This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

The government is doing all it could do to curb the demand as well as imports of physical gold, but the government is yet to understand the psychology of people living here in India. We love our country, but we do not leave any chance to spread litter on our roads, parks and all other places wherever we can. We want ‘Azaadi’ within India, despite having all the Azaadi to burn and destroy public and private properties and commit the most condemnable offences such as rapes, murders etc.

We are very patriotic, but we do not leave any chance to leave our country and spend a comfortable life outside India for the rest of our life cursing the Indian systems. We consider Indian culture to be the best, but we do not leave any chance to make fun of our Prime Ministers.

To cut it short, we need to understand that if any of our measures are not working in our favour to achieve any of our targets, we need to rework on our strategy to achieve it and that is what the government has not been able to do in case of its flagship gold scheme – Sovereign Gold Bond Scheme. Despite the gold investment giving negative returns in the past two years or so, the lure of buying gold in India is not going down and the government has failed to curb the demand of physical gold.

After two consecutive unsuccessful attempts, the government will be launching its third tranche of gold bonds from Tuesday, 8th of March. The scheme will remain open till March 14 and the bonds will be issued on March 29, 2016.

Here are some important features of this scheme:

Issue Price – The investors can invest in these bonds at Rs. 2,916 per gram of gold. The issue price this time is higher than the previous two issues. Issue price for the first tranche was fixed at Rs. 2,684 per gram of gold and that of the second tranche was Rs. 2,600 per gram of gold.

The government could raise only Rs. 246 crore from its first issue in November issuing bonds with around 916 kg of gold and Rs. 798 crore from the second issue in January issuing bonds with around 3,071 kg of gold.

Issue Price Methodology – The issue price has been fixed on the basis of simple average of closing price for gold of 999 purity of the previous week (February 29, 2016 to March 4, 2016) published by the India Bullion and Jewellers Association Ltd. (IBJA).

Coupon Rate @ 2.75% p.a. – Sovereign Gold Bonds offer two streams of returns – one in the form of regular interest income @ 2.75% per annum payable semi-annually and the other in the form of increase or decrease in the market price of gold.

Tenor of Investment – These bonds will be issued for a period of 8 years from the allotment date, which is March 29, 2016, with an exit option from the 5th year on the interest payment dates.

Premature Redemption – In case of premature redemption (after 5 years), investors can approach the concerned intermediary 30 days before the coupon payment date. Request for premature redemption can only be entertained if the investor approaches the concerned intermediary at least one day before the coupon payment date. Redemption proceeds will be credited to the customer’s bank account.

Taxation – Budget 2016 has tried to make these bonds more attractive from taxation point of view. As per the Budget speech “It is proposed to provide that redemption by an individual of Sovereign Gold Bond issued by Reserve Bank of India under Sovereign Gold Bond Scheme, 2015 shall not be charged to capital gains tax. It is also proposed to provide that long terms capital gains arising to any person on transfer of Sovereign Gold Bond shall be eligible for indexation benefits”.

So, as an individual, whenever you redeem these gold bonds after holding them for 5 years, you are not liable to pay any capital gain tax.

Minimum and Maximum Investment – Investors are required to buy a minimum of 2 units of these bonds i.e. 2 grams of gold or a minimum investment of Rs. 5,832. On the other hand, you can buy a maximum of 500 units of these bonds or 500 grams of gold, which works out to be Rs. 14,58,000.

NRI/QFI Investment Not Allowed – Non-Resident Indians (NRIs) and Qualified Foreign Investors (QFIs) are not eligible to invest in these bonds. Only Resident Indian Entities, including individuals, trusts, universities and charitable institutions are eligible to invest in these bonds.

Transferability – Though these bonds are tradable, but trading is allowed only once it is notified by the Reserve Bank of India (RBI). Bonds can be transferred also by execution of an Instrument of Transfer, in accordance with the provisions of the Government Securities Act.

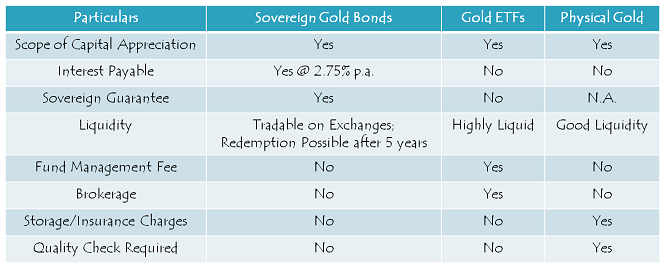

Sovereign Gold Bonds vs. Gold ETF vs. Physical Gold – A Comparative Chart

As you can check from the table above, almost all the points of comparison are in favour of these Sovereign Gold Bonds, except the liquidity thing. That too, I think is not a big issue as and when the RBI notifies these bonds to trade on the stock exchanges. So, if you are bullish about the gold prices rising from hereon and/or if your asset allocation permits you to invest in gold or gold derivatives, I think there cannot be any better option other than these Sovereign Gold Bonds. Personally, I think the government should first cut high import duties on gold to make them attractive for me from investment point of view.

