This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Volatile stock markets are again testing the nerves of Indian investors. People, who invested in stocks or equity mutual funds in the hope of some quick fixing by the Modi government, have been left disappointed with the kind of returns they have earned in the last one year or so. Some investors are headed towards safe fixed deposits where interest rates are continuously falling, while others are looking to invest in debt funds.

But, the recent problem with JP Morgan debt funds, in which the fund house restricted redemptions in two of its debt schemes – Short Term Income Fund and India Treasury Fund, has once again shaken the investors’ confidence in debt funds as well.

So, what do investors do in the current economic scenario? Stay in cash? Or invest in gilt funds and tax-free bonds only?

It is said that the best time to invest is when there is a panic. But, the problem is that it is very difficult to figure out whether the panic is based on some kind of reality or it is just a perception and a short-term phenomenon.

After a gap of one financial year, tax-free bonds are making a comeback this financial year and NTPC is the first public sector enterprise (PSE) to launch the public issue of such bonds from the coming Wednesday, September 23rd. As the company is confident of raising the desired amount very quickly, the issue will remain open for just seven working days to get closed on September 30th i.e. the next Wednesday.

Size of the Issue – NTPC has been authorized to raise Rs. 1,000 crore from tax free bonds this financial year and it has already raised Rs. 300 crore by issuing these bonds in private placement. The company will raise the remaining Rs. 700 crore from this issue.

The issue size of Rs. 700 crore is very small for a large population of investors waiting for these bonds for around 18 months now and for this reason, I think the issue should get oversubscribed on the first day itself.

Rating of the Issue – NTPC is India’s largest power generator and a ‘Maharatna’ company with market capitalization of Rs. 104,759 crore. Being a PSU with strong fundamentals and government backing, CRISIL, ICRA and CARE have assigned ‘AAA’ rating to the issue.

Moreover, these bonds are ‘Secured’ in nature and certain fixed assets of the company will be charged equivalent to the outstanding amount of the bonds.

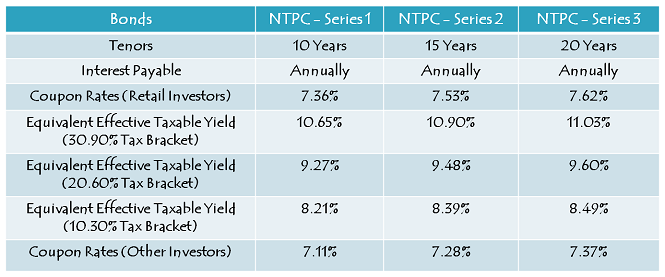

Coupon Rates on Offer – NTPC is offering yearly rate of interest of 7.36% for its 10-year option, 7.53% for the 15-year option and 7.62% for the 20-year option to the retail investors investing less than or equal to Rs. 10 lakh.

As mandated by the government, these rates would be lower by 25 basis points (or 0.25%) for the non-retail investors.

NRI Investment Allowed on Non-Repatriation Basis – Non-Resident Indians (NRIs) are also eligible to invest in this issue, but only on a non-repatriation basis. NRI investors will not be allowed to repatriate its interest amount or maturity proceeds outside India.

QFI Investment – Qualified Foreign Investors (QFIs) are not allowed to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 70 crore

Category II – Non-Institutional Investors (NIIs) – 25% of the issue is reserved i.e. Rs. 175 crore

Category III – High Net Worth Individuals including HUFs & NRIs – 25% of the issue is reserved i.e. Rs. 175 crore

Category IV – Resident Indian Individuals including HUFs & NRIs – 40% of the issue is reserved i.e. Rs. 280 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – NTPC has decided to get these bonds listed on both the stock exchanges i.e. National Stock Exchange (NSE) as well as the Bombay Stock Exchange (BSE) and has successfully got the necessary in-principle listing approval also from these exchanges. The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat Account Mandatory – This is one of the noticeable changes as compared to the last time. NTPC has decided to allot these bonds only in dematerialised form and thus, the investors do not have the option to apply these bonds in physical or certificate form.

