This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

First of all, we wish all the readers of OneMint a very Happy & Prosperous New Year !! May God give you success in your work and peace in your life and 2016 turns out to be the best year in your life !!! 🙂

IREDA 7.74% Tax-Free Bonds

Hunger without food is bad for health, so is overeating. Investors were hungry for tax-free bonds, especially a big issue to satisfy their demand, like the NHAI one. But, when such an issue came, they were not able to have full of it. It only got subscribed by 0.86 times in the retail investors category.

Such a big supply or say shortage of demand resulted in poor listing for the IRFC bonds. Investors were expecting some healthy listing gains with IRFC bonds after it received a good response and big oversubscription on the first day itself. But, that did not materialise, probably because NHAI offered slightly higher rate of interest or probably many investors subscribed to IRFC bonds to get its listing gains only.

As the NHAI issue got closed on the last day of 2015, IREDA announced slightly higher rate of interest for its issue which is getting launched on Friday next week i.e. January 8th. It will offer a maximum of 7.74% coupon rate for a period of 15 years, which is 0.14% higher than NHAI’s 7.60%. But, at the same time, this issue is AA+ rated, so it can carry a slightly higher rate of interest.

The issue is officially scheduled to close on January 22, but I think it should get fully subscribed much before than that.

Before we analyse it further, let us first quickly check the salient features of this issue:

Size of the Issue – IREDA is authorized to raise Rs. 2,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 284 crore by issuing these bonds through a private placement. The company will try to raise the remaining Rs. 1,716 crore in this issue.

Rating of the Issue – ICRA and India Ratings have assigned ‘AA+’ rating to the issue, thus suggesting that these bonds carry very low credit risk and high degree of safety regarding timely payment of financial obligations. As all the previous issues were rated ‘AAA’, this is the first issue this financial year which is rated AA+.

Moreover, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

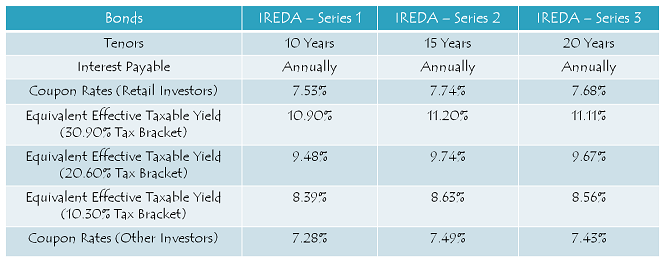

Coupon Rates on Offer – As this issue is rated AA+, it can offer interest rates which are 10 basis points (or 0.10%) higher than the rates which a AAA-rated issue could have offered. While NHAI 15-year option carried 7.60% rate of interest, IREDA is offering 7.74% for the same duration. For 10-year period, IREDA issue will have 7.53% rate of interest as against 7.39% which NHAI was offering.

As the NHAI issue did not offer 20-year investment period, IREDA offer will be attractive for the long-term institutional investors like insurance companies or pension funds. For 20-year period, IREDA is offering 7.68% to the retail investors and 7.43% for the non-retail investors.

For the non-retail investors, these rates would be lower by 25 basis points (or 0.25%).

NRI/QFI Investment NOT Allowed – Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 20% of the issue is reserved i.e. Rs. 343.20 crore

Category II – Non-Institutional Investors (NIIs) – 20% of the issue is reserved i.e. Rs. 343.20 crore

Category III – High Net Worth Individuals including HUFs – 20% of the issue is reserved i.e. Rs. 343.20 crore

Category IV – Resident Indian Individuals including HUFs – 40% of the issue is reserved i.e. Rs. 686.4 crore

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first serve (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the stock exchanges.

Listing & Allotment – IREDA has decided to get these bonds listed only on the Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. Whether you apply for these bonds in demat or physical form, the interest payment will still get credited to your bank account through ECS.

