This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Volatile stock markets are again testing the nerves of Indian investors. People, who invested in stocks or equity mutual funds in the hope of some quick fixing by the Modi government, have been left disappointed with the kind of returns they have earned in the last one year or so. Some investors are headed towards safe fixed deposits where interest rates are continuously falling, while others are looking to invest in debt funds.

But, the recent problem with JP Morgan debt funds, in which the fund house restricted redemptions in two of its debt schemes – Short Term Income Fund and India Treasury Fund, has once again shaken the investors’ confidence in debt funds as well.

So, what do investors do in the current economic scenario? Stay in cash? Or invest in gilt funds and tax-free bonds only?

It is said that the best time to invest is when there is a panic. But, the problem is that it is very difficult to figure out whether the panic is based on some kind of reality or it is just a perception and a short-term phenomenon.

After a gap of one financial year, tax-free bonds are making a comeback this financial year and NTPC is the first public sector enterprise (PSE) to launch the public issue of such bonds from the coming Wednesday, September 23rd. As the company is confident of raising the desired amount very quickly, the issue will remain open for just seven working days to get closed on September 30th i.e. the next Wednesday.

Size of the Issue – NTPC has been authorized to raise Rs. 1,000 crore from tax free bonds this financial year and it has already raised Rs. 300 crore by issuing these bonds in private placement. The company will raise the remaining Rs. 700 crore from this issue.

The issue size of Rs. 700 crore is very small for a large population of investors waiting for these bonds for around 18 months now and for this reason, I think the issue should get oversubscribed on the first day itself.

Rating of the Issue – NTPC is India’s largest power generator and a ‘Maharatna’ company with market capitalization of Rs. 104,759 crore. Being a PSU with strong fundamentals and government backing, CRISIL, ICRA and CARE have assigned ‘AAA’ rating to the issue.

Moreover, these bonds are ‘Secured’ in nature and certain fixed assets of the company will be charged equivalent to the outstanding amount of the bonds.

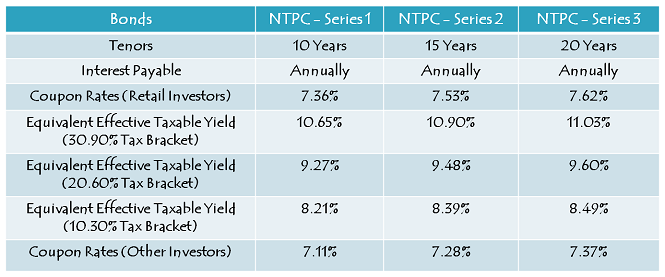

Coupon Rates on Offer – NTPC is offering yearly rate of interest of 7.36% for its 10-year option, 7.53% for the 15-year option and 7.62% for the 20-year option to the retail investors investing less than or equal to Rs. 10 lakh.

As mandated by the government, these rates would be lower by 25 basis points (or 0.25%) for the non-retail investors.

NRI Investment Allowed on Non-Repatriation Basis – Non-Resident Indians (NRIs) are also eligible to invest in this issue, but only on a non-repatriation basis. NRI investors will not be allowed to repatriate its interest amount or maturity proceeds outside India.

QFI Investment – Qualified Foreign Investors (QFIs) are not allowed to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 10% of the issue is reserved i.e. Rs. 70 crore

Category II – Non-Institutional Investors (NIIs) – 25% of the issue is reserved i.e. Rs. 175 crore

Category III – High Net Worth Individuals including HUFs & NRIs – 25% of the issue is reserved i.e. Rs. 175 crore

Category IV – Resident Indian Individuals including HUFs & NRIs – 40% of the issue is reserved i.e. Rs. 280 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – NTPC has decided to get these bonds listed on both the stock exchanges i.e. National Stock Exchange (NSE) as well as the Bombay Stock Exchange (BSE) and has successfully got the necessary in-principle listing approval also from these exchanges. The bonds will get allotted and listed within 12 working days from the closing date of the issue.

Demat Account Mandatory – This is one of the noticeable changes as compared to the last time. NTPC has decided to allot these bonds only in dematerialised form and thus, the investors do not have the option to apply these bonds in physical or certificate form.

