This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

“Insurance sirf ek rupay mein – Aisa Kaise?” The boy asks his father and the father’s response makes his daughter emotional. You must have watched this commercial on your TV sets many a times this week as the government has launched its Jan Suraksha initiative very aggessively.

Prime Minister Mr. Narendra Modi is in Kolkata today and will be launching Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Atal Pension Yojana (APY) from there. These schemes are targeted to provide social security benefits to a large percentage of the low income earning population in India.

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

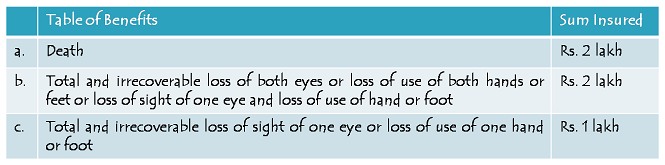

Policy Coverage – The scheme offers to provide you or your family a cover of up to Rs. 2 lacs in case of any mishappening, resulting into death or disability of the insured. In case of death or full disability, you or your family will get Rs. 2 lacs and in case of partial disability, you will get Rs. 1 lac. Full disability means loss of both eyes or both legs or both hands, whereas partial disability means loss of one eye or one leg or one hand.

Age of the Insured – Savings bank account holders aged between 18 years and 70 years are eligible to apply for this scheme. People aged more than 70 years will not be able to get the benefits of this scheme.

Premium Amount – It costs you just Rs. 12 in annual premium for having an accidental death or disability cover of Rs. 2 lacs under this scheme. It works out to be just Re. 1 a month, which is extraordinarily low. Again, your age has nothing to do with the premium payable for your insurance cover under this scheme as the premium is fixed at Rs. 12 for a cover of Rs. 2 lacs.

Period of Insurance – You will remain insured for a period of one year from June 1, 2015 to May 31, 2016. Next year onwards as well, the risk cover period will remain to be June 1 to May 31.

Administrators for PMSBY – The scheme would be offered / administered by many of the general insurance companies, both in the public sector as well as in the private sector. Participating banks will be free to engage any such general insurance company for implementing the scheme for their subscribers. National Insurance Company Limited, Oriental Insurance Company Limited and ICICI Lombard are some of the companies which would be offering this scheme.

Auto Debit Facility – You will be required to provide your consent for auto debit of Rs. 12 as the annual premium from any one of your bank accounts at the time of enrolling for this scheme. This premium of Rs. 12 will get deducted from your savings bank account through auto debit facility every year between May 25 and June 1.

Last Date for Enrolment – May 31, 2015 is the last date for getting enrolled for this scheme, but the government has given an extension of three months up to August 31, 2015 for us to get enrolled and give auto-debit consent for this scheme. This enrolment period may be extended by the government for another period of three months, up to November 30, 2015.

Those joining this scheme subsequent to May 31, 2015 will have to pay the full year’s premium of Rs. 12 and agree to specified terms of this scheme.

Toll-Free Numbers – 1800 110 001 / 1800 180 1111 – These two are the National Toll-Free Numbers for this scheme. You can check the state-wise toll-free numbers from this link – State-Wise Toll Free Numbers

Service Tax Exempt – Yes, Finance Minister Mr. Arun Jaitley has proposed to exempt this scheme from service tax. So, you will not be charged any service tax on the premium payable.

Know Your Customer (KYC) – Aadhaar Card issued by the UIDAI will be the primary requirement for your KYC under this scheme.

Application Form – Here you have the link to the application form for you to enroll yourself for this scheme – Application Form for PMSBY

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Age of the Insured – Bank account holders aged between 18 and 50 years are eligible to apply for this scheme. So, if you are aged more than 50 years, you are not eligible to enroll yourself for this scheme. But, once enrolled, you can continue with this scheme till you attain the age of 55 years.

Premium Amount – Less than Re. 1 a day or an annual premium of Rs. 330 is what you need to pay to get a life cover of Rs. 2 lacs. No matter what your age is, the premium is fixed at Rs. 330 for a life cover of Rs. 2 lacs. This annual premium of Rs. 330 has been fixed for the first three years from June 1, 2015 to May 31, 2018, after which it will again be reviewed based on the insurers’ annual claims experience.

Period of Insurance – June 1st, 2015 to May 31st, 2016 is the period for which this scheme will cover all kind of risks to your life in the first year of operation. Next year onwards as well, the risk cover period will remain June 1 to May 31.

LIC as the Administrator – The scheme would be offered / administered by the Life Insurance Corporation (LIC) and other life insurance companies like SBI, ICICI etc. through their tie ups with the interested banks like SBI, ICICI, Canara Bank etc. Participating banks are free to engage any such life insurance company for implementing this scheme for their subscribers.

Auto Debit Facility – Annual premium of Rs. 330 will get deducted from your savings bank account through auto debit facility. You will have to give your consent for auto debit of premium from any one of your bank accounts at the time of enrolling for this scheme.

Last Date for Enrolment – May 31, 2015 is the last date for getting enrolled for this scheme, but the government has given an extension of three months up to August 31, 2015 for us to get enrolled and give auto-debit consent for this scheme. This enrolment period may be extended by the government for another period of three months, up to November 30, 2015.

Those joining this scheme subsequent to May 31, 2015 will have to pay the full year’s premium of Rs. 330 and submit a self-certificate of good health in the prescribed proforma.

Toll-Free Numbers – 1800 110 001 / 1800 180 1111 – These two are the National Toll-Free Numbers for this scheme. You can check the state-wise toll-free numbers from this link – State-Wise Toll Free Numbers

Service Tax Exempt – Finance Minister Mr. Arun Jaitley has proposed to exempt this scheme from service tax. So, you will not be charged any service tax on the premium payable.

