This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Budget 2016 has proposed a significant change in the taxation laws for National Pension Scheme (NPS). It has been proposed by the finance ministry to make 40% of your lump sum withdrawal to be tax exempt at the time of your retirement i.e. as you attain 60 years of age. But, does it make any sense to invest in NPS post this amendment or should you continue investing in equity mutual funds or PPF for your retirement years?

We all know that our contribution up to Rs. 50,000 in NPS provides us tax deduction under section 80CCD (1B). Unlike investments eligible for tax deduction u/s 80C, 80CCD (1B) provides an exclusive tax benefit for NPS. So, if you do not contribute in NPS, you need to pay tax as per your respective tax slabs. So, should you save tax by investing in NPS or just pay tax and then invest the remaining amount in equity mutual funds, PPF or debt mutual funds for wealth maximisation?

Honestly speaking, it is not an easy decision to take. To come to a conclusion, I’ll do a couple of comparative analysis here – one, comparing an investment in Equity Mutual Funds with NPS and the second one, comparing an investment in PPF with NPS. We will also have to make certain assumptions here based on which this analysis would come to a conclusion and you are most welcome to agree or disagree with my assumptions here because I am as human as you are and that is why there is enough scope of me committing mistakes as bad as anybody else on this earth.

Here are the assumptions I have made in this analysis:

- You are 35 now and would retire after 25 years from now.

- You are in the 30% tax bracket and will have to pay Rs. 15,450 as tax in case you decide not to invest Rs. 50,000 in NPS.

- Equity Mutual Funds would generate on an average 13% annual returns for the next 25 years.

- PPF would generate on an average 8.1% annual returns for the next 25 years.

- NPS with 50% contribution towards equity, 25% contribution towards Government Debt and 25% contribution towards Corporate Debt would generate on an average 10.375% annual return for the next 25 years. To provide more clarity here, I have assumed 12% annual returns from equity, 8% annual returns from government debt and 9.50% annual return from corporate debt.

So, should you invest in NPS for saving Rs. 15,450 in tax?

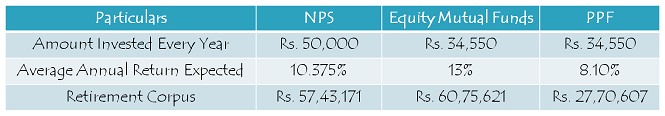

Scenario I – Say No to NPS in the present scenario, as it is not advisable to invest in NPS even with the exclusive tax benefit it enjoys u/s 80CCD (1B). Your investment of Rs. 34,550 in diversified equity funds should result in a higher retirement corpus for you as compared to Rs. 50,000 invested in the NPS. Here is what you’ll have in your retirement corpus at the end of 25 years from now:

Portfolio I – NPS – 50% of Rs. 50,000 invested in equity index, 25% in Government securities and 25% in corporate debt – Retirement Corpus Rs. 57,43,171

Portfolio II – Equity Mutual Funds – 100% of Rs. 34,550 invested in diversified equity mutual funds – Retirement Corpus Rs. 60,75,621

Portfolio III – PPF – 100% of Rs. 34,550 invested in PPF – Retirement Corpus Rs. 27,70,607

So, the above calculation clearly shows that investing in diversified equity mutual funds would generate the highest retirement corpus for you, even after paying 30% tax + 0.90% education cess on your taxable income over and above Rs. 10 lakh.

But, there are certain points which you need to keep in mind here which are in favour of NPS. Firstly, from taxation point of view, I think the present situation is not the best one for NPS and it could only improve from hereon. There is still a lot of scope of improvement for making NPS a better product to invest in. Also, I think the present taxation laws are already highly favourable for equity mutual funds. So, let us have a look at some other scenarios and whether it is a ‘Yes’ or a ‘No’ for NPS in those scenarios.

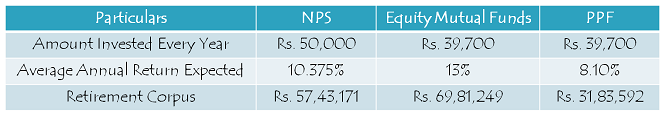

Scenario II – Say No to NPS, if you are in the 20% or lower tax brackets. You should rather invest in equity mutual funds to generate a healthy corpus for your retirement years.

Scenario III – Say No to NPS, even if you think this government or some other government will increase the exempt portion of your lump sum withdrawal in NPS from the current 40% to 100% or any percentage between 40% and 100% during the next 25 years.

