This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Prime Minister Mr. Narendra Modi launched three new social security schemes under his government’s Jan Suraksha initiative during his visit to Kolkata on May 9. As most of us know by now, these schemes are – Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY).

People are keen to know more about these schemes and how to get themselves enrolled/subscribed to get insurance coverage in case of death or disability. Though banks are also aggressive & keen in attracting their customers to subscribe to these schemes, many people are still clueless how to get themselves enrolled and whether banks are providing online subscription facility or not.

Customers of banks, like Kotak Mahindra Bank, HDFC Bank, ICICI Bank, IndusInd Bank and SBI, can subscribe to PMJJBY and PMSBY in any of the following manners:

* Visiting a bank branch nearest to your place, filling the Consent-cum Declaration Form & depositing in the branch itself

* Through Netbanking by filling the online form

* Sending an SMS to the number provided by your bank

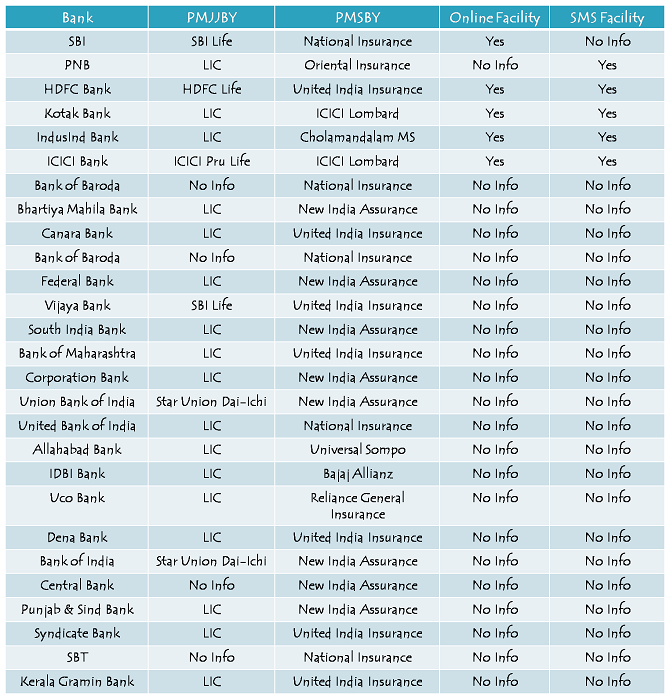

I have tried to compile a list of participating banks which have tied up with different insurance companies for providing life insurance and accidental death & disability insurance to their interested customers. Here you have the list of banks along with their partner insurance companies and whether they are providing the online and/or SMS facility to their customers or not:

LIC affiliated Banks for PMJJBY – PNB, Kotak Mahindra Bank, IndusInd Bank, Bhartiya Mahila Bank, Canara Bank, Federal Bank, South India Bank, Bank of Maharshtra, Corporation Bank, United Bank of India, Allahabad Bank, IDBI Bank, Uco Bank, Dena Bank, Punjab & Sind Bank, Syndicate Bank and Kerala Gramin Bank.

Banks affiliated with SBI Life for PMJJBY – State Bank of India (SBI) and Vijaya Bank.

Banks affiliated with New India Assurance for PMSBY – Bhartiya Mahila Bank, Federal Bank, South India Bank, Corporation Bank, Union Bank of India, Bank of India, Central Bank and Punjab & Sind Bank.

Banks affiliated with United India Insurance for PMSBY – HDFC Bank, Canara Bank, Vijaya Bank, Bank of Maharashtra, Dena Bank, Syndicate Bank and Kerala Gramin Bank.

Banks affiliated with National Insurance for PMSBY – State Bank of India (SBI), Bank of Baroda, United Bank of India and State Bank of Travancore (SBT).

Banks affiliated with Oriental Insurance for PMSBY – PNB.

Banks affiliated with ICICI Lombard for PMSBY – Kotak Mahindra Bank and ICICI Bank.

I will try to update this list as & when I get info about more banks joining these schemes. You may visit the respective websites of these banks to download their application forms for getting yourself enrolled. In case you need to get yourself updated with the terms of any of these schemes, here you have the links to our previous posts in which we covered these schemes:

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) – Form in English – Form in Hindi

Pradhan Mantri Suraksha Bima Yojana (PMSBY) – Form in English – Form in Hindi

Atal Pension Yojana (APY) – Form in English – Form in Hindi

If you have any query regarding any of these schemes, please share it share and I will try to respond to it as soon as possible.

I have an account In sbi what is the code of sms on PMJJBY and PMSBY

Hi Prasanta,

Sorry, I don’t have the SMS number of SBI for these schemes.

