This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Matrimony.com Limited is all set to enter the primary markets with its initial public offer (IPO) of Rs. 497 crore. The IPO is a combination of fresh issue of equity shares worth Rs. 130 crore and an offer for sale (OFS) of 37.67 lakh shares in a price band of Rs. 983-985 a share. Subscription to the issue started yesterday and will remain open for two more days to close on September 13.

In order to attract retail participation, the company has decided to offer a really big discount of Rs. 98 a share. However, the retail investor will have access to only 10% of the issue size.

Before we analyse it further, let us first check the salient features of the issue:

Price Band – Matrimony.com has fixed its price band to be between Rs. 983-985 per share and the company has decided to offer a discount of Rs. 98 a share to the retail investors and its own employees.

Size & Objective of the Issue – As mentioned above, Matrimony.com is targeting to raise Rs. 497 crore from this IPO. Out of this Rs. 497 crore, Rs. 367 crore will go to some of its existing investors and with the remaining Rs. 130 crore, the company plans to use Rs. 42.58 crore for the purchase of land in Chennai to construct its office premises, Rs. 43.34 crore for repayment of its existing overdraft facilities, Rs. 20 crore towards advertising and business promotion activities and the remaining amount for general corporate purposes.

Retail Allocation – 10% of the issue size is reserved for the retail individual investors (RIIs), 15% is reserved for the non-institutional investors and the remaining 75% shares will be allocated to the qualified institutional buyers (QIBs).

Rs. 98 a share Discount for Retail Investors & Employees – Matrimony.com has decided to offer a discount of Rs. 98 to the retail investors and its employees, which is about 10% of the issue price.

Anchor Investors – The company has already sold approximately 22.93 lakh shares to the anchor investors @ Rs. 985 a share, which makes their investment to be Rs. 225.89 crore. These anchor investors include Smallcap World Fund, HDFC Prudence Fund, Goldman Sachs India, ICG Q Limited and HDFC Growth Fund, among others.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 15 shares and in multiples of 15 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,775 at the upper end of the price band and Rs. 14,745 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 15 lots of 15 shares each @ Rs. 887 i.e. a maximum investment of Rs. 1,99,575. At Rs. 885 per share as well, you can apply only for 15 lots of 15 shares, thus making it Rs. 1,99,125.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on September 13th. Its shares are expected to get listed on September 21st.

Here are some other important dates after the issue gets closed on September 13:

Finalisation of Basis of Allotment – On or about September 19, 2017

Initiation of Refunds – On or about September 20, 2017

Credit of equity shares to investors’ demat accounts – On or about September 20, 2017

Commencement of Trading on the NSE/BSE – On or about September 21, 2017

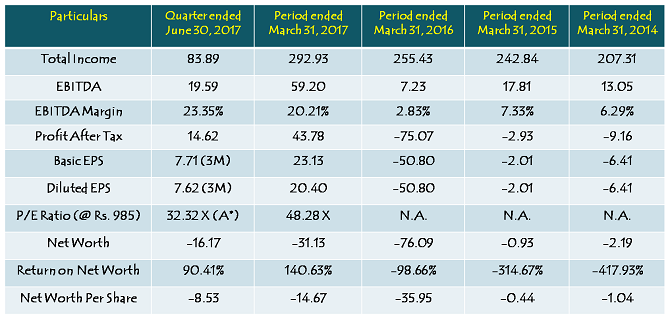

Financials of Matrimony.com Limited

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Should you invest in Matrimony.com at Rs. 983-985 a share?

At Rs. 985 a share, the company is valued at 48 times its FY17 earnings and around 36 times its EV/EBITDA. Based on its quarter-ended June 2017 financial performance, the company is valued at 32 times its annualised earnings and 25 times its expected EV/EBITDA. But, fundamentally speaking, the company carries a volatile history of earnings growth despite having steady growth in revenues and we just cannot bank on its recent turnaround in financial performance to justify its steep IPO pricing. The company reported a net loss in the four out of last five financial years and still carries a negative net worth to the tune of Rs. 16 crore.

This IPO is a combination of fresh issue of shares worth Rs. 130 crores and offer for sale by its existing investors to the tune of 367 crore. The company will use its Rs. 130 crore for the repayment of its overdraft facilities (Rs. 43.34 crore), purchase of land in Chennai for constructing an office premises for its own use (Rs. 42.58 crore) and advertising and business promotion activities (Rs. 20 crore). All these factors do not fully justify the need of raising money through an IPO route and it seems that the existing investors want to book some of their profits in this existing overheated IPO market.

Moreover, it is difficult for me to understand the reasons for which the company is giving such a big discount of Rs. 98 a share to the retail investors. As long as I remember, no company in the past few years has done so and it smells fishy to me to get such a steep discount.

Although, current market sentiment might give it an extraordinary listing pop, but long term investors would do well to analyse its financial performance for at least 2-3 more quarters before taking any investment call. Personally, I would avoid this IPO at this juncture and will relook at it once its financial performance shows some kind of consistent improvement.

Good Insight. I have come to the right place for all the IPS henceforth.

good Job Mr. shiv..u were bang on this IPO..keep it up

Thanks Abhinav!

Final Day (September 13) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 1.88 times

Category II – Non Institutional Investors (NIIs) – 0.41 times

Category III – Retail Individual Investors (RIIs) – 18.16 times

Category IV – Employees – 3.20 times

Total Subscription – 4.44 times

Day 2 (September 12) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.82 times

Category II – Non Institutional Investors (NIIs) – 0.01 times

Category III – Retail Individual Investors (RIIs) – 4.97 times

Category IV – Employees – 0.81 times

Total Subscription – 1.35 times

Day 1 (September 11) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.82 times

Category II – Non Institutional Investors (NIIs) – 0.00 times

Category III – Retail Individual Investors (RIIs) – 1.19 times

Category IV – Employees – 0.15 times

Total Subscription – 0.66 times

please advise me sme ipo, should apply or avoid