This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Asia’s oldest stock exchange, Bombay Stock Exchange or BSE, is coming out with its Initial Public Offer (IPO) of Rs. 1,243 crore from today. The issue comprises of an offer for sale of around 1.54 crore shares by its existing shareholders in a price band of Rs. 805-806. Like all other IPOs, this issue will also remain open for three days to close on January 25.

Before we analyse some of its fundamental attributes, let us have a take a look at some of the salient features of this IPO:

Price Band – BSE has fixed its price band in a very tight range to be between Rs. 805-806 per share and no discount or special preference will be given to the retail investors.

Size & Objective of the Issue – This issue is an Offer for Sale (OFS) by some of the BSE’s existing shareholders and thus no fresh issue of shares is involved. Singapore Exchange, Quantum (M) Limited, Atticus Mauritius Limited, GKFF Ventures, Caldwell India, Acacia Banyan Partners and Bajaj Holding and Investment are a few of the 302 shareholders selling their stakes in this offer either fully or partially.

These shareholders will sell approximately 1.54 crore shares and raise around Rs. 1,243 crore in this offer at Rs. 806 per share. These shares represent 28.26% of the total outstanding shares of BSE.

Retail Allocation – 35% of the issue size is reserved for the retail individual investors (RIIs) i.e. approximately 54 lakh shares out of 1.54 crore shares. 15% of the issue size is reserved for the non-institutional investors and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

No Discount for Retail Investors – BSE has decided not to offer any discount or any other special treatment for the retail investors in this IPO.

Anchor Investors – Out of 1.54 crore shares to be issued, BSE has already issued around 46 lakh shares to some of the big anchor investors at Rs. 806 per share. Investment form these investors would amount to Rs. 373 crore. These investors include Smallcap World Fund, ICICI Prudential Mutual Fund, Goldman Sachs India, HDFC Trustee Company, Reliance Trustee Company, FIL Investments (Mauritius) and Kuwait Investment Authority Fund, among others.

Bid Lot Size & Minimum Investment – Investors in this offer need to bid for a minimum of 18 shares and in multiples of 18 shares thereafter. So, you as a retail investor would be required to invest a minimum of Rs. 14,508 at the upper end of the price band and Rs. 14,490 at the lower end of the price band.

Maximum Investment for Retail Investors – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 18 shares @ Rs. 806 i.e. a maximum investment of Rs. 1,88,604 or @ Rs. 805 i.e. a minimum investment of Rs. 1,88,370. Investors opting for the “Cut-Off Price” option should apply for a maximum of 13 lots of 18 shares.

Listing – As BSE itself is a stock exchange, as per SEBI regulations, it cannot go ahead and list itself on its exchange. So, it will have to get itself listed on the National Stock Exchange (NSE). Allotment and listing will happen within 6 working days after the issue gets closed on January 25. These shares are expected to list on February 3 on the stock exchanges.

Here are some of the important dates for this IPO:

Issue Opens – On January 23, 2017

Issue Closes – On January 25, 2017

Finalisation of Basis of Allotment – On or about January 31, 2017

Initiation of Refunds – On or about February 1, 2017

Credit of equity shares to investors’ demat accounts – On or about February 2, 2017

Commencement of Trading on the NSE – On or about February 3, 2017

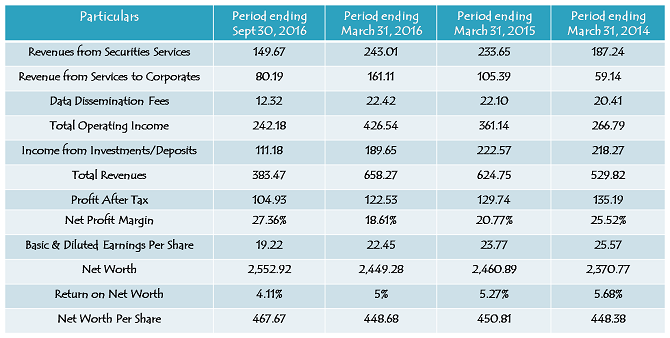

Financials of BSE Limited

BSE has four sources of revenues — Securities Services, Services to Corporates, Data Dissemination Fees and Income from Investments and Deposits. As you can check from the table below, around 39% of BSE’s total revenues in the first six months of the current financial year have come from its securities services, 29% from investment income and 21% from services to corporates. Rest of its revenues are derived as data dissemination fees.

Note: Figures are in Rs. Crore, except per share data & percentage figures

BSE reported an EPS of Rs. 19.22 for the period ending September 30, 2016 and on an annualised EPS of Rs. 38.44, this issue is valued at 20.97 times at the upper end of its price band. As per the SEBI regulations, BSE is required to reduce its stake in CDSL from 50.05% to 24% and whenever that happens, it would result in a one-time healthy jump in its EPS. If you consider that, this issue would look less expensive to you.

MCX is the only other listed exchange here in India and it is currently trading at around 32 times its estimated FY 2017-18 earnings. However, MCX is a growing exchange and commands leadership in the commodities derivatives market with close to 90% market share. That is why it would be unfair to offer such a high price multiple to BSE.

