This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Tax-Free Bonds, which carry coupon rates as per the G-Sec yield in the market, have suddenly become more attractive post this year’s budget. Finance Minister Arun Jaitley in his Budget speech announced his target to contain the government’s fiscal deficit at 3.5% of GDP in 2016-17. This lower than expected fiscal deficit has resulted in a sharp fall in bond yields in the past one week or so.

Moreover, these bonds will not be available in 2016-17 and probably afterwards as well. This will increase demand for these bonds multifolds. So, before these bonds become part of history, we have two such issues left – one is from NABARD and the other would be from IRFC. I will cover the IRFC issue in another post, let’s have a look at the salient features of the NABARD issue.

Issue Opening & Closing Dates – The issue is opening for subscription on 9th of March, the coming Wednesday and will get closed on March 14.

Size of the Issue – NABARD is authorized to raise Rs. 5,000 crore from tax free bonds this financial year, out of which the company has already raised Rs. 1,500 crore by issuing these bonds through a private placement. NABARD will raise the remaining Rs. 3,500 crore in this issue.

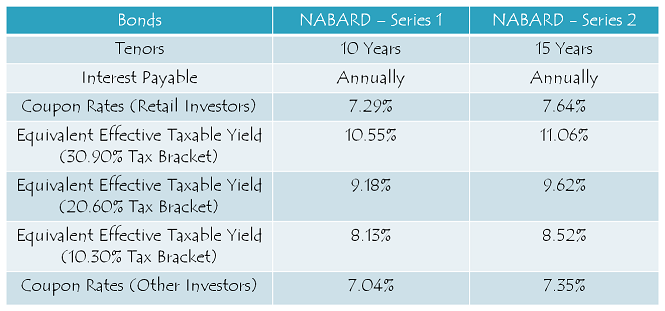

Coupon Rates on Offer – 10-year and 15-year G-Sec yields have fallen in the last few days, which has resulted in a fall in the coupon rates of these tax-free bonds as well. This issue will carry 7.29% for 10 years and 7.64% for 15 years.

For the non-retail investors, coupon rate will be lower by 25 basis points (or 0.25%) for the 10-year option at 7.04% and 29 basis points (or 0.29%) for the 15-year option at 7.35%.

Investor Categories & Allocation Ratio – The investors have been classified in the following four categories and each category will have certain percentage of the issue size reserved during the allocation process:

Category I – Qualified Institutional Bidders (QIBs) – 15% of the issue is reserved i.e. Rs. 525 crore

Category II – Non-Institutional Investors (NIIs) – 15% of the issue is reserved i.e. Rs. 525 crore

Category III – High Net Worth Individuals including HUFs – 10% of the issue is reserved i.e. Rs. 350 crore

Category IV – Resident Indian Individuals including HUFs – 60% of the issue is reserved i.e. Rs. 2,100 crore

60% Issue Reserved for Retail Investors – This is something very unique to this issue. As we all know, the retail investors were getting 40% of the bonds reserved in all previous issues. This will be the first issue in which the retail investors will be allotted 60% of the total issue size. I think this is a good step in favour of the retail investors.

NRI/QFI Investment NOT Allowed – Like most of the past issues, Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in this issue as well.

Rating of the Issue – CRISIL and India Ratings consider investing in these bonds to be safe and that is why they have assigned ‘AAA’ rating to the issue. Moreover, these bonds are ‘Secured’ in nature i.e. in case of any default, the bondholders would carry a right to make claim on certain assets of the company.

Listing & Allotment – NABARD has decided to get these bonds listed only on the Bombay Stock Exchange (BSE). The company will allot the bonds and get them listed within 12 working days from the closing date of the issue.

Allotment on First Come First Served Basis – Subject to the allocation ratio, allotment will be made on a first come first served (FCFS) basis in each of the investor categories, based on the date of upload of each application into the electronic system of the Bombay Stock Exchange (BSE).

Demat A/c. Not Mandatory – It is not mandatory to have a demat account to apply for these bonds. Investors have the option to subscribe to these bonds in physical form as well. To apply in physical or demat form, the applicant is required to fill the physical form and attach the KYC documents along with the investment cheque. KYC documents include a self-attested PAN card copy, a self-attested address proof copy and a cancelled cheque.

Whether you apply for these bonds in demat or physical form, the interest payment will still be credited to your bank account through ECS. Moreover, even if you get these bonds allotted in your demat account, you have the option to rematerialize your holding in physical/certificate form if you decide to close your demat account in future.

No Lock-In Period – After these bonds get listed on the stock exchanges, these tax-free bonds are freely tradable and do not carry any lock-in period, the investors can sell them at the market price whenever they want.

Interest on Application Money & Refund – Successful allottees will earn interest at the applicable coupon rates i.e. 7.29% p.a. for 10 years and 7.64% p.a. for 15 years, on their application money, from the date of realization of application money up to one day prior to the deemed date of allotment. Unsuccessful allottees will get interest @ 5% per annum on their refund money.