Also, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – These tax-free bonds are freely tradable and do not carry any lock-in period. The investors may sell them at the market price whenever they want after these bonds get listed on the stock exchanges within 12 working days of the closing date.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.53% p.a. for 10 years and 7.74% p.a. for 15 years and 7.68% p.a. for 20 years on their application money, from the date of realization of application money up to one day prior to the date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – IREDA will make its first interest payment exactly one year after the date of allotment and the date of allotment will be announced just before the listing date. I will update this post as and when it gets announced.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

IREDA (Indian Renewable Energy Development Agency), 100% owned by the Government of India, was established in 1987 to promote, develop and extend financial assistance for renewable energy and energy efficiency/conservation projects. As the company has strategic importance in the development of the renewable energy sector, certain special privileges have been provided to the company:

* Regular capital infusion in the company by the Government,

* Sovereign guarantee to the lenders against approximately 58% of IREDA’s total borrowings,

* Rs. 300 crore allocation from the National Clean Energy Fund (NCEF),

* Access to cheaper sources of funding, like these tax-free bonds etc.

Reasons for a lower Credit Rating as ‘AA+’ – Many investors want to know why this issue has been rated ‘AA+’ this time around when last time in February 2014, IREDA issued these bonds and the issue was assigned ‘AAA’ rating by the credit rating agencies. Investors also need to decide whether they should invest in this issue with a higher rate of interest being a AA+ rated issue or wait for HUDCO to announce its interest rates and then take a decision.

So, as the HUDCO interest rates are yet to get announced and we also don’t know when exactly the issue will be launched, it is difficult to guesstimate its interest rates. That is why I can talk only about this issue at this point in time. As far as the rating is concerned, I think higher NPAs and lower yield on its lending portfolio resulting in a fall in the company’s net interest margins (NIMs) are the two primary reasons for its rating downgrade from AAA to AA+.

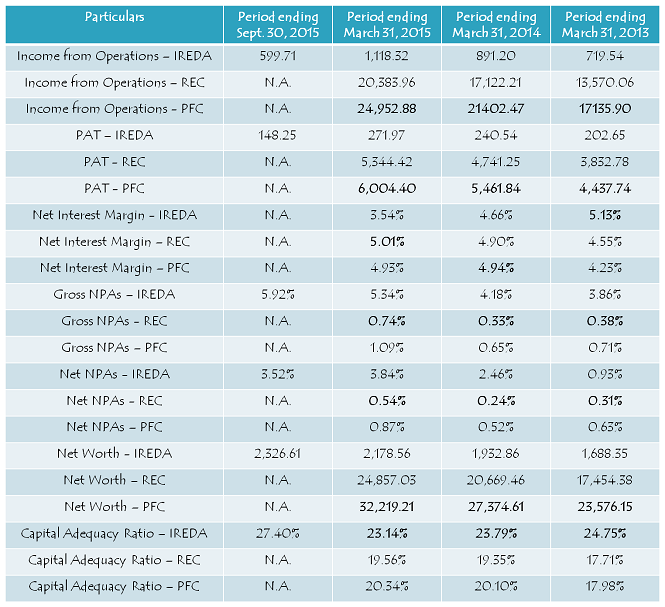

IREDA was doing well in terms of managing its asset quality a couple of years back. Its Gross NPAs improved from 19.9% in 2007 to 3.86% in 2013. But, in recent times, its financials have taken a hit and its Gross NPAs have again increased to 5.34% by March 31, 2015 and 5.92% by September 30, 2015.

IREDA vs. REC vs. PFC

(Note: Figures are in Rs. Crore, except figures in %)

Moreover, as per ICRA, lending only to the renewable energy sector, low net worth of the company as compared to some of the bigger players in the power financing business and higher NPAs in the small hydro, cogen and biomass segment are a few other reasons for a lower rating.

However, as IREDA is 100% owned and backed by the Government of India and as the government is committed to encourage the use and development of renewable sources of energy, I think the company should be able to improve its financials going forward. Its capital adequacy ratio (CAR) is quite comfortable at 27.40% on September 30, 2015 and its debt-to-equity ratio is expected to be 3.93% after this issue gets completed. IREDA also plans to go public in the next 2-3 years.

