This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Last Year’s Post – Post Office Small Saving Schemes – FY 2015-16 Interest Rates – PPF @ 8.70% & Sukanya Samriddhi Yojana @ 9.20%

In a move which could disappoint many small savers here in India, Finance Ministry today decided to reduce interest rates on many of its small saving schemes, including Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), National Savings Certificate (NSC) and Senior Citizen Savings Scheme (SCSS) among others. These rates will be effective April 1, 2016 and will be subject to a quarterly revision based on a new formula to determine these rates.

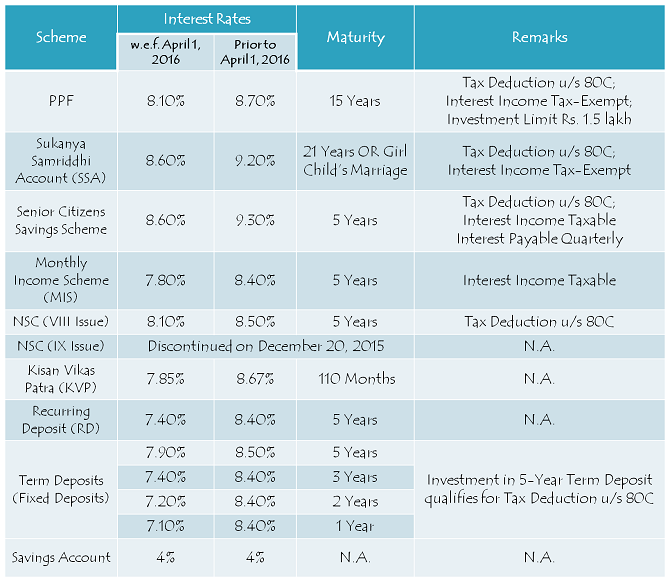

Here you have the table having all the small saving schemes with their applicable interest rates and tax benefits for the next financial year 2016-17:

Public Provident Fund (PPF) – Rate Cut from 8.7% to 8.1% – There has been a significant cut in the interest rate offered by PPF, India’s most popular small savings scheme. PPF will earn you 8.10% for the next financial year as compared to 8.7% for the current financial year. However, interest rate on PPF continues to remain tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Sukanya Samriddhi Yojana (SSY) – Rate Cut from 9.2% to 8.6% – Government’s pet scheme for girl child, Sukanya Samriddhi Yojana, has seen a rate cut to 8.60% from its present rate of 9.20%. But, there is still a gap of 0.50% between this scheme and PPF, which would likely keep its popularity intact.

Interest earned on Sukanya Samriddhi Yojana is also tax-exempt on maturity and investment up to Rs. 1,50,000 will keep getting exemption under section 80C.

Senior Citizens Savings Scheme (SCSS) – Rate Cut from 9.3% to 8.6% – Senior citizens will also feel disappointed as the interest rate on Senior Citizen Savings Scheme has also been reduced to 8.60% from 9.30% earlier. The interest earned on this scheme is taxable and subject to TDS as well. But, the investment made gets you a deduction of up to Rs. 1,50,000 under section 80C.

Post Office Monthly Income Scheme (POMIS) – Rate Cut from 8.4% to 7.8% – Post Office Monthly Income Scheme will also have a steep cut in interest rate from an earlier 8.40% to 7.80% effective April 1. Following this rate cut, Post Office MIS will go out of favour with many of the investors.

National Savings Certificates (NSCs) – Rate Cut from 8.5% to 8.1% – Effective December 20, 2015, the government stopped issuing 10-year NSCs. Now even 5-year NSCs will have a rate cut, from 8.50% to 8.10%. Your investment in NSCs will keep giving you tax exemption under section 80C.

Kisan Vikas Patra (KVP) – Tenure Raised from 100 Months to 110 Months – Your investment in KVP was promised to get doubled in 100 months earlier. But, from April 1, you’ll have to wait for 10 months more to get the same benefits. Effectively, this scheme will earn you 7.85% now.

Impact of Rate Rationalisation on Small Savers, Borrowers and Indian Economy

Though the government would be criticised badly for this move and the opposition parties would try to take maximum benefit out of small savers’ emotions, I would term it as one of the best moves by the Modi Government. Why am I saying this? This move will send the right signals to the global investors as well as to the Reserve Bank of India (RBI) that the government is serious about removing anomalies existent in our systems and also meeting its fiscal deficit target of 3.5%. This move, along with an expected rate cut by the RBI, is going to put more pressure on the lenders to cut lending rates in the system. It will also reduce the borrowing costs of the government, as well as many of the corporates which are currently burdened with high debt in their books.

CPI Inflation, which matters to you and me the most and was ruling in double digits during the UPA tenure, has come down to 5.18% in February 2016. WPI Inflation, which measures wholesale prices of goods and services, has been ruling in the negative zone for a very long time now. This fall in inflation is a result of a slump in the global commodity prices and crude oil prices.

Small savers need to understand that interest rates on deposits and other investments have also come down in the last 2-3 years. During FY 2013-14, our favourite ‘AAA’ rated tax-free bonds carried as high as 9.01% rate of interest. These same ‘AAA’ rated tax-free bonds carried a maximum coupon of 7.69% in the current financial year. So, effectively a fall of 1.32%.

If you compare this fall of 1.32% with a 0.60% reduction in PPF’s rate of interest or 0.40% in NSC’s rate of interest, I think the cut is truly justified. Rest I think it is very difficult to keep everyone happy in the country and at the same time, carry out economic reforms for an overall development.

