This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

ICICI Lombard General Insurance IPO Review – Should You Invest or Not @ Rs. 651-661?

ICICI Group’s general insurance arm, ICICI Lombard General Insurance Company Limited, is all set to enter the primary markets through its initial public offer (IPO) of Rs. 5,700 crore from tomorrow, September 15. The IPO is an offer for sale (OFS) by ICICI Lombard’s promoter, ICICI Bank and its existing shareholder, FAL Corporation. The company has fixed its price band in the range of Rs. 651-661 a share. Subscription to the issue will remain open for three days to close on September 19.

The offer would carry around 8.62 crore shares for subscription and constitute 19% of ICICI Lombard’s post-offer paid-up equity share capital. No discount is offered to the retail investors and employees of the company, however around 43 lakh shares will be reserved for the ICICI Bank shareholders.

Here are some of the salient features of this issue:

Price Band – ICICI Lombard has fixed its price band to be between Rs. 651-661 a share and the company has decided not to offer any discount to the retail investors and/or its employees.

Size & Objective of the Issue – ICICI Bank and FAL Corporation are collectively selling their 19% stake in ICICI Lombard in this offer to raise Rs. 5,700 crore. ICICI Lombard will not get any proceeds from the IPO.

Retail Allocation – While retail individual investors (RIIs) will get 35% reservation in the IPO, 15% of the issue will remain reserved for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Reservation for ICICI Bank Shareholders – Around 43 lakh shares have been reserved for the ICICI Bank’s existing shareholders, which is 5% of the total issue size.

No Discount for Retail Investors & Employees – The company has decided not to offer any discount to the retail investors and its employees.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 22 shares and in multiples of 22 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,542 at the upper end of the price band and Rs. 14,322 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 22 shares each @ Rs. 661 a share i.e. a maximum investment of Rs. 1,89,046. At Rs. 651 per share also, you can apply only for 13 lots of 22 shares, thus making it Rs. 1,86,186.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on September 19th. Its shares are expected to get listed on September 27th.

Anchor Investment – ICICI Lombard has sold 24,580,447 shares to the anchor investors @ Rs. 661 a share, which makes their investment to be Rs. 1,625 crore as the issue gets opened for subscription today. These anchor investors include Nomura India Stock Mother Fund, Amansa Holdings Private Limited, Franklin Templeton Investment Funds, DSP Blackrock, Abu Dhabi Investment Authority, Birla Sun Life Trustee Company, SBI Mutual Fund, Kotak Mutual Fund, L&T Mutual Fund and Reliance Top 200 Fund, among others.

Here are some other important dates as the issue gets closed on September 19:

Finalisation of Basis of Allotment – On or about September 22, 2017

Initiation of Refunds – On or about September 25, 2017

Credit of equity shares to investors’ demat accounts – On or about September 26, 2017

Commencement of Trading on the NSE/BSE – On or about September 27, 2017

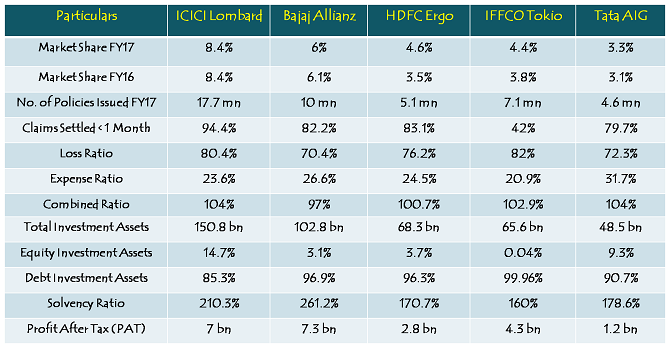

Peer Comparison

(Note: Figures are in Rs. Crore, except per share data, figures in millions/billions & percentage figures)

ICICI Lombard is the largest private sector non-life insurance company in India with a market share of 18% among private insurers, and 8.4% market share across all non-life insurance companies. The company issued around 1.77 crore policies in FY17 amounting to Rs. 10,725 crore in Gross Direct Premium Income (GDPI). During FY17, it settled 94.4% of its claims within 1 month of their filing, which is the fastest among all non-life insurance companies.

