This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

As the sentiment in the stock market has improved considerably, we are seeing a flood of new initial public offers (IPOs) getting launched. These issues, big or small, are getting lapped up in huge numbers. No IPO has been able to satisfy the appetite of retail investors fully and they are getting left disappointed with no allotment or only one lot getting allotted.

To tap these favourable market conditions, ICICI Bank has decided to sell its 12.63% stake in ICICI Prudential Life Insurance Co. Ltd. and get it listed on the stock exchanges. ICICI Bank will sell around 18.13 crore shares in ICICI Pru Life through its initial public offer (IPO) at an expected price of Rs. 334, thus amounting to Rs. 6,057 crore. This will be the biggest IPO since Coal India’s Rs. 15,200 crore IPO in October 2010 and as it is a big issue, one can expect a better allotment this time around.

But, how good is the company, how is it valued and if it is worth investing in this big IPO either for long term wealth creation or short term quick gains? Before we come to any conclusions, let us quickly take a look at its salient features first.

Price Band – ICICI Life has fixed its price band to be between Rs. 300-334 per share and no discount will be given to the retail investors or ICICI Bank’s existing shareholders.

Size & Objective of the Issue – As mentioned above, ICICI Bank will sell its 12.63% stake in ICICI Life i.e. 18,13,41,058 shares at a price between Rs. 300 to 334 a share. At the upper cap of this price band, ICICI Life will be able to raise Rs. 6,057 crore from this issue. As it is an OFS and no fresh shares will be issued, ICICI Life will not get any proceeds from this IPO.

Retail Allocation – 35% of the issue size, after 10% reservation for ICICI Bank shareholders, is reserved for the retail individual investors (RIIs) i.e. 5.71 crore shares out of 16.32 crore shares, 15% is reserved for the non-institutional investors and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Reservations for ICICI Bank’s Shareholders – ICICI Life has reserved 10% of its shares on offer i.e. approximately 1.81 crore shares for the existing shareholders of ICICI Bank. Such shareholders will be allotted ICICI Life shares out of such reserved 1.81 crore shares.

No Discount for Retail Investors or ICICI Bank Shareholders – Though there is 35% and 10% reservation for the retail investors and ICICI Bank shareholders respectively, no discount will be given to any of such categories of investors.

Anchor Investors – Out of 16.32 crore net issue size, ICICI Life has already roped in some big anchor investors for 30% of its net issue size i.e. 48.96 lakh shares. These investors have agreed to pay Rs. 334 for their subscription, thus amounting to Rs. 1,635 crore. Some big anchor investors include Morgan Stanley Mauritius, Government of Singapore, UTI Trustee Co., SBI Trustee Co., Birla Sun Life Trustee Co., L&T Mutual Fund, Nomura India Investment Fund and Goldman Sachs (Singapore).

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 44 shares and in multiples of 44 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,696 at the upper end of the price band and Rs. 13,200 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 44 shares @ Rs. 334 i.e. a maximum investment of Rs. 1,91,048. However, at Rs. 300 per share, you can apply for 15 lots of 44 shares, thus making it Rs. 1,98,000. Investors opting for the “Cut-Off Price” option can apply for a maximum of 13 lots of 44 shares.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on 21st September. September 29th is the tentative date for such listing.

Here are some of the important dates to consider for this IPO:

Issue Opening Date – September 19, 2016

Issue Closing Date – September 21, 2016

Finalisation of Basis of Allotment – On or about September 26, 2016

Initiation of Refunds – On or about September 27, 2016

Credit of equity shares to investors’ demat accounts – On or about September 28, 2016

Commencement of Trading on the NSE/BSE – On or about September 29, 2016

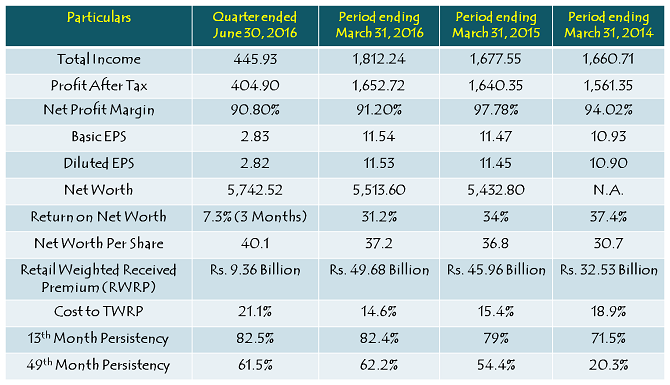

Financials of ICICI Prudential Life Insurance

Note: Figures are in Rs. Crore, except per share data, figures in billions & percentage figures