Do you think these gold bonds make a good investment option for you? If ‘Yes’, please share why you think so. If ‘No’, please let us know why you think so. Also, in case you think I have missed anything in the post above, please let me know. I will incorporate that point in the article as soon as possible.

I have not got the gol bond certificate for my investment in March 2016 scheme. Bank says I will get by email and that the bank has given the receipt for the investment. Whom to contact to know whether I am allotted the nond or not.

If your bank account is debited for the amount of Gold Bonds subscribed be rest assured you will get the Bonds. If no payment has been debited to your bank account for the bonds applied for, then be sure you will NOT get any Bonds.

RBI does not seem to be playing fair in this regard.

Hi ,

Is the government planning to come up with fourth tranche of SGB? I am looking forward to invest in SGB. Wanted to know approximate timing so that I can plan by cash-flows accordingly.

Regards,

Harsh Parekh

i subscribed for gold bond tranche III March 2016. As per the condition they were to issue the bond on 29-4-2016. It is more than a month but i have not received the bond. whom should i contact. is there any website to find out the allotments

mukuntharajan

I ,too, have not received any hard copy of SGB till date.You may send your complaints to : Chief General Manager and Banking Ombudsman,

Reserve Bank of India,

6, Sansad Marg, New Delhi

I have applied for Gold Bonds Tranche 3 thru ICICI bank Online platform. Amount have been debited on 29th March (which was liened earlier). till date I have neither received any holding certificate letter/pdf from RBI nor any getting credited to my demat. No help from ICICI bank. Pls help.

any idea if 4th tranche will open for Gold Bond? Has earlier tranche listed in DMAT? any idea on their BSE NSE code?

Hi Siv,

Any idea as to when these bonds will start appearing in one’s demat a/c? I’ve subscribed to both the II and III tranche and other than an email from RBI with the details in a PDF, I haven’t seen this getting credited to my demat a/c.

I got my bond applied in Jan delivered to my DMAT now in June, Since following up with Bank didn’t help sent an email to [email protected] forwarding the earlier received email confirmation from RBI in Jan, within a week’s time it got delivered. However I had received the softcopy of the bond certificate in Feb.

right same here no listing in dmat but went from saving account

Infibeam Incorporation Ltd IPO of worth 450 crore.

http://moneydial.com/infibeam-incorporation-ltd-ipo-of-worth-450-crore/

Bharat Wire Ropes Ltd IPO details

http://moneydial.com/bharat-wire-ropes-ltd-ipo-details/

What about income tax on @ 2.75interest to be received?

It is taxable!

Dear Shiv,

Allow me to add one point from Portfolio perspective. Over a period of last 25 years, Indian rupee has depreciated by around 4% p.a. Also RBI is going for a 4% to 6% CPI p.a. over the medium term. As Gold in Rupees has been a good hedge against Rupee depreciation & against CPI, it’s reasonable to expect Gold price appreciation at 4% to 5% p.a. in coming years, particularly Gold Has fallen a lot in the last 2-3 years. So, if you add 4% to 5% Gold price rise p.a. to 2.75% p.a. interest, youa are looking at 6.75% to 7.75% p.a., minimum. So it may not be bad idea to invest upto 5% of your portfoilio in Sovereign Gold Bond Scheme, as a Rupee and inflation hedge. Thanks for all the useful info you are putting up. Best Wishes.

M.Lakshmiram.

Dear Mukul and Kartavi,

I had applied through Andhra Bank (non DEMAT) and got the allotment certificate (printed copy from the email sent to the bank from RBI) within a week of allotment. No physical certificate received.

Thanks Man. Is there any RBI contact detail in the allocation mail you received which can be used to enquire? Can you pl share.

No contact info. Got the certificate as shown here:

http://rbidocs.rbi.org.in/rdocs/content/pdfs/HOLDC140115_FC.pdf

I get also the same sbi e-mail copy of holding certy.

Third tranche of Gold Bond Scheme (GBS) of worth 1,050 crore.

http://moneydial.com/third-tranche-of-gold-bond-scheme-gbs-of-worth-1050-crore/

Hi Shiv,

I like most (if not all) the post that comes through this blog, as they are crisp and to the point without missing any point. In my opinion 1st 2 para of this post were not worth reading at this esteemed finance blog.

I prefer Goldbees as my preferred vehicle of investment. Because for Last One and half year of I was & am relatively more bullish on Gold compare to Equity or Bonds. (Gold rose by 10%, Equity fell by 13%: Relative Return of 23%)

Keeping my money in Goldbees, allows me to undertake advantage of small trading opportunities, both in Equity as well as Bonds. My broker allows me to buy anything against Goldbees. I need not liquidate it when I see any opportunity. And even if I need to liquidate for my some immediate requirements (like OFS etc or for any other personal reason) I can sell it any point of time.

