This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Last Year’s Post – Post Office Small Saving Schemes – FY 2015-16 Interest Rates – PPF @ 8.70% & Sukanya Samriddhi Yojana @ 9.20%

In a move which could disappoint many small savers here in India, Finance Ministry today decided to reduce interest rates on many of its small saving schemes, including Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), National Savings Certificate (NSC) and Senior Citizen Savings Scheme (SCSS) among others. These rates will be effective April 1, 2016 and will be subject to a quarterly revision based on a new formula to determine these rates.

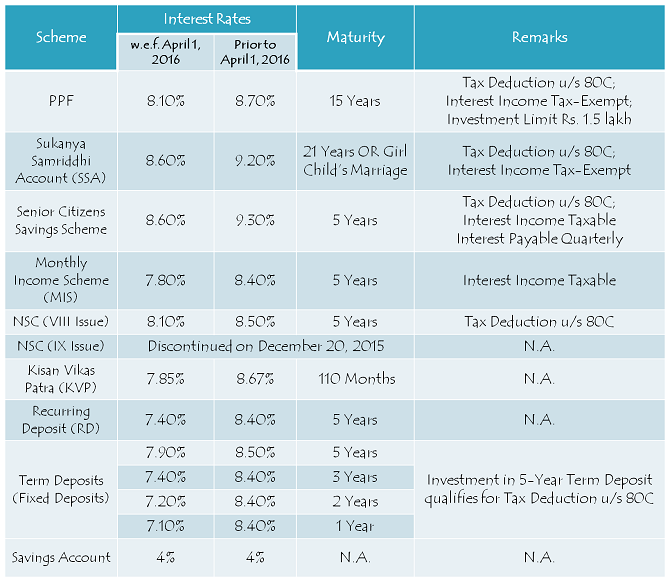

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the next financial year 2016-17:

Public Provident Fund (PPF) – Rate Cut from 8.7% to 8.1% – There has been a significant cut in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.10% for the next financial year as compared to 8.7% for the current financial year. However, interest rate on PPF continues to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Yojana (SSY) – Rate Cut from 9.2% to 8.6% – Government’s pet scheme for girl child, Sukanya Samriddhi Yojana, has seen a rate cut to 8.60% from its present rate of 9.20%. But, there is still a gap of 0.50% between this scheme and PPF, which would likely keep its popularity intact.

Interest earned on Sukanya Samriddhi Yojana is also tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Senior Citizens Savings Scheme (SCSS) – Rate Cut from 9.3% to 8.6% – Senior citizens will also feel disappointed as the interest rate on Senior Citizen Savings Scheme has also been reduced to 8.60% from 9.30% earlier. The interest earned on this scheme is taxable and subject to TDS as well. But, the investment made gets you a deduction of up to Rs. 1,50,000 under section 80C.

Post Office Monthly Income Scheme (POMIS) – Rate Cut from 8.4% to 7.8% – Post Office Monthly Income Scheme will also have a steep cut in interest rate from an earlier 8.40% to 7.80% effective April 1. Following this rate cut, Post Office MIS will go out of favour with many of the investors.

National Savings Certificates (NSCs) – Rate Cut from 8.5% to 8.1% – Effective December 20, 2015, the government stopped issuing 10-year NSCs. Now even 5-year NSCs will have a rate cut, from 8.50% to 8.10%. Your investment in NSCs will keep giving you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Tenure Raised from 100 Months to 110 Months – Your investment in KVP was promised to get doubled in 100 months earlier. But, from April 1, you’ll have to wait for 10 months more to get the same benefits. Effectively, this scheme will earn you 7.85% now.

Impact of Rate Rationalisation on Small Savers, Borrowers and Indian Economy

Though the government would be criticised badly for this move and the opposition parties would try to take maximum benefit out of small savers’ emotions, I would term it as one of the best moves by the Modi Government. Why am I saying this? This move will send the right signals to the global investors as well as to the Reserve Bank of India (RBI) that the government is serious about removing anomalies existent in our systems and also meeting its fiscal deficit target of 3.5%. This move, along with an expected rate cut by the RBI, is going to put more pressure on the lenders to cut lending rates in the system. It will also reduce the borrowing costs of the government, as well as many of the corporates which are currently burdened with high debt in their books.

CPI Inflation, which matters to you and me the most and was ruling in double digits during the UPA tenure, has come down to 5.18% in February 2016. WPI Inflation, which measures wholesale prices of goods and services, has been ruling in the negative zone for a very long time now. This fall in inflation is a result of a slump in the global commodity prices and crude oil prices.

Small savers need to understand that interest rates on deposits and other investments have also come down in the last 2-3 years. During FY 2013-14, our favourite ‘AAA’ rated tax-free bonds carried as high as 9.01% rate of interest. These same ‘AAA’ rated tax-free bonds carried a maximum coupon of 7.69% in the current financial year. So, effectively a fall of 1.32%.

If you compare this fall of 1.32% with a 0.60% reduction in PPF’s rate of interest or 0.40% in NSC’s rate of interest, I think the cut is truly justified. Rest I think it is very difficult to keep everyone happy in the country and at the same time, carry out economic reforms for an overall development.