So, if you want to apply for these bonds in this issue and do not have a demat account, act now as you have only two days with you to get a demat account opened. However, once allotted in demat form, the investors can rematerialise the bonds in physical/certificate form if they decide to close their demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the BSE or NSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NTPC will make its first interest payment exactly one year after the deemed date of allotment and the deemed date of allotment will be announced just before the listing date. I will update this post as and when it gets announced.

Fundamentally, NTPC is a good company, ranked nineteenth among the top Indian companies by market capitalization. Also, at present, there are only seven central public sector enterprises (CPSEs) which have been conferred the status of Maharatna and NTPC is one of them.

Among the seven companies which have been authorized to issue tax free bonds this financial year, NTPC is the only company which has the ‘Maharatna’ status.

Should you invest in this issue?

There are many reasons why I think yield on government securities (G-Secs) should fall here in India. China slowdown, no rate cut by the US Federal Reserve on September 17 and falling WPI & CPI inflation – I think all these factors would make the RBI governor Dr. Rajan to think about cutting policy rates in its monetary policy scheduled to be held on September 29th. But, less than normal rainfall and less than desired improvement in the Indian economy & fiscal deficit, are a couple of reasons which might not work in favour of a rate cut.

Moreover, Congress playing spoilsport in the passage of important bills like GST and the land acquisition bill are also putting pressure on the Indian economy and thus making it extremely difficult for the Modi government to take further actions on the reforms front. RBI is keeping a close eye on the steps taken by the government to strengthen the economy and revive the investment sentiment.

If all goes well and the government is able to implement GST from April 1 and the land acquisition bill after the Bihar elections, I think India would replace China to become the most attractive investment destination for the global institutional investors.

Personally, I feel there is a good scope of 50 basis points (0.50%) rate cut by the RBI in the next 6-9 months and as a result, the 10-year G-Sec yield should fall below 7% by April-June next year. If that materialises, then there would be at least 8-10% appreciation in the market price of these bonds by the end of current financial year.

Application Form of NTPC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NTPC tax-free bonds, you can contact me at +919811797407

Wow 11.55 times subscription in retail !!

In 2013, I applied for most of the TFBs with 100% allocation, in most cases I applied on 2nd or 3rd day looking at the daily subscription figures ! Can’t do that anymore !

Hi Sagar,

Bidders are giving competition to each other now. Number of applicants have gone up significantly.

Thank you Shiv for this post ! Can you please help me in understanding following points..

1. What is the point in investing this TF bond at about 7.5 % while the debt MF schemes available in market are offering about 9 % and after paying taxes using indexation mechanism one can earn more than 7.5 %.

2. How about if someone buys higher interest TF bond from secondary market with a premium, just wanted to understand what else someone has to pay apart from premium ?

3. If some one buys TFB from the secondary market then he gets the same interest as originally offered by TF bond or its less by 1% ?

4. Who will earn the TFB interest if someone buys it in the middle of the year, is this buyer or seller ?

Thank again,

Hi Krishna,

1. Mutual Funds do not assure returns. I don’t know which mutual fund scheme you are talking about. Debt mutual funds invest in these kind of bonds/NCDs only.

2. It is advisable to compare listed tax-free bonds’ yield (YTM) with coupons of current tax-free bonds. Whichever is higher, net of charges, should be bought.

3. Original rate of interest will be paid, subject to an investment limit of Rs. 10 lakhs.

4. Buyer will get the interest payment, seller will get the premium which the listed bond would be carrying.

Shiv, I think Krishna is referring to Gilt funds. Considering the Govt bonds are trading at average 7.8% interest, he is suggesting 7.5% return from these bonds. If interest rate goes down the return of these bonds will be higher. Though we cannot compare TF bonds with these funds, if we are looking at low interest rates, these debt funds will give return above 8% if invested now. But to avail tax benefit by indexation one will have to hold them for minimum 3 years. Both products have advantage and disadvantages and one will have to take this decision based on the requirement.

Thanks Shiv & George !

1. I was talking about ultra short term MF like ICICI Prudential Flexible Income Plan, they are not guaranteed but generally they give 9% return and after indexation we will get about more than 7.5% tax free.

2. Regarding point no 4 above, in that case do you mean to say that the premium amount gets reduced every time when the interest is paid ? As the interest is already paid to seller and now the buyer has to wait for complete one year.

Thanks !

