan pls advice I am 37 years old

Hi Sandeep,

Please visit any of your nearest eligible bank branch to get more details about this scheme.

Hi Shiv,

My APY monthly installments are debiting regularly.But I do not receive PRAN card yet.Bankers are saying that they are not having any information regarding PRAN card.when will I get it?and from where can I get It?From Bank or is it delivered to my address?

Hi Tarlika,

Even we do not have any info regarding the same. You will get the PRAN number for sure, but we are not sure about PRAN card.

I joined it my share is 1087 as I am 37.but after 23 yrs 5000’s value is only today’s 560.can I leave it .am I eligible to get my investment

Hi Prasanth,

You need to check it with the bank whether you can withdraw the money or not.

Sir, as you earlier said that my wife whose DOB : 17/04/1975 is eligible to enrol APY but the SBI bank officials informed that your age is overaged.

Sir, Please inform the status of age regarding.

Thanks.

Hi Irissappin,

As per the info we have, your wife is eligible for the same. Still you should get it checked with the aggregators.

I subscribed for atal pension scheme . Do I get certificate of APS registration and and website to check the details of my atal pension scheme account .

Hi Praveen,

You’ll get physical statement for your account transactions. Online facilities are not available as yet.

It is one of the best yojana.

Thanks Nishith for sharing your views.

DEAR SIR,

AT PRESENT AGE IS 39 YEARS 3 MONTHS.

WHAT WILL THE PREMIUM FOR THE AMOUNT OF PENSION OF RS 5000/- IN ATAL PENSION YOJONA.

Hi Chiranjib,

It would be Rs. 1,318 for 39 years old subscriber.

Hi,

My self Venugopala, pls suggest below my requests.

What is monthly maximum amount pay for pension scheme & what is amount of benefit after 60 years.

I had other bank savings account example ICICI bank, can it works or new account i use to open.

Hi Venugopala,

Rs. 5,000 per month is the maximum amount you’ll get on retirement. You need not open a new account. It can work with your exisitng bank account as well.

I’ve contacted bank branch where I had opened APY account to know the reason for not deducting any amount in July. They are saying they don’t have clarity to whom to contact. Please help so that I can contact.

Sorry Mr. Pal, we can’t help you in such matters. You need to contact the PFRDA.

What is differences in pension or corpus amount who get govt.Contribution and who not get it

Hi Mukesh,

Pension is the monthly payment you’ll get on retirement. Corpus is the amount which gets accumulated due to your monthly deposits and what your nominee will get in your absence. If you are not a tax payer and you are not covered under any other social security scheme, then you’ll get the government contribution.

In Ataul Pension Yojna, Bank give me any certificate or document? Bank inform me only passbook update is enough for this and in my Aadhaar card address is not correct but in my bank passbook address is ok, which address will be kept in Atal pension yojna database, my bank passbook address nor aadhar card address?

Hi Sanjay,

In APY, you’ll get a statement for your account transactions. Passbook update is also fine. You can provide your bank statement as your address proof.

Do we get any certificate for Atal Pension Yojna or passbook update is enough? What is the use of PRAN number?

I have NPS regular/all citizen account.

Can i open APY account ?

I checked with SBI bank according to them, i can not open APY account.

Can anyone help me..

Hi Shantanu,

You should check with some other bank also to confirm your eligibility.

Hello Shiv, I have few queries… Hope you would be able to answer them.

How is the age for enrollment calculated? Is it as per nearest birthday or only number of years completed?

What is the lump sum amount for various pension amounts? Does it depend upon corpus accumulated or fixed by govt.?

If the policy holder expires before 60, what lump sum amount will be paid to nominee for 5000/- pension scheme?

In case the policy holder expires before 60,

do the spouse need to pay premium for remaining term?

Will the spouse start getting pension (immediately or after 60 yrs) or will get lump sum amount?

If spouse gets pension, after spouse expiry, will the nominee get lump sum?

If no premium deposited for 24 months, the account gets closed. What will happen to corpus accumulated?

Is it possible to withdraw Lump sum amount / accumulated corpus amount any time during the policy (before 60 yrs age) / (after start of pension by self or by spouse due to death of policy holder)?

If the spouse and nominee are same, how will it work for providing pension to spouse and lump sum to nominee?

I know the queries are many, but I believe answers to these will help many get a clarity, and decide on subscribing for this scheme.

Thanks in advance for your time and efforts in answering these queries.

Please let me know the answer

I have a PPF account in SBI. I am eligiable for open Atal Pension Yojana account. If not, then what will be happened if I opened APY account.

Hi Dashrath,

If you are 40 years or less, you are eligible for this scheme.

rameshwar pratap singh ka bima hua hai ya nahi.

my instalment of this July month rs 1454 has not been debited from my saving account yet so no one have any answer shiv my birth date is 5 – 5 – 1975 so is there any problem from my age but then how bank have deducted my first instalment and they have given me a copy of pran number so its very much confusing please help

Hi Nitesh,

You should get in touch with the bank where you have opened this account.

I had registered for atal pension last month and amount was deducted from savings account on 8th June. However, this month – in July no amount got deducted till date What should I do? Any contact? Please help.

Hi Jyoti,

You should contact the bank branch where you have opened this account.