Ahead of polls in five states in April-May, I would call it a truly bold move by the government. This act of rationalising interest rates will benefit the borrowers immensely, which in turn will create a right balance in the economy.

Hi Shiv

It is very much true that the interest rates offered in India are offered nowhere else in the world.Govt has to show significant infrastructure growth for all these cuts.Education is one place I see useless direction and interference in universities but nothing at school level. Improving the municipality school standards and conditions will kill the private school business and take this country far ahead. This is where US wins over rest, an extremely strong public school system. Singapore is definitely a great example for public transit. Delhi govt should have put more focus in building a exemplary public transit system instead of the silly odd/even rule.

People will appreciate economic moves when they see accountability in the system.More than Vijay Mallya the banks are more culpable and we are never going to see any action taken against the people who did the reckless lending.US subprime crisis was driven by greed and again no action was taken against the key participants(You must have watched or read “The Big Short”). Sadly it will never happen not in India nor anywhere in the world, only small fish get caught because politics is so interwined with the financial world.

Hi Harinee,

I completely agree with your views here. But, trust me, this government is working really hard to get things in order, unlike the dramas Delhi government is doing. It will take this government some more time to get its acts together and then once this big ship starts sailing, you will see a healthy growth taking this country to the next level. Vajpayee government also did an excellent job during his tenure, but the next 10 years whitewashed all his efforts. Privatisation/strategic sale of PSEs or their planned revival is the key here.

Yes Vajpayee govt never gets the credit it deserves.It is the divisiveness within BJP which doesn’t allow marketing of their achievements.The only power surplus states are BJP ones but most people have no awareness of this.

Hi Harinee,

India’s time will come, negative forces will be defeated sooner or later.

Are these rates applicable for older deposits as well. Suppose, I open a SCSS (currently at 9.3%) on 31st March, 2016. Will reduced rate of 8.6% (effective from April 1, 2016 and to be reviewed quarterly) be applicable on my savings as well. Regards

No Mr.sailender,

Once u booked before 31st March, u will get 9.30% till the end of the tenure of ur deposit.

Yes Mr. Bali, I also was worried as no official clarification yet from Govt., BUT I think it will not be so for old deposits, so still few days before 31 st March 16 comes, hope some authority or Mr.Shiv confirms immdtly now with full confidence for all such readers like u and me !!

Hi Mr. Hemant, Hi Mr. Bali,

SCSS investors will keep earning 9.30% (or whatever rate they invested at) for the entire tenure of 5 years.

thanks a lot Shiv,for your swift response,

also pl.let me know if the same fix interest for PPF also ? OR effective from April 1, 2016 to be reviewed quarterly ? then what a person like me will get after long 15 years in PPF !! may be interest rate that time will come down to 2 % ??

I think this is very ridiculous step of govt.

Hi Mr. Hemant,

PPF interest rate will be reviewed on a quarterly basis w.e.f. April 1, 2016. At 2% PPF rate, India will be a developed economy. Then you’ll not call this move a ridiculous step of the government.

my opinion the intrest rates on small savings may be good in long way..

please think about senior citizens who will depend on this intrest .they don’t have any alternate investments like mutul funds which will give good returns after 5to6 years and no garentee…

pl. govt has to think about senior citizens .they can be given more tax exemption or no tax on their intrests…

thanq

Hi Mr. Rao,

I think the government is first required to think about those poor people of India who do not have money to get even two meals a day to survive and to live to see their children grow and become responsible citizens of India. Then only the government is required to think about Senior Citizens who can at least invest in these schemes.

Senior Citizens are already tax exempt up to Rs. 3 lakh of their income and over & above that it is very easy to avoid paying any tax if you invest to save tax u/s 80C. What else a common senior citizen of India requires to survive? We need to first think about the poor people of India. Not only this government, we also need to work for them.

I would like to know from any expert , how much reliance industry is benefitted by not lowering base rate of oil. I have not come across any article towards this aspect and want to know more towards this.

Hi Prakash,

You mean market rate of petrol prices or base rate of gas/oil?

Hi Shiv

First and foremost, I appreciate your positive outlook on both pros and cons of the issues involved. I live in Bangalore. Only thing that has come down during the Modi regime is the interest rate on all investments. We, senior citizens are squeezed by both the Centre and the State Govts. Prices of every single essential items like milk, water. power, fuel, vegetable and provisions has gone up while every investment options have cut their rates. This is economy!!!!!!!!!!

Thanks Hariharan!

I do not agree with you here. I think the prices of most of the essential items have either fallen here in India in the last 18-24 months OR have risen at a slower pace than the growth in income levels. Please make a list of 50 items you use in your household and compare their prices today and the prices which were there in May 2014 and you’ll get to know what I am saying is correct and I don’t want to give all of its credit to the Modi government. It is the global factors in many of the cases which have led to a sharp decline in commodity prices.

Moreover, you would agree with me that it is our income levels which are giving us more liberty to spend higher outside. We spend a minimum of Rs. 2,000 for a weekend movie and dinner for two these days as compared to around Rs. 300-400 for the same 15 years ago. Our children easily buy iPhones worth Rs. 30-40K these days as compared to how we used to buy phones for ourselves 15 years ago.

