This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

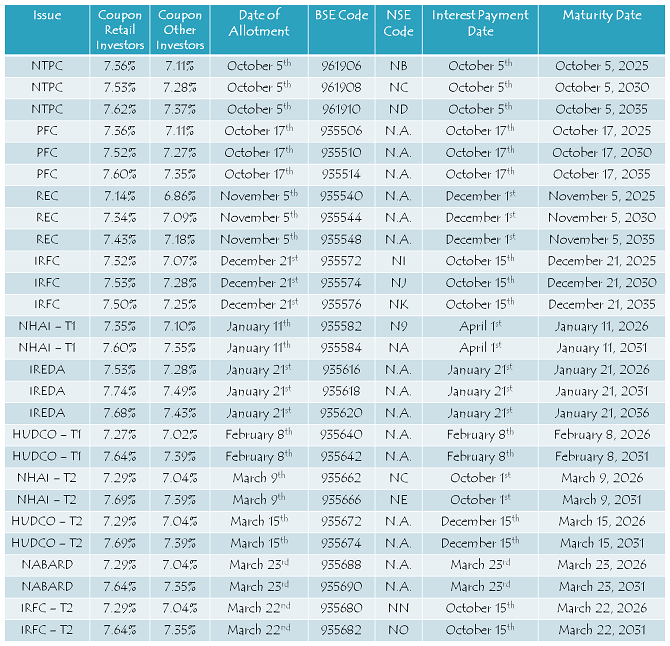

Tax-Free Bonds issued last financial year have all been allotted by now and as many of you wanted to get their basic details, like allotment date, maturity date, interest payment date, BSE Code, NSE Code etc. all at one place, here you have the post covering all such details required. The table pasted below also carries the coupon rates applicable to the retail investors as well as non-retail investors.

Tax-Free Bonds issued during Financial Year 2015-16

Bonds listed on the National Stock Exchange – NSE Link

Bonds listed on the Bombay Stock Exchange – BSE Link

These BSE and NSE links carry all the bonds, tax-free as well as taxable, and non-convertible debentures (NCDs) which get traded on these exchanges on a regular basis. NTPC, REC, PFC, IRFC, NHAI, IREDA, HUDCO and NABARD were the eight companies which issued these tax-free bonds during the previous financial year.

If you require any other info regarding these bonds or have any suggestion to improve this table, please share it here.

What about the NABARD Tax free bond issued on 23rd March 2016, Shiv?

Naresh

Hi Mr. Naresh,

NABARD tax free bond details are there in the table above. Please check.

Please clarify on the above 2 BSE & NSE Links for the bond market. However, in BSE there exists another page for RETAIL MARKET. Shouldn’t retail investors like us be referring to that page instead?

Also BOND YIELDS against last traded price are missing against many of the TAX FREE BONDS in both BSE & NSE links. Can you educate us on the reasons for such glaring omissions?

Hi S.K.,

As far as the Retail Market link is concerned, you can refer to that link as well. Moreover, I too wonder why BSE and NSE are not able to have the correct bond yields on their websites. It is very surprising and disappointing.

Dear Shiv

There is hardly any lively discussion these days on your site or am I missing out?

The closing of many HSBC branches across India and world over make me wonder, are we going to face Virtual Banking soon, beginning of a Cashless society? With more e commerce, online banking, credit and debit card payments,Wallet payments, our beloved INR Currency is going to disappear in the future?

Your thoughts on (?)future cashless India can be a good subject for discussion.

kind regards

Dear Shiv

There is hardly any lively discussion these days on your site or am I missing out?

The closing of many HSBC branches across India and world over make me wonder, are we going to face Virtual Banking soon, beginning of a Cashless society? With more e commerce, online banking, credit and debit card payments,Wallet payments, our beloved INR Currency is going to disappear in the future?

Your thoughts on (?)future cashless India can be a good subject for discussion.

kind regards

drpaulose

Hi Dr. Paulose,

I was slow to post articles during that period, but it is getting somewhat better now. Virtual banking is the future. It seems cost cutting and technological advancement would lead to more and more closures of physical bank branches going forward.