So, if you want to apply for these bonds in this issue and do not have a demat account, act now as you have only two days with you to get a demat account opened. However, once allotted in demat form, the investors can rematerialise the bonds in physical/certificate form if they decide to close their demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the BSE or NSE.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NTPC will make its first interest payment exactly one year after the deemed date of allotment and the deemed date of allotment will be announced just before the listing date. I will update this post as and when it gets announced.

Fundamentally, NTPC is a good company, ranked nineteenth among the top Indian companies by market capitalization. Also, at present, there are only seven central public sector enterprises (CPSEs) which have been conferred the status of Maharatna and NTPC is one of them.

Among the seven companies which have been authorized to issue tax free bonds this financial year, NTPC is the only company which has the ‘Maharatna’ status.

Should you invest in this issue?

There are many reasons why I think yield on government securities (G-Secs) should fall here in India. China slowdown, no rate cut by the US Federal Reserve on September 17 and falling WPI & CPI inflation – I think all these factors would make the RBI governor Dr. Rajan to think about cutting policy rates in its monetary policy scheduled to be held on September 29th. But, less than normal rainfall and less than desired improvement in the Indian economy & fiscal deficit, are a couple of reasons which might not work in favour of a rate cut.

Moreover, Congress playing spoilsport in the passage of important bills like GST and the land acquisition bill are also putting pressure on the Indian economy and thus making it extremely difficult for the Modi government to take further actions on the reforms front. RBI is keeping a close eye on the steps taken by the government to strengthen the economy and revive the investment sentiment.

If all goes well and the government is able to implement GST from April 1 and the land acquisition bill after the Bihar elections, I think India would replace China to become the most attractive investment destination for the global institutional investors.

Personally, I feel there is a good scope of 50 basis points (0.50%) rate cut by the RBI in the next 6-9 months and as a result, the 10-year G-Sec yield should fall below 7% by April-June next year. If that materialises, then there would be at least 8-10% appreciation in the market price of these bonds by the end of current financial year.

Application Form of NTPC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NTPC tax-free bonds, you can contact me at +919811797407

#Multibaggerstockideas- Market positive on Global cues ::

Indian economic expansion for the first quarter ending June 2016 came at 7.1% down from 7.9% reported in prior quarter and 7.5% increase in Q1 June 2015. Another data showed the index of eight core infrastructure sector rose 3.2% in July 2016 over July 2015, while its cumulative growth stood at 4.9% in April to July 2016. The India Meteorological Department (IMD) said that for the country as a whole, cumulative rainfall during this year’s monsoon so far (till 1 September 2016) was 2% below the long period average (LPA). The outcome of the monthly survey on India’s services sector, trend in global markets, investment by foreign portfolio investors (FPIs) and domestic institutional investors (DIIs), the movement of rupee against the dollar and crude oil price movement will dictate market trend in the truncated trading week ahead. India’s stock market remains closed on Monday, 5 September 2016 on account of Ganesh Chaturthi.

NABARD Tax-Free Bonds Issue Update:

Issue opens – 9th March, 2016, Issue closes – 16th March, 2016, Issue Size – Rs. 3,500 crore

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.64% p.a.

HUDCO Tranche II update:

Issue opens – 2nd March, 2016, Issue closes – 10th March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 1,788.50 crore, including Green-Shoe Option to retain Rs. 1,288.50 crore

NHAI Tranche II update:

Issue opens – 24th February, 2016

Issue closes – 1st March, 2016

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.29% p.a.

15 years – 7.69% p.a.

Total Issue Size – Rs. 3,300 crore, including Green-Shoe Option to retain Rs. 2,800 crore

HUDCO 7.64% Tax-Free Bonds Review – http://www.onemint.com/2016/01/21/hudco-7-64-tax-free-bonds-tranche-i-january-2016-issue/

HUDCO tax-free bonds issue update:

Issue opens – 27th January

Issue closes – 10th February

Base Issue Size – Rs. 500 crore

Total Issue Size – Rs. 1,711.50 crore

Interest Rates for Retail Individual investors investing upto Rs. 10 lacs:

10 years – 7.27% p.a.