We easily spend Rs. 5 lakhs on foreign holidays and many Indians do that these days, it was not easy to spend such a money 15 years back. School fee for 2 children costs us a minimum of Rs. 1 lakh per annum these days as compared to Rs. 10,000 per annum 15 years ago. Medical costs were also lower 15 years ago. So, it is our income levels or our lifestyle which is resulting in higher spending rather than the government acting against its pubic.

If I invest in Senior Citizen FD account before 31st March, will I still get annual fixed interest rate of 9.3% for 5 years, payable quarterly ?

Yes Arun, you’ll get 9.30% rate of interest.

Hello Shiv and others, this one seems to be a good discussion with Shiv having provided some insightful responses.

But Shiv, without going into a whole lot of detail here, I would like to mention that though the steps taken by the Govt might be in the right direction, they pitifully address only one side of the story. Multiple other critical things need to be addressed before or alongside this. Having gone ahead with just the angle of rate cuts shows lack of knowledge and understanding on what needs to be done to arrive at a better overall economic state in the country. These so called economists and their quasi economics gets so lame, every time.

Just comparing on similar instruments between say India and the advanced countries (example US), you can see the wrong that is being done here – cost of living is much cheaper there, people have social security, etc. Many other countries even have free health insurance. Simply put, people are not at high risk on their livelihoods before and after retirement. Please also check on the proportionate income and expenditure quotients between India and US. Does the average Indian even know now how much is going to be enough to support his family even the next year? Prices of life essentials in US have not moved for so many years now beyond a necessary minimum. And you see the state of affairs in India…

Whoever tries to justify govt actions, is doing nothing but giving a big thumbs up to the act of the real Indian working class, salaried private workers and retirees, perpetually being forced to pay for the expenses of govt and govt employees at the cost of their future.

What the govt needs to do rather to counter their debts, etc is to have educated people in the govt, understand the uniqueness attached to India as a country, revise the constitution, have govt establishments become profit centers or sell them off, generate increased and new sources of revenue, cut out sick establishments including their own free perks. govt offices should become accountable and stop handing out default pay, perk and pension packages to themselves. Then come things like social security, savings instruments, etc. There is so much more, but this can be a start. Thanks.

Hi Priyam,

I agree with you that a whole lot of things need to be corrected here in India and the time is NOW, NOW and NOW. We’ll be very unfortunate to live in India if we let away this golden opportunity to rebuild India as the next superpower.

But, can you please explain me how other developed countries achieved high growth? By creating anomalies or by removing them?

Who is responsible for India’s current state – Modi Government, Congress, State Governments or we the people of India? I think Indian democracy and its constitution are its biggest strength as well as its problems. It takes a lifetime in India to correct anomalies. GST bill, which even Congress supports and says it is our bill, has failed to see the light of the day till today because Congress will not allow the bill to get passed till Mrs. Sushma Swaraj is made to resign for her so called support to Lalit Modi to fly out of India. This is pure politics and nothing else. These politicians are not for you, but for your votes only most of the times.

You are saying that there is a hell lot of difference between India and the developed countries like the U.S., but then you are comparing India only with the U.S. Please compare India with all other countries, not only with the U.S., with Japan, U.K., Singapore, Pakistan, North Korea, Somalia, Zimbabwe, Greece, Spain etc. Each country has its positives and negatives.

I think India still is a much cheaper country to live in as compared to the U.S. and other developed countries. If the prices of essential goods have risen here in India in the last 15 years, so have the income levels of a common Indian citizen. What was your family’s average monthly income in 2001 and what is it now? I am 100% sure that standards of living of more than 90% Indians have improved considerably in the last 15 years.

I completely agree and strongly support your thoughts you have listed out in the last para of your comment. India needs more people like you with positive and growth-oriented mindset.

Hi Shiv

As these rate cuts are effective from 1st april can i buy KVP and NSC at old rates NOW?. If i buy now will the rate reduction will be applicable for those purchases also once we reach 1st april?

Also what abt the KVP/ NSCs which i hold now. Will there be any change in interest / marurity period for those instruments

Hi Kumar,

This rate reduction will NOT impact your new as well as existing investments made in KVP and NSC prior to April 1, 2016.

Just going a bit offtrack from this topic, can the lenders to Mallya’s venture auction assets of KFA or lease it to some other airline /or service. Like Amazon is looking to lease flights for its single day delivery of its ecommerce consignments 🙂 … this way atleast something can be recovered … otherwise its no use just beating the bush & wait for Mr. Mallya to return

Hi Sandeep,

Banks are trying their best to monetize KFA’s assets, but either the value of the assets is too less to recover even 5-10% of their loans or they are not easily saleable.

Yes, I agree with you Hemant, by raising excise duty several times, it seems that the government has once again brought in some kind of regulation. But, trust me, a country like India does not deserve low Petrol & Diesel prices and I am sure, more than 90% of urban population would agree with me on this. Won’t you?

