This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

Reliance Nippon Life Asset Management Limited (Reliance AMC) is all set to enter the primary markets with its initial public offer (IPO) of Rs. 1,542 crore. The issue is getting opened for subscription from Wednesday, October 25 and will remain open for three days to close on October 27. This IPO is a mix of fresh issue of about 2.45 crore equity shares by the company and an offer for sale (OFS) of around 3.67 crore equity shares by the promoters.

The company has fixed its price band in the range of Rs. 247-252 a share and no discount has been offered to the retail investors. The offer would constitute 10% of the company’s post-offer paid-up equity share capital.

Here are some of the salient features of this issue:

Size of the Issue – This IPO is a combination of an offer for sale (OFS) of 3.67 crore shares by the promoters, Reliance ADAG and Nippon Life Asset Management Limited and a fresh issue of 2.45 crore shares by the company. This makes it a Rs. 1,542 crore IPO at the upper end of the price band i.e. Rs. 252.

Price Band – Reliance AMC has fixed its IPO price band to be between Rs. 247-252 a share and the company has decided not to offer any discount to the retail investors.

Retail Allocation – 35% of the issue has been reserved for the retail individual investors (RIIs), 15% for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

No discount for Retail Investors or Employees – The company has decided not to offer any discount to any of its investors or to its employees either.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 59 shares in this offer and in multiples of 59 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 14,868 at the upper end of the price band and Rs. 14,573 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 13 lots of 59 shares each @ Rs. 252 a share i.e. a maximum investment of Rs. 1,93,284. At Rs. 247 per share, you can apply for a maximum of 13 lots of 59 shares, thus making it Rs. 1,89,449.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on October 27th. Its shares are expected to get listed on November 6th.

Here are some other important dates as the issue gets closed on October 27:

Finalisation of Basis of Allotment – On or about November 1, 2017

Initiation of Refunds – On or about November 3, 2017

Credit of equity shares to investors’ demat accounts – On or about November 3, 2017

Commencement of Trading on the NSE/BSE – On or about November 6, 2017

Financials of Reliance Nippon Life AMC

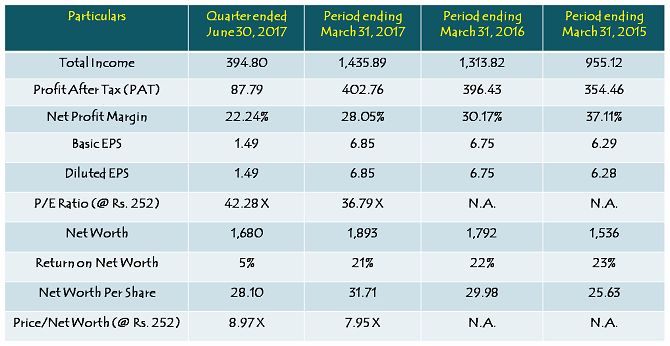

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Should you invest in Reliance AMC IPO or Not @ Rs. 252?

Like most of the IPOs that have hit the streets in the last six months or so, this IPO too seems to seek a high premium for its shares on offer. At Rs. 252 a share, the company is valued at 36.79 times its FY17 earnings and 8.97 times based on its book value as on June 30, 2017. For a company which is facing a tough competition from the existing as well as new entrants in the asset management business and seeing a consistent decline in its financial health, these valuations are not attractive for either listing gains, or for long term wealth creation.

The company reported profit after tax (PAT) of Rs. 402.76 crore during FY17, as against Rs. 396.43 crore in FY16 and Rs. 354.46 crore in FY15. This translates into a growth of just 1.6% in the last year’s profits and 6.6% CAGR in the last two years’ profits. This growth is not upto the mark if you consider this 2-year period to be a bumper one for the growth in the AUMs of the mutual fund industry as a whole.

Despite of the fact that Reliance AMC is one of the better companies in the ADAG group of companies, I think the company is seeking valuations way higher than what it deserves for the kind of growth it has been able to deliver. Personally I would avoid this IPO at these valuations and wait for it to correct to reasonably attractive valuations before making an entry into it.

Reliance Nippon falls below issue price – http://www.business-standard.com/article/markets/adag-group-stocks-rcom-down-15-reliance-nippon-falls-below-issue-price-117111500546_1.html

Bharat 22 etf launching on 15th November is there any discount for retail investors details please Shiv

hi Shiv thanks. wondering why the IPO got such much of subscription from big institutions? as per your advice i am skipping this IPO.

may i know what is your view on NLC OFS? is it worth t o subscribe at the OFS price

wondering the same..

Same wondering on NLC OFS.But most OFS have been flops saved by LIC.

Reliance Nippon Life Asset Management Ltd IPO (Reliance Nippon Life IPO) –Upcoming IPO details

In the list of upcoming IPO Reliance Nippon Life Asset Management Ltd is planning to launch IPO. The tentative size of the upcoming IPO (initial public offering) is Rs 1,542.24 Cr. The issue consists of two things

Fresh Issue of 24,480,000 Equity Shares of Rs 10.

Offer for Sale of 36,720,000 Equity Shares of Rs 10.

The Reliance Nippon Life IPO might open on 25 Oct, 2017.

The tentative price band might be Rs 247-252 per share.

The IPO (Initial public) Offering might close on 27 Oct, 2017.

More @ http://sharpcareer.in/blog/financial-update/reliance-nippon-life-ipo/

Hi Shiv, another good & objective analysis of an IPO…I will skip this one, thanks to you. One question that begs an answer is: why do people oversubscribe to IPOs of such companies which are unworthy of super-high valuations. It is this overscubscption that has enabled companies to move valuation needle beyond the red mark.

Thanks Pandri!

People don’t have time to analyse each and every IPO, or for that matter, listed companies as well. They act on the basis of what they read or watch on the business channels or what their brokers/friends/colleagues tell them to do. Initially, it works well, but when the euphoria fizzles out, they keep holding these stocks till their share prices go down to 10-15% of their cost. That is how the stock markets are ultimately considered to be bad for one’s investments.

Hi Shiv Ji,

Many thanks for your kind advise.

Apart from high valuations, ADAG has track record of wealth erosion of companies they launched. ( Rel. Power, Rel. Comm. , RNRL…) . Entire group is in distress and there is no reason to buy in current scenario, where ample opportunities are available elsewhere…

Agree, Mr. Vasu. Request you to kindly share your inputs on other better opportunities for investment in current scenario. Thanking you, in anticipation.

Hi Vasu,

I agree, ADAG group has a track record of wealth erosion, some due to business failures, but primarily due to mismanagement. I also think that Reliance AMC is one of the better companies in the ADAG group, and I have mentioned it in the post also. But, still think that they are running their business way below its true potential and seeking high valuation for the same in this IPO.