Know Your Customer (KYC) – Aadhaar Card issued by the UIDAI will be the primary requirement for your KYC under this scheme.

Application Form – Here you have the link to the application form for you to enroll yourself for this scheme – Application Form for PMJJBY

I covered Pradhan Mantri Jeevan Jyoti Bima Yojana yesterday, a scheme which provides life insurance cover of Rs. 2 lacs to its subscribers for an annual premium of only Rs. 330. I think both these schemes are quite attractive and provide a combined cover of Rs. 4 lacs for a premium of just Rs. 342, which works out to be less than Re. 1 a day.

In a country like India, where many members of a family are dependent on the primary earner’s income to survive and grow, I think these schemes would play a very important role in providing a much required social security comfort to the citizens of India. I think the government is doing a wonderful job in taking these initiatives to attract low income group people to get themselves covered against the risks of untimely death or accidental disabilities. I think you should definitely subscribe to both these schemes.

From my number_7842741416

I didn’t get any such message. I don’t know on which no. you sent the message.

From my mobile_7842741416

Sir,

I have sended you message to register me for PMJJBY,PMSBY but still I dont get any confirmation message.so how can know either my request is recieved or not.

Sorry, I didn’t get any such message. On which mail id/number, you sent the message?

Hi,

Rightnow I want to cancel my PMJJBY Scheme whats is the Procedure please help mesir

Hi Divya,

Cancellation procedure is not yet disclosed by any of the banks or insurance companies. You need to contact your bank for the same.

Is there any return after maturity?

No Vinay, nothing would be returned in case no accidental event happens during the insurance period.

how can i check confirm pradhanmantri yojana form.i have submitted form in icici bank through and toll free no of maharashta state

Hi Mukesh,

You need to check it with your bank itself.

i already registeted my sister name. before two days back now she got accident can plz reply me now its appplicable

Coverage under this scheme starts from June 1, 2015. So, I don’t think your sister can claim this amount for an accident before June 1. But, you can still check it with the bank/insurance company.

Hi sir,

Can i submit my application form online

Because i am live in other place and my account my hometown

So please guide me

Hi Ravindra,

Yes, you can submit your application online through your bank’s net banking platform.

Hdfc bank ….sms servic i want to kw the number

or through net banking we can do?

Hi Rita, Y to 5676712 from your registered mobile number. Y to 5676712 from your registered mobile number.

With HDFC Bank, you can subscribe to these schemes through Net Banking as well as by sending an SMS.

PMJJBY – To subscribe, you need to SMS PMJJBY

PMSBY – To subscribe, you need to SMS PMSBY

I registered for PMSBY & PMJJBY both online. The amount has been deducted from my account also. Now how can i get my receipt against both the security schemes. I should have proof of having the schemes other than the bank account statement showing the debited amount against the scheme. Please help!

Hi Sanjeet,

I think you’ll have to wait some time for the bank to provide you with some kind of e-acknowledgement and SMS confirmation.

If in insurance policy …crosses the insurance age !

Will he be refunded ?

And what is insurance age ?

Age limit in PMSBY is 70 years. Nothing will be refunded back to the insured in case he/she survives the insurance period.

I need information like I have two bank account. To enroll this PMSBY I text in PNB and got the request ref no. and to enroll the same policy in icici I put a service request online and got the policy no.

After that I came to know this schema we can have only in one bank. then what is the procedure to cancel PNB request online.

I have no idea how to cancel your request, you will have to contact PNB for the same.

Hi Sir,

I am working in Private company & I have EPF account. can I take the Aatal Pension scheme because in APS instruction that this policy for unstructured income people/ poor people.

secondary, can I open the both PMSBY & Jiven jyoti scheme online through SBI Net banking.

Hi Gopal,

Every citizen of India can open APY account. But, as you are already covered under EPF, you won’t get the government contribution of up to Rs. 1,000 per annum. Moreover, yes, you can get both PMJJBY & PMSBY opened through SBI net banking.

How can I activate PMSBY scheme in SBI bank by moblile message…?

Sorry Shalini, I don’t have the SMS details of SBI for this scheme.

I want to take both plan for my son. He is studying …so time doesn’t suit to bank time…we can apply through sms? Please give me detail where to sms?

Hi Rita,

Every bank has its own number for servicing clients for these schemes though SMS. Which bank is yours?

sir i m 17 year old.can i take these insurance polcies

No Suraj, you are not eligible for these policies.

Hi,

I have registered through SBI net banking. However, in the final form the email ID was seen as blank. So how will I get the policy details if they don’t have my email id registered?

Also, can I register to PMBSY by sending an SMS to SBI?

Hi Dhaval,

I have no idea how SBI is going to confirm the receipt of your application, I think they would send an SMS to you once your application is processed & premium gets debited. Also, SMS facility must be there with SBI, but I don’t know the format of the SMS to be sent.

Sir, I have submitted PMJJY and PMJSY applications through SBI online, but I want to check (view) my application again to edit. I have a doubt that I have entered my nominee’s DOB wrong, how would I change it. Applications submitted but amount not deducted from my account.

Thank you

You need to contact SBI for the same and ask for making changes to your application.

In PMSBY scheme there is any income boundation

No Mr. Vijay, there is no income cap for PMSBY.

Sir

I have applied for PMSBY through online banking(Axis Bank). my question is will they give(Axis bank) any certificate Or document for this?

Hi Nanjundaswamy,

Not sure about it, but I don’t think they will give any certificate for the same. You will be provided with some kind of e-Acknowledgement and that will work as your Certificate of Insurance as well.