Personally, I am quite comfortable investing in this issue as I think IREDA should be able to improve its balance sheet going forward and the government backing will always be there for a company financing the renewable energy space. However, conservative investors, who need to invest only Rs. 10 lakh or less in these tax-free bonds, should wait for the HUDCO issue or NHAI Tranche II.

Application Form for IREDA Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in IREDA tax-free bonds, you can contact me at +919811797407

Hi Shiv,

I am Comparing NHAI issue & IREDA issue, wrt Subcription numbers.

On Day1 of NHAI, Institution Subscription was 4 times, while in this issue its till now less than 0.7 times.

Why institutions are staying away from this small issue.. while they were madly interested in bigger issue of NHAI ?? when its offering higher rate.

Normally they bid in the last hour.

Reply is in your query. In case of smaller issues, their sizable fund gets blocked almost for 15 days and also chances of getting higher allotment are much lower, compared to the large issues. So it is advisable to get higher allotment at slightly lower rate than to get smaller allotment at minimal 10 – 15 higher basis points.

In relative terms, Subscription TIMES should have been same in both, if not more because of higher rate.

In NHAI they will get 25% of their application, in this they will get 100% of application.

So, ideally it should close at 4 times.

Though, I checked it again at 4:38, now its 10 times (for Rs 1000), so directionally going correct. Factoring, the oversubscribtion absorbtion, it will close above 5 times.

It is 6.11 times finally.

I had written to both BIGSHAREONLINE & PFC on several occasions but without success to both the following emails.

[email protected],

[email protected]

I had provided them all details of my Newly Opened Demat Account while requwsting them to fredit my Demat account directly.

My Physical Certificate too has not arrived so far. What do you suggest I do to directly credit TFB’s to my DEMAT Account?

Do you have any other/additional contact emails/telephone numbers which may be of use.

Here you have the contact numbers of Bigshare Services – 022-40430200, 011-23522373

Sorry, I meant to say allotment letter copy was attached and sent to BIGONLINE & PFC.

Oh ok, that’s fine.

In my above application (Application copy attached) for Tax Free Bonds of 5.10.2015, I had applied for Bonds in Physical Mode, since my demat account was under process. However, subsequently, my NEW DEMAT ACCOUNT has been opened recently and I wish that my Tax Free Bonds be DIRECTLY CREDITED to my New Demat Account, instead of sending them in physical mode.

Attached ?? Where is it ??

Retail Category is Rs. 968.27 crore subscribed, should easily cross Rs. 1,250 crore by 5 p.m.

Retail portion fully subscribed now: 6864000 reserved, 6900642 subscribed.

Retail category is fully subscribed (Rs.687 Cr.) in the first half of the bidding period.

Applicants can expect partial allotment.

Can I make 2 bids for a separate series – eg. 20 year category + 15 year category?

Yes, you can do do. But, your total investment should not exceed Rs. 10 lakh to get a higher rate of interest.

categories 2,3,4 filling up very fast.

seems retail portion will get oversubscribed today itself..

Yes Chaitanya, seems so.

please provide links to check today’s supscription figures of ireda taxfree bonds

http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?id=1034&type=DPI&idtype=1&status=L&IPONo=1109&startdt=1%2f8%2f2016

How can one apply for these bonds? Where do I submit the physical form? Is there a webpage for electronic application? Thanks in advance for your answer.

Hi Ashish,

To invest in IREDA tax-free bonds in physical form, you need to download the application form from the link pasted above in the post & mail me the scanned copy of the duly filled form on my email id – [email protected]

I’ll do the bidding of your application and provide you the “Bid Id” of your application generated on the BSE platform. You’ll be required to mention the Bid Id on your application form and submit it at one of the designated bank branches in your area along with your PAN card copy, address proof copy, a cancelled cheque and an investment cheque. For any assistance or query, you can contact me on my number 9811797407

Dear Mr. Shiv,

I had applied for NTPC/PFC and was allotted few bonds in HNI category at lower rate. Can I buy in SAME SERIES RETAIL TFB’s and get higher interest rate? Or is this HNI classification PERMANENT?

