This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Prime Minister Mr. Narendra Modi launched three new social security schemes under his government’s Jan Suraksha initiative during his visit to Kolkata on May 9. As most of us know by now, these schemes are – Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY) and Atal Pension Yojana (APY).

People are keen to know more about these schemes and how to get themselves enrolled/subscribed to get insurance coverage in case of death or disability. Though banks are also aggressive & keen in attracting their customers to subscribe to these schemes, many people are still clueless how to get themselves enrolled and whether banks are providing online subscription facility or not.

Customers of banks, like Kotak Mahindra Bank, HDFC Bank, ICICI Bank, IndusInd Bank and SBI, can subscribe to PMJJBY and PMSBY in any of the following manners:

* Visiting a bank branch nearest to your place, filling the Consent-cum Declaration Form & depositing in the branch itself

* Through Netbanking by filling the online form

* Sending an SMS to the number provided by your bank

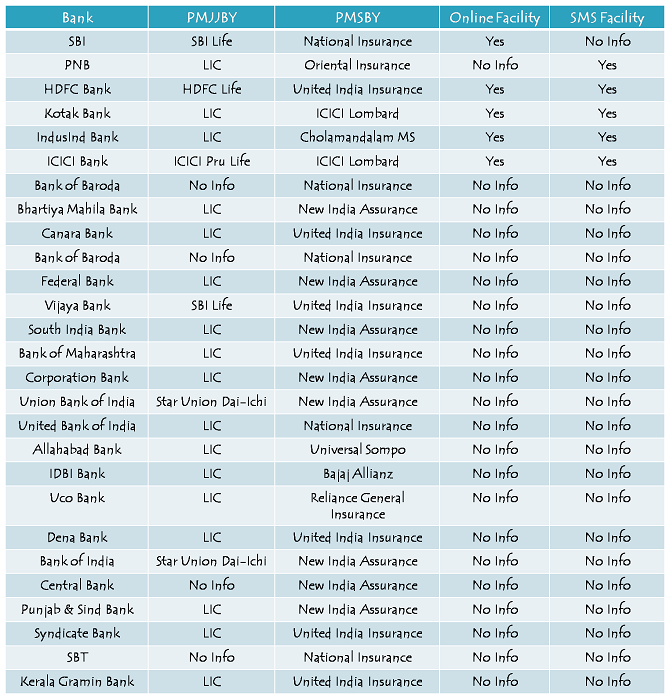

I have tried to compile a list of participating banks which have tied up with different insurance companies for providing life insurance and accidental death & disability insurance to their interested customers. Here you have the list of banks along with their partner insurance companies and whether they are providing the online and/or SMS facility to their customers or not:

LIC affiliated Banks for PMJJBY – PNB, Kotak Mahindra Bank, IndusInd Bank, Bhartiya Mahila Bank, Canara Bank, Federal Bank, South India Bank, Bank of Maharshtra, Corporation Bank, United Bank of India, Allahabad Bank, IDBI Bank, Uco Bank, Dena Bank, Punjab & Sind Bank, Syndicate Bank and Kerala Gramin Bank.

Banks affiliated with SBI Life for PMJJBY – State Bank of India (SBI) and Vijaya Bank.

Banks affiliated with New India Assurance for PMSBY – Bhartiya Mahila Bank, Federal Bank, South India Bank, Corporation Bank, Union Bank of India, Bank of India, Central Bank and Punjab & Sind Bank.

Banks affiliated with United India Insurance for PMSBY – HDFC Bank, Canara Bank, Vijaya Bank, Bank of Maharashtra, Dena Bank, Syndicate Bank and Kerala Gramin Bank.

Banks affiliated with National Insurance for PMSBY – State Bank of India (SBI), Bank of Baroda, United Bank of India and State Bank of Travancore (SBT).

Banks affiliated with Oriental Insurance for PMSBY – PNB.

Banks affiliated with ICICI Lombard for PMSBY – Kotak Mahindra Bank and ICICI Bank.

I will try to update this list as & when I get info about more banks joining these schemes. You may visit the respective websites of these banks to download their application forms for getting yourself enrolled. In case you need to get yourself updated with the terms of any of these schemes, here you have the links to our previous posts in which we covered these schemes:

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) – Form in English – Form in Hindi

Pradhan Mantri Suraksha Bima Yojana (PMSBY) – Form in English – Form in Hindi

Atal Pension Yojana (APY) – Form in English – Form in Hindi

If you have any query regarding any of these schemes, please share it share and I will try to respond to it as soon as possible.

How can open online this insurance

Hi Virendra,

You can subscribe to these schemes through net banking portal.

I have got no document or phone or message against PMSBJ though requisite amount has been deducted from S/B A/c of SBI, B-Zone, PO-Durgapur,Distt – Burdwan, WB till 26.08.15 C.Nandy

Hi Chanchal,

Debit entry of Rs. 12 is the proof of your subscription, you need not worry about that. If required, you should talk to your bank branch.

Sir

My account is in Hdfc bank with my wife.I got 3 sms from Hdfc bank for 1.PMJJBY 2.PMSBY 3.APY

I have reply for 1& 2 by bank sms reply but not for sms no 3(APY).

Today when I update my passbook thr is Rs 12 & Rs 330 debited its ok but also debited Rs689 for APY which I never applied.

I talked with hdfc branch official they told me to call hdfc help line,when call to help line they are saying to talk with branch.