Minimum & Maximum Investment – Investors are required to put in a minimum investment of Rs. 5,000 in this issue i.e. at least 5 bonds of face value Rs. 1,000 each. There is no upper limit for the investors to invest in this issue. However, an investor investing more than Rs. 10 lakhs will be categorized as a high networth individual (HNI) and will get a lower rate of interest as applicable.

Interest Payment Date – NABARD will make its first interest payment exactly one year after the date of allotment and the date of allotment will be announced as the company allots its bonds to the successful applicants.

Record Date – For the payment of interest or the maturity amount, record date will be fixed 15 days prior to the date on which such amount is due to be payable.

Should you invest in this issue?

60% of the NABARD issue i.e. Rs. 2,100 crore is reserved for the retail investors. Not 100% sure, but I think it should take at least a couple of days for this issue to get subscribed in the retail investors category. I think many investors would have got the NHAI refunds credited by then.

As the Finance Ministry has a view that these tax-free bonds create some kind of imbalance in the market, especially for our commercial banks, they have decided not to extend such support to these issuers from the next financial year onwards. That makes this issue and the IRFC issue to be the last two opportunities for the investors in the higher tax brackets to make their investments. Such issues will not be available for at least next 18 months or so, even if the government decides to allow their issuances in Budget 2017. So, if you want to invest in these bonds and earn tax-free income, you need to act now and fast.

Application Form for NABARD & IRFC Tax Free Bonds

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in NABARD or IRFC tax-free bonds, you can contact/whatsapp me at +919811797407 or mail me at [email protected]

Subscribing to this issue. Will use the proceeds of NHAI to subscribe to IRFC if it comes by time, else this will be the last issue for me.

That’s great!

Hi Shiv ,

I don’t have demat account .

Is it possible to buy Nabard TFB in physical form currently and later convert it into demat form after opening a demat account?

Please advise.

read the post….it says Demat A/c. Not Mandatory. All your questions are answered there…

Better hurry since you have a lot of documentation to do

Hi AS,

Yes, you can buy these bonds in physical form now and get them converted later whenever you want.

Thanks Shiv for the info..

You are welcome AS!

I understand we can buy the TFBs from secondary market also. Can you please share the link for yields on different TFBs in the market

Technically Yes, you can purchase thru secondary market.

Since liquidity is less, difficult to find a seller for a reasonable price.

Yields are not fixed, depends on last traded price (which is not accurate as it depends on seller price for that last transaction only).

While trading in secondary market very important to put limit value prices .

Some older TFB issues have less interest rates , if bought in secondary market.

The ideal way is to get thru primary market and we are left with only two last opportunities now.

What´s unique for these issue is, the retail quota increased to 60% (normally it´s 40%).

So I strongly suggest, to subscribe now.

There is no mention of TFBs in this budget for next year.

Hope this helps, though I await Mr Shiv´s comment on this.

Thanks Vasu for your inputs!

Some older TFB issues have less interest rates , if bought in secondary market.

This is normal. The interest (Yield to Maturity “YTM”) rates are in direct proportion to the tenure (outstanding period) of the bond. Since the balance outstanding period for the older bond is lower..the rate (YTM) will be lower. One good example is that the rate for the 10 year bond is lower than the 15 year bond.

The interest rate is not dependent on balance amount. It´s fixed at the time of issue and the rates are generally different for different tenures (Ex: 10/15 yrs have different rate). However when YTM is only calculated based on LTP (Last traded price), which again not a realistic guideline because it´s based on just last trade. Unlike stocks where we have very high volumes .., we can predict at what price you are going to get a particular stock. However in TFB trades in secondary market, it´s difficult. (Must have limit prices , or else you may lose a lot while selling, and pay a lot while buying). Brokers may assist in purchasing from secondary market.

My mention of older issues was, for some issues that came couple of years back…they had a special clause of different applicable interest rate…once they are bought in secondary market. They were not many such issues though…

There are two parts. I have mentioned YTM, which is the final return that you get on your secondary purchase. This is independent of the “coupon yield” that is the interest rate fixed at the time of issue of the bond.

As I explained in my other post, even though you have purchased a “coupon rate” of 8.20, the YTM that you have managed is closer to 7.5 odd. This is the reason discount/premium on the bonds. exists.

To simplify..if I were to sell a bond 8.20 bond today at a premium and buy a similiar bond @ 7.69, my net cash flow would not change. The extra money I get for the 8.20 bond is compensated by the lower interest (7.69) per year on the HIGHER invested amount and I most probably will be at a loss due to the brokerage.

Shiv can correct me if I am wrong, but if I buy from a HNI who was issued at a lower COUPON rate..I will get the lower COUPON rate..but this is adjusted in the YTM.

When you compare prices of two different bonds on the exchange with same tenure, most probably the difference is due to the different interest dates (accrued interest) but the YTM will be similiar.

Hi Tarun,

Here is the link to check the LIVE trading status of all the tax-free bonds/corporate NCDs listed on the NSE – https://www1.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

You can get the details about each of these securities by clicking on their symbols.

Dear Shiv,

Are the NRIs (Gulf countries) can invest in upcoming IRFC TFBs?Pls clarify.