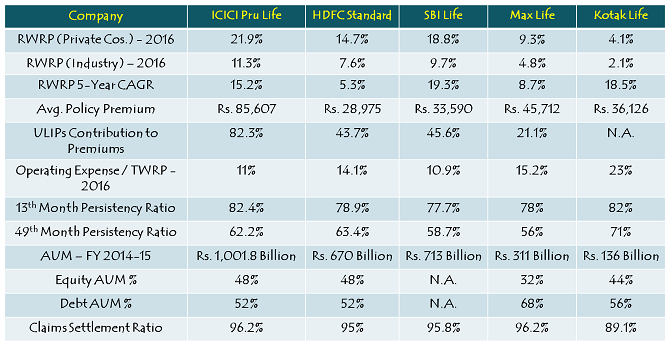

Comparison of the five largest private sector life insurers

Should you invest in ICICI Prudential Life IPO @ Rs. 334 a share?

This IPO doesn’t excite me at all. First of all, I am not a great fan of the way life insurance companies carry out their businesses here in India and probably outside India as well. I think life insurance business should have nothing to do with one’s investments and insurance & investments should strictly be carried out separately.

Investors have hardly made any money with life insurance companies in the first 5 years of their investments. High commissions, high operating expenses and complicated fee & expense structures have always resulted in relatively lower returns for insurance plans. Also, there is no clarity how life insurance companies will expand their reach and operations going forward.

Moreover, this IPO seems steeply overpriced to me. Presently, it is valuing ICICI Life at 29 times based on its FY 2016 earnings. With ICICI Life showing a very dismal growth in its profits in the last 4-5 years, buying its shares at 29 times would be highly unjustifiable.

ICICI Life is a JV between ICICI Bank, holding 67.52% stake and Prudential Corp. Holdings Ltd. (PCHL), holding 25.83% stake. ICICI Bank sold its 4% stake in ICICI Life to Wipro Chairman Azim Premji’s Hasham Traders on November 27, 2015 at Rs. 226.34 per share. Can anybody explain me what has changed in the last 9-10 months to make ICICI Bank seek a 47.57% premium from the general public and other investors?

ICICI Bank reported a profit after tax (PAT) of Rs. 101.80 billion in FY 2015-16 and Rs. 122.47 billion in FY 2014-15. On the other hand, ICICI Life reported PAT of 16.53 billion in FY 2015-16 and Rs. 16.40 billion in FY 2014-15, which is less than 20% of ICICI Bank’s PAT in both these financial years.

At Rs. 334 a share, ICICI Life would be valued at Rs. 47,957 crore and that makes ICICI Bank’s 67.52% stake worth Rs. 32,381 crore. However, at Rs. 267.35 a share, ICICI Bank itself is valued at Rs. 1,55,533 crore. Interestingly, ICICI Bank had a market cap of Rs. 1,05,153 crore when it made its 52-week low early this year on February 26. It clearly shows it is just a turnaround in the investors’ sentiment which has made ICICI Bank seek higher valuations for ICICI Life. Its fundamentals remain intact based on which it doesn’t make any sense for me to invest in ICICI Life at 29 times its FY 2015-16 EPS.

Comparing these financials and giving it a consideration that ICICI Bank is a much bigger company having many other profitable subsidiaries other than ICICI Life, I find no justification for me to assign such a steep valuation to ICICI Life. I would give this issue a miss and advise my clients as well to avoid it.

Big jump in Category I & Category II subscription nos. post 2 p.m.

I think, it should be open with 20 to 25 Rupees premium, but not think so the same will sustain later.

ICICI Life IPO stands fully subscribed now. Retail subscription stands at 1.04 times.

Hi Shiv,

What is the subscription figure for this IPO currently (say @ 1PM on 21Sep).

Which other IPOs in coming days looks interesting.

Hi Partha,

At 12:42 p.m., retail category is subscribed 0.96 times.

Hi Shiv,

How many ICICI Bank shares I should hold to apply in the Category 5 of “Reservation Portion Shareholder”

Hi Shiv,

How many ICICI Bank shares I should hold to apply in the Category 5 of “Reservation Portion Shareholder”

Hi Rohit,

Even if you held a single share of ICICI Bank on September 7, you would be eligible to apply in Category IV.

What You have explained Sir,is absolutly right.

How does the cut of price work. I am new investor wanted to understand I lf the IPO is not fully subscribed does the cut off price become 300

Hi Fakhri,

Once an IPO gets closed, the management of the company fixes the allotment price of its shares. In this case, ICICI Life will fix the allotment price between Rs. 300-334. If you bid at the “Cut-Off” price, you agree to subscribe to the IPO irrespective of the price fixed by the management. So, you’ll be eligible to get the shares allotted no matter what the allotment price fixed by the company.