Scenario IV – Say Yes to NPS, if you believe in the theory of “one bird in hand is better than two in the bush”. If you decide not to invest in NPS to save Rs. 15,450 today, you’ll have to pay it to the government and you’ll be left with Rs. 34,550 only to invest. With NPS, your first tax outgo will happen when you retire at the age of 60. Then also, if you withdraw 40% of your retirement corpus as lump sum, it is tax-free and invest the remaining 60% for buying an annuity, you are not required to pay any tax on that 60% as well. You’ll be required to pay tax only on the annuity income you would receive on your investment.

On the other hand, if you decide not to invest in the NPS, you’ll have to pay a tax of Rs. 15,450 to the government and your investment of Rs. 34,550 in equity mutual funds will take a long 25 years to beat NPS as far as a higher retirement corpus is concerned.

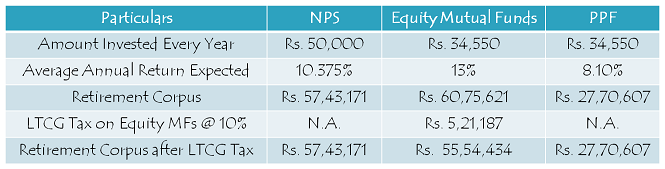

Scenario V – Say Yes to NPS, if you fall in the 30% tax bracket and you think this government or some other government will make long term capital gains (LTCG) on equity mutual funds taxable anytime during the next 25 years. Even a 10% LTCG tax on equity mutual funds will make NPS a better retirement product to invest in.

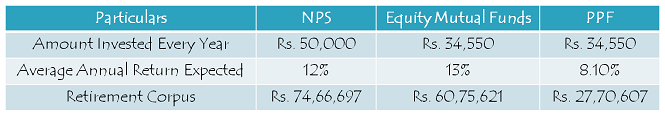

Scenario VI – Say Yes to NPS, if you are hopeful that this government or some other government would allow you to invest more than 50% of your Rs. 50,000 in equity portion of NPS. Personally I think there should an option allowing you to invest 100% of your money in equity. That would make NPS an attractive investment for me to save tax.

Scenario VII – Say Yes to NPS, if you are hopeful that this government or some other government would give you the liberty to invest 60% of your lump sum withdrawal anywhere you want and make it tax exempt as well.

Scenario VIII – Say Yes to NPS, if you are a conservative investor and don’t want 100% of your investment to be made in equities. With NPS, even 50% of your investment in equity index would result in a healthy retirement corpus which should be very close to the expected retirement corpus with 100% investment in equity mutual funds.

NPS vs. Equity Mutual Funds vs. PPF – Other Factors

There could be other such scenarios based on which your decision to invest in NPS could change. If you think I have missed any such significant scenario, then please share it here, I’ll incorporate that also to make it an even more comprehensive analysis.

Thanxalot,

I[36yr] have PPF [3lac]for me,

I m opened sukanya samridhi for 2 yr daughter

n thinking to start an RD 10 k monthly at DHFL{ ~9% interest} for my one yr son.

My wife[36yr] has a PPF[4lac]

NPS of 5k monthly

We have 3 lac FD

own house,one flat for real estate,a family health insurance,life insurance.

Two questions

1.Is saving in RD at DHFL ok,good n secure return ?

2.All extra income I want to save in wife’s NPS tier II

so can NPS tier II give me

Good returns approaching equal to MF

It has better security,liquidity,tax saving.

I am not very smart in following market so it gives me a peace of mind

too

Since NPS is now open for NRI’s, do you recommend this as a good retirement investment, since currently there are no tax implications?

Dear Shiv

Very good article, it has cleared many of my doubts but probably not all. I have slightly different background.

I am 36 and working out of India with present residency status as NRI. Unfortunately I didn’t open a PPF account while I was in India and now I can’t open it due the residency status. The pension scheme in my overseas company has some stricter legislation issues such as the pension accumulated here can only transferred back home only if the pension fund in India Doesn’t allow ANY type of withdrawal until I reach the age of 60 years. I had been searching for such pension plan for a while and I think from that point NPS is ideal solution for me.

I do not have to worry about tax savings, already I am having a moderate portfolio on SIPs that I have built over past 5 years.

Please can you comment if there are better options than NPS for me?

Thanks again!

