This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Last Year’s Post – Post Office Small Saving Schemes – FY 2015-16 Interest Rates – PPF @ 8.70% & Sukanya Samriddhi Yojana @ 9.20%

In a move which could disappoint many small savers here in India, Finance Ministry today decided to reduce interest rates on many of its small saving schemes, including Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), National Savings Certificate (NSC) and Senior Citizen Savings Scheme (SCSS) among others. These rates will be effective April 1, 2016 and will be subject to a quarterly revision based on a new formula to determine these rates.

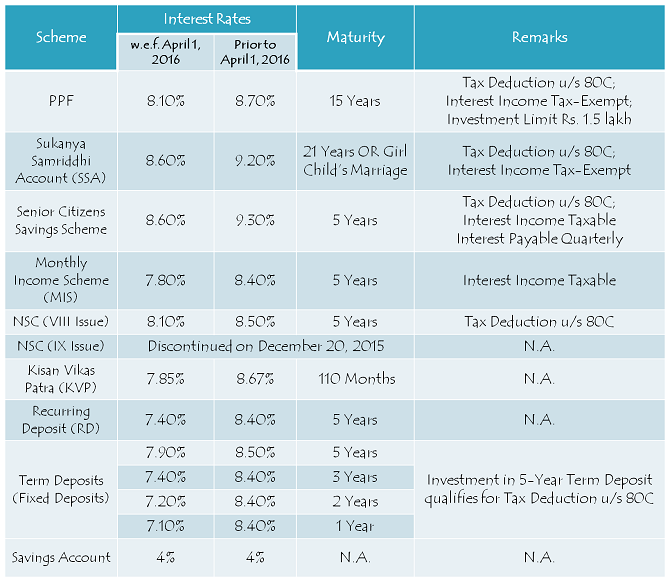

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the next financial year 2016-17:

Public Provident Fund (PPF) – Rate Cut from 8.7% to 8.1% – There has been a significant cut in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.10% for the next financial year as compared to 8.7% for the current financial year. However, interest rate on PPF continues to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Yojana (SSY) – Rate Cut from 9.2% to 8.6% – Government’s pet scheme for girl child, Sukanya Samriddhi Yojana, has seen a rate cut to 8.60% from its present rate of 9.20%. But, there is still a gap of 0.50% between this scheme and PPF, which would likely keep its popularity intact.

Interest earned on Sukanya Samriddhi Yojana is also tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Senior Citizens Savings Scheme (SCSS) – Rate Cut from 9.3% to 8.6% – Senior citizens will also feel disappointed as the interest rate on Senior Citizen Savings Scheme has also been reduced to 8.60% from 9.30% earlier. The interest earned on this scheme is taxable and subject to TDS as well. But, the investment made gets you a deduction of up to Rs. 1,50,000 under section 80C.

Post Office Monthly Income Scheme (POMIS) – Rate Cut from 8.4% to 7.8% – Post Office Monthly Income Scheme will also have a steep cut in interest rate from an earlier 8.40% to 7.80% effective April 1. Following this rate cut, Post Office MIS will go out of favour with many of the investors.

National Savings Certificates (NSCs) – Rate Cut from 8.5% to 8.1% – Effective December 20, 2015, the government stopped issuing 10-year NSCs. Now even 5-year NSCs will have a rate cut, from 8.50% to 8.10%. Your investment in NSCs will keep giving you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Tenure Raised from 100 Months to 110 Months – Your investment in KVP was promised to get doubled in 100 months earlier. But, from April 1, you’ll have to wait for 10 months more to get the same benefits. Effectively, this scheme will earn you 7.85% now.

Impact of Rate Rationalisation on Small Savers, Borrowers and Indian Economy

Though the government would be criticised badly for this move and the opposition parties would try to take maximum benefit out of small savers’ emotions, I would term it as one of the best moves by the Modi Government. Why am I saying this? This move will send the right signals to the global investors as well as to the Reserve Bank of India (RBI) that the government is serious about removing anomalies existent in our systems and also meeting its fiscal deficit target of 3.5%. This move, along with an expected rate cut by the RBI, is going to put more pressure on the lenders to cut lending rates in the system. It will also reduce the borrowing costs of the government, as well as many of the corporates which are currently burdened with high debt in their books.

