This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

India’s biggest public sector bank, State Bank of India, has given a new year gift to thousands of its borrowers on Sunday by cutting its 1-year MCLR rate by 0.90% from 8.65% to 7.75%. This move by SBI has resulted in a slew of rate cut announcements by public sector banks, which should be followed by private sector banks taking such decisions very soon. Reducing lending rates with such steep cuts is the need of the hour as banks are flushed with unprecedented liquidity and our economy needs cheaper loans to keep itself growing in these toughest of the times.

Unfortunately, lower interest rate environment results in a fall in deposit rates as well and that has been the case with most of the fixed income investments, including fixed deposits (FDs) and non-convertible debentures (NCDs). One such NCD issue is getting launched from today and the company that is launching this issue is SREI Equipment Finance Limited.

Let us take a look at the salient features of this issue.

Size & Objective of the Issue – Base size of this issue is Rs. 250 crore, with the green-shoe option to retain an additional Rs. 250 crore, thus making it a Rs. 500 crore issue. The company plans to use at least 75% of the issue proceeds for its lending activities and to repay its existing loans and up to 25% of the proceeds for general corporate purposes.

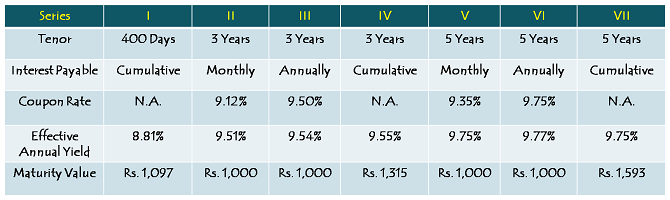

Coupon Rate & Tenor of the Issue – The issue will carry coupon rate of 9.12% p.a. payable monthly and 9.50% p.a. payable annually or cumulative for a period of 3 years (36 months) and 9.35% p.a. payable monthly and 9.75% p.a. payable annually or cumulative for a period of 5 years (60 months). There is one more option of 400 days which carries an effective annual yield of 8.81%.

Minimum Investment – Investors need to apply for a minimum of ten bonds in this issue with face value Rs. 1,000 each i.e. a minimum investment of Rs. 10,000.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 30% of the issue i.e. Rs. 150 crore

Category II – Non-Institutional Investors – 20% of the issue i.e. Rs. 100 crore

Category III – Individual & HUF Investors – 50% of the issue i.e. Rs. 250 crore

Allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which it gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating & Nature of NCDs – Brickwork Ratings has rated this issue as ‘AA+’ and SMERA has rated it as ‘AA’, with ‘Stable’ outlook by both the rating agencies. Debt instruments with such a rating are considered to have high degree of safety regarding timely payment of interest and principal. Moreover, these NCDs are ‘Secured’ in nature i.e. in case of any default on its payment of interest or principal, the bondholders will have the right on certain secured assets of the company.

Listing, Premature Withdrawal & Put/Call Option – These NCDs will be listed on both the stock exchanges i.e. Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE). The listing will take place within 12 working days after the issue gets closed. Though there is no option of a premature redemption, the investors can sell these bonds on the stock exchanges if NCDs are held in demat form.

Demat Not Mandatory – Demat account is not mandatory to invest in these NCDs as the investors have the option to apply for these NCDs in physical or certificate form as well.

TDS – Interest income earned is taxable with these NCDs and the investors are required to pay tax on the interest income as per their respective tax slabs. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000. NCDs held in demat mode will not attract any TDS.

Should you invest in SREI Equipment Finance NCDs?

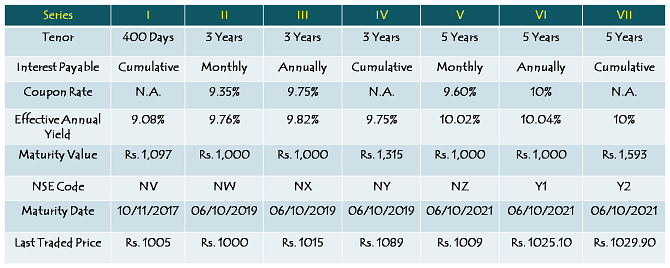

SREI Equipment Finance Limited (SEFL) is a wholly-owned subsidiary of SREI Infrastructure Finance Limited (SIFL) which is a listed company on the BSE and NSE and came up with its own issue of NCDs in September this year. Below pasted is the table having issue details, NSE scrip codes and last traded prices of those NCDs.