The same cut off price is valid with the Bids also right? so for example if some one bid 305 and the cut off price was set as 307 by the company then in this case they wouldnt get it to right.. or does the company have the right to accept all bids irrespective what they set the cut off price as?

In case of oversubscription, the company would try to allot its shares at the Cut-Off price. In case of undersubscription, all bidders would get the shares allotted. But, a retail investor should always bid at the Cut-Off price.

Day 2 (September 20) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.59 times

Category II – Non Institutional Investors (NIIs) – 0.15 times

Category III – Retail Individual Investors (RIIs) – 0.65 times

Category IV – ICICI Bank Shareholders – 0.48 times

Total Subscription – 0.52 times

Most of the brokers or financial analysts gave positive view on this IPO,but still IPO is only about 50% subscribed as of 2nd day. Not sure whether this is going to be listed with great premium?

Seems to be a long term bet..

Hi Chaitu,

As it is a big IPO, it is taking time to get fully subscribed. I hope it gets fully subscribed by tomorrow afternoon.

I found one major flaw in the analysis. Are you analyzing as an investor or as a customer??. As a customer who “invests” in ULIP or like products of an insurance company are basically invest in a basket of products. Buying shares of the insurance company is a totally different ball game. It hardly matters whether “High commissions, high operating expenses and complicated fee & expense structures have always resulted in relatively lower returns for insurance plans”. You are not buying an insurance plan. This pertains to customers not investors. From what I read in the media, the price is cheaper compared to the valuation of MAX and HDFC merged entity. The ROCE is 30%+ for last 3 years which is an indicator of profitability.

Hi Partha,

At Rs. 1,288.45, HDFC Bank has a market cap of 2,58, 383 and trading at a Price to Book Value of 4.41 times & P/E Ratio of 26.69 times. On the other hand, at Rs. 272.10, ICICI Bank has a market cap of Rs. 1,58,296 crore and trading at a P/BV of 1.73 times & P/E Ratio of 16.46 times. So, going by your logic, all fund managers/investors should sell their HDFC Bank holdings and add ICICI Bank to their portfolios ?? Isn’t it ??

There is a difference between ICICI Life and Max-HDFC Life combo. Being a non-banking platform company, what Max has done is commendable and that is why it would command a higher premium for its business as compared to ICICI Life. ICICI Life is an early entrant to this business and that is why it is enjoying a better market share. HDFC group companies always command a higher premium for their ops and that is why ICICI Life should trade at a discount to HDFC-Max Life combo.

Moreover, if a product or service is not up to the mark, then you won’t buy it and would advise your friends/relatives also not to buy it. Maruti has been a multi-bagger stock. How? Bcoz the company has been successful in keeping its products attractive enough for its customers to buy them. In the long run, only such companies survive, which care for their customers. Earning profits and creating wealth for its shareholders is an important factor for a company, but not at the cost of its customers. Please check the difference between Volkswagen sales nos. and Maruti sales nos. in the last 12 months or so. Please check the share prices of Airtel, RCom and MTNL. You’ll get to realise the difference automatically.

I think you have missed the point. What I wanted to say that an investor should look at company fundamentals rather than its products while investing (here the “ULIPS” and similar useless/harmful ones). ITC has cigarettes at about 80% of sale and over 90% of profits from it. Now cigarettes are carcinogenic – causes cancer. Still ITC is a darling of investors. You must be knowing that LIC is the largest non-promoter shareholder of ITC, hence the joke on ITC-LIC – Zindagi ke saath bhi, Zindagi ke baad bhi.

Now how the ICICI Pru stocks will fare in future no one can say with certainty. I mentioned that certain parts of media are reporting that it is not very expensive based on its last three year performance and also comparing it to MAX HDFC combine. I would not copy the same here as it is available in the internet.

Thanks for updating immediately.

Thank you!

Nice point and very well written, nobodies knows what will be opening price but what i believe, this is for sure that insurance business has great potential and scope here in India specially. In US nearly 90% citizen are covered and in India not even 2 %. So I see it as a very good long term investment.

Thanks Deepak!

I have no doubt about it, insurance business, like all other businesses, has huge potential here in India. But, it has to be public-oriented and carried out in an efficient manner and that is not happening here in India.

It is not Insurance business, what these companies are doing now. Insurance business is good for the country, but most of the companies in Life Insurance doing till now is deceit business, which will expose them once people are more informed. Kudos to people like Shiv to call a spade a spade.

More insurance coverage in India will happen only if the co.s become customer centric rather than trying to cheat.