Pls tell me what I wl do & how to cancel this.

Hi Mr. Roy,

You need to talk to the bank branch and ask for the receipt of your request for APY. If they are not able to show it to you, you can file a complaint against the bank.

why policy is not given under this scheme,secondly does all the co’s which are insuring are indian

Hi Srijan,

It is a group insurance scheme which has been kept low priced by keeping its costs in check. One of those costs is issuing policy documents. To make it low priced, policy documents are not getting issued. Also, all of these insurance companies are Indian.

bank staffs are saying that the policy.is not useful.

I think it is one of the best insurance policies offered by any insurance company in India.

PMSBY @ Rs12/- per annum is a unique and wonderful insurance. It is highly low priced product declared for the benefit of common man. However I am surprised people are so anaware that despite all publicity, efforts by Ministry, Media, Banks and INsurance 10 crore approx have purchased this product. My personal appeal to all educated and influential people of the society to make every possible effort to bring everyone under the suraksh net. It is must for everyone. If any one wants further clarification he/she may contact nearest National Insurance Office in this connection and our people would guide them.

Thanks Mohan for inspiring people here!

joined at pmsby scheme through pnb dharmtola st. br. kolkata-13 so far not received the policy certificate through oriental insurance, kindly provide the contact, mail no. sms enabling me to contact them . already premium debited from my pnb sb a/c

thanks & regards

swapna ghosh

9433035866

Hi Swapna,

You’ll not get any policy certificate for the same. Debit entry in your passbook/bank statement is the proof of your insurance.

sir

iam applied PMSBY AND PMJJBY nearly 4 months back but iam not received policy how to get policy please tell me

My father applied for PMSBY on 22nd june, and met an accident on 23rd June, resulting in death on 25th June.

When I went to bank for claiming this money, they said that the deduction was not done as Nominee’s relationship was not mentioned in it.

The bank had accepted the form and issued him a receipt of this, however they did not forward it for deduction of money from his account. There was no alarm from the bank regarding the incompete form.

I am confused about the status of this claim now ! Can anybody help please !

Hi Deepa,

Even we are not sure whether you are eligible for the claim or not in this case. You need to talk to the bank about the same. If not satisfied with the bank’s response, you can approach IRDA or the Banking Ombudsman.

Did HDFC started Atal Pension Scheme registration process through net banking?

Hi Biplab,

I do not have any such info with me. You’ll have to contact HDFC Bank for the same.

Please sens padhanmantei surksha bima yojna form

Hi Shekhar,

Here you have the link to the application form – http://www.jansuraksha.gov.in/Files/PMSBY/ENGLISH/APPLICATIONFORM.pdf

sir I want to know that do I need to pay same amount through out these scheme term or amount will be increased in subsequent years. also can I claim for expenses during accidental treatment

and in which hospitals

Hi Poonam,

For 3 years at least, the premium would remain the same. Accidental treatment expenses are not covered.

Sir,

If the person doesn’t have PAN Card and Adhar Card but possess Voting Card and Ration Card, Whether he is entitled to apply for the same.

Regards,

Mukund

Hi Mukund,

You just need to have a bank account to apply for these schemes.

hi, is there any last date for submitting the applications for all the schemes?? pls help.

Hi Reena,

August 31, 2015 is the last date for applying to these two schemes.

Dear Sir,

In case of death during 1st year of insurance i.e. before 31-May-16, will the claim be accepted & settled under PMJJBY & PMBSY?

Yes Ashish, the claim will be accepted & settled.

Dear shiv,

Your work is appreciable. Please do solve my query. I have taken both the scheme through onlinesbi. Com the premium is also deducted from my account. From where i can get the acknowledgement of the scheme?

Hi Piyush,

I have been told that no such acknowledgement will be provided to the subscribers and bank entries of Rs. 330 & Rs. 12 are good enough proofs for your subscription.

Hi,

I already have an LIC policy.

Am I still eligible for both the policies?.

Thank you,

Vijay

Yes Vijay, you are still eligible.

sir,

Any idea whether SBT has this facility ? if yes please provide the link

Hi Leena,

SBT has started providing services for PMJJBY & PMSBY. Here is the link to the SBT’s website where the details have been given – http://www.statebankoftravancore.com/portal/agriculture/-/asset_publisher/deKLJYWD5D02/document/id/8567649

You can subscribe to these schemes through SBT’s net banking platform.

Hello Shiv sir, Thank you so much.. Thanks.Venkat

You are welcome Venkat!

Sir, I enrolled for PMJJBY through internet banking, but premium Rs.330/ two times debit from my saving a/c.My a/c is in SBI so I contact & complained in SBI,he told regarding this type of problem u contact this no.- 18001801111. I contact this no. he told, I will give only details of this policy, so u contact ur bank. So kindly request to u help & guide me , what I do?

I think you should visit the branch and tell them to reverse one transaction.

Hello Sir, Today I want to enroll for pension plan to nearest HDFC bank and the representative said I am not eligible for pension as my salary per month is 50k. I am working in private company. Please let me know is I am eligible or not for pension plan. My age is 35. If I can invest for pension plan how much max I can pay per year. What all the plans are there. Thank in advance, Venkat

Hi Venkat,

As per the terms of Atal Pension Yojana, all citizens of India are eligible for this scheme. But, if you are a tax payer, then you won’t get the annual government contribution of up to Rs. 1,000.