Hi Krishna,

1. Check the portfolio of ICICI Pru Flexible Income Plan – https://www.valueresearchonline.com/funds/portfoliovr.asp?schemecode=10467. It has also invested in bonds/NCDs of corporates & PSEs. In a falling interest rate scenario, I think income funds like this one should give superior returns than tax-free bonds and in a rising interest rate scenario, such funds would perform poorly as compared to tax-free bonds. There is no historical evidence with me though to prove this point.

2. Yes, that’s correct. On the Ex-Interest Date, market price of these bonds fall by 7-9% as against their previous closing price.

Hi George,

In the last two years or so, I think tax-free bonds and Gilt funds must have given similar returns i.e. +/- 2%. But, still you are right, each of these products has its own advantages & disadvantages.

I agree with you Shiv. Those who purchased TF bonds last time got better deal than any other fund investment. But considering the low yield offered by the current issues, the rush is not justified. I will consider the following reasons.

1. People were waiting eagerly and those who heard about the benefit reaped by previous investors were just waiting for an opportunity.

2. Last times, most of the issues came 2 issues at a time and the amt was also in few 1000 crores.

3. NTPC is having only this issue and NTPC is considered as one of the favorites in the lot.

4. This is initial rush and not likely to substain as we have seen in 2012-2013 where yield offered was between 6.8 to 7.5. Those who invested in those bonds repented when 2013-14 bonds came.

Regarding Krishna’s argument of 9% from some Debt MF, one should be cautious and look at which bonds those funds invested. If it is with rating less than AA-, Amtek default should be an eye opener for such investors investing directly low rated bonds or fund which have investment in such funds.

Hi George,

I agree with all the points you made above. One more thing – the methodology for calculating & fixing coupon rates on these bonds has remain unchanged from the last time in 2013-14. So, I think the coupon rates are moving in tandem with our G-Sec yield. So, these rates are equally attractive or unattractive to me. Only noticeable difference is the rate of inflation & sentiment around the government policies.

In 2013-14, there was a panic with US Fed announcing its decision to hike its policy rates. US treasury yield spiked up very sharply, creating a panic among the global investors with Indian G-Sec yield rising from a low of 7.20% to 9%+. Situation has not changed dramatically on the global front, but inflation has cooled down here and there is investors’ confidence in the government policies now.

Thank you to both of you ! It helped me. Can you please share some attractive gilt fund names ?

Thanks,

I Suggest SBI Long term Gilt fund or HDFC High interest and Dynamic fund. Look at investing in direct funds.

Thank you George !

The issue is already oversubscribed 1.22 times by noon for retain category IV.

http://www.nseindia.com/products/content/equities/ipos/debt_ipo_current_ntpctfb15.htm

All retail investors are definitely not going to get full allotment. Still 3 hours to go for day 1.

Hi Parthiv,

I think only 15-20% allotment will be made to the retail investors. Still more than one hour to go.

Yeah Shiv, but on NSE website they have put the NCDs offered as 40,00,000 only, whereas it should be 70,00,000.. right? I mean they have kept the option open to retain over subscription upto 300 crores.

So, even though it shows 0versubscribed by 1.64 times as of now, wouldn’t retain investor still have chance to get full allotment, as compared to 28,00,000 NCDs (280 crores) for retain investors, as of now 26,25,705 NCD bids have come in this category.

Thanks for your wonderful insights, as always.

Hi Shiv,

Your estimation on allocation is correct. It will be around 20-22% for retail which oversubscribed 4.62 times.

Based on 11x oversubscription for retail , allotment will be around 9% only. I guess awareness of TFB has gone up substantially in last 1.5 years. Cant explain anything else for this much euphoria for a fixed income instrument.

Ramdas, 11X for 400 Crores and complete 100%. NTPC can go upto 700 Crores. There is 40% reserved for Retail investors out of 700 Crore. This 40% retail will have 280 crores. The subscription for retail is 6.6 times. Mostly the allocation will be around 14-15%.

Allocation would be between 15-16%.

Sir, what is bidding. My agent has asked me to fill up the form and attach a cheque and handover the same to him. Will I not get the bonds?

Hi Sveety,

Your agent will do the bidding on the stock exchange before banking your application. So, the process is the same.