Moreover, will you pay Rs. 150 for 1 litre of petrol, if crude prices cross $100 per barrel in 6 months time i.e. a jump of 150% from $40 per barrel now ?? You will not and I am sure nobody will. That is when this government will have to absorb the losses and cut its excise duty on petrol & diesel. This is a democratic country with mindless media, unlike North Korea.

As far as the matters of NPAs and wilful defaulters are concerned, you would also agree with me that businesses do fail. Very few people expected crude prices to fall from a level of around $120 per barrel to $26.50 per barrel and nobody knows (except God) where the prices would be in 6 months from now. Very few people expected big American banks to fail during sub-prime crisis in 2007-08 and you know what, this crisis was a result of two big anomalies in the system – low interest rates and sky rocketing property prices.

If people knew about KFA’s fate, its employees would have been the first to shun the airlines. I am not advocating here any wilful defaulters, like Vijay Mallya. But, businesses do fail and it becomes difficult sometimes to survive. You will see the KFA case going to the Supreme Court and Vijay Mallya coming out of it without any major liability to pay banks’ loans because under the law, a business and an individual are two distinct entities and the law cannot force an individual to pay up for the defaults of a business.

However, I do agree that the government now has the opportunity to make stricter laws against wilful defaulters.

Good article and good discussion. In my opinion, the Govt. is doing a right thing by lowering interest rates on small savings, which will trigger lowering of interest rates on fixed deposits first and then lowering of interest rates on loans (be it home loan/personal loan), good for boosting spending and infrastructure developments.

However, at the same time, Govt. although the prices of Fuel are de-regulated, by raising excise duty several times in the recent past, in a way again bringing a regulation in place. Which I think is not fair!

Also, the timing of some these moves, like first announcement of tax on EPF and then rollback of that decision and now immediately lowering the interest rates is not going well for the Govt.

Govt is not acting swiftly on defaulters and bad NPAs of the banks, afterall for all the Govt. funded banks the money is going through taxpayers pockets.

If the Govt. expects us middle class tax-payers to co-operate then it should also act Swiftly against many such things..

Hi Shiv,

As you are a wise financial planner, you may write an article and advice average middle class people like me what are the best options available for right investment road to take at the current scenario, say from 1st April 2016 onwards.

Now TFBs are the thing of past, what about corporate FDs, Bank FDs,Gold funds,MFS, SIPs, Stockmarket etc…I think many people will be interested to read. You are doing a good job.

kind regards

Thanks Dr. Paulose!

I will definitely try to write a post on it sometime in April.

if I open recurring account in a post office before 1st April 2016 will I get 8.40 % or 7.8%

8.40%

Do you need a loan at 2% if yes email me [email protected]

Govt does not mean that it is for business and generating rvenue. They have to consider all section of people. Poor, middle and upper class for their well being.

These kind of savings are not only help for retirement, we have to consider children education which fees/donation are all sky rocketting and medical.

I doubt inflation rates are calculated considering these factors also.

Hi Srinivasan,

Inflation is calculated considering most of these factors. But, why don’t we raise our voice against private schools charging abnormal fees and asking for high donations and hospitals for having high medical charges? I think a government should always work like a company i.e. with 100% professional attitude. It must be made accountable for every rupee spent on infrastructure and for growth. People have been looted here for years by the previous governments and many of the state governments. Now is the time to work for a better India.

Thanks Shiv,

In my opinion, govt should not act like a banker. It is not only for business.

As you told, we raised our voice and brought change of guard in last lok sabha elections. However if current govt does not make any difference with previous govts it is frustrating.

When MMS took over as fin minister he told people should be ready to take bitter pills. If a patient has to take more and more bitter pills than food every year for 25 years, the patient will think why should he live?

I beg to differ on your opinion on this…

Hi Srinivasan,

Differences in opinion are most welcome here on this forum! If people are not ready to take bitter pills for better health, they should keep themselves fit on their own.

I have already invested in SCSS in Jan 2016 with the interest rate 9.3% at SBI. Will this investment affect due to yesterdays declaration of reduction of interest rates from 1st April? Will I continue to get interest at 9.3 or it shall be 8.6 ?

No Venkatraman, this reduction will not affect your investment in SCSS.

Cutting down PPF interest rate is very bad idea. It’s a special financial instrument for common man to make some savings for retirement in a Country where social security is nil.

I’m afraid with this kind of over enthusiastic approach the Govt. digging it’s own grave. It’s deceiving the very same people who has voted it.

I have been supportive of govt efforts so far, but it seems the Babus (so called Economists specially inducted in to finance ministry) are misleading the govt.

PPF always had a special status and crores of people, mainly those who can’t use EPF are solely dependent on PPF for their retirement planning. Treatment PPF at par with all other products is a foolish act.

Why Govt is after, hard earned middle class and poor people’s money and watching largest corporate defaulters openly ‘escape’?

Govt already taken a U-turn in case of EPF withdrawal issue, hope better sense prevails again.

Hi Vasu,

For retirement, one should invest in NPS or EPF or probably equity mutual funds. It is not the government’s job to keep on subsidising these schemes. PPF always had a special status and continue to have a special status by being an EEE scheme. Interest rates on PPF, SSY and SCSS are still subsidised even after this reduction. The government in this country cannot be against its people, at least in the public domain. Can you send your children abroad for a lavish holiday when you don’t have money even for your basic necessities like food, shelter etc.?