CPI Inflation, which matters to you and me the most and was ruling in double digits during the UPA tenure, has come down to 5.18% in February 2016. WPI Inflation, which measures wholesale prices of goods and services, has been ruling in the negative zone for a very long time now. This fall in inflation is a result of a slump in the global commodity prices and crude oil prices.

Small savers need to understand that interest rates on deposits and other investments have also come down in the last 2-3 years. During FY 2013-14, our favourite ‘AAA’ rated tax-free bonds carried as high as 9.01% rate of interest. These same ‘AAA’ rated tax-free bonds carried a maximum coupon of 7.69% in the current financial year. So, effectively a fall of 1.32%.

If you compare this fall of 1.32% with a 0.60% reduction in PPF’s rate of interest or 0.40% in NSC’s rate of interest, I think the cut is truly justified. Rest I think it is very difficult to keep everyone happy in the country and at the same time, carry out economic reforms for an overall development.

Ahead of polls in five states in April-May, I would call it a truly bold move by the government. This act of rationalising interest rates will benefit the borrowers immensely, which in turn will create a right balance in the economy.

Now i open SSY account in post office in this year & i deposit amount yearly, my doubt is “if i could not deposit the amount on 1st April of the year & i deposit it on 2nd or 3rd April of every year the interest rate &maturity value should be same or decrease. please tell me.

Hi Mr. Swain,

Interest rate on SSY will change on a quarterly basis. So, the maturity value will change based on the rate of interest and the timing of your deposits.

You can support this government for swach bharat, service tax, black money, low interest rates, ppf nsc slash, water tax, uturns etc etc but the fact is a fact. This government is taking money from us and giving it to Ambani/Adnai/Mallya. Sooner you realize better for you.

I am glad Mr. Agrawal that you have realized what this government is doing. Good for the country. Thanks for sharing!

Mr. Vishal,

I suggest you to watch the documentary “The Men Who Built America”.

It is a 5 hr documentary about 5 businessmen who built America from scratch. While Americans respect their businessmen, sadly, we Indians hate them. Difference is visible.

Hope it is available on Youtube.

Whether investment made in Senior Citizens Savings Scheme before 31/03/2016 will continue to earn interest at9.3% for next five years or it is subject to quarterly revision?

Hi Mr. Kundapur,

SCSS will keep earning 9.30% for you for 5 years if invested before April 1, 2016.

What is the amount of the yearly interest earned on NSC (10 and 5 Years maturity) for reflecting in ITR to pay the income tax as it used to be in tabular form in earlier NSC issues.

Hi Mr. Jain,

We do not have such ready reckoner with us.

Just Posted – Should You Invest in NPS Post Budget 2016? – http://www.onemint.com/2016/03/25/post-budget-2016-should-you-invest-in-nps/

It is too loses for the people.. & Govt donot take good decisions for middle class people.. I do not vote it..

Hi Mr. Shah,

Inflation has fallen over the past 18-24 months and that has made banks to cut their deposit rates. Now, it was natural for the government to cut interest rates on these schemes which was long overdue as well. This would result in the RBI cutting its rates and then lending rates would also come down. This is good for the economy overall. Good steps taken never get a thumbs up from the voters in this country, we need false promises!

Beautifully said. I can”t agree with you more on the subject. The wrong and misplaced concept of Nehruvian socialism is the main reason for poverty and wretchedness in society . That socialistic way of thinking which has done all the harm to the society is so well entrenched in our minds ,that any such daring step by progressive Government like the one which we have now is criticised. Time that people realize whether they want real or artificial progress financially.

