This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

The government is doing all it could do to curb the demand as well as imports of physical gold, but the government is yet to understand the psychology of people living here in India. We love our country, but we do not leave any chance to spread litter on our roads, parks and all other places wherever we can. We want ‘Azaadi’ within India, despite having all the Azaadi to burn and destroy public and private properties and commit the most condemnable offences such as rapes, murders etc.

We are very patriotic, but we do not leave any chance to leave our country and spend a comfortable life outside India for the rest of our life cursing the Indian systems. We consider Indian culture to be the best, but we do not leave any chance to make fun of our Prime Ministers.

To cut it short, we need to understand that if any of our measures are not working in our favour to achieve any of our targets, we need to rework on our strategy to achieve it and that is what the government has not been able to do in case of its flagship gold scheme – Sovereign Gold Bond Scheme. Despite the gold investment giving negative returns in the past two years or so, the lure of buying gold in India is not going down and the government has failed to curb the demand of physical gold.

After two consecutive unsuccessful attempts, the government will be launching its third tranche of gold bonds from Tuesday, 8th of March. The scheme will remain open till March 14 and the bonds will be issued on March 29, 2016.

Here are some important features of this scheme:

Issue Price – The investors can invest in these bonds at Rs. 2,916 per gram of gold. The issue price this time is higher than the previous two issues. Issue price for the first tranche was fixed at Rs. 2,684 per gram of gold and that of the second tranche was Rs. 2,600 per gram of gold.

The government could raise only Rs. 246 crore from its first issue in November issuing bonds with around 916 kg of gold and Rs. 798 crore from the second issue in January issuing bonds with around 3,071 kg of gold.

Issue Price Methodology – The issue price has been fixed on the basis of simple average of closing price for gold of 999 purity of the previous week (February 29, 2016 to March 4, 2016) published by the India Bullion and Jewellers Association Ltd. (IBJA).

Coupon Rate @ 2.75% p.a. – Sovereign Gold Bonds offer two streams of returns – one in the form of regular interest income @ 2.75% per annum payable semi-annually and the other in the form of increase or decrease in the market price of gold.

Tenor of Investment – These bonds will be issued for a period of 8 years from the allotment date, which is March 29, 2016, with an exit option from the 5th year on the interest payment dates.

Premature Redemption – In case of premature redemption (after 5 years), investors can approach the concerned intermediary 30 days before the coupon payment date. Request for premature redemption can only be entertained if the investor approaches the concerned intermediary at least one day before the coupon payment date. Redemption proceeds will be credited to the customer’s bank account.

Taxation – Budget 2016 has tried to make these bonds more attractive from taxation point of view. As per the Budget speech “It is proposed to provide that redemption by an individual of Sovereign Gold Bond issued by Reserve Bank of India under Sovereign Gold Bond Scheme, 2015 shall not be charged to capital gains tax. It is also proposed to provide that long terms capital gains arising to any person on transfer of Sovereign Gold Bond shall be eligible for indexation benefits”.

So, as an individual, whenever you redeem these gold bonds after holding them for 5 years, you are not liable to pay any capital gain tax.

Minimum and Maximum Investment – Investors are required to buy a minimum of 2 units of these bonds i.e. 2 grams of gold or a minimum investment of Rs. 5,832. On the other hand, you can buy a maximum of 500 units of these bonds or 500 grams of gold, which works out to be Rs. 14,58,000.

NRI/QFI Investment Not Allowed – Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in these bonds. Only Resident Indian Entities, including individuals, trusts, universities and charitable institutions are eligible to invest in these bonds.

Transferability – Though these bonds are tradable, but trading is allowed only once it is notified by the Reserve Bank of India (RBI). Bonds can be transferred also by execution of an Instrument of Transfer, in accordance with the provisions of the Government Securities Act.

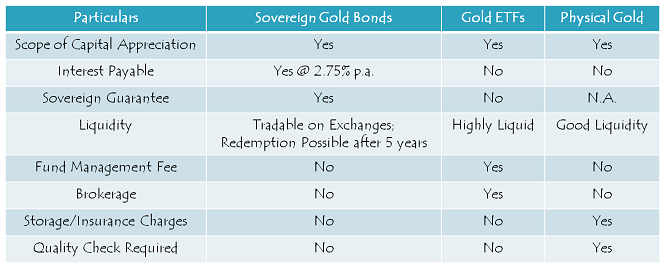

Sovereign Gold Bonds vs. Gold ETF vs. Physical Gold – A Comparative Chart

As you can check from the table above, almost all the points of comparison are in favour of these Sovereign Gold Bonds, except the liquidity thing. That too, I think is not a big issue as and when the RBI notifies these bonds to trade on the stock exchanges. So, if you are bullish about the gold prices rising from hereon and/or if your asset allocation permits you to invest in gold or gold derivatives, I think there cannot be any better option other than these Sovereign Gold Bonds. Personally, I think the government should first cut high import duties on gold to make them attractive for me from investment point of view.

Do you think these gold bonds make a good investment option for you? If ‘Yes’, please share why you think so. If ‘No’, please let us know why you think so. Also, in case you think I have missed anything in the post above, please let me know. I will incorporate that point in the article as soon as possible.