Request that in future please post in a separate writeup most attractive bargains of TFB’s available in Market with good yields & safety & liquidity and RETAIL PURCHASE LIMITS for getting higher rate & hence not getting downgraded if limit is exceeded due to lack of knowledge.

Hi S.K.,

Yes, you can buy Retail Series bonds. But, your total investment should not cross Rs. 10 lakh across all Series.

sorry sir kindly delete this message .

It is ok, I have mentioned it there that it belongs to January 2013 issue.

Dear Mr shiv,

Good Evening,

Kindly cross check above article regarding the Hudco bonds issue.I saw in google search just now.is it true or not?

Oh come on man, these details belong to the January 2013 issue of HUDCO. Please don’t share these details.

The minimum subscription is five bonds across all series and in multiples of one bond thereafter.

The issue will open on January 9 and close on January 22.

The bonds have been assigned credit rating of ‘CARE AA+’ by CARE and ‘IND AA+’ by India

Ratings and Research Private Limited (IRRPL), indicating high degree of safety regarding timely

servicing of financial obligations and carrying low credit risk.

The company intends to utilise the issue proceeds for lending purposes, working capital

requirements, augmenting the resource base of the company and for other operational

requirements.

HUDCO is offering 15 basis points more than other issuers which have recently launched their

tax-free bonds, Chairman and Managing Director V. P. Baligar told reporters here, adding, “for

the first time ever, non-resident Indians and foreign institutional investors will be able to

participate in the issue.”

Last year, the company mobilised Rs.5,000 crore and managed to utilise all the funds, he said.

The coupon rate for qualified institutional buyers (QIB), corporates and high-net worth

individuals has been fixed at 7.51 per cent per annum for 15 years and 7.34 per cent for 10 years.

For retail investors, the coupon rate is 7.84 per cent for 10 years and 8.01 per cent for 15 years.

The bonds will be listed on the National Stock Exchange .

Kindly ignore these details as they belong to HUDCO’s January 2013 issue.

HDFC’s Keki Mistry, media entrepreneur Raghav Bahl, Bollywood bid for Rs 10,000-crore NHAI bonds

http://economictimes.indiatimes.com/articleshow/50460497.cms

Reliance invested Rs. 350 crore, SBI Rs. 3,000 crore, Akshay Kumar Rs. 65 crore and Kareena & Karishma Rs. 25 crore between them. Axis Bank, IDFC Bank and Yes Bank put in between Rs. 500 crore to Rs. 1,500 crore.

Hi,

While you have mentioned NRI’s and QFI’s are not allowed, in the subsequent para, you have mentioned in Category 3 is for HNI’s and NRI’s with 20% of the issue reserved.

Can you please review and confirm whether NRI’s are allowed or not or are they allowed to invest only in the HNI category. Thanks ..

Hi Prashant,

Thanks a lot for pointing that out, I’ve made the required changes now. NRIs/QFIs are not eligible to invest in this issue.

HUDCO may not prove to be a better issue. IREDA has offered the highest interest so far. Who knows by the time HUDCO issue comes out, the interest rate may be lower. I plan to split my investment in equal parts in IREDA, HUDCO and NHAI, if it’s second tranche comes.

Thanks Vin for your inputs!

Really informative discussions. Please mail me details of future issues of Tax Free Bonds along with your analysis . Thank you.

Thanks Mr. Poddar,

You may please subscribe to our free newsletter to receive these updates – https://feedburner.google.com/fb/a/mailverify?uri=onemint%2Ffeed

Thanks Shiv again for the wonderful post. Only question is,is it worth waiting for HUDCO which seems a better option?

Thanks Harinee,

As we don’t know what rate of interest the HUDCO issue would carry and when exactly the issue would get launched, it is very difficult to make a choice. I’ve updated the post above, so you can read my view about it.