I am with you Mr. Srinivas! 🙂

Shiv,

Just wanted to increase the dimension of the discussion and increase the frame of reference in terms of time and savings avenues …

Unlike the West where personal savings have a large (at times 80%) component or more in market linked equity instruments (Including Govt. Mandated Schemes like 401k and Roth schemes in US), in India for years we have been preaching a pseudo ‘Government/welfare scheme/welfare state culture’ which has no political/economic basis… the state is an administrator of the limited resources available to it.. it is not your guiding angel or protector… every person in the state is on his own…if you have to make money/retire rich/be of use to yourself and the society… you have to make every effort to study hard in early life….make your job useful so that it can generate sufficient cash surplus for you…(or you have to squeeze yourself so that you manage to save every small bit… by making Sacrifices) and then invest that money saved in so called Risky (but I believe the only possible avenue) Equity investments over a long term so that your financial future is protected… believe me.. anybody who has invested continously in equity for 20 to 30 years in life… whatever be his economic condition… will end up being rich…in the current situation… whatever little you will lose due to reduction in interest rates of small savings instruments… you will make much more through the interest rate reductions in long term bonds/higher eps earning for companies in equities… its a mindset issue we have in terms of our choice of financial instruments/our expectations from government and our overall idea of ‘entitlement’… friends grow up… there is no free lunch….

Shiv, I could not understand what Mr.Sourav Ganguly meant by his comments . May be I am an airhead to understand all his view points or dimensions of discussions.

Can you please translate into simple english.

Hi Dr. Paulose,

Sourav wants people to change their mindsets and invest more and more in market-linked securities, preferably equity-linked instruments, for high returns, as they give the highest returns over a long period of time.

Thanks Sourav for your inputs here! I agree with you that investors here need to change their mindsets and try to stand on their own feet for their brighter future instead of depending on the government subsidies for artificially high returns!

well said. Investments for market linked returns is the key. An economy which survives on fixed returns is doomed to fail.

Shiv,

pl. do give me your confirmed clarification – I m senior citizen, I have put 1.50 lacs in SCSS scheme on 8-3-16 @ 9.30 % for first time in a bank branch , now-

1.what interest rate will I get on this deposit for next full 5 years by quarterly interest credit in my SB a/c, and ,

2.if I put further 5.00 lacs before 31-3-16 in the same branch, will it be accepted, and if yes, whether I will continue to get 9.30 % interest for full 5 years ? or will it keep changing every quarter or year ?

3. if I put 1 lac in my existing PPF a/c, what rate of interest will I get from 1-4-16 and upto which date ? whether it will keep changing every quarter ?

Hi Mr. Pandya,

1. You’ll get 9.30% till maturity

2. Yes, your investment of an additional Rs. 5 lakh will be accepted. You’ll continue getting 9.30% till maturity.

3. PPF will earn you 8.10% w.e.f. April 1, 2016 and it will remain 8.10% till the time it gets changed in any of the quarterly revisions.

Today I visited SBBJ today and was informed that if I deposit say Rs. one lac today in SCDS, interest payable to me would be 9.3% for period up to 31.3.2016 and thereafter it will be 8.6%. Earlier it was not so, I presume. Am I correct?

This is wrong Fd Nsc carry fixed interest untill maturity. If you deposit in Po TD or Sr Citizen Fd in any branch you will continue to enjoy the same rate untill maturity. If you deposit after 31st Mar you will get the new rate untill maturity. Every qtr the govt will review rate which will affect new deposits only. In the case of PPF the rate will keep changing every qtr if there is a change. Some mis communication happened

Thanks George!

Today I visited SBBJ today and was informed that if I deposit say Rs. one lac today in SCDS, interest payable to me would be 9.3% for period up to 31.3.2016 and thereafter it will be 8.6%. Earlier it was not so, I presume. Am am correct?

No Mr. Apte, that is not correct. Deposits made before April 1, 2016 will keep earning 9.30% till maturity.

Sir,

Pl let me know that if RD is opened upto 31 Mar 2016, the maturity value will remain the same i.e. Rs 746.53 for Rs 10/- RD which will be maturing in Mar 2021.

Thanking You

Regards,

Nem Kumar Jain

Mob: 9450111316

Yes Mr. Jain, the maturity value in Post Office Recurring Deposit will remain Rs. 746.53 if invested before April 1, 2016.

Dear Shiv

Is there any authentic official Circular to the effect that if a deposit is made in Sr citizen savibgs scheme before 31 March 16,the rate of interest till 31 March 2021 will be 9.3 p.a.and not as revised by GOI from time to time.PL urgent response.

