This post is written by Shiv Kukreja, who is a Certified Financial Planner and runs a financial planning firm, Ojas Capital in Delhi/NCR. He can be reached at [email protected]

After divesting its stake in GIC Re, the government has placed its stake on sale in its 99.99% subsidiary, The New India Assurance Company Limited, through its initial public offer (IPO) of Rs. 675 crore. The issue is getting opened for subscription from today, November 1 and will remain open for three days to close on November 3. The IPO is a mix of fresh issue of 2.40 crore shares by the company and an offer for sale (OFS) of 9.60 crore equity shares by the Government of India.

The company has fixed its price band in the range of Rs. 770-800 a share and a discount of Rs. 30 a share will be given to the retail investors and eligible employees of the company. The offer would constitute 14.56% of the company’s post-offer paid-up equity share capital.

Here are some of the salient features of this issue:

Size of the Issue – This IPO is a combination of an offer for sale (OFS) of 9.60 crore shares by the Government of India and a fresh issue of 2.40 crore shares, which makes it a Rs. 9,467 crore IPO at the upper end of the price band of Rs. 800.

Price Band – New India Assurance has fixed its IPO price band to be between Rs. 770-800 a share and the company has decided to offer a discount of Rs. 30 a share to the retail investors, as well as its eligible employees.

Retail Allocation – 35% of the issue has been reserved for the retail individual investors (RIIs), 15% for the non-institutional investors (NIIs) and the remaining 50% shares will be allocated to the qualified institutional buyers (QIBs).

Rs. 30 a share discount for Retail Investors & Employees – The company has decided to offer a discount of Rs. 30 a share to the retail individual investors and its eligible employees.

Reservation for Employees – The company has decided to keep 36 lakh shares worth Rs. 277.20 crore reserved exclusively for its employees.

Bid Lot Size & Minimum Investment – Investors need to bid for a minimum of 18 shares in this offer and in multiples of 18 shares thereafter. So, a retail investor would be required to invest a minimum of Rs. 13,860 at the upper end of the price band and Rs. 13,320 at the lower end of the price band.

Maximum Investment – Individual investors investing up to Rs. 2 lakh are categorised as retail individual investors (RIIs). As a retail investor, you can apply for a maximum of 14 lots of 18 shares each @ Rs. 770 a share i.e. a maximum investment of Rs. 1,94,040. At Rs. 740 a share, you can apply for a maximum of 15 lots of 18 shares, thus making it Rs. 1,99,800.

Listing – The shares of the company will get listed on both the stock exchanges i.e. National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) within 6 working days after the issue gets closed on November 3rd. Its shares are expected to get listed on November 13th.

Here are some other important dates as the issue gets closed on November 3:

Finalisation of Basis of Allotment – On or about November 8, 2017

Initiation of Refunds – On or about November 9, 2017

Credit of equity shares to investors’ demat accounts – On or about November 10, 2017

Commencement of Trading on the NSE/BSE – On or about November 13, 2017

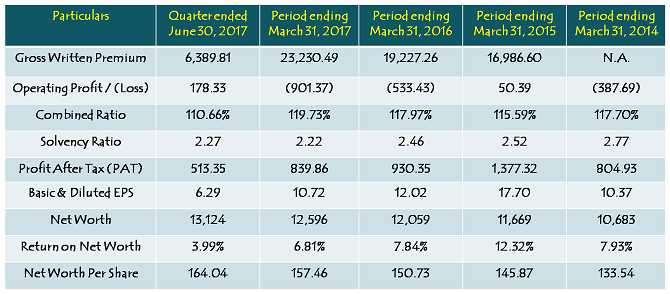

Financials of The New India Assurance Company Limited

(Note: Figures are in Rs. Crore, except per share data & percentage figures)

Should you invest in New India Assurance IPO or not @ Rs. 770-800?

During the financial year 2016-17, New India Assurance reported Gross Written Premium of Rs. 23,230 crore, up 20.82% against previous year’s Rs. 19,227 crore. However, Gross Written Premium is the only area in which the company registered some kind of growth, as the company failed to perform on all other parameters. The company reported an operating loss of Rs. 901.37 crore as against Rs. 533.43 crore loss it had in FY 2015-16. Its profit after tax (PAT) was also down 9.72% at Rs. 839.86 crore as against Rs. 930.35 crore in 2015-16.

Combined Ratio stood at 119.73% (vs. 117.97% in FY 2015-16) and Solvency Ratio was at 2.22 times (vs. 2.46 times in FY 2015-16). Combined Ratio of 100 or above indicates that the company is incurring losses in its core insurance business. As far as Return on Net Worth (RoNW) is concerned, it has fallen from a high of 12.32% in FY 2014-15 to almost half at 6.81%.

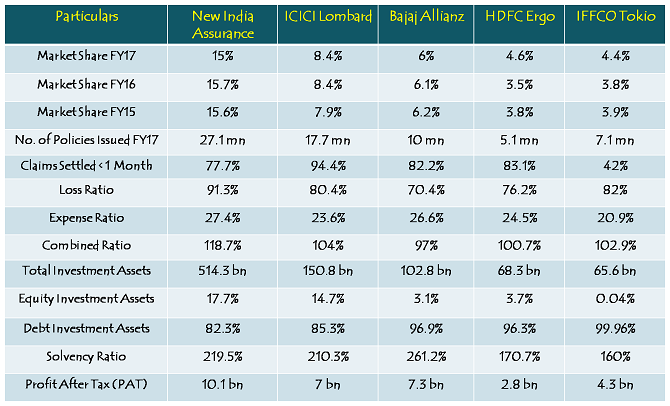

Recently listed ICICI Lombard is the only listed company with which we can compare NIA’s pricing and valuations, and NIA lags ICICI Lombard in almost all the parameters except Solvency Ratio. Firstly, NIA’s market share has declined from 15.6% in FY 2014-15 to 15% in FY 2016-17, whereas ICICI Lombard has been able to increase its pie from 7.9% in FY 2014-15 to 8.4% in FY 2016-17. HDFC Ergo and IFFCO Tokio too have gained on their respective market shares. Moreover, ICICI Lombard reported far better Combined Ratio (104%), Loss Ratio (80.4%) and Expense Ratio (23.6%) as compared to NIA for which these ratios stood at 118.7%, 91.3% and 27.4% respectively during the same period.

As far as its pricing is concerned, NIA is seeking a valuation of 74.63 times its trailing EPS of Rs. 10.72 and 4.88 times its book value of Rs. 164.04 as on June 30, 2017. The company showed a surprisingly remarkable turnaround in the first quarter of the current financial year and reported an EPS of Rs. 6.29 a share, based on which the PE ratio it is seeking has fallen to 31.8 times its annualised EPS of Rs. 25.16. However, looking at its declining or inconsistent performance in the past, I have a serious doubt over sustainability of this turnaround and that is why I don’t think the company deserves such high valuations. At these high valuations, I would personally avoid this IPO and invest my money with better managements and bankable businesses.

Sir, what is your opinion on HDFC Life IPO & on KHADIM IPO please? Your inputs would be greatly appreciated.

Hi S.K.,

We are not covering Khadim IPO, but we’ll review HDFC Life IPO soon.