I want to know whether both this pradhan mantri plans benefits apart from LIC policy I already have. is it good idea to opt for this in addition to existing LIC policy. please guide..

Hi Hem,

I think it is a good idea to subscribe to these two schemes even if you have other insurance policies. Only if you are overinsured, then probably you should skip subscribing to these schemes.

TJSB Bank (a multistate scheduled bank) offering PMJJSY through LIC and PMSBY through Oriental Ins. Co.

Thanks again!

Hi.. Maheshji and Shivji,

for Kotak Mahindra bank and ICICI bank? through which agency?

I am eagerly waiting to receive positive response vial email or via call.

Thanking you a lot in prior anticipation.

With best regards-

Jyoti Debnath.

Mob – 8697443425

Mail id – [email protected]; [email protected]; [email protected]

TJSB Bank (a multistate scheduled bank) is offering PMJJBY through LIC and PMSBY through Oriental Ins. Co.

Bank Of Baroda offering PMJJBY through IndiaFirst.

Thanks Mahesh for providing this info, it is helpful!

pmsjby

Sir,

Namaste!

Do you have any update on when ICICI bank will start accepting the contributions for Atal Pension Yojana? I don’t see any such provision on their website. Is it that for APY, you have to personally visit a bank and fill up a form?

Thanks in advance.

Namaste Pradeepji,

Here is the link to the list of POP – SP where you can get the APY account opened w.e.f. June 1, 2015 – https://npscra.nsdl.co.in/pop-sp.php

Hello,

I wanted to know the name of Insurance Company, which is providing that scheme….

Hi Pulkit,

Which scheme you are talking about?

Hello Shiv,

I am talking about the name of the Insurance Company which is giving benefit under the Scheme of Pradhanmantri Suraksha Bima Yojna.

Hi Pulkit,

There are 10 companies providing insurance cover under PMSBY – National Insurance, New India Assurance, Oriental Insurance, United India Insurance, ICICI Lombard, Bajaj Allianz, Reliance GIC, Tata AIG, Universal Sompo, Cholamandalam MS.

Sir

Once we have started the scheme, is it auto debit to next to next year every time or we have to make it renew yearly.

2nd thing where we ll claim the money in case of any mishaps.

Hi Manjeet,

Auto debit facility is there for premium payment. You need not pay the premium every year, it will automatically get debited from your bank account.

Also, in case of any mishap, you/your nominee need to approach your bank to deposit the claim form and the amount will be transferred to your/your nominee’s bank account.

How many terms for these two schems & When did we take this 330 rs scheme metured amount.

How many years we pay this scheme.

Eligible age for PMJJBY is 50 years and that for PMSBY is 70 years. Also, nothing is paid back on maturity in these two schemes.

Very useful information for all of us. Please help. How to enrol by sms in suraksha bima yojana in SBI bank. I really need this information.

Thanks Atul,

As of now, I do not have info regarding the same. As soon as I get this info, I’ll share it here.

Any information/experiences about any insurance policy which is less than 300 annual premium and 2Lac coverage would be rally appreciated. The reason for asking this question is to know paying 300Rs premium for PMJJBY is of any worth over other available schemes in the market.

Hi KKR,

Please check this link if it is of any help – http://www.onemint.com/2015/05/15/pradhan-mantri-jeevan-jyoti-bima-yojana-pmjjby-vs-lic-eterm-plan-sbi-life-eshield-plan-kotak-preferred-e-term-plan-max-life-online-term-plan/

pmjjby nomini mrs rajeshree datta more

pmjjby

pmjjy

Hi

In the PMJJBY ( Pradhan Mantri Jeevan Jyoti Bima Yojana) scheme if we are still alive after the 55 years cover will get the 2 lakhs or it is given only in case of death , Thanks . One of my friend in bank was told that it would be given once complete 55 years if member is alive

Hi Sunil,

Nothing will be paid in case the subscriber survives the insurance period.

SMS “PMJJBY Y to 5676712″ for enrolling yourself under Pradhan Mantri Jeevan Jyoti Bima Yojana with HDFC Bank. HDFC Standard Life Insurance Company Ltd. is the servicing insurance company for the same.

thx for the help

You are welcome!

how to enrol by sms in suraksha bima yojana in hdfc bank

i have allready enrolled for accident insurance by sms

sir i would like o know hdfc PMSBY POLICY AND PMJJY POLICY. HOW TO GET THE FORMS FROM HDFC ONLINE BANKING

Hi Tataji,

PMJJBY & PMSBY forms are not yet available on HDFC Net Banking.