Is it country specific rule or your company-specific rule? Which overseas country is it.. just curious..

Hi Shiv,

Thanks a ton for such a comprehensive post. I opened a NPS account and the reasons are combination of what you gave – 30% tax, hoping government changes 50% equity limit, annuity changes and also possible LTCG tax on MFs.

I have opened eNPS account online and i have received I-PIN and can verify my account online also. My employer also covers NPS. Now can i give the same PRAN account to my employer and can we both invest simultaneously?

Yes, give same PRAN for employer also

Wonderfully said!

Hi,

Is there any difference in charges if I register through e-NPS or take this facility from any private bank.

Good one Shiv!

Many blogs give a “1 solution fits all” and say NO to NPS, but the way you provided different scenarios for investors to brainstorm considering their personal preferences/situations is awesome.

I’ve been investing in NPS and will continue, due to scenario 4.

Nice

Dear Shiv,

The retirement corpus for NPS at age of 60 is still not in the hand of an individual. 60% of this corpus needs to be invested in annuity. I would suggest to include returns of these annuity plans after tax treatment, which is truly the in hand corpus of the NPS.

Thanks.

Sir, contribution to Tier I account is eligible for up to Rs. 50,000 tax deduction u/s 80CCD (1B), subject to 10% of baisc pay+dearness allowances other allowances are not eligible. If one does not get dearness allowance in his pay [pvt. sector employee], then whether allowances called ‘special allowances’ which are factored in monthly pay do count for 10% of tier I contribution tobe eligible for dedn.u/s.80CCD[1B].

Thanks, for your valuable information, even layman like me grasp the points analyzed by you in simple language.

A well written and researched piece with objective analysis.

Excellent post. i really liked it personally. this is true that we do not have patience .

Dear Shiv,

I have started investing in the NPS exactly because of your aptly fitting theory “one bird in hand is better than two in the bush”.The aggregate data about returns from equity mutual funds may be promising.But a huge majority of investors actually lament poor returns because of the continual erosion in holding of units due to quarterly fees in various hues and shades.It requires the razor sharp acumen and equity-street smartness of Shiv to discern and pick the few good equity mutual funds to enjoy the assumed high average annual returns of 13%.A lot of hype tends to conceal the tremendous risk hidden in equity mutual fund investments.Shiv,please educate me if my perception is flawed by my own experience with equity mutual funds and the tales of woe narrated by average investors.

Nice article Shiv!

Also there is a section 80 CCD(2) wherein the employee can invest additional amount upto 10% Basic Salary through Employer through his salary. I understand that the tax benefit under 80 CCD(2) is over and above the 80C and 80CCD (1B) benefits?

Hi Shiv,

As per the new provisions, does one have the option of getting the remainder 60% fund value by paying taxes, and give a miss to annuity? In other words, what percent of annuity one has to compulsorily buy?

Thanks,

Prat

Hi PP,

It is at least 40% of your retirement corpus with which you need to compulsorily buy annuity.

Does it mean only 60% of the corpus can be withdrawn as lumpsum? if 40% of withdrwan lumpsum is tax free means , we have to pay tax on 60% of the lumpsum amount. Since in any case annutiy is taxable,then does it mean only 24% (40% of 60% of corpus) of accrual in NPS amount is actually taxfree ? Is the understanding right sir?

Hi Shiv,

I am sorry if I missed it but what about the scenario where I invest in NPS each year, and invest the money I am saving from tax benefit, Rs. 15450, in equity mutual fund each year? Thanks!

Hi Akshay,

Rs. 15,450 is already getting invested in the NPS itself, otherwise you would have been required to pay this to the government.

That makes sense. Thanks Shiv.

You are welcome Akshay!

Dear Sir,

How 15,450 is invested in NPS, We get tax rebate of 15,450 . then it can be reinvested right ??

Hi Shiv,

Thank you for a very thoughtful article considering various scenarios.

For NPS, one also needs to think about the rate of annuity after 25 years. Any thoughts on roughly how much monthly income would one fetch after he or she invests 34,45,902 (60% of 57,43,171) in annuity?

– PP

Hi PP,

I think post tax annuity returns should not be more than 6%. So, it should be around Rs. 17,230 per month after retirement.

Thanks Shiv. Assuming 4% annual inflation, Rs. 17,230 will be equivalent to today’s Rs. 6,500 after 25 years.

Yes, that’s right PP! One should make higher contributions to equity mutual funds in his/her younger age to have a healthy corpus on retirement.