REC Ltd’s main objective is to finance and promote rural electrification projects all over the country. It provides financial assistance to State Electricity Boards, State Government Departments and Rural Electric Cooperatives for rural electrification projects as are sponsored by them. If we look at the Annual Result of the Company, FY15 EPS was 54.12, while the FY16 EPS is at 57.64, a jump of only 6.5 per cent. This means that Company has not shown ample growth compared to FY15. Due to lack of good return the company is trading at low PE of 2.82. Until unless a major change in demand arises in Power sector, the stock may not be a good stock for investment. If we look at the Share Price Movement, the stock has not given any return to the investors in last one year.

INSTRUMENT MOVEMENT

1M (-2.28 )

3M (-4.03)

6M (-25.95)

1Y (-41.09)

For more Weekly & Monthly Support & Resistance Levels Visit @ Share Price History

https://www.dynamiclevels.com/en/rec-share-price-history

Good work

Thanks Al falah!

Sir, forgot to include one more query above, I understand there are some NCDs strictly for Institutional Investors and some for Retail and while applying in IPO, and retailers would apply appropriately. But after they get traded on SEs, how can I, retail investor, make sure I dont buy those NCDs meant for Insti. Investors ? OR there is no such segregation for secondary markets ?

Hi Mr. Naeem,

You should buy bonds which carry different scrip codes and have higher rate of interest.

Sir,

Almost all of TFBs trading at premiums viz.. 8.2% TFB trading at almost at 11.2-11.5% premium, so buying them now will result in negative yield in 1st year( -3+%) So is it worth buying them ?

Also, what is your advise in general to buy TFBs, as I depend on only FDs for my income as of now (my age is 50yrs)

Hi Mr. Naeem,

With falling interest rates, yield on these tax-free bonds has also been falling. If you still anticipate interest rates to fall going forward, I think it makes sense to buy them. However, I think interest rates should stabilise around these levels now.

Dear Shiv,

Hi! wanted an input, if you happen to exceed the 10 lakh retail quota, does your whole portfolio becomes non retail or just the excess portion alone. When is that decided for retail consideration, is it the next interest paying date ?

thanks and regards

Hi Ashish,

If you exceed Rs. 10 lakh in a single issue, it is applicable to whole of your investment. It gets determined on the Record Date.

#Stockmarkettips:: NTPC Stock News:-

The documents submitted by NTPC clearly shows that BSES has been very irregular in paying their dues. NTPC has been supplying power to BSES Rajdhani Power Ltd (BRPL) & BSES Yamuna Power Ltd (BYPL). According to a NTPC statement, power allocated to BRPL by NTPC from various power stations is about 1,350 MW and average monthly bill hovers around Rs 260 crore. NTPC supplies about 678 MW of power with an average monthly bill of about Rs 130 crore. Total monthly bill for both companies is about Rs 390 crore. According to BSES it has made 90% of payments to NTPC. In the last two years, BSES discoms have paid in excess of Rs 9,500 crore to NTPC. This is really a high voltage issue for BSES.

For more Stock tips Visit @

Stock Market Tips

Hi Shiv,

Thanks a lot for compiling this information, very helpful.

Do you have any blog or write-up on how to pick up TFBs from secondary market ? and whether it is advisable to do so?

Regards,

Amit

Hi, excellent dashboard. Request you to come up with a guidance on listed pvt company NCDs – regular, NCD – taxfree (Gov) which offer better returns thank bank deposits.

Dear Shiv,

Good Work and lot of effort keep it up

Raju

Good consolidated information, Shiv ! Thanks for your efforts.

Thanks Rakesh!

Dear Shiv,

Many Thanks for this valuable information which is very handy.

As per request from other members, I transformed it into excel and can be found at :

http://www.4shared.com/file/QzeBpqpLce/Interest_Payment_Date_Allotmen.html

Thanks for the table. I was looking for this data.

Regards,

Pradeep

You are welcome Pradeep!

Thank you so much Shiv…been waiting for this 🙂

You are welcome Gaurav! 🙂

Thanks Shiv. I had REC in my notes as December 28. Can you double check please

Hi Bhaskar,

December 28 was applicable only for the first year, now onwards it will be paid on December 1 every year.

Why not have the data in an excel file?

Hi Sudhin,

I really don’t know how to have an excel file pasted here in the post.

Post it on some site (4shared.com for example) and give the link from where it can be downloaded, also just to keep up the accuracy of the displayed data if the ISIN nos. are given this would help in detecting any errors. Tough ask but no harm in trying as everyone can pitch in, incase of an error.

Give a link where you have storedit or if you have it in excel format you could mail it if possible.

Thanks,

Awesome effort Shiv! Thanks!!

Thanks Akshay!