This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

NTPC Tax-Free Bonds, which got oversubscribed by 6.31 times last month on September 23, have finally got allotted yesterday. As the issue got oversubscribed by 6.60 times in the Retail Investors’ category, the investors have been allotted 15.6% to 15.7% of the applied number of bonds.

Against an application size of Rs. 10 lakhs, 156-157 bonds have been allotted and the remaining amount will be refunded to the investors starting today itself. Some investors, who applied for 10 bonds, have been allotted 1-2 bonds only.

Allotment process is expected to get completed by today itself and I expect the bonds to get listed on the stock exchanges BSE and NSE earliest by tomorrow. NTPC has been able to raise Rs. 700 crore with this issue.

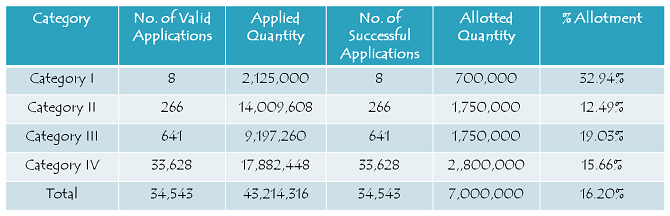

Here you have the Basis of Allotment among all categories of investors:

If you want to check the allotment status, here is the link of Karvy Computershare – http://karisma.karvy.com/investor/jsp/IDFC-APP.jsp

Karvy Computershare is the Registrar for the issue and if you have any query related to your application, allotment process or refund of application money, you can contact Karvy at 1800 3454 001 or write a mail at [email protected]

Investors, who are disappointed with such a small number of bonds getting allotted, will get an opportunity with NHAI to get full allotment. NHAI is expected to come up with its bonds issue by October-end with an issue size of Rs. 11,200 crore. I think with lower coupon rates, euphoria related to these bond issues will get settled down very soon now.

dear shiv ji

will u please let me know the expected coupon rate for nhai 20 years bond(if it gets issued in nov 1st week).thanks in advance.

.

Any news on nhai coupon rates?

Dear Sir,

when will be the bonds listed on BSE? Also share the scrip code in Debt segment.

They will be taking last quarter for arriving at Coupon rates and it will be surely 7.3 to 7.6%

The issue size going to be 5000 Cr with over subscription upto 10K. This gives an opportunity for 100% allotment. Only question is the coupon rate?

will it be 7%?

Hi Shiv

NHAI filed DRAFT SHELF PROSPECTUS on October 7, 2015. We can expect the issue by 3rd week of Oct.

NPTC Tac free bond is trading at 1,056.15

much better than many of IPOs!

Question I have is, to get a better allocation, how do they differentiate between applications based on the duration?

Any better to submit (a) an application split for say X for 15 yr & X for 20 yr bonds OR better to (b) apply for 2X on 20 yr bonds

Hi Vinay,

There is no such way to get a better allocation. Allocation % is equal across all the Series.