The company has around Rs. 150.8 billion in investment assets, out of which 14.7% is equity investments, both of which are highest among all of the non-life private insurance companies. As the “Combined Ratio” of ICICI Lombard is more than 100%, the company earns its profits by making these equity and debt investments. In a falling interest rate environment and bullish stock markets scenario, it is working well in favour of the company.

Loss Ratio – Loss ratio is the ratio of the claims incurred, net to the Net Earned Premium (NEP).

Net Expense Ratio – Net expense ratio is the ratio of the sum of operating expenses related to insurance business and commission paid (net) to the NWP. The net expense ratio is a measure of an insurance company’s operational efficiency.

Combined Ratio – Combined ratio is the sum of loss ratio and net expense ratio. The combined ratio is a measure of the profitability of an insurance company’s underwriting business. A ratio below 100% usually indicates that the insurance company generates a margin in its insurance operations, while a ratio above 100% usually indicates that insurance company is paying out more money in claims and operating expenses than it is receiving from premiums.

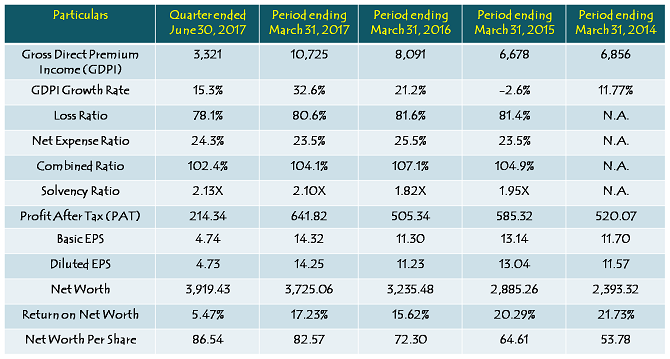

Financials of ICICI Lombard General Insurance Company Limited

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

ICICI Lombard reported Rs. 641.82 in profits, Rs. 14.25 a share as diluted EPS and Rs. 82.57 as book value per share during the previous financial year i.e. FY 2016-17. At Rs. 661 being the likely issue price, the company is valued at 46.38 times its 12-month trailing EPS and 8 times its book value as on March 31, 2017. I think these are stretched valuations by any standards and makes me extremely uncomfortable to put my money in this IPO.

What disturbs me more than anything else is the steep premium the company is seeking in this IPO as compared to the transaction carried out in May 2017 with the selling shareholder being the same. Fairfax sold its 12.18% stake in ICICI Lombard in May 2017 for Rs. 2,473 crore, which valued it at Rs. 450 a share. Now, in less than 4 months’ time, what fundamental changes have been carried out in the company to seek a 47% premium from the common investors?

I think it is highly unreasonable to seek such a steep premium in such a short period of time and probably the biggest reason for me to avoid this unreasonably expensive issue. Exuberance might help ICICI Lombard to have some listing gains, but then there is no way this investment could be a multibagger for its investors. I would advise my clients to avoid this issue at these valuations.

Last Day (September 19) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 8.17 times

Category II – Non Institutional Investors (NIIs) – 0.83 times

Category III – Retail Individual Investors (RIIs) – 1.23 times

Category IV – ICICI Bank Shareholders – 0.99 times

Total Subscription – 2.98 times

Day 2 (September 16) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 2.37 times

Category II – Non Institutional Investors (NIIs) – 0.10 times

Category III – Retail Individual Investors (RIIs) – 0.62 times

Category IV – ICICI Bank Shareholders – 0.58 times

Total Subscription – 0.98 times

Day 1 (September 15) Subscription Figures:

Category I – Qualified Institutional Buyers (QIBs) – 0.62 times

Category II – Non Institutional Investors (NIIs) – 0.04 times

Category III – Retail Individual Investors (RIIs) – 0.18 times

Category IV – ICICI Bank Shareholders – 0.21 times

Total Subscription – 0.27 times

Hi:

These kind of bare details are available all over. What I would expect is your critical in depth analysis of IPOs that I believe you are known for. Hope you will find time to do that. Look forward to read more good stuff from you.

Hi Pandri,

Here you have the review post – ICICI Lombard General Insurance IPO Review – Should You Invest or Not @ Rs. 651-661?

http://www.onemint.com/2017/09/15/icici-lombard-general-insurance-ipo-review-should-you-invest-or-not-rs-651-661/