This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

HUDCO IPO is opening today for subscription. I covered the details of this IPO on Friday. Here is the link for some of its general details – HUDCO IPO – May 2017 Issue

So, now comes the turn of the most important aspect of this IPO and that is, whether one should invest in it or not? Let’s begin to analyse it by checking its financials and other aspects.

HUDCO operates in two broad segments – housing finance and urban infrastructure finance. It has a loan portfolio of Rs. 36,385.82 crore as on December 31, 2016, of which 30.86% are housing finance loans and 69.14% are urban infrastructure finance loans. Housing finance loans, which is branded as HUDCO Niwas, is further categorised into social housing – EWS and LIG borrowers being the ultimate beneficiaries, residential real estate – middle-income and high-income group of society being the ultimate beneficiaries, and retail finance.

Under Urban Infrastructure Finance, HUDCO provides loans for projects relating to water supply, roads and transport (including railways and ports), power, emerging sectors including SEZs, industrial infrastructure, gas pipelines, oil terminals and telecom sector projects, and other commercial and social infrastructure.

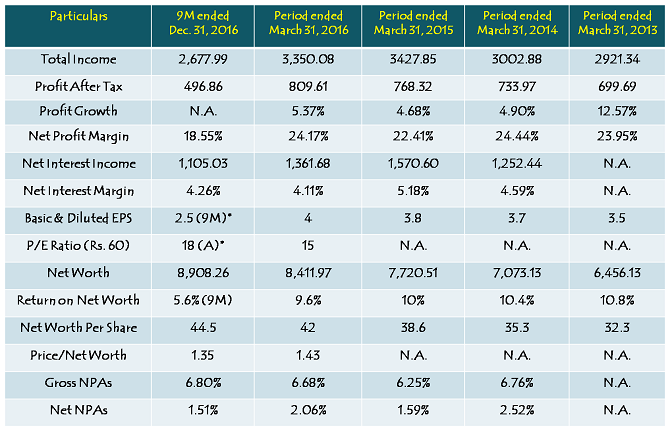

Financials of HUDCO

Note: Figures are in Rs. Crore, except per share data & percentage figures

Note: Figures are in Rs. Crore, except per share data & percentage figures

Should you invest in HUDCO IPO @ Rs. 58 a share?

Personally, I have many reasons to avoid this issue and the most important of them are – size of the issue, growth of the company in the past few years, and an irrational exuberance around this issue. I mean why people want to invest only in the HUDCO IPO today? Even if somebody can convince me about the company’s future growth and the size of the issue being not too small, that’s ok, but I am still very confident that it would get oversubscribed to the tune of at least 15-20 times in the retail investors’ category, which makes allotment highly unpredictable for me. And, even if I get lucky in the lottery system of allotment, I would not get more than 200 shares allotted. And, even if it gets listed at Rs. 90 a share (which I think is highly unjustified), I would make only Rs. 6,000-7,000 on listing. So, I don’t want to get indulged in such kind of mad rush for such a tiny gain. I think it is time to find out some hidden gems, which are not in the market spotlight as of now, but have a good potential to carry higher growth and provide higher returns.

Pricing in this issue, if not expensive, is not cheap either. At Rs. 60 a share and a discount of Rs. 2 for the retail investors, I think the issue is fairly valued at 17-18 times PE ratio and 1.3 times its book value, and not greatly attractive as the market participants are claiming it to be. As you can check from the table above, the company reported a PAT of Rs. 699.69 crore for FY 2012-13, and that has grown to just Rs. 809.61 crore during FY 2015-16. With a PAT of Rs. 496.86 crore in the nine-month period ending December 31, 2016, it seems the company would report a degrowth in its profits for the previous financial year.

HUDCO has reported a profit growth of 12.57%, 4.90%, 4.68% and 5.37% from FY 2012-13 to FY 2015-16, but it is still seeking a PE ratio of 17-18 times, which is on a higher side from PEG (Price Earnings over Growth) perspective.

HUDCO’s net interest margins (NIMs) are also seeing a decline in the past few years, from 4.59% in FY 2013-14 and 5.18% in FY 2014-15, it has fallen to 4.11% in FY 2015-16 and 4.26% in the nine-month period post that. Moreover, despite of the fact that the company stopped sanctioning new social housing and residential real estate loans to entities in the private sector in March 2013, its gross NPAs and Net NPAs are still elevated at 6.80% and 1.51% respectively.

There are many public sector companies which offer better growth opportunities and are priced even more attractively as compared to HUDCO. I think there is an unnecessary euphoria around it as it is an IPO. IPOs in such euphoric times have been given such kind of hype in the past as well. But, the investors would do well to keep their heads steady and invest in some of the already listed, professionally managed, reasonably priced companies as compared to HUDCO.

This issue could still earn you some decent listing gain, but that would happen only due to a change in the investors’ sentiment post BJP’s UP poll win and big jump in the indices in the last 3-4 months. But, I want to ask, why do you need to participate in a lottery system in which the probability of getting allotment is too low and the fundamentals of the company are yet to show any signs of improvement?