Acche Din has come.Put UR hand up and dance.

You are an educated person. Education is not only meant for getting a job but also to find out what is good and bad. Why don’t you find out the fact by calculating how much money you loose every month with the new rate and old rate. You may read my comments

This is a well written article , for a growing economy , one should have the mindset like the author of this article ,

Thanks Vikas!

Article is well written and understand the mindset of the author, but the common man is not mindless.If the elected politician of our society cannot help the many who are poor, it cannot save the few who are rich .

They will be paying the price in the coming elections..

That would again be a bad decision by the voters. If the current government is not able to take this country in the right direction, then God knows what will happen when leaders like Lalu Yadav, Akhilesh Yadav, Mamata Banerjee, Rahul Gandhi, Kejriwal would rule this country.

Shiv Kukreja

Please do not quote the names of political leaders.It proves you are also biased.You can disclose your opinion about Hon’ble FM decision either in favour/against for the betterment of the country obviously.rgds

Thanks Debasis for your suggestion!

Main responsibility lie on politicians and the media. Majority of them and their followers do not know how to calculate simple interest. They make comments without any study, Without basic mathematics there is no economics. Most of the politicians particularly commies are liars. To know more about interest rate read my comments

Please let me know whether the reduced rate is applicable for the existing MIS/NSC holders also,or it will applicable for those purchasing from 01.04.2016 on wards.

Please confirm.

Hi Debasis,

Except PPF and Sukanya Samriddhi Yojana (SSY), it will not affect any of your past investments, including MIS and NSC.

Thanks Shiv. What about Senior Citizen Saving Sceheme. If I had put money in Jan-2015 say 15 lacs. Will it continue to fetch 9.3% for the entire 5 years?

Yes Mr. Singh, you’ll keep getting 9.30% for the entire tenure of 5 years.

It will be applicable to new Accounts. or in any scheme is maturing after 1.4.2016 and a person want to renew the scheme further.

Hello Shiv,

all what you mean is this rate cut good for this country, but see practically, the govt/RBI has cut the interest rate many times, but how many time or was there any interest rate cut implemented by any banks? or was there any price decrease in the necessary articles those mostly using by common people. OK, take this petrol/diesel, how may time the price went down in international market and was this govt reduced the price accordingly?

Hi Mohanan,

Banks did not cut interest rate aggressively due to high interest rates elsewhere. Tax-Free Bonds and post office schemes carried artificially high interest rates so far, which increased the effective cost of deposits for banks. Now, tax-free bonds are history and interest rates on these schemes have been rationalised somewhat. Next 6-12 months will see at least 1% fall in the cost of deposits for these banks and many of us will also have a fall in our loan EMIs. Next 6-12 months will result in high credit offtake for these banks and will increase corporate spending for newer projects.

I have observed a price fall in around 90% of the products I use in my daily life, including food articles (except Dal etc.). Also, I can guarantee you that India is one of the cheapest countries to live in as far as the cost of living is concerned.

As far as the prices of Petrol/Diesel are concerned, again I personally think what this government did was the best thing a government could have done in a country like India. Firstly, the government was required to meet its fiscal deficit target of 3.9%, which it did by increasing excise duty on Petrol/Diesel. I think it was a good move. Moreover, I think, in a country like India, the prices of Petrol should be increased by at least Rs. 30-40 per litre for cars costing Rs. 10 lakh & above. Price of diesel should also be increased as diesel vehicles create a lot of pollution. Every penny of this rate hike should be given to organisations like Delhi Metro for creating public infrastructure. Go to Singapore and try to buy a car there, you’ll get to know what a bomb it costs to buy a car in that country. India needs to take some harsh decisions to become a superpower and compete with countries like China and the U.S. It is Now or Never my friend!

Mr.shiv kukreja have u gone mad to support such a mad move of government. All senior citizens who do not get pension will suffer very badly. Are u really going in market to purchase. Neeta peya has gone up from rs Four to rs.ten.simple vada pao has increased three fold.people who are buying big houses should not at the cost of poor old people.

By the grace of God, I am perfectly fine Mr. Makbul! Yesterday itself, I purchased 2 kgs. of Potatoes for Rs. 10 a kg., 1 kg. of good Tomatoes for Rs. 15 a kg and 1 kg. of Onions for Rs. 15 a kg. FYI, I live in Lajpat Nagar, New Delhi. I would advise you to cook your food in house so that you save on paying huge margins to the restaurant owners and service tax to the government on your food bills sitting in an A/C. You will definitely save a lot of money for your retirement years. Thanks!

Perfect reply Shiv !!! Its funny how people want low interest rates for their loans and want higher interest rates for their savings…. There are a bunch of free loaders in our country who want the govt to baby feed them all the time !!!

Completely agree Gaurav, we need to change our mindset!

Slashing Interest rate on PPF,Post office savings, Senior citizen saving scheme etc- is unfair.

Why the FM put axe on the neck of poorer sector, the common man in India.

Twenty-nine state-owned banks wrote off a total of Rs 1.14 lakh crore of bad debts between financial years 2013 and 2015 and the billionaire defaulters don’t understand what is poverty..

