This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

IRFC 7.64% Tax-Free Bonds Issue – Tranche II – March 2016 Issue

It has been a very long time since NHAI filed the draft shelf prospectus for its tax-free bonds issue in the first week of October. Investors have been desperately waiting for a bigger issue as all the previous issues by NTPC, PFC and REC have left them fairly disappointed.

All these issues were of smaller sizes of Rs. 700 crore each and got hugely oversubscribed on the first day itself. But, before NHAI could make it, IRFC has taken the lead to launch its tax-free bonds from the coming Tuesday i.e. December 8th.

As the issue size is quite big, I hope it does not get oversubscribed on the first day itself and the retail investors get full allotment at least this time around. The issue is scheduled to get closed on December 21st.

Before we analyse it, let us first quickly check the salient features of this issue:

Size of the Issue – IRFC is authorized to raise Rs. 6,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 1,468 crore by issuing these bonds through private placements. The company will raise the remaining Rs. 4,532 crore in this issue.

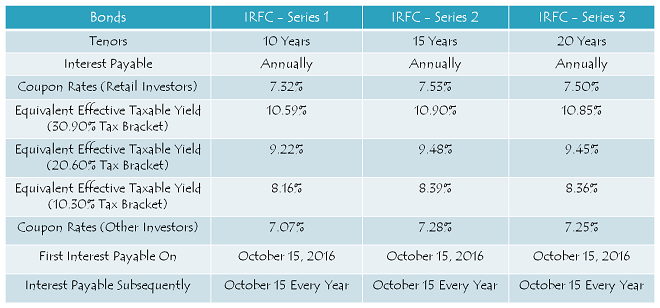

Coupon Rates on Offer – REC offered 7.43% as its highest rate of interest for the 20-year investment period. Due to a sharp reversal in G-Sec rates, coupon rates for this issue have risen by 0.07% to 0.19%. IRFC will offer yearly rate of interest of 7.32% for its 10-year option, 7.53% for the 15-year option and 7.50% for the 20-year option to the retail investors investing less than or equal to Rs. 10 lakh.

As always, these rates would be lower by 25 basis points (or 0.25%) for the non-retail investors.

Rating of the Issue – CRISIL, ICRA and CARE consider investing in these bonds to be safe and as a result, have assigned ‘AAA’ rating to the issue. Also, these bonds are ‘Secured’ in nature and in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

NRI/QFI Investment Allowed – Non-Resident Indians (NRIs) are eligible to invest in this issue, on a repatriation basis as well as non-repatriation basis. Unlike earlier issues, Qualified Foreign Investors (QFIs) are also allowed to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 15% of the issue is reserved i.e. Rs. 679.80 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 906.40 crore

Category III – High Net Worth Individuals including HUFs & NRIs – 25% of the issue is reserved i.e. Rs. 1,133 crore

Category IV – Resident Indian Individuals including HUFs & NRIs – 40% of the issue is reserved i.e. Rs. 1,812.80 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – IRFC has decided to get these bonds listed on both the stock exchanges, National Stock Exchange (NSE) as well as Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in an electronic form, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – IRFC will make its first interest payment on October 15 next year and subsequent interest payments will also be made on October 15 every year.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

Long-Term Potential – While the sentiment for real estate and gold investments has already been pretty negative, stock markets are once again testing risk appetite of the retail investors. Conservative investors can do nothing but invest in fixed deposits or explore some other relatively safer options like debt funds or tax-free bonds.

A sharp reversal in the G-Sec yield has again given an opportunity to the investors to invest at higher coupon rates. I personally think that India should have a relatively lower inflationary scenario in the next 3-5 years as compared to the previous few years. If you also have the same view and if you want to earn tax-free interest on your investments for the longest possible period of time, then I think you should opt for the 20-year bonds which carry 7.50% rate of interest. The 15-year option with 7.53% is also equally attractive with a relatively shorter investment period.