Thanks Shiv once again for the information, I just applied for this issue. Although interest rates are quite low than last year but I believe this is still a better option compared to marginally high Bank Fd’s. Let’s see how the overall response is. Btw I am still holding very substantial qty of last year’s TFB’s which are trading at 15 to 20% premium. Do you think I should sell them now and book profit or wait further for interest rates to fall. Regards

Thanks Ikjot!

I agree, these bonds are way better than bank FDs. Moreover, I have recommended my family members to hold on to their holdings as I think interest rates should fall further from here. It is up to you what your view is about the interest rates and economic growth.

I am also thinking of switching into new bonds with following considerations –

1) Diversification

2) With indexation, I believe any capital gain upto 15% is tax free ! ( 2013-14 Index being “939” and this year it is “1081” )

3) Any holdings in 15 year series then, can be switched into 20 years now, for additional 7 yrs

Hi Sagar,

Point No. 2 – It is 10% flat capital gain tax on listed bonds after 1 year of holding. Indexation benefit doesn’t apply here.

PFC tax-free bonds issue update – Issue opens 5th October, closes 9th October. Issue size Rs. 700 crore. Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.36% p.a.

15 years – 7.52% p.a.

20 years – 7.60% p.a.

Demat account is NOT mandatory for the PFC issue.

I am not sure if tax free bonds issues this year will be a big hit like 2013. NTPC issue will sail through easily as issue size is small. Rest of the issues will face challenge especially when G-sec continues to fall. Interest rates for TFB are quite low compared to previous years. Most of the HNI’s would have stocked up enough TFB from previous issues. Long term gilt funds will offer a better play for interest rate cut scenario than tax free bonds. 1.3% interest differential with PPF is another dampener. Let us see how first day subscription looks for NTPC TFB and that will give us a trend for future issues

I agree with you Ramadas! After all, tax-free bonds with 8.75% to 9.01% rate of interest were quite attractive in 2013. But, I think only NHAI will struggle to raise Rs. 16,800 from these issues, rest should sail through comfortably. Those investors who missed out on the previous issues will invest this time around. First day trend will be very interesting to observe. Moreover, PFC has just announced the coupon rates for its forthcoming issue. PFC’s rates are marginally lower than the rates offered by NTPC. So, investors will be attracted more towards the NTPC issue.

Thanks a lot Shiv for this post on TFB

For any information related to Tax Free bonds, I always rely on your posts as I find all the relevant information which enables me to take the decision. Thanks once again.

Thanks a lot Mr. Singh for your kind and motivating words !! 🙂

Sir,

I wants the ntpc bond so how could Buy me it

Hi Jagdish,

To invest in NTPC tax-free bonds, you need to have a demat account. If you have a demat account, then you can either invest in it through your broker OR you can download the form from the link pasted in the post above & contact me on 09811797407 to do the bidding of your application. After the bidding is done, I’ll let you know your Exchange Bid Id, get your application collected from your place and submit it at the designated collection centre.

Very good article Shiv!!

Thanks Anubhav! 🙂

Dear Mr. SHIV KUKREJA,

For retail investor, how difficult it is to trade tax free bonds in the secondary market ? Any idea about the volume of such bonds being traded in the secondary market. Where to find the info regarding trade volume of these bonds.

Hi Nawraj,

I think liquidity is good enough for a retail investor to liquidate his/her holdings at a short notice. But, he/she might get a price which is Rs. 5-10 lower than the market price i.e. a discount of Rs. 0.5-1% to the market price. Otherwise, I don’t think there is any liquidity crisis as such in tax-free bonds. The better the company is, more will be the demand for its tax-free bonds. Here you have the link to check the trading data on a daily basis – http://www.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

Please check this link of NHB 9.01% tax-free bonds – http://www.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=NHBTF2014&series=N6

212 bonds of NHB got traded today on the NSE with a value of Rs. 1.315 crore. Market price is Rs. 6205, a couple of buyers are willing to buy 20 bonds at around Rs. 6200 and a couple of sellers are willing to sell their 20 bonds at around Rs. 6210. So, it is a game of demand and supply. Higher the demand is, higher will be the market price and it will be easier for the sellers to sell their holdings.

Thanks to BJP govt after approving such attractive scheme which is guaranteed for Small investor for long term without any puzzle having AAA Rating of PSU.We should adopt such guaranteed Return bonds which is appearing after 2 years.