I don’t wish to lock-in my money in Gold for 5 years. When I first bought Gold by selling equity, I thought I ll reverse it in 6-9 months period, though it stretched to 18 months and further I cannot completely rule out the possibility of it extending to 60 months, but this is not planned.

If I buy SGB, I ll have to necessarily wait till 5 years for liquidation, which is most dampening. If these are trade-able on BSE & NSE, I’ll immediately switch over to SGB from Goldbees.

For people like me, Gold, Equity or any other asset class all are at par. I personally don’t like gold chain and Ornaments. But Prices of asset class matters the most, then liquidity and ease of transaction.

Would be thankful to you, if you can tell us BSE & NSE code of SGB, as and when they get listed.

I HAVE PURCHASED SGB TRANCHE II (JAN-16) THROUGH SBI CAP SECURITIES.

TILL DATE, NEITHER I HAVE GET THE CERTIFICATE OF HOLDING NOR MY DEMAT ACCOUNT IS CREDITED WITH SGB.

SBI CAP IS TELLING THAT YET SGBs ARE NOT YET ALLOTTED BY GOVT / RBI.

IS IT TRUE ?

PLEASE GUIDE.

We give Commission on gold bond scheme .50% on total investment. 09462659179

RBI, it seems alloted Gold Bonds in Tranche II on discretionary basis. They did not allot Bonds to all. Check with ICICI, the lien amount from your account must have been removed without allotment. 🙁

It is surprising and beyond normal business ethics that RBI should act in such arbitary way and deny allocation ! RBI has acted like a shady business person not fulfilling his committment because the prices have gone up. Now in TrancheIII they are offering at over 2900 per gram. think one must persue the matter with fin. min. in this regard and more so as this is a scheme launched by none other than our most reverred PM,Shri Modi ji !

Hi Ravindra,

Can you explain how can we find out that it is allocated or not, I got reply form ICICI that rbi would have sent soft copies. If not allocated, why it is not credited back? Whom should we ask?

Regards,

Ganga Reddy

Hi

Thanks Shiv

How does one apply and how does one redeem ? Can we be sure that they will be listed else its really hard to redeeem govt instruments? Can we apply through icicidirect?

If government can put tax on 60% of EPF corpus then government can also put tax on 60% of “Soveriegn Gold Bond” Corpus. 🙂

Goverment backed savings instruments are not just illiquid – they are subject to taxes at will! 🙂

Anyone got allocation update from tranche II of SGB? They were supposed to be allocated on Feb 8th, but ICICI bank says it has not been allocated yet. Any updates would be useful on how to track.

RBI, it seems alloted Gold Bonds in Tranche II on discretionary basis. They did not allot Bonds to all. Check with ICICI, the lien amount from your account must have been removed without allotment. 🙁

It is surprising and beyond normal business ethics that RBI should act in such arbitary way and deny allocation ! RBI has acted like a shady business person not fulfilling his committment because the prices have gone up. Now in TrancheIII they are offering at over 2900 per gram. think one must persue the matter with fin. min. in this regard and more so as this is a scheme launched by none other than our most reverred PM,Shri Modi ji !

i also didnt got allotment for traces three but amt gone from my account

Finally I got it credited in my demat acct on 4th Aug.

Hi,

I had applied for SGB in 2016 March – 29 from ICICI Online account. As of now I haven’t received any receipt from ICICI or RBI.

Following up with ICICI but it became like I am a ping-pong ball. If I go to bank they say call to customer care as I had applied through online. If I call customer care they say go to nearest bank and check with them. I am totally frustrated with this kind of response from ICICI.

For the recent tranche I had applied in Sharekhan and received a receipt for the same.

Anybody applied in ICICI for SGB Tranche III and got the bonds either in physical format or DEMAT format.

Regards,

GSR

When will these start trading in exchanges?

With 2 tranches already past, RBI/govt should have atleast clarified when these will be listed on exchanges.

whenever equity is falling gold balance my portfolio. so i keep 10 % in gold

and buy some index funds at crashing market price. this help me get big returns in bonds & equity without much mental volatility pressure.

Where does one apply for these? What documents are needed?

investing in soverign gold bonds is safe compared to physical gold. But the price of third tranche is very high compared to first and second tranches. The interest percent of 2.75 for one year is also to be linked with market price of gold(based on avg price of last 6 months). So the scheme can be more attractive.

Its more safer and profitable

Benefits

1) Additional interest rate of 2.75%

2)The bond is valued at same price as MRP gold rate

3) No issues of purity or theft

4) If the gold price is increased whrn u choose to sell the bond , you get additional profit margin for the difference

5) You can avail loan against it as well