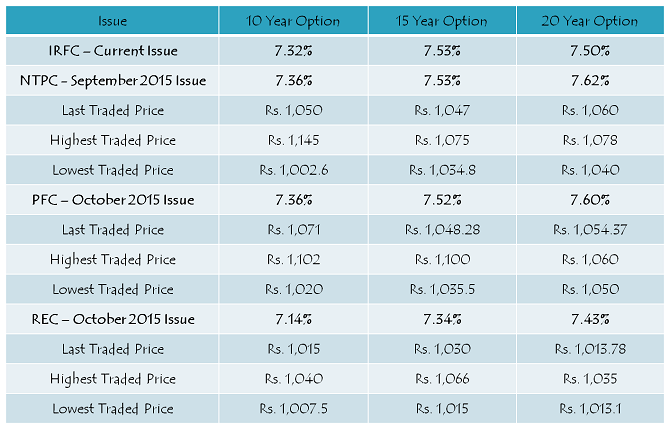

Listing Gains – IRFC is offering 7.53% rate of interest for its 15-year option, which is also the highest rate of interest for its bonds across all three options. NTPC issue also carried the same 7.53% rate of interest for its 15-year option. As you can check from the table above, NTPC 15-year bonds last traded at Rs. 1,047 on Friday on the NSE i.e. a 4.7% premium to its issue price. Even if I consider Rs. 12-15 premium to be the accrued interest for the 2-month period since listing, these bonds are still earning a natural premium of approximately 3-3.50%.

Even the REC 15-year bonds, which got listed on November 5th on the BSE and carried a lower rate of interest of 7.34%, got traded at Rs. 1,030 on Friday i.e. a premium of 3% including one month’s accrued interest. This observation makes me believe that there is a scope of making some quick short-term listing gains with IRFC bonds as well.

Application Form for IRFC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IRFC tax-free bonds, you can contact me at +919811797407

Finally got it in my Demat. Has the trading started?

Thanks, Shiv. The link gives the shares allotted and amount refunded. I got the refund amount but the Demat balance shows 0. Perhaps I need to wait for some time?

That’s right Malcom, you should wait at least till these bonds start getting traded on the exchanges. Thanks!

Dear All, I applied through ICICI Direct and the amount is deducted but in “History”, it shows “0” in allocated bonds. Nor does it show up in my Demat Allocation. Is it a cause for concern or the allocation process is still on?

Hi Malcom,

I think allotment process is complete and bonds have been allotted to all the successful allottees now. First, you should check your allotment status on this link – http://kosmic.karvy.com:81/ipotrack/ and if it is not showing here on this link, then you should contact your broker first and then Karvy Computershare, the Registrar for IRFC bonds issue.

On ICICIDirect site, go to demat allocation where you see all other bonds if any. There is a “Allocate” button. Click that button and there you will find those bonds. You will have to allocate bonds manually by entering quantity in the text box. Bonds are in your demat account but you will have to explicitly allocate them for trading only then it will show up. In trading history it will show 0 for some time(1 month)

IRFC tax-free bonds to get listed on the BSE & NSE on December 28th i.e. Monday – http://www.bseindia.com/markets/MarketInfo/DispNewNoticesCirculars.aspx?page=20151223-7

Here are the BSE & NSE codes for the same:

7.32% 10-year bonds – BSE Code – 935572, NSE Code – NI

7.53% 15-year bonds – BSE Code – 935574, NSE Code – NJ

7.50% 20-year bonds – BSE Code – 935576, NSE Code – NK

Deemed date of allotment has been fixed as December 21, 2015. Interest will be paid on October 15th every year.

Hi Shiv,

Will it be a good strategy to sell IRFC 7.53% bond on Dec 28 and invest the proceeds in NHAI 7.60%? Any chance of NHAI retail portion getting over-subscribed before that?

Yes Jason, it will be a good strategy to do that given you get a decent premium of 1-3% after brokerage & statutory taxes.

Link to check the allotment status of IRFC tax-free bonds – http://kosmic.karvy.com:81/ipotrack/

dear shiv i have applied for irfc tfb . i got allotment. but i did not get refund balance amount . i apply under NRE Dement a/c . so can you guide me regarding this issue to whom i need to contact for refund with my bank or IRFC.

thanks

Hi Nisar,

Refund amount must have got credited to your bank account yesterday, please check. If it is still not there, you can contact Karvy Computershare on 1800 3454 001.

dear Shiv in link is showing that refund is credited to my bank account on 21-12-2015 but not credited to my bank account yet. so i need to call Karvy Computershare on 1800 3454 001. is it ? or i can send mail to them.