Shiv

Thanks for the article…but the point remains that since 1979,the sensex has delivered a 17% annualised return on equity and some mutual funds have done even better …giving 24% plus CAGR over 20 yrs…hence in the money accumulation phase in spite of the upfront tax saving element NPS will stand no chance to equity investments based on past history…..additionally one significant area that gets missed in our discussions is the significantly less returns that any kind of fixed annuity instrument will generate in the payout (pension) phase compared to mutual fund SWP…assuming a person lives till the age of 80….A 15% SWP payout vs a 6% to 7% annuity payout…would mean sacrificing 2 to 3 times the initial corpus saved…its a bigger loss compared to any comparison of the accumulation phase any day…not to speak of the flexibility and liquidity of equity mutual funds along with the non taxability of SWP vis a vis taxability of pensions today….

Hi Sourav,

I agree with your thoughts here. Initially, I wanted to incorporate post retirement returns also in my analysis, but then decided against it, as that would have involved a lot of brainstorming for the readers to do.

Health is Wealth- Let me share few of my thoughts to the youngsters, not the 60+.This forum is full of discussions in investing in MFs, SIPs ,NPS, PPF and other saving schemes for the old age , saving for the “future”.

You may not like me being blunt, to the youngsters in particular, who take a “don’t care “attitude towards your health. From such an young age you work so hard earning and saving every penny for the future and a day may come when you cannot enjoy any of this,then it will be sad.

Please remember your loved ones care for you, when you reach old age do you want to become a physical nuisance to your loved ones do you? You don’t care, but your loved ones care for you. You may be in ICU or a ventilator but remember there are the loved ones sitting outside the ICU waiting to see what will happen..You may be in a wheel chair with paralyzed body, head to toe unable to express even utter a word. What investment can help you then.

So take care of your body, in the right time, don’t pamper it too much, eat less, spend 1 hr of a day in exercise, Yoga ,walk the stairs, throw the remote of your TV, leave the car, walk to the shop.

How may of you go for a regular walk every day, how many bought a treadmill in your house and now the ladies are using it to dry the clothes. Give an hour to look after your system. Don’t indulge in gluttony, pizzas and burgers and KFC, Pepsi..Eat like a beggar and die like a King!!!

Don’t say no time for exercise, you have enough time to watch the IPL, the movies or sleep in Shavasana. Don’t pamper your body too much, like to a child show tough love to your body, then the body respect you and love you in return.

I strongly recommend Yoga breathing –Pranayama-Meditation at least 10 minutes a day. Let the ladies stop putting so much sun screen on their face and body to protect from sun, you are getting free VitD for a day from sun by exposing the body for 10 minutes in the sun. If there is lack of Vit D your bones will break due to lack of calcium, you loose sleep , feel depressed and so many illness. Do Suryanamaskar if you can. Be a vegan if you can, why killing yourself with high cholesterol and other lipids eating the dead carcass.

Please understand our body is wonder full piece of engineering, it has to be taken care off, other wise it will break down prematurely and disappoint you.

Every one die one day but try to die peacefully, have a decent death, try not to become a burden to you loved ones at the end of the day.

You have 24 hrs a day, give at least half an hour or hour to look after your body.

And please stop complaining that the Govt. not doing enough for your own negligence in the past.

If you are wise you don’t need to shell out the hard earned NPS and PPF etc to the hospitals!!!

Then all these savings make sense!!!!

( I thank Shiv Kukreja asking me to write my thoughts on health and wealth)

@PAULOSE

Sage advice, sir! Succinct and well fit on this subject.

I’d definitely recommend this “note” as a valuable read and a timely reminder.

Wonderfully said. Thank you sir.

By the way which one is difficult between eating less and exercsing for 1 hour a day? I find exercising is a lot easier than controlling the diet consistently.

Thanks Shiv for the detail analysis with so many case studies/scenarios.

I believe, based on this, informed investors will be able to take the correct decision.

I would like to add 2 points:

1. Nowadays many employers are helping their employees to save additional tax by contributing directly to their NPS a/cs.

2. If you are already investing heavily in Equity Mutual Funds and want some sort diversification, NPS can be considered.

Personally I like NPS and I am investing in it since 2011 even though there were no additional tax benefits at that time. 🙂

Thanks Amlan!

Yes, apart from the tax benefits it provides, I think NPS is good from diversification point of view.