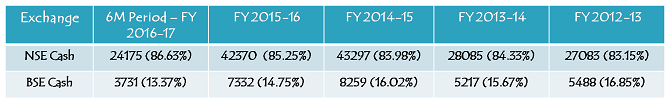

While BSE’s market share in the equity derivatives segment is less than 1%, it has been declining steadily in the equity cash segment as well and currently stands at 13.37%. It has resorted to liquidity enhancement initiatives in the past in order to attract brokers to trade more on its platform, but that has not resulted in a sustained gain in market share for the exchange.

Market Share of NSE and BSE in Equity Cash Segment – Rs. 000 million

At Rs. 806 a share, I think BSE’s valuation is not greatly expensive and if the market sentiment remains positive post budget, it should ideally get listed at a premium. But, the issues with the exchange are fundamental in nature. Why is it that the exchange is losing market share to the NSE in the equity cash segment and why has it failed to retain its market share in the derivatives segment after its liquidity enhancement initiatives got discontinued?

Also, though the exchange is not going to get any cash out of this IPO, but are there any plans the management is working on to utilise the cash the exchange currently has in order to increase its revenues and profitability on a sustainable basis? If you look at the growth in its revenues and profits in the last 4-5 years, it seems every effort made by the exchange to increase its market share and add value to the shareholders has failed to do so.

I think as a risk taker you can apply to this IPO and expect some listing gains. But, in the long run, I think the exchange will have to work very hard on its strategy to gain market share on a sustainable basis. Investors can hold on to their shares till the time NSE comes out with its IPO and gets its shares listed on the BSE. But post that, they need to push BSE’s management to do it differently this time to gain a sustainable market share.

great post

10 Points about Nitiraj Engineers Ltd IPO: You must know

More info@ https://www.moneydial.com/blogs/10-points-nitiraj-engineers-ltd-ipo-must-know/

Hi Shiv,

I had also applied on ASBA basis on the first day itself. I don’t see any money deducted from my account or any allotment. But saw a small credit from NSE this week. Not sure what that means.

Thanks

After grand success of BSE Ltd IPO, DMart is expected to come up with its IPO by the end of Feb 2017.

5 Unique Facts about DMart IPO – https://goo.gl/BsQrKS

BSE shares to get listed on the NSE tomorrow.

Dear Shiv

Can you please let us know, if BSE shares allotment has taken place. I had applied in IPO through ICICI Direct, but so far, money has not been deducted.

As always, thanks a lot for all the info provided.

Bhupender

Thanks Mr. Bhupender,

Yes, BSE allotment is complete now, shares must be there in your demat account. But, if money is not yet deducted, then I think there is some issue with your application. Please check with your broker.

Thanks for your reply Shiv

I checked in ICICI direct, “Zero” allotment 🙁

Probably due to lottery system of allotment, shares were not allotted to you.

Last Day (January 25) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 48.64 times

Category II – Non Institutional Investors (NIIs) – 159.03 times

Category III – Retail Individual Investors (RIIs) – 6.48 times

Total Subscription – 51.22 times

Day 2 (January 24) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.21 times

Category II – Non Institutional Investors (NIIs) – 0.57 times

Category III – Retail Individual Investors (RIIs) – 2.73 times

Total Subscription – 1.55 times

Day 1 (January 23) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.17 times

Category II – Non Institutional Investors (NIIs) – 0.12 times

Category III – Retail Individual Investors (RIIs) – 0.86 times

Total Subscription – 0.50 times

Is MOIL OFS worth subscribing?

Hi Harinee,

It is better to buy it from the market itself rather than subscribing to its OFS and not getting any shares.

Dear Shiv,

Based on fundamentals, what would be a good price to bid at ?

As you have advised to buy from market, do you think its market price will fall below the discounted floor price of the OFS, in near future ?

Thanks

TCB

Hi TCB,

Can’t really comment about a good price to bid at. Also, I think it could fall to the levels of Rs. 360-362 or so tomorrow.

Hi shiv, am very much confused abt this ofs i had applied for few ofs in past at cutoff price but never got alottment. Can u pls give some tips on how to decide abt the price to apply

Hi Kumar,

There is no easy mechanism to apply & get confirmed allotment in these OFS. You need to keep a track of price bidding during market hours and place your bids at higher prices to get allotment. With MOIL, floor price was Rs. 365 and Rs. 378 seems likely allotment price.

Thanks Shiv. I never knew this. I thought that we could get alottment by applying at cutoff price. I applied at 365 and i didnt get it. Will retail investor be able to quote at a reasonable price in OFS mechanism. Or most of them dont get alottment coz the quote was lower and hence that portion also goes to other category investors?

Hey Shiv,

Thanks the post is quite informative and specially the data on it income for last three years. If you see roughly ~40%-50% income is from deposits vs the business. Also the losing market share is a concern, so even I would exit these shares post the listing gains.

Thanks Vaibhav for sharing your thoughts!