Nishar

i think yes

NRIs are not allowed to subscribe to TAX Free Bonds as mentioned in prospectus. Suggest, to invest in the name of family members who live in India. (Resident Individual Investor)

Hi Firoz,

NRIs are allowed to invest in the IRFC issue.

Subscribe

Dear Shiv,

Is the interest on NABARD bonds payable every year and not the full amount on maturity?

Yes Mr. Mittal, that’s right. Interest will be paid every year on the “Interest Payment Date” which will be declared once the bonds get allotted.

according to wealth 18.com care and icra have given nabard AAA is true shiv

Hi Nitesh,

It is CRISIL and India Ratings which have rated NABARD issue and not CARE and ICRA.

IRFC Limited (Indian Railway Finance Corporation Limited) – (AAA)

Issue Opening Date March 10, 2016 (Thursday)

Issue Closing Date March 14, 2016

Issue Size Amount aggregating to a total of up to Rs. 2,450 crore

Interest Rates:

Coupon rate for Category IV (Retail Individuals up to 10 Lacs)

Series of Bonds Coupon / Interest Rate

Series 1B (10 Yrs) 7.29%

Series 2B (15 Yrs) 7.64%

Recvd in email….

Kindly verify Shiv and keep-up the good work!!!

Thanks Aashish, the details are correct!

Hi Shiv,

Thanks for the details.

You are welcome Nagarajan!

Sir..good afternoon

really u r v helping to each n every 1s..

when s coming irtc bonds which is expected

on 10th..

pl give your CTC n office details

with phone nombr. .

thanks

Hi Anoop,

IRFC issue is opening on March 10th. My contact no. is +91-9811797407.

U r doing so good n help to investment

In gov.tfb..

Can I purchase from market.now

Your cell is not reachable. .

Thanks for good guidance

Sir..

Thanku for valuable guidance

I did not received any SMS or allotments

N refund of Nabard. .u hv advice

to wait.28..now what we can…?

Hi Anoop,

You should first check the allotment status here before contacting the Registrar – http://www.linkintime.co.in/bonds/BondsAllot.aspx

Thanks Shiv – this links helps a lot.

I see the allotment, however, on entering my bank account, this shows that the account number is incorrect.

Would that be because the data is yet to be updated (I see my address blank) or is that because someone has entered incorrect bank account. 🙁

Hi Praveen,

Just wait for a few more days and let the Registrar do its work. If you don’t receive your bond certificate/allotment advice and/or your interest on allotment, then probably you can contact the Registrar to get its data corrected.

Its not Karvy and probably thats the reason for the delayed responses. Now I realize how much the prompt and accurate services of Karvy has spoilt us 😉

🙂

Dear Shiv,

When is IRFC Issue date ?

Possible to get HUDCO Tranch 2 refund by then ?

Hi Vasu,

IRFC issue is opening on 10th of March. I don’t think HUDCO refunds would get credited by 10th, but I think it should be there by 11th or 14th morning. It is highly unlikely that IRFC will remain open till 14th.

Many thanks for your feedback.

True, it´s bit risky to depend on HUDCO refund.

You are welcome Vasu! In case you want to invest in the IRFC issue based on HUDCO refunds, then please drop me a mail, I’ll try my best to help you do that.

So, it´s bit risky to depend on HUDCO refund.

Many thanks for your advise.

Hi,

In the budget speech there is some mention of allocation of bonds to seven entities, in the next financial year… isn’t it not referring to this kind of similar tax free bonds?

“83. To augment infrastructure spending further, Government will permit mobilisation of additional finances to the extent of `31,300 crore by NHAI, PFC, REC, IREDA, NABARD and Inland Water Authority through raising of Bonds during 2016-17.”

Kindly throw light on this matter.

Regards,

Chirag.

Government clarified that , these bonds in next fiscal do not have tax-free status.

http://www.mydigitalfc.com/government-finance/infra-bonds-not-be-tax-free-fy17-418

Thanks Vasu!

are you sure nhai refund will come before nabard TFB

Hi Vishal,

Yes, I am quite confident that NHAI refunds should get credited either today or tomorrow morning.

Thanks Shiv.

1. Do we have the opening date for IRFC?

2. When are you planning to write similar article on IRFC?

Hi Bobby,

1. IRFC issue is opening on March 10.

2. I’ll write a post about it by today evening.

hdfcsec gives the issue size as 1788 crores. Probably a copy paste error from HUDCO issue. Which is correct? 3500 crores or 1788 crores?

NABARD issue size is Rs. 3,500 crore.

Thanks Shiv for the info. Will subscribe.

Thanks KS!

What is the opening date of this issue?

Found it on some other site. Its 9th March.

Yes, that’s right Shirish, it is March 9th. I have updated the same above in the post as well.

and interest payment date of irfc dear shiv

Hi Nitesh,

I do not have any info about the same as yet.

Shiv – Do we know if IRFC wld provide TFBs for 20 yr period?

No Bobby, IRFC issue does not carry the 20-year investment period.

I like this article. A good extract of all facts about the issue along with advise in simple to understand manner.

Thanks Vasu!