Ahead of polls in five states in April-May, I would call it a truly bold move by the government. This act of rationalising interest rates will benefit the borrowers immensely, which in turn will create a right balance in the economy.

Sir mostly text free scheme in post office

How and where does one apply for NSC?

Hi Shiv,

Very useful article indeed. The interest rate of Sukanya Samriddhi Yojana has been reduced a lot compared to its starting rate. However, it still is the best savings scheme for a girl child in India. Thank you for sharing the information along with your detailed insights.

DO YOU NEED A LOAN TO START A BEFITTING NEW YEAR!!!!!!

Compliments of the day,

Are you a business man or woman? Do you need a loan to start up your own business? Do you need a loan to settle your debts

or pay off your bills? Do you need funds to finance your project? We Offer guaranteed loan services of any amount

Please contact us for your secure and unsecured Loan with an Interest rate of 3.00%, Interested applicants should Contact us via email: ([email protected]) or ([email protected])

Are you a business man or woman? Are you in any financial mess or do you need funds to start up your own business? Do you need a loan to start a nice Small Scale and medium business? Do you have a low credit score and you are finding it hard to obtain capital loan from local banks and other financial institutes?. solution to your financial problem is Dr. Harley Lewis Our program is the quickest way to get what you need in a snap. Reduce your payments to ease the strain on your monthly expenses.

**Are you financially squeezed?

**Do you seek funds to pay off credits and debts?

**Do you seek finance to set up your own business?

**Are you in need of private or business loans for various purposes?

**Do you seek loans to carry out large projects?

We offer a wide range of financial services which includes: Business Planning, Commercial and Development Finance, Properties Mortgages, Home loans, business loans, bad credit loans, commercial loans, start-up- working capital loans, construction loans ,car loans, hotel loans, student loans, personal loans, Debts Consolidation Loans with low interest rate at 3.00%

Yours Sincerely,

Dr. Harley Lewis

([email protected]) or ([email protected])

Hello Sir,

Where and how does one apply for PPF and NSC?

10 Differences between Tax Saving Tools like PPF and ELSS.

More info@ https://www.moneydial.com/blogs/10-differences-between-tax-saving-tools-like-ppf-and-elss/

This is the very bad condition for medal family.We find loan very high interest but returning interest on my amount is very low.It,s want be re wise interest rate again if you with medal family background.This is the not a fare with anyone.Everything is costly on date ………………………….

want to be think to Jetli sahab(FM)

Thanks

GANESH

Dear friend

if I have a corpus of 70 lakhs as my life savings & I need a monthly income from it to live my life with family, what would be the safest yet best instrument(s) to park my money in? kindly give me a detailed guide as to how should I go abt it.

thanks a lot for your valuable advise.

Nishanth

Interest rate reduced from 8.5% to 8.1% w.e.f 01.04.2016. Previously it was half yearly compounded (10,000.00 on maturity become 15,162.00) but now, though there are no notifications of becoming it “yearly compounded” but practically it has effected (10,000.00 on maturity become 14,761.00). It is mentioned in India Post web that the rate being offered as half yearly compounded. Need clarifications.

Hi Shiv,

I am looking to invest in post. Is there any scheme in which interest will not deduct from interest & can get tax excemption too.

Is it good compare to investment schemes in bank. PLease guide.

THanks

Sanjay Sawant

how to calculate interest amount for saving account in post office & what time will credited interset for our account, plz give me information regarding this issue.

kindly give rules & regulation of the post office.

Is interest accuring from NSC taxable as in the case of FD for 5 years interest is taxable.? Which should be preferred NSC or FD.

My daughter’s age is 9 yrs and contribute amount yearly 24000/ after 21 yrs how much maturity amount received me so pls tell me

By children’s monthly 1000 rs paid ro s s y

So please 21 year what amount paid

Just look how each central govt is befooling the native people. Earlier PO MIS was really lucrative for a regular income @8% pa for a tenor of 6 yrs with a maturiy bonus of 7.5% then in the year 2011, the so called secular cheats reduced the tenor to 5 yrs and abolished the bonus but raised the interest rate to 8.4%. Up to this, the situation was somehow acceptable. Now the sangh paribar cheats additionally reduced the interest rate to 7.8%! Where is the charm now?

Plz gove me the updates regards fd

post office may uski website bataa do please

sir sukanya smiriti yojana ka account online kisey check kar tey hai

PF body may invest Rs 6,000 crore in Equity Market for year 2016-17

More info @ https://www.moneydial.com/pf-body-may-invest-rs-6000-crore-equity-market-year-2016-17/

Dear sir I have read all the question and answers provide by professional shri Kukreja. Dear sir what is social security provided by government to common man specially the middle class man. Although i shall be retiring from a Govt. PSU having no pension facilitates accept that the the PF what i could save i will have to eat out of it, beside getting other family responsibilities carried out of it. Still i am lot worried how i shall carry on further. If govt can not give pension and is slowly getting rid of this responsibility than at last it should not cut on or touch the postal saving scheme rates of SCSS or monthly schemes where the individual is investing the money Is not the responsibility of govt that the person who is retiring after putting 30 year or more year of service lives a respectable life. what contribution govt has made on soscial security scheme of middle class family. Even the LPG subsidies are also withdrawn once u come in income tax bracket. all are nit conversant with the market based schemes of investment. Who will pay if the amount invested in trhe market gets doomed. Govt should not have touched on to atleat SCSS this is only income or pension poor fellow have which he gets after investing his hard earned money which remains with the Govt for quite a few year as a capital money