Bleed the ones who pay tax even more! This is unfair.

That is not correct Dr. Paulose! It is a move which would remove some of the anomalies in the system, we badly need to take such moves. No country in the world has so many small saving schemes and that too with such high rates. Even a growing country like China does not provide such high rates. Poor people do not pay any tax in this country. Poor people need work, employment and not subsidies.

Shiv, I politely disagree.We all know whats happening to the “growing” economy of China. Poor people do work hard, they are not leeches, they find it hard to survive these days . Hon. FM is indirectly telling the common man to use his tears as hair gel!!!!!

Agreement & Disagreement is part of a healthy discussion Dr. Paulose! I respect your disagreement! Next three years of this government will tell whether this decision was good for the country or not.

Hope and pray, It will turn out good for all of us…

What is not correct ? Is it correct that huge bank loan defaulters are left free to leave the country and common man has to bear the loss in the financial system? If the 2 lakh crore NPA is collected no need to burden the common man. Make new laws to recover the bad loans. Comparing with China is meaningless as the total environment of our country is different from foreign countries.India is not equal to China in all aspects. We need other changes like banning 10 cars following a minister and many wasteful expenditures to revive the economy. Govt thinks it is easy to get money form honest tax payers than from defaulters.

Hi Santh,

I agree with many of your views here. I think now is the time to act. Not only for the government, but we should also act. Why do we leave people like Mallya to leave his house? Can’t we stop him to step out on roads and board some airlines to leave this country? Can’t we stop him from celebrating in parties at places like Goa or Bangalore? Can’t we get hold of him in IPL auctions? If the law cannot force him to pay up for KFA loans, I think the same law will free you as well if you do something unlawful with him. Why don’t you do something? If you cannot, then please don’t blame the government because the law of this country does not allow the government to act unlawfully. But, I agree that now is the time to act and the government has done it right by reducing interest rates on these small saving schemes.

Sorry Mr. Shiv, I totally disagree with what you have written. It should not be expected from common man to come on streets for recovering loans from defaulters..it is govt job..these are elected set of representatives who are suppose to get it done..this is part of there job entitlements….I am not against BJP…but at the moment, there inaction is just a replica what cong has done over the years. General public is not holding them from preparing strict laws against these defaulters, then why only public has to face consequences of there inefficiency…He is a wilful defaulter from so many months..why he is still a MP…Slashing rates of small saving schemes is obvious and good news for public sector banks. I am not denying that. People are ready to support govt decisions, provided they are not politically motivated…like 7th pay commission is a big hole in govt pocket..don’t you think it is politically motivated…

Thanks Saurabh for expressing your views!

I also agree with you that it is not a common man’s job to come down on streets for recovering loans from the defaulters like Mallya. But, agree with me or not, it is not the government’s job either. The government also cannot order his arrest for what he has done. I am sure you would not agree with me on this, as most of the Indians. Just go to the court and check with some of the lawyers that Mallya cannot be arrested and made liable to pay for KFA’s loans. That is where the bankruptcy law is required and this government is already working very hard to get it passed – http://www.livemint.com/Money/27jZJSt1N5qYoVRP4xjrxL/Bankruptcy-law-key-to-tackling-the-burgeoning-NPA-issue.html

If you think this government is just sitting idle and not doing anything, like Manmohan Singh’s UPA government, then you are probably living in your own world. Go outside and check what all this government is doing on the ground level. Check what all India’s Railway Minister Suresh Prabhu is doing, you’ll be surprised by the pace of actions taken by his ministry. Talk to the companies which are associated with some of the government’s projects, talk to the companies which placed their bids for the mining auctions held last year.

Talk about the social welfare schemes started by this government, like Sukanya Samriddhi Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana, Atal Pension Yojana, Make in India, Skill India and many other schemes. Has PM Modi started all these schemes for himself? He has not taken a single leave since taking over this challenging role of a PM. That too, in a country like India, where people give 80 seats to Lalu Yadav for the dramas he does on TV and make a leader like Jagmohan lose in elections and then get lost from the media limelight altogether. Why you question only Mallya for still being an MP, why not Lalu Yadav, why not A Raja, why not Kanimozhi, why not so many other politicians?

I don’t know whether implementation of 7th pay commission is politically motivated or not, but I am sure it was required and is not going to benefit Mr. Modi or Mr. Jaitley personally.

I agree with your views. Please read my comments and spread the right message where ever possible.

Mr. Shiv, I think you know our laws. If a common man stops an individual, it is a crime. and it is the responsibility of Government bodies.

During UPA time major changes were made in the post office schemes. because all these interests are based on inflation. What ever I am writing here is based on detailed study. because I am a Senior Citizen and I am depositing a large amount in PPF. If i am deposited Rs. 100000/- in P F I may loss may loose Rs. 100/- compared to old rate. This is a negligible amount. If you want to know more read my comments.

Forced to buckle under pressure for his ill willed attempt to tamper EEE on EPF, now the Finance Minister took revenge on general Public by reducing int rates on providence funds and also, to frequently review them. This Jaitly will be safe bet for Cong opposition to bring down Modi govt by 2019. Seems, thats his personal goal ??? but Public are to bear his brunt.