Poor Q2 results by HUDCO today. Still doesn’t deserve to trade at these levels.

Good to know . Thanks for update.

HUDCO has been doing exceptionally well in line with the broader markets. It had seen a peak of 102 and still going at 82, with buy recommendations. Can you please provide your assessment of this?

HUDCO closed at Rs. 72.55 on the NSE on its listing day. It opened at Rs. 73, touched a high of Rs. 77.85 and a low of Rs. 71 intraday.

please provide link to check allotment Status shiv

Hi Nitesh,

Here is the link to check your HUDCO allotment status – https://www.alankit.com/hudco-ipo-status/

So many IPOs launched in last few months and I think there are many more. Could you please suggest some must to invest upcoming IPO in 2017? I think SBI is going to launch an IPO in coming month. Please do share your review on all of them.

Thank you for sharing such details regularly on this website.

Hi Santanu,

It is not the SBI IPO, it is SBI Life’s IPO which is expected to get launched in the current financial year. I’ll keep on reviewing these IPOs as & when they come and I get time to review them. Thanks for your time!

Retail subscription in HUDCO IPO at 10.79 times is below my guesstimates of 15-20 times. But, even high overall subscription doesn’t make me bullish on the company. It remains fairly valued to me at Rs. 60 a share, and I don’t think it should list at a great premium to its issue price.

How the allotment will be. Will retail investor get minimum 1 lot based on new allotment process.

No George, as the subscription has been high, it will be allotted on a lottery basis. It will be like 1 out of 8-10 applicants will get it.

We applied in 3 accounts for 2 lots each. got 1 lot allotment in 1 account.

Lucky you George to have such a great allotment ratio! I have people around me applying in 4-5 accounts and getting no allotment.

Last Day (May 11) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 55.45 times

Category II – Non Institutional Investors (NIIs) – 330.36 times

Category III – Retail Individual Investors (RIIs) – 10.79 times

Category IV – Employees – 0.74 times

Total Subscription – 79.53 times

Hello Shive,

I really disagree with your article because even if the share price goes to 90 per lot we get 53.33% returns it’s not the matter of price but it’s a matter of percentage of returns we get, “That too in a shorter period of time”.

Hi Nikhil,

I welcome your disagreement!

Day 2 (May 9) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 2.96 times

Category II – Non Institutional Investors (NIIs) – 0.94 times

Category III – Retail Individual Investors (RIIs) – 4.13 times

Category IV – Employees – 0.21 times

Total Subscription – 3.01 times

today’s subscription figures please

today’s subscription figures please qib portion 2.5 times subscribed isn’t it Shiv

I think it is time to find out some hidden gems, which are not in the market spotlight as of now, but have a good potential to carry higher growth and provide higher returns.

Where do we find that sir?

Hidden gems are everywhere Ajay, around you as well, the companies you buy products/services of and like them.

Hi Shiv,

Very good analysis Sir.. very useful for retailers like me .. By the way you mentioned about some finding some hidden gems which are not in market spotlight .. please guide us in finding hidden gems 🙂

Thanks Anish,

I’ll try to do a post on finding good quality stocks soon.

Day 1 (May 8) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.18 times

Category II – Non Institutional Investors (NIIs) – 0.16 times

Category III – Retail Individual Investors (RIIs) – 1.52 times

Category IV – Employees – 0.01 times

Total Subscription – 0.63 times

FYI….

Hi Madan,

What information you want to share with us?

Hi Shiv, thanks. Should we apply for minimum lot or need to apply for 2 lakhs to get some alottment assuming 15 to 20 times retail oversubscription. People investing in both above will be treated differently or same

Hi Kumar,

In a highly oversubscribed IPO, there is no difference in the basis of allotment if you apply for a single lot of equity IPO or Rs. 2 lakh or so worth of lots. Please check this post – http://www.onemint.com/2012/12/26/new-basis-of-allotment-explained-with-care-ipo/

Brilliant as usual. I almost applied but your logic makes great sense. I still cannot accept dmart’s valuations. The question to be asked is why is govt in such a hurry to list it when clearly results dont look very good.

Thanks again Shiv. Would love an article on cryptocurrency exchanges and investing in same.

Thanks a lot Harinee! 🙂

I think the government is doing right in spreading out its divestments, and there is no problem in getting an issue highly oversubscribed at such valuations. Though I have a limited knowledge about it, I’ll still try covering cryptocurrency exchanges and investing in it. Would you like to write a post about your understanding of cryptocurrency exchanges?

Thanks Shiv. Fairly new to me as well but I will definitely do a post if I have more info. Thanks for the offer.

Thank you so much Shiv for this post. I am much interested in Cryptocurrency exchanges ? Could you please write something on it.

Thank you,

Satyam

Thanks Satyam!

Though I have limited knowledge about it, still I’ll try to cover it.

Dear Shiv,

Many Thanks for your time and efforts in advising on HUDCO IPO. Liked your frank review sans euphoria and that is the very reason we all like to take a cue from your advise.

Thanks Vasu! 🙂

Thanks Shiv for the candid and balanced views. Helps us stay focused 🙂

You are welcome Bobby!