As on March 31, 2016, the parent company SREI Infra carried net worth of Rs. 3,539 crore, while SEFL had a net worth of Rs. 2,322 crore. SIFL reported Gross NPAs of 4.02% and Net NPAs of 3.09%, while SEFL’s asset quality was relatively better at 2.95% of Gross NPAs and 1.99% of Net NPAs.

SREI Infra reported a profit of Rs. 61.53 crore on a turnover of Rs. 2,862 crore, while SEFL earned profits of Rs. 115.26 crore with revenues from operations of Rs. 2,614 crore. So, the operational performance of these companies favour SREI Equipment Finance over its parent company SREI Infra and probably that is why Brickwork Ratings has assigned it ‘AA+’ rating to the issue.

However, I think retail investors would do well to either avoid this issue or invest a maximum of 10% of their investible surplus in order to have a high interest rate investment in their portfolio in a falling interest rate scenario. Investors can also consider investing in already listed NCDs of SREI Infra or some other company from the markets at a better yield. Investors in the 30% or 20% tax bracket should avoid such taxable NCDs.

Application Form – SREI Equipment Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in SREI Equipment Finance Limited (SEFL) NCDs, you can reach us at +91-9811797407

Dear Shiv,

I admire your courage in giving clear and frank advise regarding the SREI NCD issue unlike many other expert who remain vague or create confusion in the minds of investor.

Your concern for safety of investor capital is admirable esp. for the fact there are many senior citizens like me who invest in such issues for their earning in old age.

I also tend to agree with your views. It is better to get less income from other investments than risk loosing money at this late stage in life.

Kindly keep up. People like me will look forward to your opinion in future too.

Regards.

Thanks a lot Mr. Mahesh for your kind & encouraging words! You are most welcome to visit this unbiased blog and participate in knowledge/experience sharing. You can subscribe to our free newsletter – https://feedburner.google.com/fb/a/mailverify?uri=onemint%2Ffeed

srei infra ncd is opening on 30th January 2017 and this time extra .25% interest on existing share holder so if I opt for 5 years monthly will I get 9.12 .25=9.37% if I purchase only 0ne share on Monday dear shiv please clear my doubt

Hi Nitesh,

As per the prospectus, you need to be a shareholder on the deemed date of allotment to be eligible for an additional 0.25% coupon.

Hi Siv, And I guess that extra .25% would be on additional purchase for existing holders, but not on existing holdings, correct?

Hi Niraj,

Yes, you won’t get any extra interest on your existing bond holdings.

Hi Siv, your thought on “Reliance Mutual Fund CPSE ETF” please, and kindly suggest if you’ve already posted some article on that.

Thanks, Warm Regards,

Niraj

Hi Niraj,

Please find below the links to the CPSE ETF Review:

http://www.onemint.com/2017/01/16/cpse-etf-further-fund-offer-ffo-january-2017-issue/

http://www.onemint.com/2017/01/18/cpse-etf-ffo-how-to-apply-invest-other-faqs/

Also, please subscribe to our free newsletter for such product updates – https://feedburner.google.com/fb/a/mailverify?uri=onemint%2Ffeed

Thanks a lot Siv.

You are welcome Niraj!

Shiv – Would appreciate your views on CPSE ETFs. Would it be worthwhile investing?

I applied on 6th jan morning. any chance of me getting alotment?

Hi Kumar,

I don’t think you will get any allotment.

Thanks Shiv. Will there be any TAX FREE BONDS issues this year?

No Kumar, there will not be any tax-free bond issues this year.

Does anyone know if any new upcoming NCD issues and when those be available for subscription?

Hi Prajju,

ECL Finance (subsidiary of Edelweiss) will soon be coming up with its issue of NCDs, most likely this month itself.

ECL Finance and Muthoot Finance soon.. as per news in economic times etc.

Something coming up from Idea also I guess. not sure that’s NCD or not.

Thanks Shiv and Chaitanya.

new ncd

This issue is getting closed today.

Hi shiv,

Any idea when ECL finance ncd opening and its rate of interest?

This issue should get closed tomorrow. Retail investors should not apply for these NCDs now as they won’t get allotment for applications submitted from now onwards.

Day 3 (January 5) Subscription Figures:

Category I – Rs. 116.31 crore as against Rs. 150 crore reserved – 0.78 times

Category II – Rs. 7.31 crore as against Rs. 100 crore reserved – 0.07 times

Category III – Rs. 414.77 crore as against Rs. 250 crore reserved – 1.66 times

Total Subscription – Rs. 538.38 crore as against total issue size of Rs. 500 crore – 1.08 times

hi Shiv,

as it is oversubscribed in Cat 3, yesterday itself, if we apply today, will we get allottment?