Hi Mr. B D Gupta,

As per the rules governing SCSS – “In case of an account, continued after maturity under sub-rule (3) of rule 4, the deposit in such account shall earn interest at the rate applicable to the new accounts opened or to be opened under the provisions of these rules on the date of maturity”.

This clearly means interest rate will remain 9.30% till maturity if invested before April 1, 2016.

Retired Senior Citizens, who have no pension benefits, have to depend on the interest earned on the Small Saving Schemes, like SCSS, PPF, NSC etc.

Government can exempt the rate cuts for these deposits from Senior Citizens and this will help them to continue their normal life.

Senior Citizens already get many extra benefits Mr. Parthasarathy! Why do we always need subsidies to live a normal life? SCSS, PPF and NSC are already subsidized, even after these cuts.

Hi Shiv

Regarding the health care, the cost of medicines and treatment is sky rocketting. Its part of the inflation you may say. Like the price of petrol its not going to come down in the future.

There is hardly any investment in public health care system by the Govt. This Govt is encouraging private sector and medical insurance system like in the west, but how many of the poor can afford and get a decent treatment in rural villages.Yes the private sector “medicities” are booming. Its good for the urban class. But the remote villages of India, the health care system is primitive.

Its nice to hear all these talks of health care developmental activities, but in reality its not true. The health of all the sectors of community- poor middle class and upper class-are getting worse, newer disease,costlier medicine all add the agony.

In future,every one should be prepared to shed more from the pocket if you fall ill, so live a healthy life style.Its easy to preach those live on burgers and pizza, but what about those “less fortunate”who live on air breathing (Yoga)..!!!!

Hi Dr. Paulose,

Let me share my experience with you despite of the fact that you are more experienced in these matters than me. People who practice Yoga & Meditate regularly require minimal medical support as compared to those who love to live on burgers and pizzas.

Also, people in villages, who work hard to earn their livelihood, are less likely to fall ill and succumb to healthcare problems than urban Indians. So, the Modi government wants every Indian citizen to practice Yoga and Meditation so that the government is able to spend more money on other important infrastructure related expenditures.

Jokes apart, I completely agree with your views here! The government is required to work very hard and implement its policies efficiently to improve healthcare facilities for the rural population and I am confident that the new healthcare scheme announced in the current budget will take care of your concerns.

My Dear Shiv, Its not easy to advise one to breathe air (Yoga) when you are hungry and starved..I am glad our Hon.Prime minster did not advocate to practise Kundalini yoga to the common man (which is a dangerous type of Yoga if you don’t know what you are upto).

Any way your forum is getting heated up, let it fire…

Very intersting..

🙂

Shiv, readers may wonder what dangers hidden in Kundalini yoga they are welcome to read one of my post in my blog-

http://drpaulose.com/spirituality/spiritual-industry-in-india-dangers-of-kundalini-yoga

btw-Spritual Industry is growing in India as it needs no investment, only air to breathe….

Nice article on Kundalini Yoga Dr. Paulose!

Thank you Hemant…Let me thank Shiv Kukreja allowing me to write on his space…

Thanks Dr. Paulose for becoming a part of this OneMint family! 🙂 Would you like to write a Guest Post for OneMint Dr. Paulose, which you think could be of interest to our readers here?

My dear Shiv

You want me to get engaged in the vigorous combat zone of One mint forum?? My resources are limited..Any how it’s a great complement..let me think about it…:-)

Nice article indeed Dr. Paulose!

Hi Dr. Paulose,

Nature has given us many essential things to live “free of cost”. Many other essential things which are good for health are very cheap to buy. Practising Yoga, Pranayama, Meditation and living a healthy lifestyle keeps you away from Doctors and medicines. Huge money is required for non-essential things, luxury items and desires most of the times and there is no end to one’s desires. I agree that you cannot practice Pranayama when you are hungry and starved, but if you practice these things, you can live a healthy life.

Shiv

I agree desire has no end..who will say “enough enough”, the only word we say enough is when our stomach is full…

I agree with you we need to keep a healthy life style (but what we “guys” will do to earn a living, if there is no illness around..bit selfish thought!!!)

