SREI Equipment Finance is coming up with its issue of non-convertible debentures (NCDs) from this Monday i.e. July 17th. The company is offering interest rates in the range of 9.25% to 9.55% per annum, which effectively fall between 9.30% to 9.92%. These NCDs will be issued for a period of 5 years & 3 months, 7 years and 10 years.

These NCDs have been rated ‘AA+’ by Brickwork Ratings and SMERA and would also carry a tag of ‘Unsecured’ as far as the rights of its investors’ are concerned. Though the issue is scheduled to close on 31st of July, but given it carries such attractive interest rates in a falling interest rate scenario, it is highly unlikely that the issue would remain unsubscribed till then.

Let us quickly check some of the salient features of this issue:

Size & Objective of the Issue – Base size of this issue is Rs. 500 crore, with a green-shoe option to retain an additional Rs. 500 crore, thus making it a Rs. 1,000 crore issue. The company plans to use at least 75% of the issue proceeds for its lending activities and to refinance its existing loans and up to 25% of the proceeds for general corporate purposes.

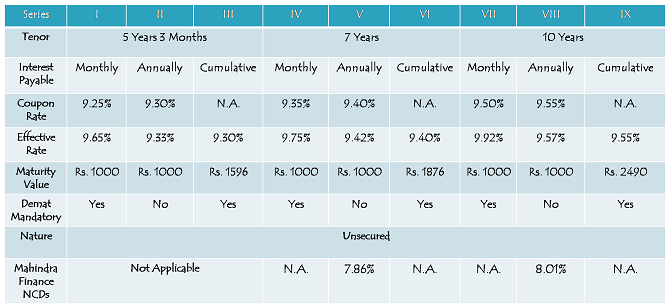

Coupon Rate & Tenor of the Issue – The issue will carry a coupon rate of 9.25% p.a. payable on a monthly basis, 9.30% p.a. payable annually and on a cumulative basis for a period of 5 years & 3 months. For 7 years maturity period, these rates would be 9.35% payable monthly and 9.40% for annual and cumulative options. The rates on offer are the highest for 10 years – 9.50% payable monthly or 9.55% payable annually or on a cumulative basis.

As you can check from the table below, these rates are effectively higher by 1.54% p.a. than the rates offered by Mahindra Finance in its ongoing issue.

For Category I and Category II investors also, these NCDs carry the same rate of interest as it is for Category III investors.

0.15% Additional Coupon for SREI Equipment Finance & SREI Infra Shareholders, NCD Holders, Senior Citizens & Employees – Existing shareholders and NCD holders of SREI Equipment Finance, SREI Infra, senior citizens aged more than 60 years of age and the employees of the company and SREI Infra will be offered an additional coupon of 0.15% per annum. Deemed date of allotment will be considered as the relevant date for these investors to be eligible for this additional rate of interest.

Minimum Investment – Investors are required to subscribe to at least ten units of these NCDs, thus making it a minimum investment of Rs. 10,000.

Categories of Investors & Allocation Ratio – The investors have been classified in the following three categories and each category will have the below mentioned percentage fixed in the allotment:

Category I – Institutional Investors – 30% of the issue i.e. Rs. 300 crore

Category II – Non-Institutional Investors – 20% of the issue i.e. Rs. 200 crore

Category III – Individuals Investors & HUFs – 50% of the issue i.e. Rs. 500 crore

Allotment will be made on a first-come first-served basis, as well as on a date priority basis i.e. on the date of oversubscription, the allotment will be made on a proportionate basis to all the applicants of that day on which the issue gets oversubscribed.

NRIs Not Allowed – Non-Resident Indians (NRIs), foreign nationals and qualified foreign investors (QFIs) among others are not eligible to invest in this issue.

Credit Rating – Rating agencies, Brickwork Ratings (BWR) and SMERA have rated this issue as ‘AA+’ with a ‘Stable ‘ outlook. Debt instruments with such a rating are considered to have a high degree of safety regarding timely payment of interest and principal.

Unsecured NCDs – These NCDs are ‘Unsecured’ in nature i.e. in case of any default on its payment of interest or principal, the bondholders will not have any right on any of the assets of SREI Equipment Finance.

Listing, Premature Withdrawal & Put Option – These NCDs will get listed on both the stock exchanges – Bombay Stock Exchange (BSE) as well as National Stock Exchange (NSE), and the listing will take place within 12 working days from the issue closure date. Moreover, there is no option with the bondholders for a premature redemption and there is no option either with the company to buyback these NCDs from the investors.

Demat Mandatory except Series II, Series V and Series VIII NCDs – Though demat account is not mandatory to apply for these NCDs, however investors can apply for these NCDs in physical form only for Series II, Series V and Series VIII NCDs. Notably, these NCDs will pay interest rates on an annual basis.

TDS – Interest income earned on these NCDs is taxable and the investors are required to pay tax on it as per the respective tax slabs they fall into. TDS @ 10% will be deducted if these NCDs are held in physical/certificate form and annual interest income is more than Rs. 5,000. NCDs held in demat mode will not attract any TDS.

Should you invest in SREI Equipment Finance NCDs?

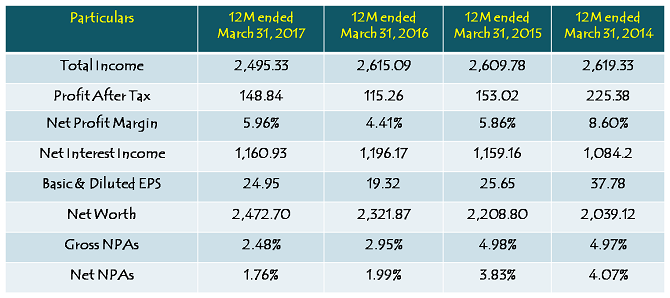

Infrastructure finance space has been facing a really difficult time over the past few years. But, off late it has been recovering well for the company and it has been able to improve on its asset quality front. The company has been able to contain its gross NPAs from 4.97% in FY14 to 2.48% in FY17 and net NPAs from 4.07% to 1.76% in the same period. However, this improvement has come at the cost of a slowdown in its revenue growth and net interest income.