Hi Kumar,

Category III allotment would depend on the subscription nos. of Category II & Category I on the day the issue gets closed. If the issue gets closed tomorrow and category II and/or category I remain undersubscribed, then retail investors category would get the left over portion of category II/I.

Day 2 (January 4) Subscription Figures:

Category I – Rs. 90.21 crore as against Rs. 150 crore reserved – 0.60 times

Category II – Rs. 7.05 crore as against Rs. 100 crore reserved – 0.07 times

Category III – Rs. 294.26 crore as against Rs. 250 crore reserved – 1.18 times

Total Subscription – Rs. 391.52 crore as against total issue size of Rs. 500 crore – 0.78 times

BSE Ltd IPO: You must Know.

More info@ https://www.moneydial.com/blogs/bse-ltd-ipo-you-must-know/

Hello sir,

Can you suggest me names (code no.) of other Secured NCD’s giving a yield of around 9.5 % p.a. (mthly option preferred).

Thanks.

CODE- EHFL FIN(N5),SREI INFRA (NZ) AND DHFL(N6) , above are nse codes for some of the NCD.

Hello Sir,

As mentioned by you there are some of the listed NCD’s that offer better yields. I went through some of them’s like IIFL 12%,IIHFL 12%. These are giving a YTM or (IRR) real rate of around 8.50 to 8.75 % after taking into account hefty premium with which they are trading. So, I wanted to ask you the Code no.(BSE or NSE) of other such Secured NCD’s that offer yield of around 9.25 %. and also tell me how to easily identify such NCD’s bcos till now I used to find this manually by going to the site, then getting the due dates and then computing the IRR or YTM but it is very time consuming.

Thanks ,

Yash Hariyani.

Hi Yash,

Sorry, I won’t be able to advise on such NCDs/Bonds as we provide such services to our clients on a fee basis.

Ok, So Can I get it even if it is by paying fees, that’s OK.

Sure, this service falls under our One Time Consultation service, for which we charge Rs. 2,000. You can mail me your requirement on my mail id [email protected] and from thereon we can take it forward.

Hi Shiv, Thanks for your post. When ratings and all seem good, then why you suggest to stay away from this ncd or at max 10% exposure?

And Reliance ncd was oversubscribed on day one itself, which is not the case here though both are having same rating, how would you compare this with recently launched ncds of Reliance and DHFL? Kindly suggest.

Thanks,

Warm Regards,

Niraj

Hi Niraj,

I think risk-reward matrix is not in favour of the investors here, that is why I would personally avoid this issue and advise my clients/readers as well to do so. As compared to Reliance, DHFL etc., SREI Equipment Finance is a relatively unknown group with somewhat weaker backing. That is why it is not getting a good response from QIBs & Corporates.

Understood. Thanks a lot Shiv for your kind reply.

Considering same rating “AA+” by Brickwork for SREI and Reliance made me confused. In benefit of investors, I wish Rating agency would have considered such other factors also while rating such issues.

Thanks a lot once again and appreciate your help.

Warm Regards,

Niraj

Thanks Niraj!

A Very Happy and Prosperous New Year to you Shiv and also to the missing for long time Manshu 🙂

Thanks a lot Harinee for your wishes and you too have a wonderful 2017! 🙂

Day 1 (January 3) Subscription Figures:

Category I – Rs. 36.51 crore as against Rs. 150 crore reserved – 0.24 times

Category II – Rs. 4.94 crore as against Rs. 100 crore reserved – 0.05 times

Category III – Rs. 182.39 crore as against Rs. 250 crore reserved – 0.73 times

Total Subscription – Rs. 223.85 crore as against total issue size of Rs. 500 crore – 0.45 times

Thanks for the post Shiv, Can we have today’s subscription figures please.

Thanks Ikjot!

Sir, I have DMAT a/c with icicidirect linked with icici bank. I applied for reliance home NCD through them recently. However now I find that when i go to IPO in icicidirect there is no provision to apply for SERI fin. What to do and how to apply in this situation. More importantly i wondor why i cant buy these through icicidirect. Any specific reason. Pl clarify. Thanks.

Same issue for me too. I called icicidirect, they said “we are not offering this NCD – this is the update we got from our risk team”.

Weird.

The way they operate, a possible reason could be they think customers will opt for this NCD instead of their FDs, so they are not offering this NCD, to limit available options to customers.

Thanks Chaitanya for your inputs!

Hi Mr. Handa,

As mentioned by Chaitanya, ICICI Direct is not serving SREI Equipment Finance NCDs issue. So, you need to apply for it by submitting a physical application form mentioning your demat account details on the form. You can contact/mail us for the same @ +91-9811797407 or [email protected]