Hi Mr. Suresh,

Can you please let us know what personal goals does Mr. Jaitley have achieved by cutting these rates? That too, at the cost of getting a lower vote share by you people. It takes many years to build a country, but it takes only a few bad steps to destroy it. This step is a wonderful move to rebuild our economy. We need to support it. It is not politics, it is simple economics. Would you pay 11% interest rate on your home loan when you can get the same loan at 8% or even lower?

I dont care what jaitley Does whether right or wrong, He will get positive or negative result for that. Big thing is Bjp has stop Post Office Monthly Income Scheme. Many were shock yesterday as post office were no longer accepting Re deposit after their period was over For India Post Mis scheme.

Hi Irfan,

That is not correct. Post Office MIS scheme is still running and will continue to exist even after March 31, 2016.

The reason may be March month is a financial year end and they may accept from next month.

Bandar Kya janey adrak ka swad

Please let’s reply in modest word .its a serious matter.

Cos of one word one’s image will change…..

Dear Shiv,

Just think for once that before doing what Mr. Jaitley did, it would have been very simple for him to understand that lot of public criticism will follow.

But as the author rightly pointed out that yields on bonds have been falling since 2 years you can check yourself by looking at the rates offered on tax free bonds. Hence these rates were long due to be revised downwards.

Also we need to understand that inflation has come down. See we should not be stupid as investors to ignore that component. We should always focus on “real returns” of our investment.

Lastly the move is not to save money for the government but to maintain prudent fiscal policies and channelizing of investments into development. What if this cut of 0.6-0.7% give a fillip to the economy and / or the real estate sector. We are bleeding money on those investments and we need money to be put in there.

Narrow / Short term view will make us see this as a cruel move, but its not a rocket science for the government to understand that few votes will turn against them by this action. Still they chose to go ahead with it makes it a bold long termish move!

Thanks Abhinav for sharing your views, I absolutely agree with all of them!

I completely contradict your statement and thought….

As an individual citizen this rate cut in interest will have a big blow on me….

In future I will not make any investment in government..

Rate cut of 0.5 to 0.6 % for one person will not be a big money , but from a total population of 120 CR even if 10% of population had invested which is 12 CR people the amount is significantly high…..

Best step that the goats should take is to take away all the money lying in ppf,mis,and other such schemes and distribute among industrialists like Mallya.

This govt is not at all thinking how the poor pensioners will survive when there is no social security net available.pensioners have to take care of their food and health.And this needs money.

Hope better sense prevail upon the existing rulers.

Who are the poor pensioners.? What is the yearly In come an individual?

BJP is the enemy of Aam adami.

I am a Senior Citizen and not a blind supporter of any leader. But Modi ji is the best leader. I do not agree to some of his actions. Bullet train and purchase of 36 Rafale planes etc But I support the reduction in interest rate. I have explained my views in my comments. Please go through.Today’s middle class people and Senior Citizens are the luckiest people in India. Today’s middle class people are the most pampered society in India. Senior Citizens and our school education are mainly responsible for the present condition. Majority of Senior Citizen’s brought up their children without them knowing the pinch of poverty. They do not know the sufferings of the poor people. Most of the middle class families are small and a maximum two children. They want all kinds of luxury items. I do not blame them. I also felt of purchasing electronic gadgets at that age. People particularly commies are blaming industrialist for not repaying the loan. It is not easy to run business in India so long commies are there in this country. But how many men in the middle class family have not repaid the money withdrawn through ATM cards. They won’t look after their parents and leave them in old age home. They think money is everything. Old people want the company of their grand children. When people become old the out look to wards life will change. So the expenditure will come down. But expenditure towards medicine will go up. Only thing they must do is that they should save good amount to cover hospital charges if they become sick. For that PPF is the best. Those Senior Citizens getting a yearly income Rs.2laks and more can invest money on PPF immediately after retirement. If required they can withdraw half the amount after six years, So the decrease in interest rate is not going to affect the middle class family or Senior Citizens as projected by the media or the slaves of the Sonia Congress or CPI(M) party.

Thanks Mr. Govindan for sharing your thoughts!

I am also a senior citizen who got retired in 2012 and after 38 years service in Govt U/T and a Pvt co. drawing pension of Rs.1917/M from EPS ( due to cumbersome rules of EPS on shift from Family pension to EPS). I am able manage my life since I properly planning funds since the beginning. But what about people in Pvt firms drawing a meager salary which fulfills only their essential food, clothing and education needs that too with great difficulty. Did he mean that the poor should not even think of giving good education to their children which is generally not there in most of the govt schools. Do Mr Govindan mean that recent amount of pension paid to all Category employees on retirement under the new pension scheme of EPF is 2 Lakhs per year as he assumes? (May be he thinks of only highly paid employees group not a middle class or Govt employees who take at least double digit pension) . Really for most of the retirees it never crosses above 1 Lakh. Now at market price even drinking water during travel costs Rs.20/ltr. and Life saving medicines and food grains prices has increased. How Mr. Govindan can expect people to save in PPF from pension amount. It is possible only if he don’t eat properly or don’t take timely suitable medicines for diseases he suffers due to old age.