Its better to invest in NTPC tax free bonds that its shares.

I think NTPC is a good company and stock investment is always a high risk-high reward proposition. I think its shares are very attractively valued and should provide better returns than these bonds.

Sir

Do you have any idea of PFC bonds plan and its interest rates. PFC have filed its DHRP.

Regards

Piyush

Hi Piyush,

PFC has not announced its coupon rates as yet, but the issue is expected to open in September itself.

Interest rate is low? With global deflation, I think interest rates in India will fall further if our inflation is under control.

I agree!

Very Nice and Helpful Post

Thanks Finance Blog!

What is the point in locking money for such duration at low interest rates. Even if rates fall further but still secondary market bonds offer good opportunity to investors.

Agree Ajay. It is an important point to be taken in account. The interest rate is currently low and likely to further go down. If it further go down , you will benefit provided you sell in the secondary market for the premium. Holding long term is left to the individual based on cashflow one is looking for. Interest rate is cyclical and we may have high interest rate in future. But if you are in 30% tax bracket, anytime the Tax free return that you will get from this bond is better. You should not look for the price of the bond in the market at that time and hold until maturity or when you can trade in profit.

Thanks George for your inputs!

Hi Ajay,

Most of the listed tax-free bonds are trading on the stock exchanges at a yield (YTM) lower than the coupon NTPC is offering. So, I think it makes sense to apply for tax-free bonds in such issues.

Hello Shiv,

I have heard about this YTM concept and that it helps in comparing the bonds and to decide whether one should invest in a bond or not. Could you please do a follow up post on YTM, what exactly does it mean and how to calculate/use this for our advantage.

As always, thank you for doing the good work that you and Manshu are doing via this web site.

Cheers

If i were in your place, I would invest maximum possible (10L or 10+10 L with spouse) for following reasons:

1. interest rates would go down from now on over next 1-2 years and one cut could before Dec-15. Other PSUs would wait for rate cut before issuing TFB.

2. NTPC is as safe as any other PSU navratna which is a highest rated PSU. So diversification is not necessary. Default by NTPC is extremely rare and if it happens, it would be a watershed event, so most unlikely.

3. Selling immediately on listing or immediately after interest rate cut, does not make sense. Investment in TFB should be for long term in falling interest rate environment.

Happy intesting..

Thanks makes sense. I do not hold or plan to buy NTPC equity shares so it would be ok to invest maximum in the tax free bonds.

Thanks Shirish for your inputs!

Dear Shiv – Thanks much for this post. I am planning to invest substantial amount in the coming tax free bonds and have been waiting with the funds in my savings account. (Do not want to take risk with liquid funds). I planned to invest x/4 amount in NTPC, x/4 amount in NHAI and x/2 amount in IRFC. I already hold tax free bonds from REC, PFC and am worried about the conditions of the state electricity boards and so would like to avoid these two.

In this respect, would it be better to invest max allowed retail limit in NTPC since we are not sure when the other two issues will come and the rates might go .25% down in the interim. Or is it sensible to diversify with multiple issuers. Or should we invest in NTPC now and sell the proportionate amount and switch when the other two issues come. (This assumes there is liquid market and 0.15% brokerage fees and taxes on gains) What would you have done, No onus on you. Many thanks.

I have the same query! thanks for covering it.

Hi Reader,

I completely agree with Shirish’s views here. Moreover, I think it makes sense to invest to the maximum extent in NTPC as I think it will get oversubscribed at least 2 times in the retail category on the first day itself. So, you’ll not get the full allotment. Remaining money you can diversify in the other two issues.

I think rate cut or no rate cut, G-Sec yield won’t change much on or after September 29th. It is the China effect and GST, Land Acquisition Bill, Reforms, Bihar Elections etc. which would be playing major role in the G-Sec yield movement going forward. Trajectory is biased towards a downward momentum though.

Happy to see Tax Free Bonds are back in the market. 🙂

Thanks Shiv for sharing.

Hi Amlan,

Yes, many retail/HNI investors were waiting for these bonds to get issued. These bonds were badly missed by us last year when the interest rates were high. I hope the investors have healthy returns from these issues as well! 🙂