Worst is probably not over for the company. But going ahead, with an expected improvement in the economy and the infrastructure space, the company is likely to do better and grow at a relatively higher speed.

Financials of SREI Equipment Finance Limited

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Investors, with an appetite of taking some risk and who fall in the lower tax brackets, can consider investing in these NCDs. But, as the investment period is long, the investors would do well to be vigilant about the company’s asset quality and loan growth going forward.

In a falling interest rate scenario, 9.92% effective yield is quite attractive. But then 10 years is a long period to invest with a private company. Out of the nine options available, I would personally prefer Series I, with monthly interest payment option, as I would like to get back my principal investment amount and the interest thereon with a private company as early as possible.

Application Form – SREI Equipment Finance NCDs

Note: As per SEBI guidelines, ‘Bidding’ is mandatory before banking the application form, else the application is liable to get rejected. For bidding of your application, any further info or to invest in SREI Equipment Finance NCDs, you can reach us on +91-9811797407

Day 2 (July 18) Subscription Figures:

Category I – 11.31 crore as against Rs. 300 crore reserved – 0.04 times

Category II – Rs. 22.44 crore as against Rs. 200 crore reserved – 0.11 times

Category III – Rs. 180.11 crore as against Rs. 500 crore reserved – 0.36 times

Total Subscription – Rs. 180.11 crore as against total issue size of Rs. 1,000 crore – 0.18 times

please post latest subscription figures dear Shiv

subscription figures of day 2 in details please Shiv

subscription figures of day 2 details please Shiv

TOTAL 5000000 100%

BSE + NSE Quantity 2138582 42.77%

but retail mare than .75 times(500cr) or .375(1000 cr) times subscribed

today’s subscription figures please and if I apply tommorow should I get full allotment

http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?expandable=7&id=1377&type=DPI&status=L&idtype=1&IPONo=3451

YOU SHOULD GET FULL ALLOTMENT.

Day 1 (July 17) Subscription Figures:

Category I – 0.71 crore as against Rs. 300 crore reserved – 0.24% subscribed

Category II – Rs. 9.12 crore as against Rs. 200 crore reserved – 0.05 times

Category III – Rs. 114.57 crore as against Rs. 500 crore reserved – 0.23 times

Total Subscription – Rs. 124.40 crore as against total issue size of Rs. 1,000 crore – 0.12 times

http://www.bseindia.com/markets/publicIssues/DisplayIPO.aspx?expandable=7&id=1377&type=DPI&status=L&idtype=1&IPONo=3451

Total Issue Size 5000000

Total Bids Received 1243978

No. of times issue is subscribed 0.25

total NSE+BSE

Category III 25,00,000 1,49,352

0.06 times

Total 50,00,000 1,49,701

0.03 times

today’s subscription figures please

latest subscription figures please

Very less subscription so far unlike others which got good response by noon.. Seems investors not preferring these due to unsecured?

Most likely.

what r the other secure NCD available in market now.

And what their interest rates?

Hi Narayan,

There are various Secured & Unsecured NCDs listed in the markets, with different interest rates & yields. Here is the link for the same – https://www.nseindia.com/live_market/dynaContent/live_watch/equities_stock_watch.htm?cat=SEC

I am confused, why is the effective rate less in case of cumulative interest payable across all tenures?

Hi Pavan,

Effective rates in all the cumulative options are actually the coupon rates for those respective tenors. Effective rates in monthly interest options factor-in reinvestment at their respective coupon rates.

Dear Shiv,

I have invested in previous tranches of SREI, but those were secured bonds.

I am a little unsure on this one because SREI’s interest coverage ratio does not look great ( 1.1 times ), and these are unsecured.

Please advise.

Regards,

Srikant

Hi Srikant,

If SREI NCDs are your only investment in NCDs/Bonds, then I think you should not invest in this issue. But, if you have investments in other NCDs/bonds as well, then you need to take a decision whether you want to invest in ‘Unsecured’ NCDs or not. I think it is always better to invest in Secured NCDs, but personally I look at the company, its management and its financials before taking any such investment decision. Whether it is Secured or Unsecured doesn’t matter to me much.

Please everyone be patient. I am sure Shiv Sir is well aware of the time limits and is doing the best he can.

Thanks Vanita!

Mr. Shiv, have noticed that most of your recent articles are incomplete. It is mentioned that full review would follow. But either the review does not eventually arrive or it arrives too late to subscribe. Request your timely reviews please, since we trust & respect your informative write-ups.

Thank you.

Hi S.K.,

To provide the basic info about the issue, I post it as soon as possible. Review/research needs time, and that too I try my best to post as soon as possible.

Thank you. Really appreciate your incisive review on investments.

Thanks S.K.!

Thanks Shiv for wonderfully articulating this. Eagerly awaiting your update on ‘Should you invest in SREI Equipment Finance NCDs?’. Kindly post as soon as time permits and preferably over the weekend – so I get inputs to make go/no-go decision for Monday. Hope this is not asking for too much 🙂

Thanks Bobby!

I hope I have reviewed it in a timely manner! 🙂

so if I buy a Share today then I will get 9.50+.15= 9.65% rate of interest monthly in series Vll for ten years isn’t it Shiv and I think it will list at a good premium on listing

Hi Nitesh,

You should be a shareholder/bondholder on the deemed date of allotment to be eligible for an additional 0.15%.