Can Govindan explain how a person belonging to a upper caste will survive with his meager pension when he is not entitled for any type of subsidy / facility extended by central and state govts.

Reducing interest rates should be applicable only to the creamy layer people but not to one and all.

Salary is also growing as well as pension. All of Indians want is there money to grow, (country and its ppl are stupid idea, the poor sud die). It’s ppl like u who don’t know what is hard-work, get easy money as salary every month. But in this country there are hardworking ppl like industrialists(who have to earn livelihood for many), small labourers plus lots of unemployed youth for whom the leadership need to think. A country spends much than what it earns and it has to cut the expenses. If you are worried about the rate cuts why don’t you invest in shares. You will get to know what is difference between these trusted government schemes and others

Hi Mr Shiv, Please help me understand how country is getting build by the government. Government is pulling money from public and putting it into banks or industrialist pockets (corporate tax reduction). Small saving are people money already with government that they take for 15 years. Reduction of interest rate should not be allowed on money deposited in earlier year. If I deposited 150000 in FT15-16 then that amount should continue to earn interest at 8.7%. If they reduced interest to 8.1% then it should be applicable for money paid post april 2016 onwards and not on earlier amount. By looking at corpus amount that people have saved and deposited with government, doing back calculation and figuring out saving is back stabbing. Government can easily afford to pay even 10% interest rate on this amount if the wish is there (epf already pays more). However this government is industrialist friendly and support bankers who wipe out lakhs of crs every year from system. Paper currency gives government unlimited power and hope they would have utilized it to share country rich resources with people and not just with few chosen individuals. Government ideally should reduce bureaucrats/banks and have aadhar based, online review, disbursal of money. Wonder why banker who have already wiped crs are being trusted with being judicious this time in their loan grants. Lastly government does not change interest rates on bonds sold for 15-20 years, so why they change interest rate on money borrowed from small investor/savers in between period. Government has to wake up and do things drastically different. From service class perspective life is no different and even government servant continue their lavish corrupt life-style..

Home loans will reduce up to 8%!! That is good, but why someone will go for loan if the small saving schemes interest rates will give better return. They can do savings and fulfill their requirements at here own.

very bad……………your think is very bad

shiv kuk very bad……………….your think is very bad.

.Many people who are criticizing the Govt. do not know how to calculate the interest. Those who are criticizing the Govt. should calculate simple interest and find out the loss of money for a period of 10 years at the rate of 8.1% as compared to 8.7%. if an individual deposited Rs 1 lakh in PPF to get in come tax reduction. If an individual not deposited one lakh in the PPF that person has to pay an in come tax at the rate of 10%.if his income is more than Rs.2 lakhs. Otherwise he has to pay Rs.10000/- as tax. From PPF a person will get an amount of Rs. of 8.1% (New rate). After one year he will get Rs.8100/ as interest.and it will be added in the PPF. That means a man is saving at least Rs18000/- from this invest. If the interest is 8.7% he will get Rs.8700/- as interest. From new financial years ownwords if any body invest in PPF he will get Rs.600/- less yearly. That means monthly a person will get Rs.50.less. This is a very small amount for an individual’s middle class family or Senior Citizen and can manage without having any change in their standard of living. At the same time for the Govt. it is a huge amount and this amount can be used to improve the standard of living of the people who are getting less money than the middle class.

Mr. Govindan, you are telling the reduced interest rates are very minimal and a Middle class person can sustain a loss of Rs. 50 per month. I agree with you when Mr. Jaitly asks all the MPs to pay their electricity, Phone, fuel charges to be born by them but not the government (not from so called, minimal Rs. 50 from middle class person). you are telling Middle class is the luckiest in INDIA… by this statement, I may need to understand that you never be a middle class person or Mr. Mallya is a middle class person in your view for whom Rs. 50 is nothing.

Sir, I can not understand the rationale of ppf interest rate reduction. It’s a small saving limited upto 1.5 lakhs/annum. Government spends cr of Rs on wasteful spending every year. Banks have given Crs in loan to industrialist who don’t pay back to bank(or after many year try to make deal for 1/2 the principal amount). Banks change terms for these willful defaulters so loan don’t show up in NPA. Industrialist in India manage to keep high prices of commodity in India. Cost of living is thus high (Real estate industry prices has jumped 10-20 times in last 12 years and caters to only 1% of Indian population). Why these folks need government support. If we compare our interest rate with developed nation, then pls do compare social security, medicare and unemployment benefits as well. I feel government working will ensure India will not make progress, common man will never come out of bank loan and household expense management, & old people will suffer. People will have lesser money and food item inflation will continue in double digits. Has government hospitals operation shown improvement under NDA, are more medicine and care provided. Wonder who will create industries/businesses in India that will employ 95% of our population and increase our GDP. Government plan are clearly not working. IT industry did empower common service class person but business sucked that capital by increasing cost of living around IT community. I feel our politician have run out of ideas. They are not including additional people in gdp. Our gdp revolves around inflation and not volume growth. Government need to think and do some miracle to be reelected next time.