Hi Nishar,

You can call Karvy Computershare on 1800 3454 001 OR write a mail to them on [email protected]

dear Shiv

thank you very much

You are welcome Nishar!

Allotted bonds are showing up in NSDL. But no SMS.

dear shiv

i applied for 750irfc35 but was allotted 753irfc30.

what could be the reason?

Hi Dr. Puneet,

That is just not possible. There is some goof up in bidding of your application. Please check with your broker.

ok thanks

Are these bonds already showing up in your demat account (NSDL/CDSL) or did you get sms of allotment details? I received sms of refund but have not yet got sms of allotment from NSDL. How did you know you got alloted 753irfc30. Is there an online link to check application status in karvy or linkintime.

Shiv, any idea when these bonds are going to list.

Many thanks.

my demat a/c was showing these bonds at 11.30 pm last night.moreover i got an sms and refund as well.

ok, my NSDL account is now showing this, received sms also just now

INE053F07843 INDIAN RAILWAY FINANCE CORPORATION LIMITED SR-104A 7.5 LOA 21DC35 FVRS1000

I had applied for 20 year option under retail quota

Hi Bhaskar,

I think these bonds should get listed on Thursday i.e. 24th December.

i got my 21% refund an hour before

Yes 21 % was the refund.

IRFC has started the allotment today. They have deducted amount today which was blocked under ASBA.

Oh that is great, thanks for providing this info Pankaj!

Not Yet. I think that IRFC has 12 days time from date of closing.They may decide to utilise this fully.

Thanks for a huge wide and complete information. Have the IRFC allotted the bonds and started for refund ? if not then expected time.

Hi

Where to check allotment status and when?

When will irfc allottments start?

Hi Mr. Shiv,

I am an NRI. Is there any tax free bond which we can buy in secondary market. would appreciate your advise and recommendation.

Hi Mr. Srikrishnan,

You can buy tax-free bonds which are having the highest YTM. You should contact your financial advisor for finding the best one for you as per your investment horizon.

Bollywood Actors are too investing in tax-free bonds – http://m.economictimes.com/markets/bonds/stars-bond-with-tax-free-savings/articleshow/50148968.cms

so dear shiv are you personally investing in a 15 year option or not because last time you have invested in national housing bank taxfree bonds and then I have also invested in nhbtf2014 & nhbtf2023 both with 20 years options and these bons are currently trading on huge premium so are you personally interested in nhai because 15 years option is quite good enough on the current senario

Hi Nitesh,

Personally, I would invest in equities at present as compared to tax-free bonds. But, for a conservative investor, NHAI tax-free bonds offer a good opportunity.

NHAI tax-free bonds issue update:

Issue opens 17th December, closes 31st December.

Issue size Rs. 10,000 crore.

Interest Rates for Retail Individual Investors investing upto Rs. 10 lacs:

10 years – 7.39% p.a.

15 years – 7.60% p.a.

NRIs are not eligible to apply in the issue. Also, demat account is NOT mandatory for this issue as well.

It is doubtful whether the refund of IRFC will get credited by 17th. Delay of 1 or 2 days would have helped.

Hi George,

If the retail portion does not get oversubscribed by 18th, then there is a possibility of getting the IRFC refund amount channelised into this one.

It is likely that the retail quota will spill to 3rd day, but if it get fully subscribed on 3rd day it will be oversubscribed and partial allotment. The chances of IRFC refund on 18th is quite high.

Yes, highly likely.

Thanks so much Shiv for these updates… very helpful!!!

Thanks Chaitanya!

NHAI Bonds opening on 17th Dec.

Highest interest rate for Retail investors at 7.60% for 15 years.

Retail Book Size – 4000 Crs. Should be 100% allotment, if you apply on Day 1.

Thanks Mayur for this info! You posted this info here even before I could do that.

Hello Shiv,

Can you please help us know as what all TFBs apart from NHAI are in pipeline to come before March 16 ?

Thanks

Hello KK,

Please check this post – http://www.onemint.com/2015/07/18/tax-free-bonds-notification-fy-2015-16/

After NHAI, only HUDCO & IREDA are left to issue these bonds. HUDCO is authorised to issue Rs. 5,000 crore worth of tax-free bonds this financial year and IREDA Rs. 2,000 crore.

Ok.. Thank you Shiv !