🙁

🙂 No selfish thoughts here Dr. Paulose, Sorry! 🙂 “Om Sarve Bhavantu Sukhinah !!”

“Aum Bhur Bhuvah Swah, Tat Savitur Varenyam

Bhargo Devasya Dhimahi, Dhiyo Yo Nah Prachodayat”

…Eliminates suffering and Embodies happiness….:-)

True !! 🙂

Govt. started sr. Citizen pension bima yoga a last yr inaugust 2015 n it was closed within a very short period. Does they confirm that those who r availing this facility they r not sr. Citizen but most of them r working n in the age between 55 to57. Then where the retired people will go. What is the use for the scheme which is meant for retired person?

Hi Mrs. Sadanandan,

You can invest in Senior Citizen Savings Scheme, it is meant for senior citizens only. It currently provides a good 9.30% per annum if invested before April 1, 2016. Interest will be paid on a quarterly basis.

Dear Shiv,

I totally agree with your views. Though I am a retired person and will be affected the most by these rate cuts and the resultant cuts in Bank FD interest rates, I would still prefer to reduce my household expenses rather than take subsidy from the Government. In my view many of the benefits from Government subsidies are enjoyed by the middle class and the comparatively affluent class. Do the truly poor families of our country put money in PPF, Senior Citeezen savings scheme etc. I wonder.

I only hope that the money saved by reduction in rates in small savings scheme will go in development activities such as Education and Health which will benefit the entire society.

Thank you Shiv for your articles which has helped me take investment decisions in the past.

Thanks a lot Mr. Mitra for your encouraging words and support! We need more and more people with a mindset like yours so that we become the best country in the world to live in. 🙂

Only 2-3 % people pay tax. Rest 97 % are poor people. Many people who dont pay a single paise tax have big cars and big properties. They won’t be impacted by any reduction of interest rate. 😀 After 2-3 days tax paying will foget all this.

Hello Shiv,

Few points on the decision taken:

1. Firstly, good move by the govt. for the long run

2. Income tax is being levied on PPF (if I am not wrong) and is it correct to cut the interest rates?

3. Does these new rates apply to previously saved money eg., if I have SSA account these interest rates will be applied on the amount saved during the previous FYA 2015-2016?

4. New taxes like Swachh Bharath Cess are really needed? Only tax payers are being targetted & further levied new taxes like these. Can the govt. really catch hold of people with black money? I am really disappointed of this tax in particular.

Hi Vijay,

2. PPF maturity value is tax exempt, no tax gets levied on it. In my opinion, it is a move in the right direction to cut its interest rate, but your view against this move is also welcome!

3. Yes, for SSA and PPF, these new rates will be applicable for a period of 3 months from April 1, 2016 to June 30, 2016. However, your deposit in SSA will earn you 9.20% p.a. from the date of deposit till March 31, 2016 and the accumulated amount will earn 8.60% p.a. from April 1, 2016 to June 30, 2016.

4. If we the Indians start maintaining our country, our roads, our infrastructure like our homes and our cars, then probably there is no need for the Swachh Bharat Cess. I personally want the government to start scrutinising/raiding more and more people with black money and take each and every penny of black money out of its systems.

The interest rate reducing on senior citizens scheme (SCSS) from 9.3% to 8.6% is not reasonable.FM has to re think on this issue.Other way is to reduce the max.investment amount from 15,00,000 to reasonable limit.

Thanks Uday for your inputs! The idea behind Rs. 15 lakh investment limit was to allow Senior Citizens to park their retirement corpus in this scheme and get regular quarterly income as pension for their regular expenses. It is up to the Finance Ministry to rethink about lowering or increasing this investment limit.

If i invest in 5 year term deposit in post office before 31 march 2016

will i get 8.5% rate of interest for the coming 5 years or will it be reviewed quarterly as per new rules

Hi Srinivas,

Interest Rate will remain 8.50% for the full tenure of 5 years.

If i invest in 5 year term deposit in post office before 31 march 2016

will i get 8.5% rate of interest for the coming 5 years r will it be reviewed quarterly as per new rules