15 years – 7.64% p.a.

IREDA 7.74% Tax-Free Bonds Issue – http://www.onemint.com/2016/01/02/ireda-7-74-tax-free-bonds-january-2016-issue/

NHAI tax-free bonds issue update:

Issue opens 17th December, closes 31st December.

Issue size Rs. 10,000 crore.

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.39% p.a.

15 years – 7.60% p.a.

NRIs are not eligible to apply in the issue. Also, demat account is NOT mandatory for this issue as well.

REC tax-free bonds issue update – Issue opens 27th October, Issue size Rs. 700 crore. Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.14% p.a. vs. 7.36% PFC offered

15 years – 7.34% p.a. vs. 7.52% PFC offered

20 years – 7.43% p.a. vs. 7.60% PFC offered

Demat account is NOT mandatory for the REC issue as well.

NTPC bonds have got listed today on the NSE & BSE. 7.62% 20-year bonds opened at Rs. 1070 on the NSE, which is also the highest price these bonds have traded at today, touched a low of Rs. 1,040 and currently trading at Rs. 1045.04.

Total 48,198 bonds have already got traded on the NSE. People, who say there is a lack of liquidity with these bonds, should notice these volumes. These volumes are good enough to exit, partially liquidate or increase your investments.

NTPC tax-free bonds to get listed on the BSE & the NSE on October 8th i.e. Thursday.

Here are the BSE and the NSE codes for the same:

7.36% 10-year bonds – BSE Code – 961906, NSE Code – NB

7.53% 15-year bonds – BSE Code – 961908, NSE Code – NC

7.62% 20-year bonds – BSE Code – 961910, NSE Code – ND

Deemed date of allotment has been fixed as October 5, 2015. Interest will be paid on October 5th every year.

Many thanks Shiv. Really appreciate your followup with comments.

You are really India’s tax free bonds expert. Sharekhan is showing series 3 code as NTPCND, so probably we need to prefix NTPC before the two letter codes.

Thanks Bhaskar for your encouraging words! 🙂

Got about 84% money back in account. Allotment seems to be proportional around 16%. So much for fastest finger first… Is PFC going to be the same way?

Hi Andy,

PFC allotment would be even lower than NTPC, at 13-14% only.

Hi Shiv,

Can you advise when will with the NTPC bonds be alloted. Further while the tax free bonds are attractive, it has to be kept in find that the interest is non-cumulative and therefore unless the annual interest is invested wisely the YTM may not be that high.

NSC for 10 years is offering 8.8 interest currently at the moment and its a good option to park your funds.

Gaurav, NTPC bonds are allocated in BSE and NSE. I have applied in both and got allocation. Regarding the Cumulative interest, it will depend on how one is looking the the cashflow. If you have money for locking for 10 years, then NSC 10 Yrs is fine. TF bonds allows you to book profit and sell when in need of money. Liquidity is important. Having said that I have moved some of my fund into PO NSC 5 years and TD 5 years. They are attractive at 8.5% and in all probability, Govt will revise the interest rate for small savings post Bihar election.

Hi Gaurav,

1. NTPC bonds have already been allotted and getting traded on the stock exchanges now.

2. Yes, reinvestment risk is there with tax-free bonds. I think one should invest the interest amount in diversified equity mutual funds for long term to get higher returns.

3. NSC interest is taxable. If your tax liability is nil or 10%, then only it makes sense to invest in NSC, otherwise tax-free bonds or PPF are better options. Liquidity is not there with NSC.

I have being allocated 16% of application money. Rest of money is released to back to my account.

Looks like allotment is partial and not fcfs-basis..had applied in ASBA so amt deducted is much lesser than applied. Anyone else seen such an entry in their account(s)?

Hi Haresh,

The day the issue gets oversubscribed, allotment happens on a proportionate basis for all the bids submitted on that day. As the NTPC issue got oversubscribed on the first day itself, allotment has happened on a proportionate basis @ 15.6% to 15.7% of the bonds applied for.