I had purchased gold bonds in tranche 2 but since at that time i was not having demat account i opted for physical certificate. Now i got one demat account and i want to convert my bonds to demat form soi that i can trade them on NSE. What is the procedure for the same. Banks Customer care is clueless about that.

As per my view trading in Gold is better than Gold Bonds. Bonds gives only 2.75% of interest we can get more than that by gold trading. Gold trading didn’t have certain time bound as gold bonds have we can gain immediate returns when ever we want by trading. I used to trade in Gold by taking the service from SquareIndia Advisory Pvt Ltd which helped me to get better returns what ever the market conditions may be. This only happened by their experience and brief analysis. They also provided me with Live and Local Bullion Rates. So, i would like to suggest SquareIndia Advisory Pvt Ltd to gain better returns, i’m sure you will not be regretted for your decision .

Does anyone on this forum received half yearly interest(@2.75% pa) due on Aug 8th for SGB Tranche II? It should have been credited to bank account linked to demat, but not credited yet. Any suggestions?

Hi There !

I bought these bonds in 4th tranche in demat form through sharekhan.

As u know they have not yet listed in any exchange.

I need money urgently,

My question is

How can I sell these bonds which I have in demat form, even before they get listed ?

I have got bonds allotted to me and the amount is debited from SB account. However, till today the bonds are not credited into my demat account.

Whom should i contact?

i’m new to this Sovereign Gold Bond Scheme Tranche 3 . i have purchased 1 gm of gold bond worth rupees 3119/- on 20-jul-2016 via hdfc bank because i’m a hdfc bank account holder. till date I’ve not received any acknowledgement . and one more doubt whether this gold bond scheme will deduct amount once in a while or every month. if deduction is continuing for every month means when will it stops deducting money from my account

NO PHYSICAL (HARD COPY) CERTIFICATE RECEIVED FOR MY INVESTMENT IN III ISSUE OF RBI GOLD BOND SCHEME. MY BANK THROUGH WHICH I HAVE APPLIED IN NOT RESPONDING MY REQUEST FOR THE SAME. TO WHOM SHOULD ASK NOW?

Will the gold bond certificates be sent to our address or should we go to the bank and collect them ?

As i have changed my address after paying for the bonds

What is the next step that i have to take

I had purchased Gold Bond of Tranche 3 on 14 th March,2016 through SBI Br , Jodhpur Park,Kolkata. But till date no holding certificate is issued or any mail is sent to me for allotment order but amount is deducted from my A/C. Whom and where I will make complaint-Shyamal Kr Mukhopadhyay, 25.07.2016

I am planning to buy the previous tranche which are listed on exchange. Any thoughts why it is better to buy in the current tranche (ie initial offer) than to buy in secondary market, as the underlying metal price is same.

Tranche 1 is listed on BSE & NSE

https://www.nseindia.com/live_market/dynaContent/live_watch/get_quote/GetQuote.jsp?symbol=GBNOV23&illiquid=0&smeFlag=0&itpFlag=0

Hi Sir,

I invested in Tranch 2 a total of 52000 (20 grams at 2600 per gram), but I am yet to get any interest which was said to be paid out at 2.75% semi annually.

I purchased it in my sons name (minor) through SBI, so I had no hassles all through, they allotted on 1st Feb and confirmed it on 8th Feb, got my physical certificates on 9th Feb 2016.

Question: When is the semi annual calculation done, 6 months from the allotment date which would be 8th Aug, or do they follow something else, I was actually expecting it by June end 2016 keeping with other financial institutions half yearly interest payouts?

I have applied for Gold Bonds Tranche 3 thru SBI at there Noida branch. Amount had been debited in March itself. However, till date I have not received any gold bond certificate for my investment from RBI or SBI. No help from SBI bank. When can I expect to get my certificates?

When is the next Tranche coming up? There was a new launch planned end of June as I understood.

Hi SB,

Next tranche of Sovereign Gold Bonds is expected by mid-July.

IPO from Mahanagar Gas Limited.

More info @ https://www.moneydial.com/ipo-mahanagar-gas-limited/

BSE got RBI approval to start Online Bidding Platform for SGBs.

More info @ https://www.moneydial.com/bse-got-rbi-approval-start-online-bidding-platform-sgbs/

#Niveza #Review on #Share #Market #Tips::

On the commodity market front, CRB saw some rise on the continuous upside in crude prices and some rebound in base metals. Bullion counter is expected to extend its downside momentum on stronger greenback on the back of fear of interest rate hike in FOMC June meeting and also on improved economic data. However, some short covering at the lower levels cannot be denied. Gold can trade in the range of 28200- 29700 levels while silver can move in the range of 37800-41000 levels in the near term. Crude oil prices further direction will depend upon the outcome of the OPEC meeting on June 2 in Vienna, Austria. In the last OPEC gathering in mid-April, members failed to agree on a production cap. Recently supply disruptions and improved demand outlook have lifted the prices higher. Base metal counter can witness some lower level buying while Zinc may continue its upside on supply concerns.

Stocks to watch: Talwalkars Better Value Fitness is on the upside while Bharti Airtel is on the downside.