I completely agree, thanks Anil!

Article very well written and sincere advise given. Thanks.

You missed mentioning the date of opening and closing of the issue.

Thanks Mr. Bhuwalka!

I have updated the post above to have both the dates.

Day 1 (September 19) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.06 times

Category II – Non Institutional Investors (NIIs) – 0.04 times

Category III – Retail Individual Investors (RIIs) – 0.25 times

Category IV – ICICI Bank Shareholders – 0.20 times

Total Subscription – 0.16 times

This IPO is going to be a game changer for insurance companies and can surely have first mover advantage and can list at good price

Hi Amit,

Can you please elaborate how this would be a game changer for insurance companies? Is there anything in this IPO which would change the dynamics of the insurance business?

Actually, the thing is in Indian markets anything a first is dealt with great euphoria and enthusiasm. Reliance power, Infibeam – all these first of their kind IPOs listed with premiums. Risks and ways of performing business are secondary. No business house, within days in and out of their IPO release likes to announce anything that may go against their greatest windfall collection. When Alibaba brought in their IPO, world’s largest IPO of all time, analysts were worried about its point to point business dealings and straight forward procedures of a typical online marketstore. It swept away the market by storm thrashing all the concerning apprehensions into oblivion. Similar thing is going to happen with ICICI IPO as well. This IPO opens a way for all the insurance owners to throng to market and ICICI turns out to be the one who ultimately belled the cat.

This is going to be listed on a great premium. Get it for short term folks

yes exactly you have ellobrated that i wanted. Just wantto add to it is after that hdfc insurance ipo will come and its performance will be based on this ipo only.

I don’t agree. This IPO will do nothing of this sort to change ICICI Life’s business dynamics or the industry’s. Though it is better to invest in ICICI Bank’s shares rather than ICICI Life’s IPO, I won’t advise even that. This is an expensive IPO and one should wait for at least 30% price correction before entering.

To correct, Reliance Power was not listed in premium, rather a lot of people lost a lot of money applying in that IPO and it actually killed the IPO market

My bad about reliance power being first of a kind. It wasn’t. And actually, it was indeed listed on a 90/- premium and closed at 372/- due to profit bookings of the curious few. It did manage to hit the lifetime high of 610 before tumbling down all the way to hell. Reliance declared bonus shares for all holders that effectively brought the price down to 281/- for all, though true it didn’t sustain those levels. Only the speedy investors could derive benefit from it. Same thing for infibeam – from being quoted over valued at 430, this stock is trading at more than twice of its listed price. First of a kind stock in Indian market that became investor’s darling

Great

blog

Thanks Irshad!

Thanks Shiv for the timely analysis. I was waiting for your blog on this subject to come by. Would have applied had it not been for your prudent advise.

QQs though.

1. Why have Anchor investors bought this overpriced stock at highest band – Rs 334?

2. Are they too big to care or something else normal public doesn’t know?

Thanks Bobby!

1. High liquidity, fewer investment options and their different view might be the reasons for the anchor investors to subscribe to this IPO.

2. First one is quite possible, second one seems less realistic.

Excellent analysis Shiv and I completely agree with your advice this company is n’t worth investing. I personally have had very bad experience with them of investing huge amounts annually and ended up in big loss all due to misselling by their reps. ..Avoid completely!!

Thanks Ikjot!

I call buying an insurance policy a ‘Chakravyuh’, easy to enter – extremely difficult & painful to exit. I fail to understand why people buy these policies when they know there are high charges involved and why don’t they go for mutual funds for investments when they know there are low charges involved, high transparency is there & they are managed in a better way. People lose their hard money with these insurance policies. If I were a decision maker, I would have stopped insurance companies to sell investment products in this manner.

Great review, honest and impartial advise given in this article with detailed analysis .

Thank you very much on behalf of thousands of retail investors.

Thanks a lot Sreenivas! 🙂

Very good article Mr. Shiv and agree with your views.

Q.1 where can i find your views on ipos and other issues? Let me know details of website

Q.2 how come the ipru ipo which was subscibed only 52? till day 2 was oversubscribed 10 times on last day? (Source moneycontrol) https://www.google.co.in/url?sa=t&source=web&rct=j&url=http://m.moneycontrol.com/news/ipo-issues-open/icici-prudentials-ipo-oversubscribed-nearly-2-times_7491161.html&ved=0ahUKEwiFuNKs2KDPAhWMRo8KHc5-DvQQFggcMAE&usg=AFQjCNGX953RRiDW2oyRz2JbFXzi38Tpwg&sig2=rFFKcLq6WHtxXge2DIlqPg